Q3 2025 PRMC Luxe Index

Review & Prospect

Q3 2025 PRMC Luxe Index

Review & Prospect

Exploring market stabilization and resilient consumer sentiment, tracing renewed momentum and confidence across global luxury sectors.

Macro Rebound & Sentiment Converge, Ultra Luxe Embodies Recovery

[Primary Index Performance Review]

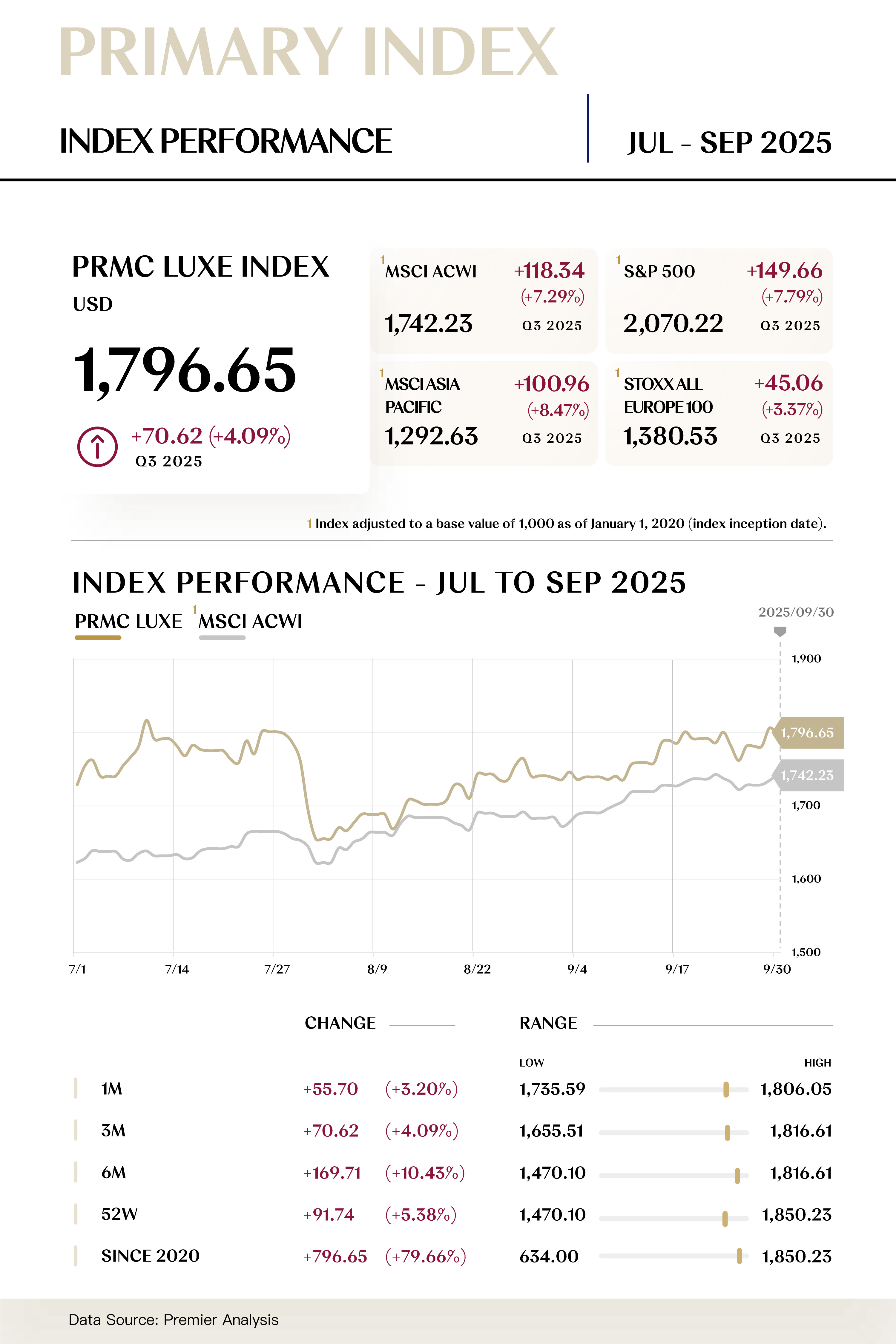

The PRMC Luxe Index closed at 1,796.65 points in Q3 2025, rising by 70.62 points (+4.09%) during the quarter. Its performance lagged behind the MSCI Asia Pacific (+8.47%), S&P 500 (+7.79%), and MSCI ACWI (+7.29%) but outperformed the STOXX All Europe 100 (+3.37%).

[Secondary Index Performance Review]

The PRMC Core Luxe Index closed at 1,899.47 points in Q3 2025, decreasing by 0.29 points (-0.02%) during the quarter;

The PRMC Ultra Luxe Index closed at 2,237.50 points in Q3 2025, rising by 263.51 points (+13.35%) during the quarter;

The PRMC Mass Luxe Index closed at 1,045.48 points in Q3 2025, decreasing by 6.25 points (-0.59%) during the quarter;

The PRMC Experiential Luxe Index closed at 1,533.00 points in Q3 2025, increasing by 39.55 points (+2.65%) during the quarter.

[Macroeconomic Review and Outlook]

In the third quarter of 2025, the global economy continued its moderate recovery, yet "uneven rebound" remained the dominant theme.

Following two years of tightening cycles, major developed economies gradually shifted toward a wait-and-see approach and monetary easing. The Federal Reserve and the European Central Bank signaled that interest rate cuts were on the horizon, contributing to a marginal improvement in global liquidity and a rebound in asset prices from their lows. However, uncertainties surrounding geopolitics and trade friction continued to weigh on market sentiment, limiting the pace of recovery in global consumer confidence.

China market maintained a pattern of structural recovery. On the policy front, efforts to "stabilize growth" and "boost consumption" worked in tandem, with fiscal expenditure continuing to favor high-value-added sectors such as tourism, green consumption, and cultural leisure. The summer consumption peak season drove a recovery in foot traffic at offline retail and luxury stores, although cautious medium- to long-term income expectations among households continued to impose constraints on mid-to-high-end consumption.

US market exhibited signs of "stability amid stagnation." While inflation gradually eased, the high-interest-rate environment and tariff uncertainties pushed up end-product prices, restricting the expansion of household disposable income. Supported by asset price recovery and stable employment, high-net-worth individuals sustained their high-end consumption, whereas mass-market consumers grew more rational in their spending.

Europe market recovery remained sluggish. Weak manufacturing performance in core economies and persistently high energy costs continued to dampen consumption momentum. Although inflation has become more manageable, cost-of-living pressures and low confidence indices have kept middle-class spending willingness subdued. Additionally, limited fiscal space within the Eurozone and insufficient coordination among member states on expansionary policies have resulted in limited stimulus effects, making it difficult to generate a meaningful boost in aggregate demand.

Looking ahead to the fourth quarter of 2025, the global luxury industry is expected to enter a "value restructuring phase within a period of structural adjustment." Luxury indices are likely to fluctuate amid a dynamic balance between valuation recovery and fundamental divergence.

On the macroeconomic front, major central banks may initiate easing cycles by year-end, and the marginal improvement in monetary conditions is expected to revive risk appetite in the markets. Continued easing of global inflationary pressures will provide a more favorable financing and spending environment for luxury consumption. At the same time, moderate fiscal policies in Europe and the U.S., coupled with enhanced consumption-side stimulus in China, are poised to jointly drive a phased recovery in high-end spending.

From a consumption trend perspective, “experience-driven consumption” will remain the key long-term growth engine for the industry. High-net-worth consumers are shifting their focus from material goods to emotional experiences and lifestyle investments—areas such as travel retail, boutique accommodations, art exhibitions, and fine dining continue to expand, injecting growth momentum into the Experiential Luxe Index.

DOWNLOADS

Lite Report (73 pages)

