Luxury Industry Outlook 2025

Luxury Industry Outlook 2025

Eight key trends empowering luxury brands to navigate industry volatility with strategic foresight and enduring progress.

Thriving Amid Flux – A Resilient Path Forward

The luxury goods sector, long sheltered from broader economic shifts, is now facing the impact of macroeconomic fluctuations.

After three years of growth following the pandemic, the luxury industry’s rapid expansion abruptly slowed in 2024. According to Premier’s analysis, less than 40% of publicly listed luxury companies that reported financial results for the first three quarters of the year showed positive revenue growth.

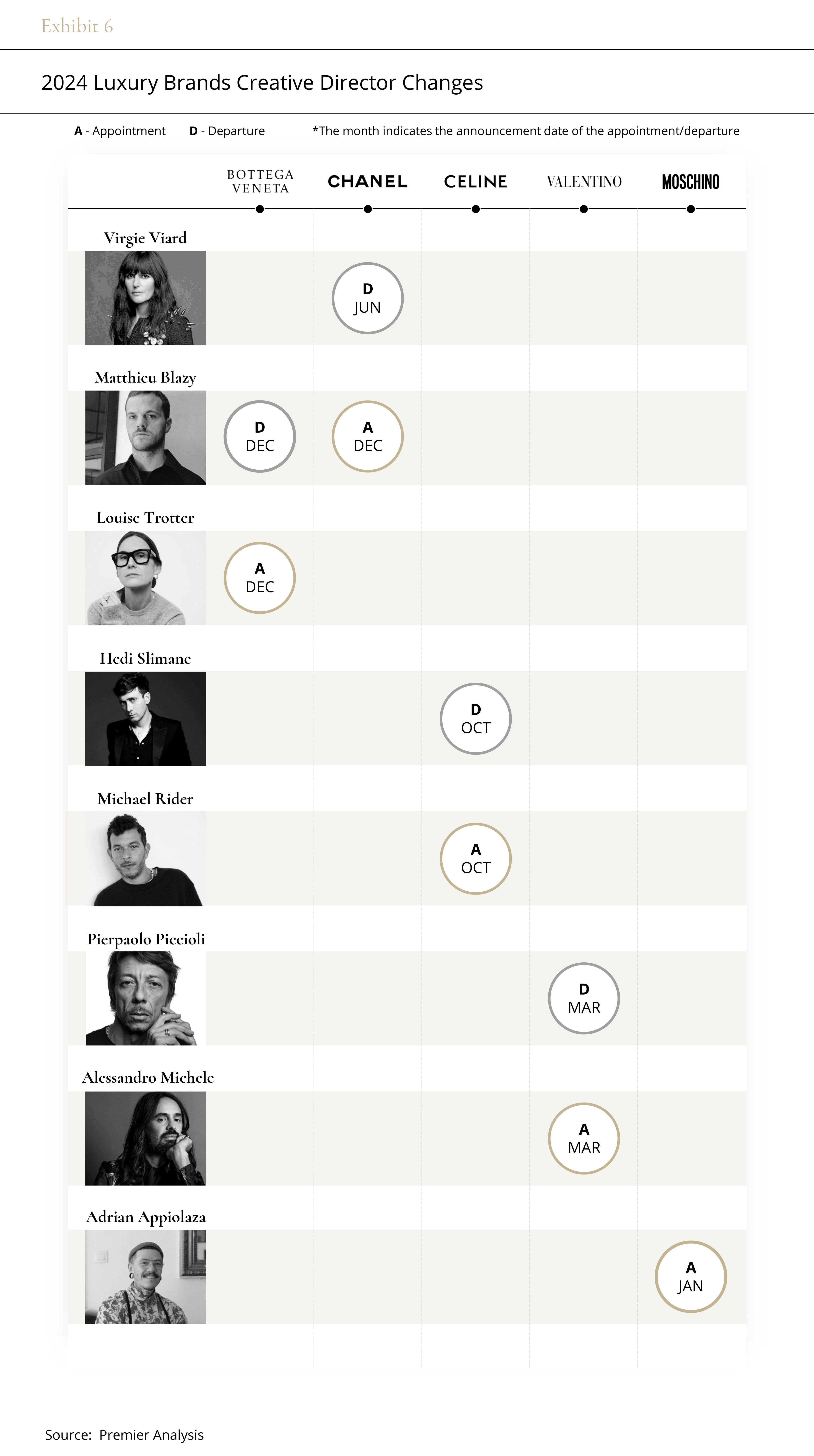

Facing performance challenges, the industry has seen an unprecedented turnover in creative director positions, contributing to internal instability. Simultaneously, key players have continued their expansion efforts, signaling a strong commitment to recovery through organizational adjustments, preparing for the year ahead.

In 2025, while opportunities may be on the horizon, uncertainty remains. Geopolitical tensions persist, and the evolving demands of both the elite and the middle class create additional challenges. The global market has entered a phase of heightened competition, with an ever-shifting landscape. Moving forward, brands must prioritize understanding customer needs to sustain loyalty and optimize operations to enhance brand value—challenges that all companies, regardless of size, will face in the coming year.

Leveraging ongoing industry analysis and in-depth expertise, Premier presents eight key trends shaping the luxury sector in 2025. By examining critical data and events, we offer actionable insights that will help brands navigate uncertainty, foster resilience, and capitalize on opportunities amidst a dynamic market environment.

DOWNLOADS

Lite Report (61 pages)

SECTION1

Experiential Luxury

Unlocking Counter-Cyclical Opportunities Despite Growth Headwinds

In 2025, geopolitical instability and consumer confidence rebound will remain the key drivers influencing the luxury goods industry.

Geopolitical conflicts and economic fluctuations continue to be significant sources of uncertainty, with changes in tariffs and trade policies following the U.S. government transition adding further pressure to the growth of other major economies. On the other hand, the rebound in consumer confidence will rely on more effective and continuous policy support across different regions.

European Market: Seeking Recovery Opportunities Amid Cautious Sentiment

As inflation gradually decreases, disposable income is showing signs of improvement. While growth in major economies like Germany and the UK remains weak, the European luxury market is gaining strength as the tourism industry recovers. Cities like Paris and Milan continue to attract international visitors, and tourism-driven consumption could become an important growth driver for the luxury sector.

U.S. Market: Steady Consumer Spending Supports Market Optimism

According to the latest forecast from the International Monetary Fund (IMF), U.S. GDP growth for 2025 has been revised upward to 2.7%, compared to the previous forecast of 2.2%. Wage growth, increased investment, and interest rate reductions are fueling consumer spending. The middle and upper classes are experiencing steady growth in purchasing power, while the ultra-high-net-worth individual (UHNWI) segment is expanding at a compound annual growth rate of approximately 5%, offering robust support for sustained growth in the luxury market.

Chinese Market: Transition Period Brings New Growth Potential

The ongoing challenges in the real estate market continue to dampen consumer confidence, contributing to slower growth within the UHNWI group. Policy intervention is necessary to restore confidence in the market. The IMF has revised China's 2025 GDP growth forecast from 4.5% to 4.6%, signaling a positive outlook for the economy. Despite this slower growth, China remains a crucial player in global luxury consumption, driven by its large market size and diverse consumer base. The "China Travel" trend, fueled by visa-free policies, is stimulating consumption and emerging as a key area for luxury brands to explore new growth opportunities.

The strong recovery of the tourism industry, driven by the macroeconomic environment, is providing a significant boost to the luxury goods market. High-end luxury experiences are becoming central to future industry growth.