CORE LUXE CONSTITUENT ZOOM-IN

Interim earnings resilience supporting valuation stability,

buyback initiatives boosting future expectations

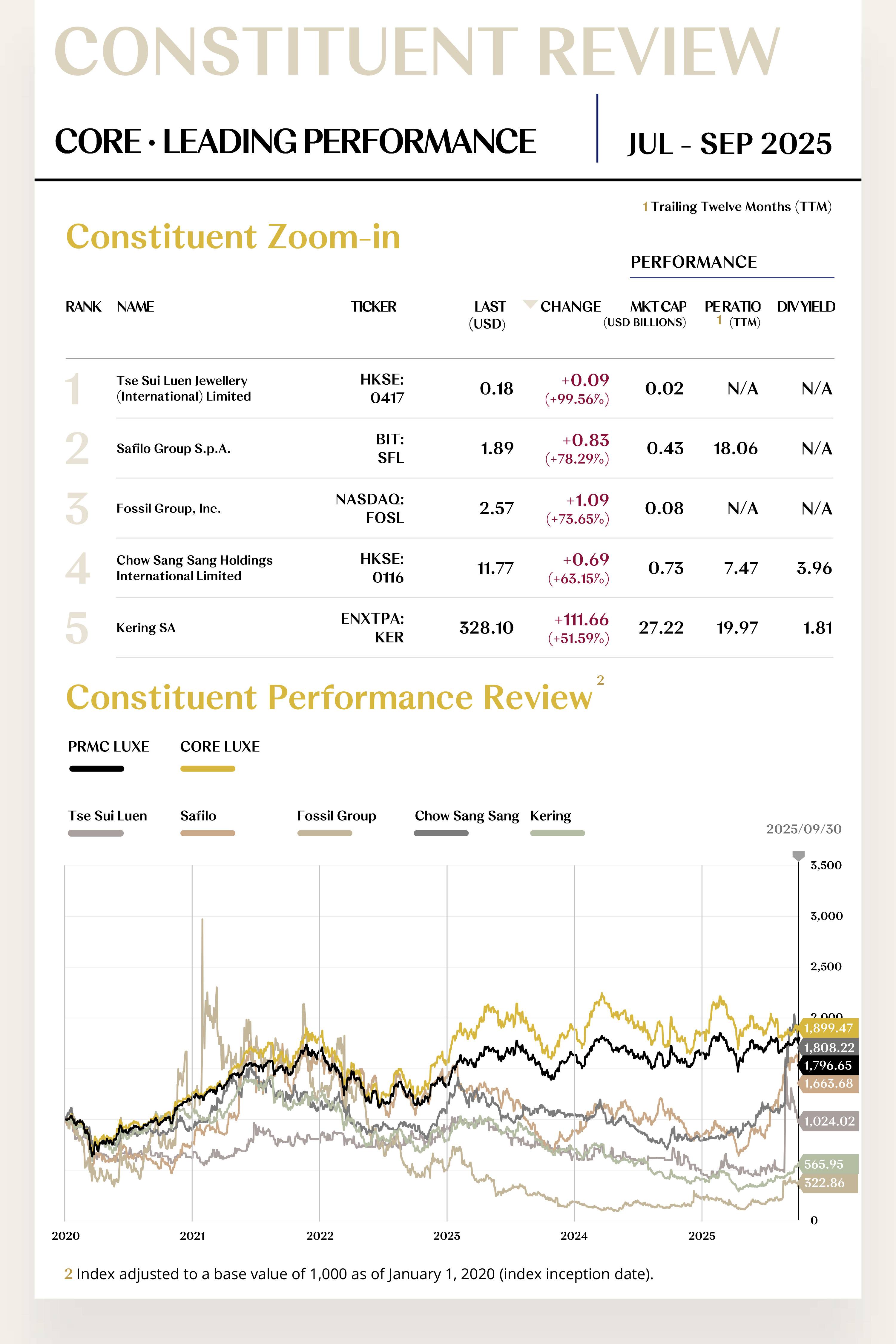

The Core Luxe Index comprises 36 stocks, with 26 rising and 10 falling.

Leading Performers

1. Tse Sui Luen Jewellery (International) Limited (HKSE: 0417)

Tse Sui Luen Jewellery specializes in high-end jewelry and precious metals, with operations spanning jewelry design, manufacturing, and retail across mainland China, Hong Kong, Macau, and Malaysia. In the third quarter of 2025, the company’s stock price rose by USD 0.09 to close at USD 0.18, marking a significant increase of 99.56%.

The strong stock performance was largely driven by sector-wide tailwinds from gold prices repeatedly hitting record highs during the quarter. Global gold prices continued to climb in Q3, with the London spot gold price surpassing USD 4,080 per ounce by the end of September, and COMEX gold futures briefly exceeding USD 4,100—both setting new historical records.

Amid this rally, Tse Sui Luen’s domestic gold jewelry prices rose to RMB 1,190 per gram on October 13 and further increased to RMB 1,235 per gram on October 15, representing a single-gram increase of over RMB 100 compared to October 1. The sustained surge in gold prices directly boosted the company’s gross margin and inventory value for gold products.

Looking ahead to the fourth quarter, continued central bank gold purchases globally and safe-haven demand driven by geopolitical uncertainties are expected to provide solid support for gold prices. As a jewelry retailer that directly benefits from the gold bull market, the company is well-positioned to further improve product margins and profitability, and its stock price is anticipated to maintain an upward trend.

2. Safilo Group S.p.A. (BIT: SFL)

Safilo Group is a well-known Italian eyewear manufacturer and distributor, specializing in the design, production, and sale of sunglasses, optical frames, and sports eyewear under both proprietary and licensed brands. In the third quarter of 2025, the company’s stock price increased by USD 0.83 to close at USD 1.89, representing a gain of 78.29%.

The stock’s rise was supported by positive capital return actions and management activities. Between August 18 and 22, 2025, the company executed a share buyback program, repurchasing 575,000 ordinary shares for a total of approximately EUR 841,000. This move signaled to the market that the company considered its shares undervalued and reflected confidence in its future development.

Additionally, Vladimiro Baldin, Chief Licensed Brands & Global Product Officer, exercised stock options during the quarter, further indicating the confidence of core management in the company’s prospects. These internal actions align with the company’s strategic initiatives aimed at enhancing shareholder value.

Looking ahead to the fourth quarter, the ongoing share repurchase program is expected to continue supporting the stock price, while the alignment of management and shareholder interests should further strengthen investor confidence. With effective cost control and product portfolio optimization, the company’s performance is likely to improve, and its stock price is projected to extend its upward trend. strategic initiatives are expected to support a return to positive sales growth.

[For more insights, please download the full report]

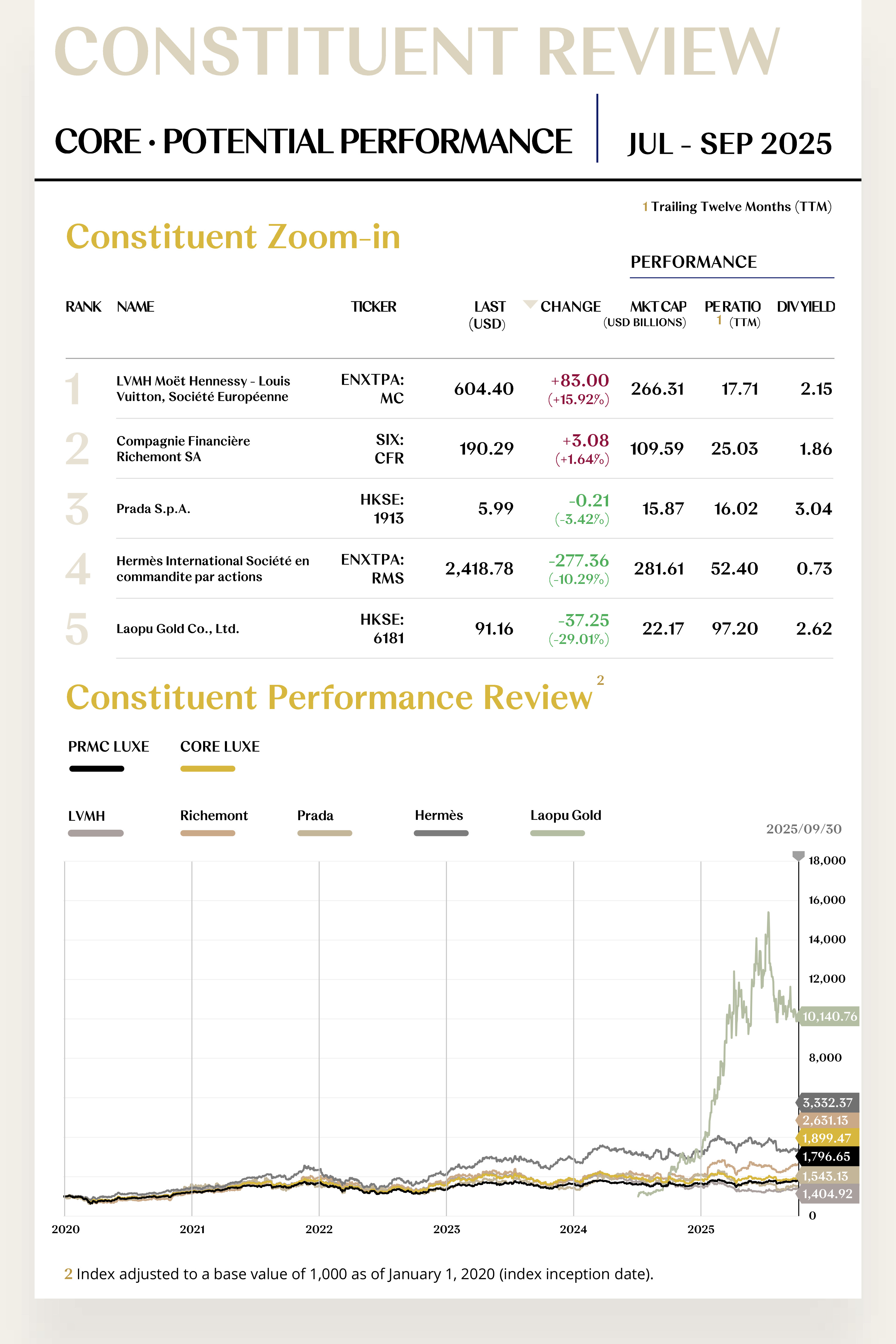

Potential Players

1. LVMH Moët Hennessy - Louis Vuitton, Société Européenne (ENXTPA: MC)

LVMH is the world's largest luxury group, with a portfolio spanning fashion & leather goods, watches & jewelry, perfumes & cosmetics, and wines & spirits. Its renowned brands include Louis Vuitton, Christian Dior, and Tiffany & Co. In the third quarter of 2025, the company’s stock price rose by USD 83.00 to close at USD 604.40, representing a quarterly increase of 15.92%.

On July 24, the group announced its first-half 2025 results. Against a backdrop of heightened geopolitical and macroeconomic uncertainties, revenue reached approximately €39.8 billion, down 4% year-on-year, while recurring operating profit declined 15% to €9.0 billion. Net profit attributable to the group fell 22% to €5.7 billion. Regionally, demand in Europe and the U.S. remained stable, while Japan experienced a decline due to the high base effect from the 2024 tourism peak.

Looking ahead to the fourth quarter, the group maintains a positive outlook. It aims to leverage brand innovation, cost optimization, and refined retail strategies to strengthen its core competitive edge. While the Fashion & Leather Goods division saw a 2% decline in Q3 sales, it is expected to recover in Q4, supported by holiday demand and steady growth in local clientele. By emphasizing iconic product excellence and global expansion, LVMH aims to achieve moderate growth and lay the groundwork for further progress in 2026.

2. Compagnie Financière Richemont SA (SIX: CFR)

Richemont is a leading global luxury group specializing in fine jewelry and premium watchmaking, with brands such as Cartier, Van Cleef & Arpels, Panerai, IWC, and Jaeger-LeCoultre. In Q3 2025, the company’s stock price increased by USD 3.08 to close at USD 190.29, a gain of 1.64%.

On July 16, the group reported first-quarter sales (ending June 30, 2025) of approximately €5.1 billion, up 6% year-on-year. Growth was primarily driven by strong demand in jewelry, with core brands like Cartier and Van Cleef & Arpels effectively weathering the broader luxury slowdown. While China remained soft, double-digit growth in Europe and Japan provided support and briefly lifted the stock.

In an August 21 media interview, Chairman Johann Rupert noted that the luxury watch industry should moderate production to buffer weak Chinese demand, praising peers for disciplined supply management. He also highlighted efforts by Vacheron Constantin and Jaeger-LeCoultre to prepare for a 2026 market recovery through craftsmanship innovation and supply chain optimization.

At the September 10 Annual General Meeting in Geneva, all agenda items were approved, including board elections and dividend distribution. Rupert reiterated the strategic importance of sustainability and digital transformation for long-term competitiveness, receiving strong shareholder support.

Looking ahead, Richemont will continue to leverage pricing optimization and product innovation to navigate competitive pressures and demand volatility in Asia. Supported by its diversified geographic footprint and rich brand portfolio, the group aims to reinforce its leadership in high jewelry and watchmaking while accelerating sustainability and digital initiatives to secure medium- to long-term advantages.

[For more insights, please download the full report]

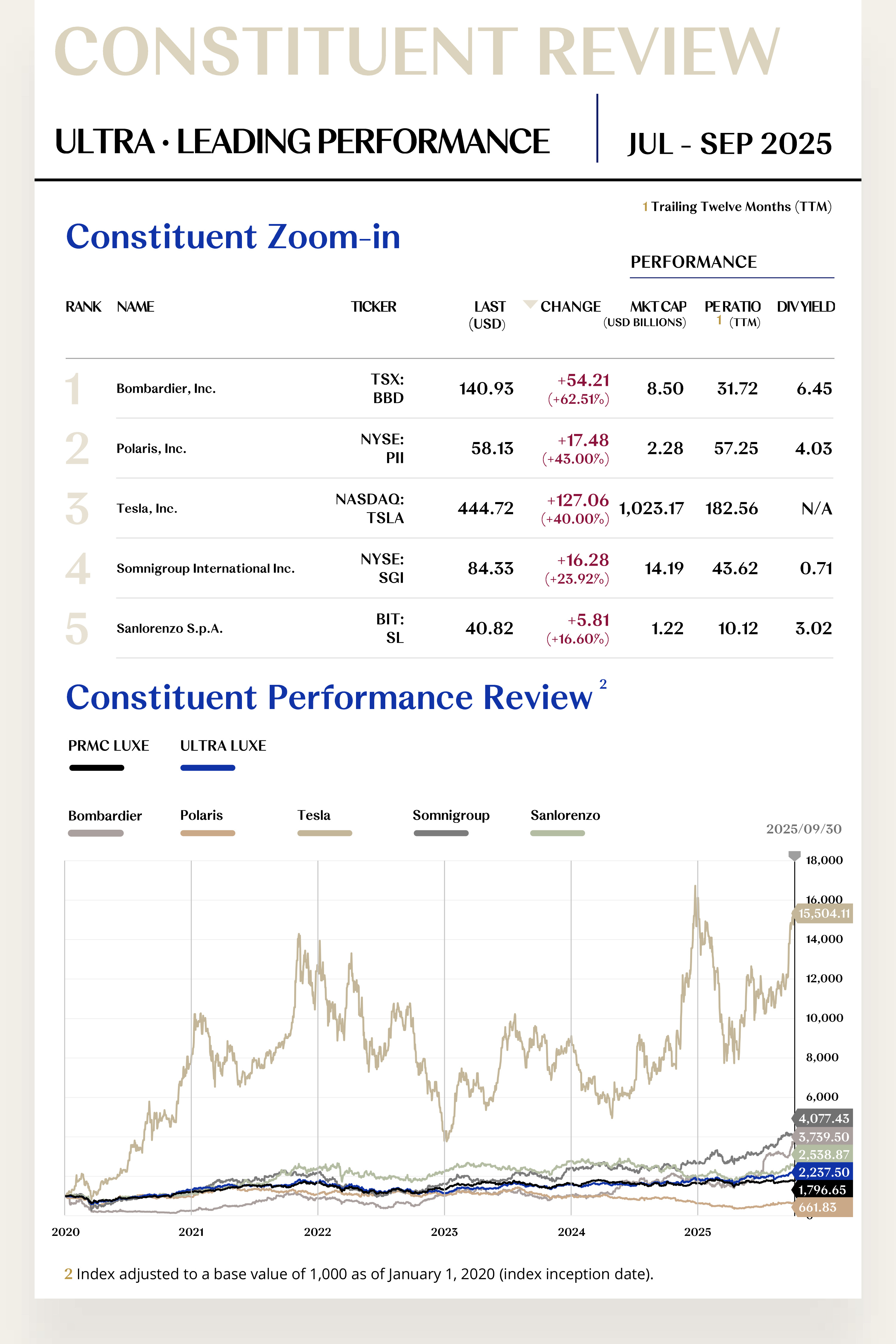

ULTRA LUXE CONSTITUENT ZOOM-IN

Record-Level Orders Reinforcing Long-Term Visibility,

Optimized Financial Structure Lifting Investor Sentiment

The Ultra Luxe Index comprises 20 stocks, with 13 rising and 7 falling.

Leading Performers

1. Bombardier, Inc. (TSX: BBD)

Bombardier is a world-leading business jet manufacturer focused on designing, producing, and supporting high-performance aircraft, including its Global and Challenger series. In the third quarter of 2025, the company’s stock price rose by USD 54.21 to close at USD 140.93, a gain of 62.51%.

During the quarter, Bombardier Defense entered into a 10-year service agreement with global aerospace leader SNC to support two Global 6500 aircraft equipped with SNC’s RAPCON-X technology. This agreement will be integrated into the company’s Smart Services Defense program, enhancing the stability and predictability of future service revenue.

Additionally, the company successfully priced and issued USD 250 million of senior notes due 2033, planning to use the proceeds along with existing cash to redeem a portion of its higher-cost outstanding debt. This move optimizes the capital structure, reduces financing costs, and strengthens market confidence in the company’s long-term solvency and sustainable profitability.

Looking ahead to the fourth quarter, with the certification of the Global 8000 model completed and the first delivery scheduled for the second half of the year, Bombardier is set to gain new momentum in its business jet segment. The steady contribution from defense service contracts will further enhance revenue visibility. Supported by an expanding global service network, the company’s earnings profile is expected to become more resilient, laying a foundation for sustained positive stock performance and medium- to long-term valuation growth.

2. Polaris, Inc. (NYSE: PII)

Polaris is a leading manufacturer of powersports vehicles, including off-road vehicles (ORVs), snowmobiles, motorcycles, and specialized military vehicles. In Q3 2025, the company’s stock price increased by USD 17.48 to close at USD 58.13, up 43.00%.

The stock’s rise was primarily driven by strategic restructuring and better-than-expected preliminary earnings guidance. On October 13, 2025, Polaris announced its decision to separate its Indian Motorcycle business and sell a majority stake to private equity firm Carolwood LP. The transaction, expected to close in Q1 2026, is projected to add approximately USD 50 million in annual adjusted EBITDA and about USD 1.00 in earnings per share.

At the same time, preliminary Q3 2025 results indicated revenue in the range of USD 1.6–1.8 billion and adjusted EPS between USD 0.31 and 0.41, both exceeding prior expectations, supported by solid shipment performance and disciplined cost management.

Looking ahead to Q4, the anticipated profit improvement from the Indian Motorcycle divestiture, combined with strong retail trends and further market share gains in the ORV segment, are expected to serve as dual growth engines. Market consensus suggests the stock will maintain its upward trend under these favorable conditions.

[For more insights, please download the full report]

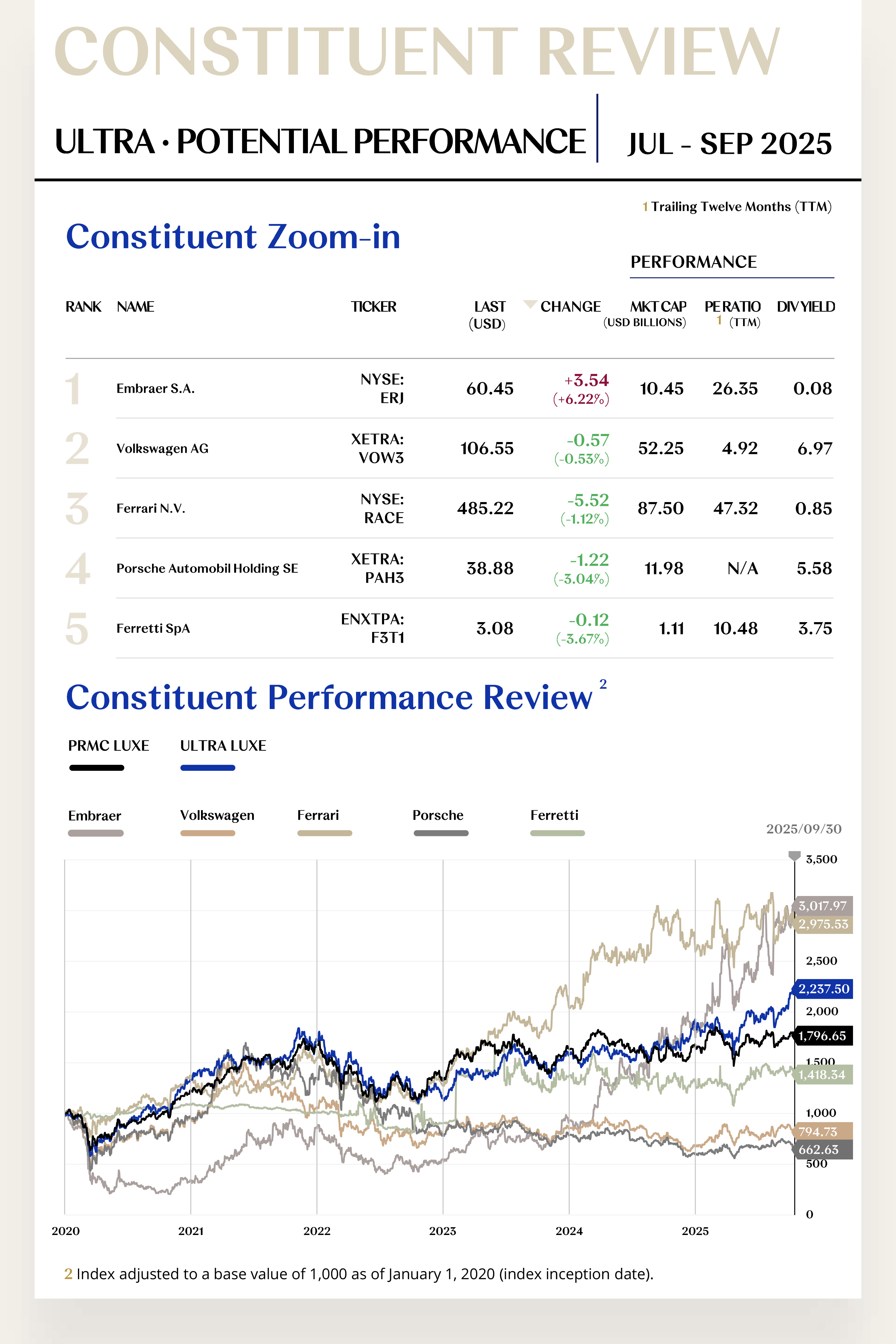

Potential Players

1. Embraer S.A. (NYSE: ERJ)

Embraer's core operations encompass the design and manufacturing of commercial, executive, and military aircraft, along with aviation services. As the world's third-largest civil aircraft manufacturer, it holds a significant position in the global aviation market. In the third quarter of 2025, the company’s stock price rose by USD 3.54 to close at USD 60.45, an increase of 6.22%.

In July and August 2025, the company successfully secured new credit facilities totaling USD 480 million to support operational expansion and supply chain optimization. This move effectively mitigated potential pressures from U.S. import tariffs and ensured sufficient funding for subsequent deliveries. On September 10, the company made a milestone announcement in Washington, D.C., outlining plans to further expand its U.S. footprint. Currently employing 3,000 people in the U.S. for business jet assembly, Embraer intends to procure approximately USD 21 billion in components to deepen local operations.

Looking ahead to the fourth quarter, the company is well-positioned to unlock further growth potential through its robust order backlog, continuously optimized supply chain, and strategic deepening in the North American market. Against the backdrop of a steady recovery in global air travel demand, the stock is expected to maintain a positive trajectory and continue benefiting from the industry's recovery cycle.

2. Volkswagen AG (XETRA: VOW3)

Volkswagen‘s portfolio includes multiple premium brands such as Volkswagen, Audi, Porsche, Bentley, and Lamborghini, offering a full range of products from traditional internal combustion engine vehicles to new energy vehicles. In the third quarter of 2025, the company’s stock price decreased by USD 0.57 to close at USD 106.55, a decline of 0.53%.

On July 25, the company announced that its first-half profit fell 38% to EUR 1.3 billion, impacted by U.S. tariff policies, and revised its full-year sales growth expectation to approximately flat. Concurrently, the Group announced plans to cut over 46,500 positions across the Volkswagen, Audi, and Porsche brands to control costs and enhance operational efficiency. This measure is expected to help restore the full-year 2025 operating margin to 4%–5%.

Looking ahead to the fourth quarter, Volkswagen is poised to continue benefiting from the high-growth trend in its EV business and the gradual deepening of supply chain cooperation. With the launch of new models, EV deliveries are expected to maintain strong momentum, further increasing penetration in key global markets. Coupled with the Group's large-scale cost optimization plan and forward-looking product investment, the market generally anticipates a gradual improvement in the company's profitability.

[For more insights, please download the full report]

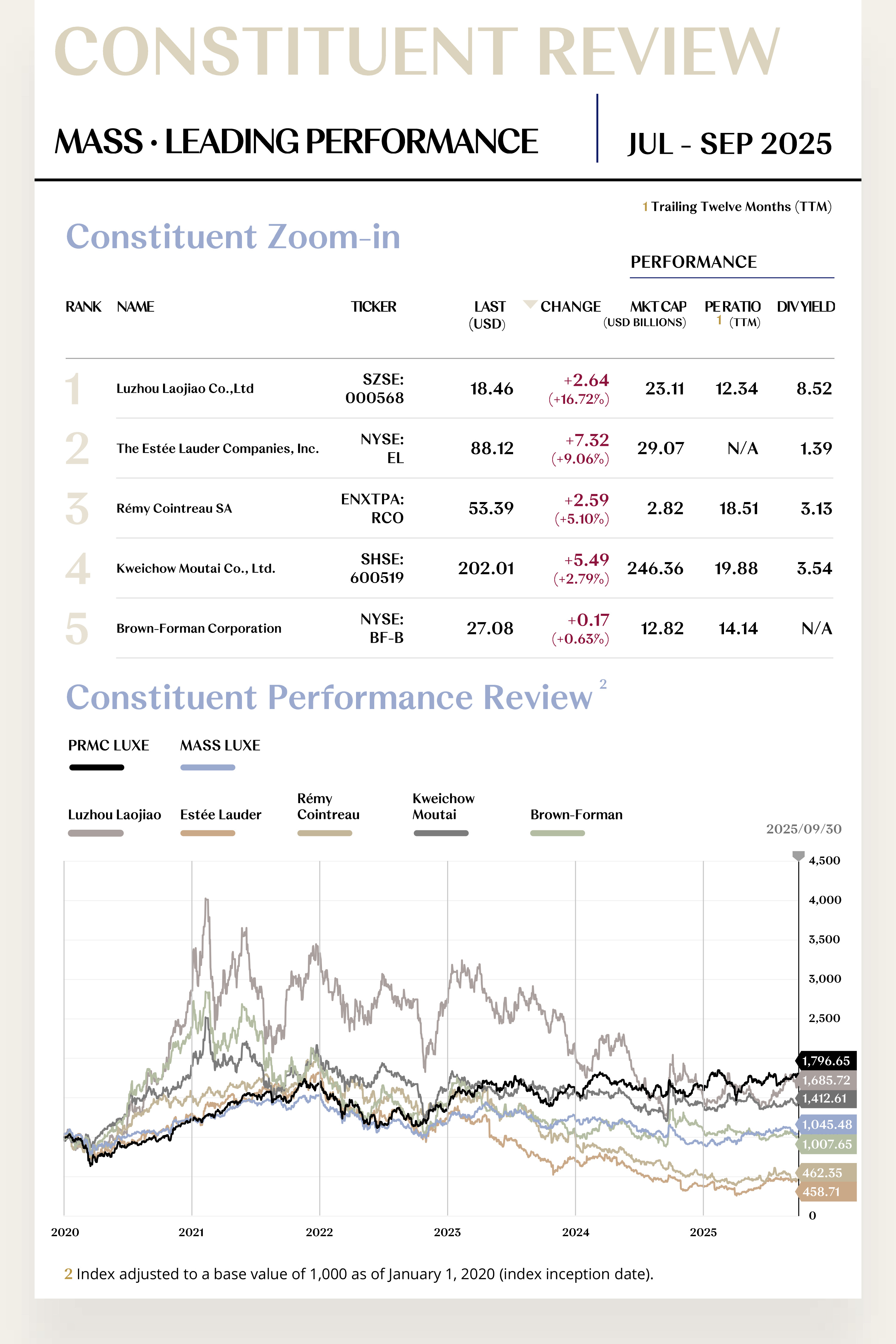

MASS LUXE CONSTITUENT ZOOM-IN

Market Confidence Rebound Cushioning Underlying Challenges,

Stable Shareholder Payouts Sustaining Price Momentum

The Mass Luxe Index comprises 19 stocks, with 7 rising and 12 falling.

Leading Performers

1. Luzhou Laojiao Co., Ltd (SZSE: 000568)

Luzhou Laojiao is a leading Chinese producer of strong-aroma baijiu, primarily engaged in the R&D, production, and sales of its product lines including "Guojiao 1573" and "Luzhou Laojiao." In the third quarter of 2025, the company’s stock price rose by USD 2.64 to close at USD 18.46, a quarterly increase of 16.72%.

On August 29, Luzhou Laojiao released its first-half 2025 results, reporting revenue of RMB 16.454 billion, down 2.67% year-on-year, and a net profit decline of 4.54%. The primary pressure on earnings stemmed from rising costs of key raw materials such as sorghum and wheat, which further compressed profit margins. Concurrently, macroeconomic headwinds limited consumer disposable income, restraining high-end baijiu sales, while a growing preference among younger consumers for low-alcohol beverages or imported wines posed structural challenges to the traditional baijiu market.

Nevertheless, bolstered by the broader recovery in Chinese capital markets and rising investor risk appetite, these positive macroeconomic factors offset fundamental pressures, driving the company's stock into an upward trend during the quarter, approaching its strongest performance since the start of the year.

Looking ahead to the fourth quarter, Luzhou Laojiao's long-term resilience remains noteworthy. Its strong brand equity and rich history provide a solid foundation for sustained growth. The company is also increasing its focus on digital marketing and e-commerce channels, while pursuing strategic investments to accelerate transformation and better align with shifting consumption patterns and new retail trends.

2. The Estée Lauder Companies, Inc. (NYSE: EL)

Estée Lauder is a globally renowned beauty products company, housing a portfolio of prestigious brands such as Estée Lauder, La Mer, and Clinique, with products spanning skincare, makeup, fragrance, and more. In Q3 2025, the company’s stock price increased by USD 7.32 to close at USD 88.12, a gain of 9.06%.

On August 20, 2025, the Group released its fiscal year 2025 results. Full-year net sales were USD 14.326 billion, down 8% year-on-year, while fourth-quarter (April–June 2025) net sales were USD 3.411 billion, a 12% decline. Geographically, the Americas, Europe, Asia/Pacific, and the Middle East & Africa all saw varying degrees of softening, primarily dragged by weak global demand in skincare, makeup, and hair care, though the fragrance business remained flat.

Looking forward, the company plans to focus on promoting core new products such as La Mer's Night Repair Serum, Estée Lauder Double Wear Concealer, and Clinique SPF Moisturizer in the fourth quarter. It will also capitalize on year-end shopping season opportunities and strengthen its presence on emerging platforms like Amazon and TikTok to enhance brand reach and penetration among younger consumers. The market expects Estée Lauder's stock to maintain a moderate upward trend in Q4, gradually restoring growth confidence.

[For more insights, please download the full report]

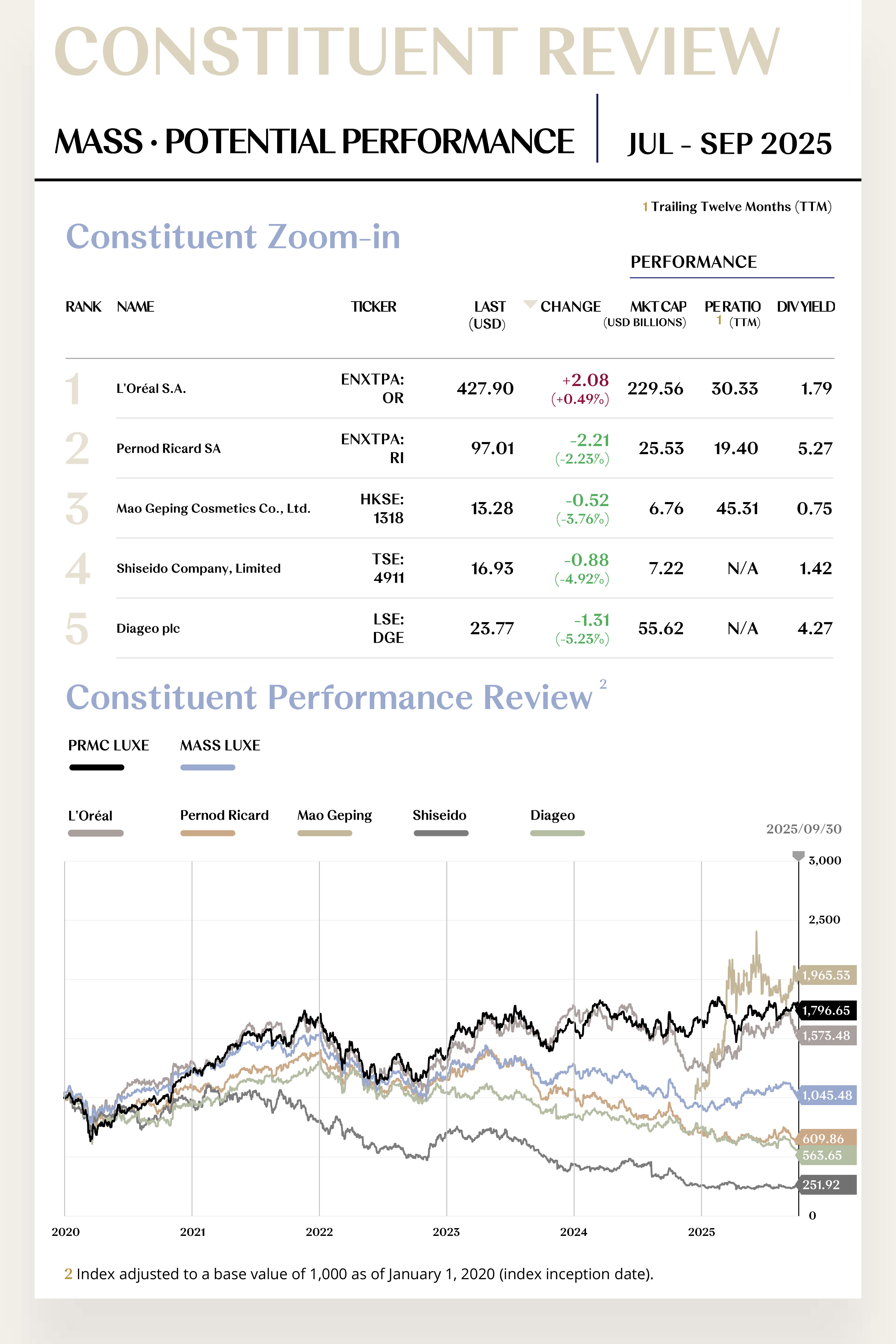

Potential Players

1. L'Oréal S.A. (ENXTPA: OR)

L'Oréal is a world-leading beauty company, operating across luxury cosmetics, consumer products, professional hair care, and dermo-cosmetics, with renowned brands such as Lancôme, L'Oréal Paris, and SkinCeuticals. In the third quarter of 2025, the company’s stock price rose by USD 2.08 to close at USD 427.90, a quarterly increase of 0.49%.

On July 1, 2025, the Group appointed Asmita Dubey as Chief Digital and Marketing Officer, focusing on advancing the application of artificial intelligence and generative AI in consumer engagement. This move is expected to further boost the contribution of digital sales channels and strengthen the growth potential of online business. In the same month, L'Oréal was recognized by CDP as a "Supplier Engagement Leader" for the seventh consecutive year, highlighting its ongoing commitment and leadership in addressing climate change across its supply chain.

Looking ahead to the fourth quarter, the company is well-positioned to achieve further sales growth, supported by the holiday shopping season and the continued rollout of digital channels and high-frequency brand activities. Given its leading position in sustainable supply chains, AI-driven marketing, and the mass beauty market, the market generally expects L'Oréal's stock to maintain an upward trend in Q4.

2. Pernod Ricard SA (ENXTPA: RI)

Pernod Ricard is a world-leading producer of wines and spirits, with a portfolio of internationally renowned brands including Martell, Jameson, Absolut Vodka, and Chivas Regal. In 2025 Q3, the company’s stock price decreased by USD 2.21 to close at USD 97.01, down 2.23%.

On July 23, 2025, the Group announced it had signed an agreement to sell its Indian Imperial Blue business to Tilaknagar Industries Ltd. for approximately EUR 500 million. This move is aimed at further focusing on the premium brand portfolio and is expected to generate annual operational savings of around EUR 100 million, thereby accelerating the implementation of the Group's premiumization strategy.

On August 28, the Group reported its fiscal year 2025 results. Full-year organic net sales declined by 3.0% to approximately EUR 10 billion, primarily dragged by weakness in China, the U.S., and Asian travel retail markets. However, volume returned to growth, increasing by 2% and marking the third consecutive period of positive growth. Brands such as Martell and Chivas Regal contributed about 70% of the incremental volume, evidencing the success of the product portfolio upgrade.

Looking ahead to the fourth quarter, the Group is expected to continue benefiting from the resilient performance of its premium brand portfolio, seasonal demand during the holiday period, and ongoing cost efficiencies. As capital market confidence in its strategic focus and profit improvement grows, the stock is projected to maintain a positive upward trend during the quarter.

[For more insights, please download the full report]

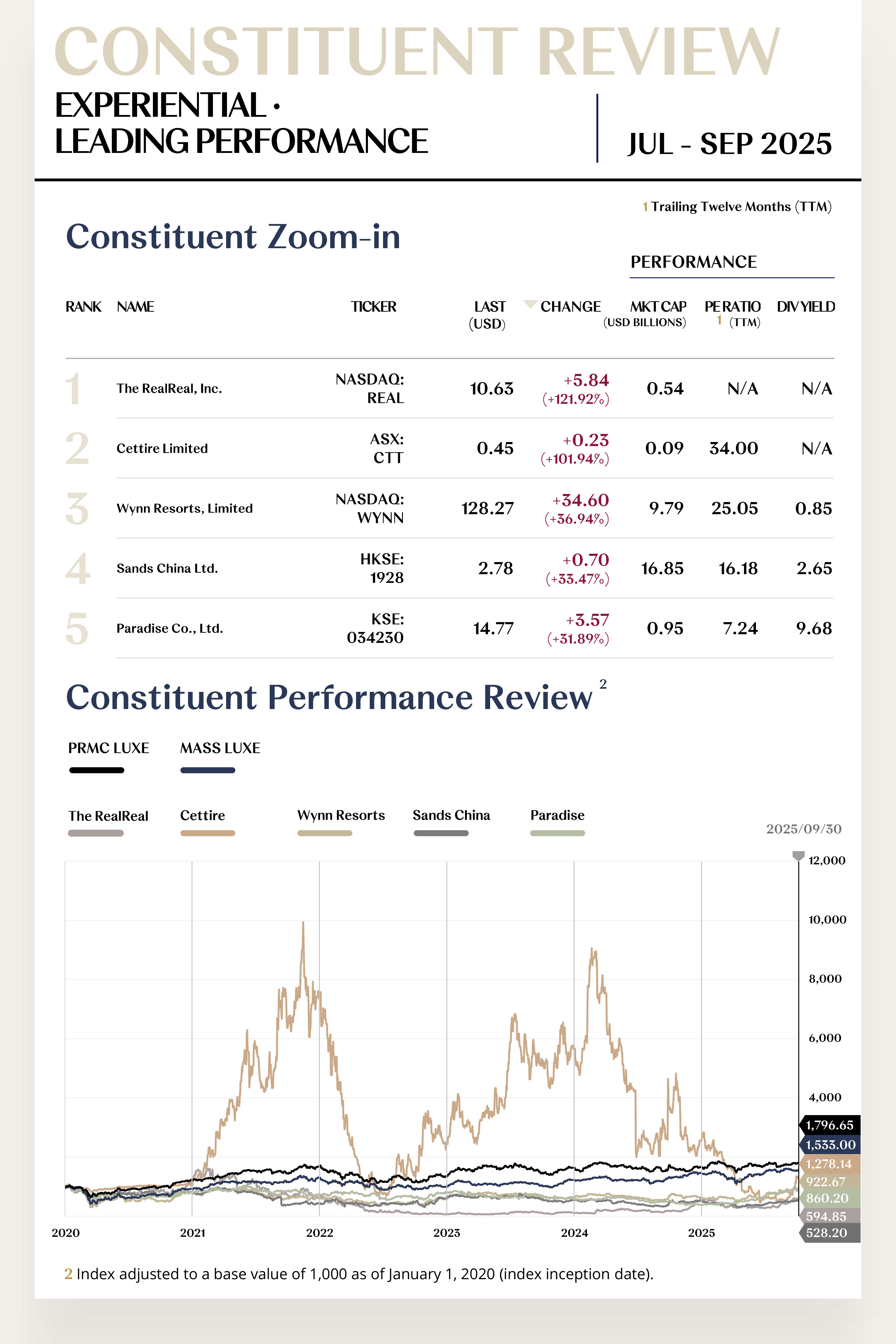

EXP LUXE CONSTITUENT ZOOM-IN

Project Refurbishments Delivering Earnings Upside,

Tourism Recovery Strengthening Sector Momentum

The Experiential Luxe Index comprises 51 stocks, with 34 rising and 17 falling.

Leading Performers

1. The RealReal, Inc. (NASDAQ: REAL)

The RealReal is a leading global luxury consignment e-commerce platform, specializing in professionally authenticated high-end fashion items including apparel, footwear, handbags, jewelry, watches, and home art. In the third quarter of 2025, the company’s stock price rose by $5.84 to close at $10.63, a substantial quarterly increase of 121.92%.

On August 7, The RealReal released its Q2 2025 financial results. Quarterly revenue reached $165 million, a 14% year-on-year increase, while Gross Merchandise Volume (GMV) hit a quarterly record of $504 million. CEO Rati Sahi Levesque stated that the deepened application of AI and automation would significantly improve operational efficiency, further consolidating the company's leading position in the luxury resale market.

Looking ahead to Q4 2025, The RealReal is expected to continue its stock price growth, supported by strong profitability, forward-looking market insights, and a sustainable brand positioning. As AI-driven operational efficiency improves and resale culture gains wider acceptance, the market generally anticipates the company will demonstrate resilient counter-cyclical growth amid economic uncertainties and maintain a positive trajectory in the capital markets.

2. Cettire Limited (ASX: CTT)

Cettire is an Australian online luxury retailer, primarily selling high-end products including apparel, footwear, bags, and accessories to global consumers via e-commerce channels. In Q3 2025, the company’s stock price increased by $0.23 to close at $0.45, surging 101.94% during the quarter.

On July 31, 2025, following updates to U.S. tariff policies, the company announced that products manufactured in China would be affected. It decided to mitigate the impact of geo-trade risks on its luxury retail business by adjusting its cost structure and supply chain layout.

On August 29, the company released its Fiscal Year 2025 Annual Report, disclosing that revenue remained largely flat compared to the previous period, but net profit shifted to a loss, reflecting pressures from the macro environment and market volatility. The report also clearly outlined a strategic focus on expanding into emerging markets such as Asia and the Middle East in the new fiscal year, alongside initiating cost optimization and a prudent expansion in the Chinese market in Q4 to lay the groundwork for future recovery.

Looking ahead to Q4, the company has stabilized its foundation through governance adjustments, asset restructuring, and supply chain optimization. With the gradual rollout of its emerging market expansion, improved cost efficiency, and cautious approach to the Chinese market, Cettire is expected to gradually restore profitability. The market anticipates the stock will have positive recovery momentum in the fourth quarter and resume its growth trajectory.

[For more insights, please download the full report]

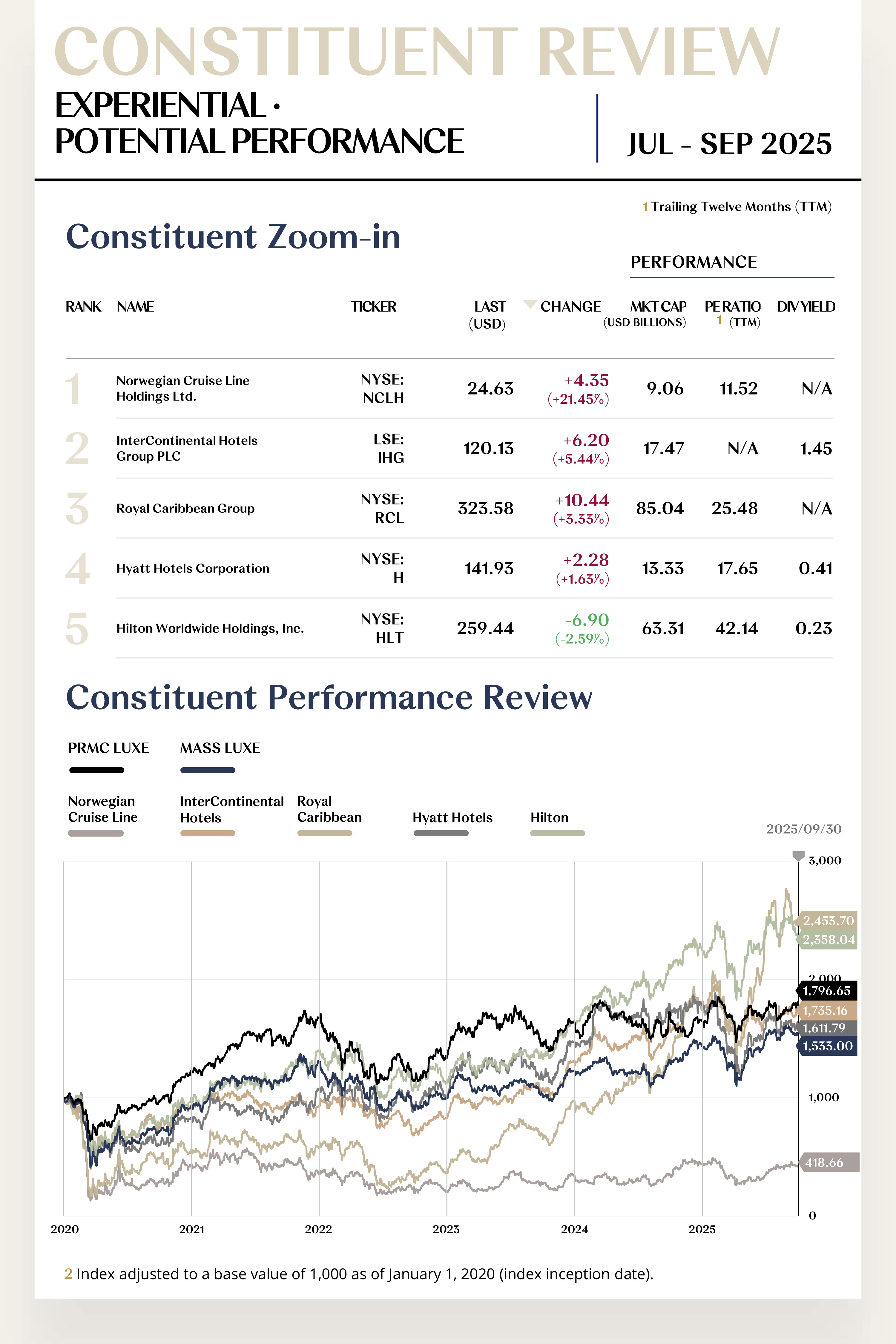

Potential Players

1. Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH)

Norwegian Cruise Line Holdings Ltd. provides consumers with luxury cruise travel services, operating several well-known brands including Regent Seven Seas Cruises, Norwegian Cruise Line, and Oceania Cruises. In the third quarter of 2025, the company’s stock price rose by $4.35 to close at $24.63, representing a quarterly increase of 21.45%.

On July 31, 2025, the company released its second-quarter financial results, reporting net income of $250 million, a 15% year-over-year increase, primarily driven by an 8% growth in passenger volume to approximately 2 million. Additionally, the company announced an expansion of its revolving credit facility from $1.5 billion to $2 billion, providing stronger financial support for its fleet expansion plan in 2026.

Looking ahead to the fourth quarter, the company is expected to benefit from cross-brand customer spending driven by the integrated loyalty program and incremental revenue from retail partnerships. Supported by an optimized capital structure and fleet expansion plans, market expectations suggest further enhancement of profitability, with the stock poised for positive upside in Q4.

2. InterContinental Hotels Group PLC (LSE: IHG)

InterContinental Hotels Group PLC operates a portfolio of renowned brands, including InterContinental, Holiday Inn, and Crowne Plaza, offering premium accommodation and leisure services. In the third quarter of 2025, the company’s stock price increased by $6.20 to close at $120.13, reflecting a quarterly gain of 5.44%.

On August 20, 2025, the company collaborated with Moët & Chandon to launch the inaugural U.S. Open Cocktail Series, featuring a limited-edition “Watermelon Slice” cocktail available at IHG Racquet Bars until September 7. The initiative, rolled out across multiple hotels in New York and Los Angeles, further strengthened the brand’s influence in the premium lifestyle segment.

On September 16, the brand introduced the “Doors Unlocked 2025” exclusive package series, covering six major international cultural events such as the New York Film Festival and Paris Fashion Week. These packages offer VIP access and tailored experiences, highlighting the company’s focus on high-end clientele and experiential consumption trends. Meanwhile, in the Greater China region, post-exhibition momentum spurred new openings, including the InterContinental Changchun, accelerating regional expansion and reinforcing its leading position in the Asia-Pacific market.

Looking ahead to the fourth quarter, the company is well-positioned to achieve steady growth, supported by the ongoing recovery in global travel. Its premium experiential product portfolio and regional expansion are expected to generate incremental momentum. Combined with solid industry footprint expansion and strengthened investor confidence, the market generally anticipates a positive stock performance in Q4, further consolidating its competitive edge as a leading global hotel group.

[For more insights, please download the full report]

MACROECONOMY UPDATES

Intensifying Protectionist Measures,

An Obscured and Fragile Global Recovery Path

Global Overview: Subdued Recovery Amid Persistent Trade Frictions and Policy Divergence

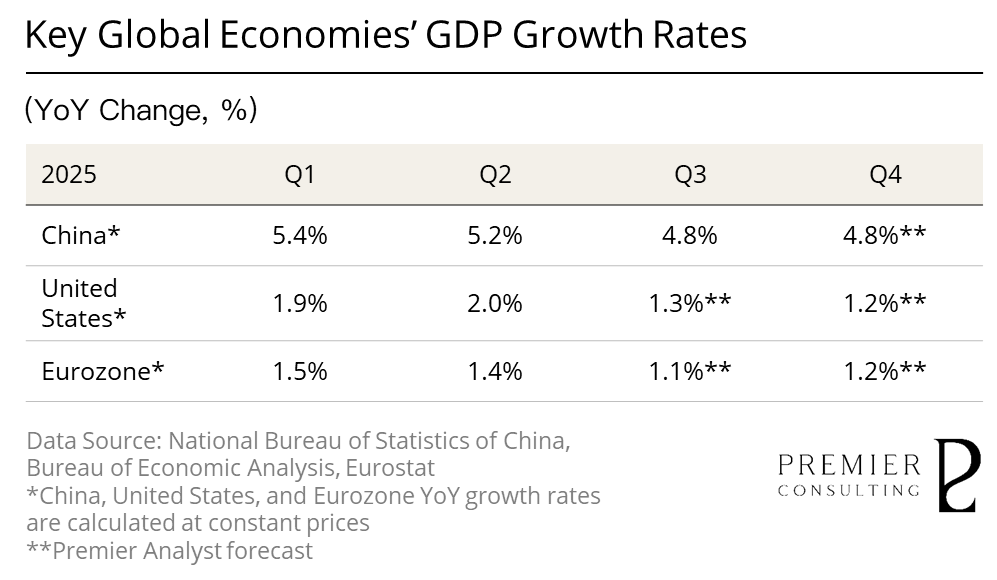

The global economy maintained a weak recovery trajectory in the third quarter of 2025, characterized by a complex interplay of slowing growth and structural risks across major economies. According to the latest International Monetary Fund (IMF) World Economic Outlook, global economic growth is projected at 3.0% for 2025. While this marks a slight improvement over 2024, it remains significantly below pre-pandemic averages, underscoring the fragility and lack of robust momentum in the global recovery.

Policy divergence among major economies has exacerbated growth disparities. Advanced economies continue to grapple with the constraints of high interest rates and sluggish demand, while emerging markets are demonstrating relative resilience, buoyed by fiscal stimulus and domestic demand expansion.

The primary challenge to global economic stability stems from the confluence of persistent trade tensions and geopolitical friction. While U.S.-China trade relations have seen intermittent easing, long-term tariff policy uncertainty continues to exert a profound influence on global manufacturing and supply chain configurations. Disputes between the U.S. and the European Union over issues such as green subsidies and the Carbon Border Adjustment Mechanism (CBAM) remain unresolved. Furthermore, supply chain restructuring efforts in Japan, South Korea, and Southeast Asian nations are elevating risks of a significant reshaping of global trade patterns.

[For more insights, please download the full report]

China: Policy Measures Gradually Take Effect, Sustaining the Momentum of Consumption Recovery

In 2025 Q3, China's Consumer Confidence Index (CCI) continued its mild recovery trend observed since Q2. The index registered 89.00 in July, climbing to 89.20 in August, marking two consecutive months of sequential improvement and reaching its highest level so far this year.

Throughout the year, targeted nationwide campaigns to boost consumption have been intensively implemented. These efforts featured coordinated policy tools, including successive rounds of state subsidy allocations and precisely targeted interest subsidy policies, which played a significant role in stabilizing expectations, enhancing economic momentum, and indirectly bolstering overall public confidence in spending.

Regarding the employment and price environment, the average surveyed urban unemployment rate for the first three quarters held steady at 5.20%, continuing the stable trend from the first half of the year. The Consumer Price Index (CPI) experienced a minor year-on-year decline of 0.10%. However, the core CPI, which excludes food and energy, rose by 0.60%. Notably, this increase expanded to 1.00% in September, marking the fifth consecutive month of acceleration and indicating that policies aimed at expanding domestic demand and stimulating consumption are gradually yielding results.

Furthermore, domestic trips during the Mid-Autumn Festival and National Day holiday period reached 888 million. Soaring popularity of mass sports events, concerts, and music festivals underscored a significant increase in cultural, tourism, and sports-related consumption, highlighting the ongoing recovery in resident confidence and the unlocking of domestic demand potential.

[For more insights, please download the full report]

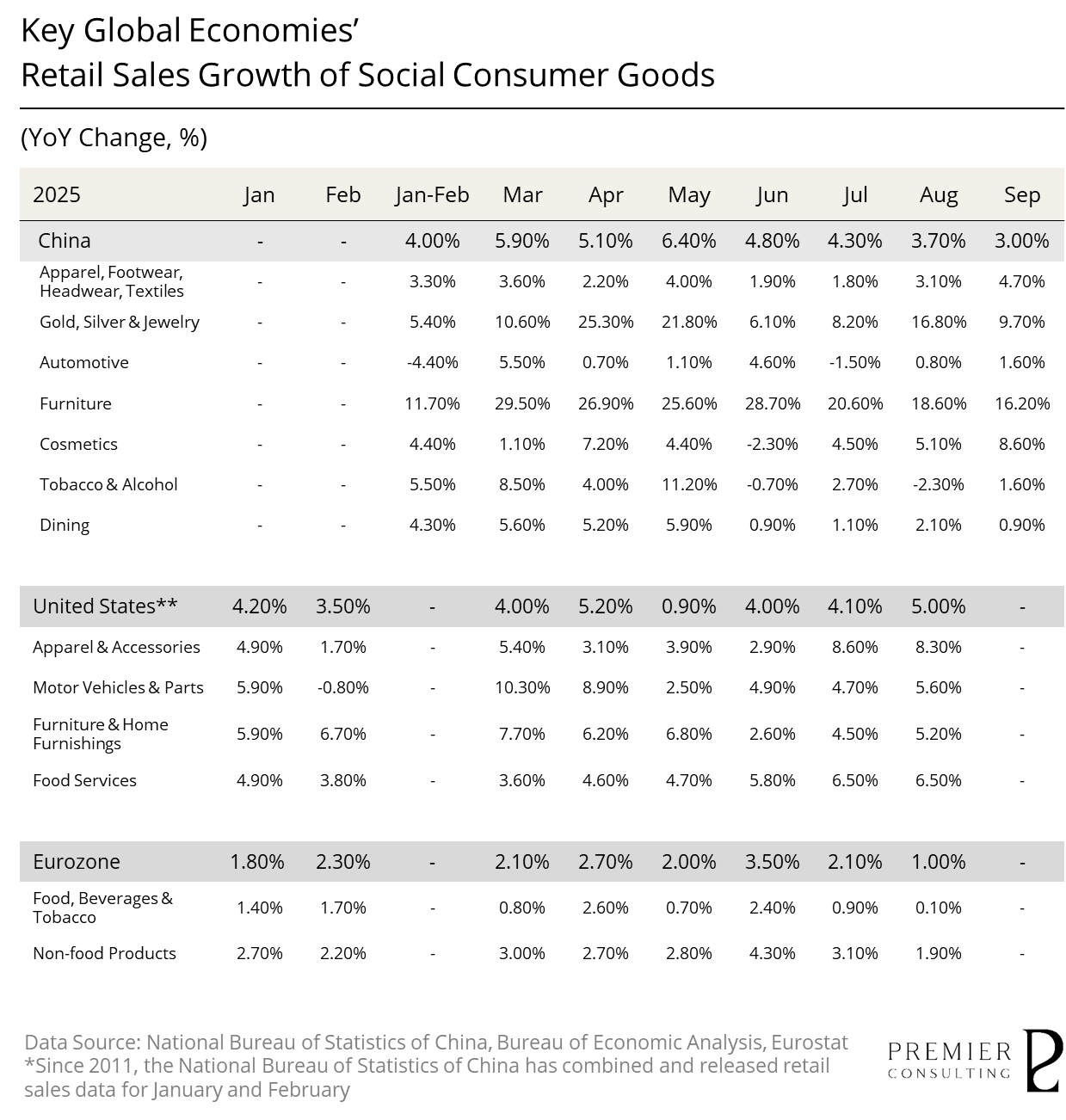

China: Proactive Macro-Policies and Orderly Release of Consumption Potential

In the first three quarters of 2025, China's total retail sales of consumer goods reached RMB 36,587.7 billion, marking a year-on-year increase of 4.50%. This growth rate accelerated by 1.2 and 1.0 percentage points compared to the same period last year and the full year of 2024, respectively. Final consumption expenditure contributed 53.50% to economic growth, an increase of 9.0 percentage points from the full year of 2024, solidifying its role as the primary engine of economic expansion.

Throughout the year, authorities allocated RMB 300 billion in ultra-long-term special treasury bond funds to local governments in four batches, aimed at strengthening and broadening the scope of the trade-in program for consumer goods. The ongoing effects of these policies have effectively boosted sales in key categories such as home appliances, office equipment, communication devices, and furniture. In the first three quarters, retail sales of product categories covered by the trade-in policy, as recorded by businesses above the designated size, all achieved double-digit growth, contributing to a marginal improvement in overall durable goods consumption.

Concurrently, demand for service consumption accelerated, showing structural expansion in sectors like culture, tourism, sports, and wellness. Service retail sales grew 5.20% year-on-year in the first three quarters, outpacing the growth rate of commodity retail sales by 0.6 percentage points, indicating a steady shift in consumption patterns from goods-oriented to service and experience-oriented.

Furthermore, emerging consumption formats remained vibrant, with rapid penetration of new models like instant retailing, live-streaming e-commerce, and social commerce, fostering the digital upgrade of consumption scenarios. National online retail sales grew 9.80% year-on-year in the first three quarters, with the growth rate accelerating consistently since May, establishing it as a significant driver of overall consumption.

Despite the overall restorative growth in consumption, its pace remains below the overall economic growth rate, indicating that household consumption willingness and confidence require further bolstering. Looking ahead to the fourth quarter, stabilizing employment expectations, improving income distribution structures, and strengthening consumer credit support will be crucial to continuously enhance households' actual purchasing power and propensity to consume, thereby guiding the Chinese consumer market towards higher-quality and more sustainable growth.

[For more insights, please download the full report]

PRIMARY INDEX REVIEW & PROSPECT

Early Downturn at Elevated Levels,

Mid-Quarter Momentum Restored through Volatile Gains

In the third quarter of 2025, the PRMC Luxe Index closed at 1,796.65 points, rising by 70.62 points during the quarter, an increase of 4.09%.

Despite a notable correction in the luxury index at the beginning of the quarter, influenced by multiple factors such as the Federal Reserve's interest rate hike expectations, the implementation of new Trump tariff policies, and weak demand in Europe, which led to a phase low at the end of July,

the market sentiment gradually recovered as the European Central Bank initiated interest rate cuts in August, U.S. employment data exceeded expectations with stability, and Sino-U.S. trade tensions did not escalate further. The luxury index oscillated and rebounded from its lows, reclaiming most of its losses by the end of September.

Looking ahead to the fourth quarter of 2025, the luxury index is expected to continue its oscillatory upward trend.

On the macroeconomic front, investors should monitor the adjustments in the Federal Reserve's monetary policy and the ripple effects of Trump's tariff measures, as these will directly impact consumer demand and the growth prospects of high-end categories. Additionally, the pace of global economic recovery and further changes in trade policies will be key variables influencing market expectations, potentially leading to increased short-term volatility in the sector.

At the industry level, the recovery process of the global consumer market remains uneven. Although consumer confidence is gradually recovering in some regions, supported by wealth effects, and the financial performance of luxury companies has improved, the consumption recovery in emerging markets such as China remains relatively slow and subject to significant uncertainty.

Against this backdrop, high-end segments with strong brand premium capabilities and clear recovery trajectories, particularly luxury experiences and collectibles, will be the main drivers of sector growth.

[For more insights, please download the full report]

SECONDARY INDEX REVIEW & PROSPECT

Ultra Luxe at the Forefront, Experiential Luxury Surging,

Core Luxe and Mass Luxe Steady

The Core Luxe Index closed at 1,899.47 points, declining marginally by 0.29 points during the quarter, a decrease of 0.02%, largely in line with the previous quarter’s performance.

On one hand, the market had already partially priced in the recovery of consumer demand in Europe and the United States, as well as the rebound in high-end experiential luxury by the end of the second quarter, leaving the Core Luxe segment with relatively elevated valuations at the start of Q3. At the same time, in the absence of significant upward revisions to earnings, further expansion of valuation premiums proved difficult. As a result, the index frequently faced profit-taking pressures upon reaching higher levels, leading to short-term declines.

On the other hand, against a backdrop of frequent macroeconomic disruptions, market liquidity exhibited high volatility, causing the index to repeatedly surge and retreat within short periods. While some investors allocated to the Core Luxe segment as a defensive strategy, internal divergence within the sector and persistent macroeconomic risks resulted in a generally range-bound and oscillatory trend rather than a clear directional movement.

The Ultra Luxe Index closed at 2,237.50 points, surging by 263.51 points during the quarter, a gain of 13.35%, making it the best-performing segment of the quarter.

Luxury vehicles, private jets, yachts, and other sub-segments recorded notable gains in Q3, becoming one of the key drivers of the Ultra Luxe segment. As market risk appetite gradually recovered, the rebound in consumption capacity among high-net-worth individuals, coupled with the wealth effect, fueled rapid growth in demand for this segment.

Order backlogs and new order volumes disclosed by multiple companies remained at high levels, reflecting strong consumption momentum. This clear demand support made the segment a preferred allocation target in the capital markets amid an uncertain macroeconomic environment.

In contrast, the high-end furniture and home furnishings segment delivered relatively stable performance during the quarter. Limited growth in the global luxury real estate market has constrained demand for high-end furniture and home goods, which are downstream of this market. Although the segment continues to attract long-term investment interest, short-term investor enthusiasm remains neutral, with overall performance aligning with market averages.

The Mass Luxe Index closed at 1,045.48 points, declining by 6.25 points during the quarter, a decrease of 0.59%.

The perfumes and cosmetics segment delivered a generally muted performance. Although certain leading companies made some positive progress through profit recovery plans and global restructuring strategies, the sector as a whole continued to face multiple constraints.

On one hand, the recovery pace across major consumer markets showed significant divergence. While demand in Europe and the United States remained stable, the recovery in China and some Asian markets lacked strength, suppressing the overall growth momentum of the segment. On the other hand, the industry is still undergoing channel structure adjustments. Persistent investments in e-commerce and emerging channels have led to elevated expense ratios, squeezing profit margins in the short term. Against this backdrop, despite intermittent stock price rebounds for individual companies, the overall sector trend remained confined to a range-bound pattern.

The spirits and wines segment performed even more weakly during the quarter, becoming a major drag on the Mass Luxe Index. Weakening consumption capacity of the global middle class and ongoing channel destocking pressures delayed a recovery in end-demand.

In Europe, sluggish economic growth significantly dampened enthusiasm for premium spirits consumption. In US, the market faced constraints from a high-inflation environment, putting pressure on mid-range product sales. In China, high channel inventories forced brands to reduce shipments, further undermining sector sentiment. Under the combined weight of these factors, the spirits segment faced pronounced downward pressure.

The Experiential Luxe Index closed at 1,533.00 points, rising by 39.55 points during the quarter, an increase of 2.65%.

The cruise travel segment performed notably well during the quarter, becoming the core driver of the Experiential Luxe Index's gains. As global entry and exit policies were gradually eased and international route capacity recovered, sustained release of pent-up cross-border travel demand drove dual growth in both booking volumes and average passenger spending for cruise operators. Several industry leaders reported that pre-sales orders for the coming quarters had reached historically high levels for the same period, significantly raising profit expectations.

In contrast, the high-end dining segment showed relative weakness in the third quarter. Although the overall consumer market steadily recovered, the appeal of high-end dining diminished compared to travel and immersive experiential consumption. Simultaneously, high-end dining operators in major global markets faced pressure from rising labour costs and fluctuating raw material prices, leading to continued compression of profit margins. This factor prompted a more cautious investment outlook on the segment and weighed on its overall performance.

[For more insights, please download the full report]

Review & Prospect

Review & Prospect

Luxury’s Refined Path Through Turbulence

Financial Discipline with Strategic Realignment

Review & Prospect

Q3 2025 PRMC Luxe Index

Review & Prospect

Feb 02, 2026

Exploring market stabilization and resilient consumer sentiment, tracing renewed momentum and confidence across global luxury sectors.

Macro Rebound & Sentiment Converge, Ultra Luxe Embodies Recovery

[Primary Index Performance Review]

The PRMC Luxe Index closed at 1,796.65 points in Q3 2025, rising by 70.62 points (+4.09%) during the quarter. Its performance lagged behind the MSCI Asia Pacific (+8.47%), S&P 500 (+7.79%), and MSCI ACWI (+7.29%) but outperformed the STOXX All Europe 100 (+3.37%).

[Secondary Index Performance Review]

The PRMC Core Luxe Index closed at 1,899.47 points in Q3 2025, decreasing by 0.29 points (-0.02%) during the quarter;

The PRMC Ultra Luxe Index closed at 2,237.50 points in Q3 2025, rising by 263.51 points (+13.35%) during the quarter;

The PRMC Mass Luxe Index closed at 1,045.48 points in Q3 2025, decreasing by 6.25 points (-0.59%) during the quarter;

The PRMC Experiential Luxe Index closed at 1,533.00 points in Q3 2025, increasing by 39.55 points (+2.65%) during the quarter.

[Macroeconomic Review and Outlook]

In the third quarter of 2025, the global economy continued its moderate recovery, yet "uneven rebound" remained the dominant theme.

Following two years of tightening cycles, major developed economies gradually shifted toward a wait-and-see approach and monetary easing. The Federal Reserve and the European Central Bank signaled that interest rate cuts were on the horizon, contributing to a marginal improvement in global liquidity and a rebound in asset prices from their lows. However, uncertainties surrounding geopolitics and trade friction continued to weigh on market sentiment, limiting the pace of recovery in global consumer confidence.

China market maintained a pattern of structural recovery. On the policy front, efforts to "stabilize growth" and "boost consumption" worked in tandem, with fiscal expenditure continuing to favor high-value-added sectors such as tourism, green consumption, and cultural leisure. The summer consumption peak season drove a recovery in foot traffic at offline retail and luxury stores, although cautious medium- to long-term income expectations among households continued to impose constraints on mid-to-high-end consumption.

US market exhibited signs of "stability amid stagnation." While inflation gradually eased, the high-interest-rate environment and tariff uncertainties pushed up end-product prices, restricting the expansion of household disposable income. Supported by asset price recovery and stable employment, high-net-worth individuals sustained their high-end consumption, whereas mass-market consumers grew more rational in their spending.

Europe market recovery remained sluggish. Weak manufacturing performance in core economies and persistently high energy costs continued to dampen consumption momentum. Although inflation has become more manageable, cost-of-living pressures and low confidence indices have kept middle-class spending willingness subdued. Additionally, limited fiscal space within the Eurozone and insufficient coordination among member states on expansionary policies have resulted in limited stimulus effects, making it difficult to generate a meaningful boost in aggregate demand.

Looking ahead to the fourth quarter of 2025, the global luxury industry is expected to enter a "value restructuring phase within a period of structural adjustment." Luxury indices are likely to fluctuate amid a dynamic balance between valuation recovery and fundamental divergence.

On the macroeconomic front, major central banks may initiate easing cycles by year-end, and the marginal improvement in monetary conditions is expected to revive risk appetite in the markets. Continued easing of global inflationary pressures will provide a more favorable financing and spending environment for luxury consumption. At the same time, moderate fiscal policies in Europe and the U.S., coupled with enhanced consumption-side stimulus in China, are poised to jointly drive a phased recovery in high-end spending.

From a consumption trend perspective, “experience-driven consumption” will remain the key long-term growth engine for the industry. High-net-worth consumers are shifting their focus from material goods to emotional experiences and lifestyle investments—areas such as travel retail, boutique accommodations, art exhibitions, and fine dining continue to expand, injecting growth momentum into the Experiential Luxe Index.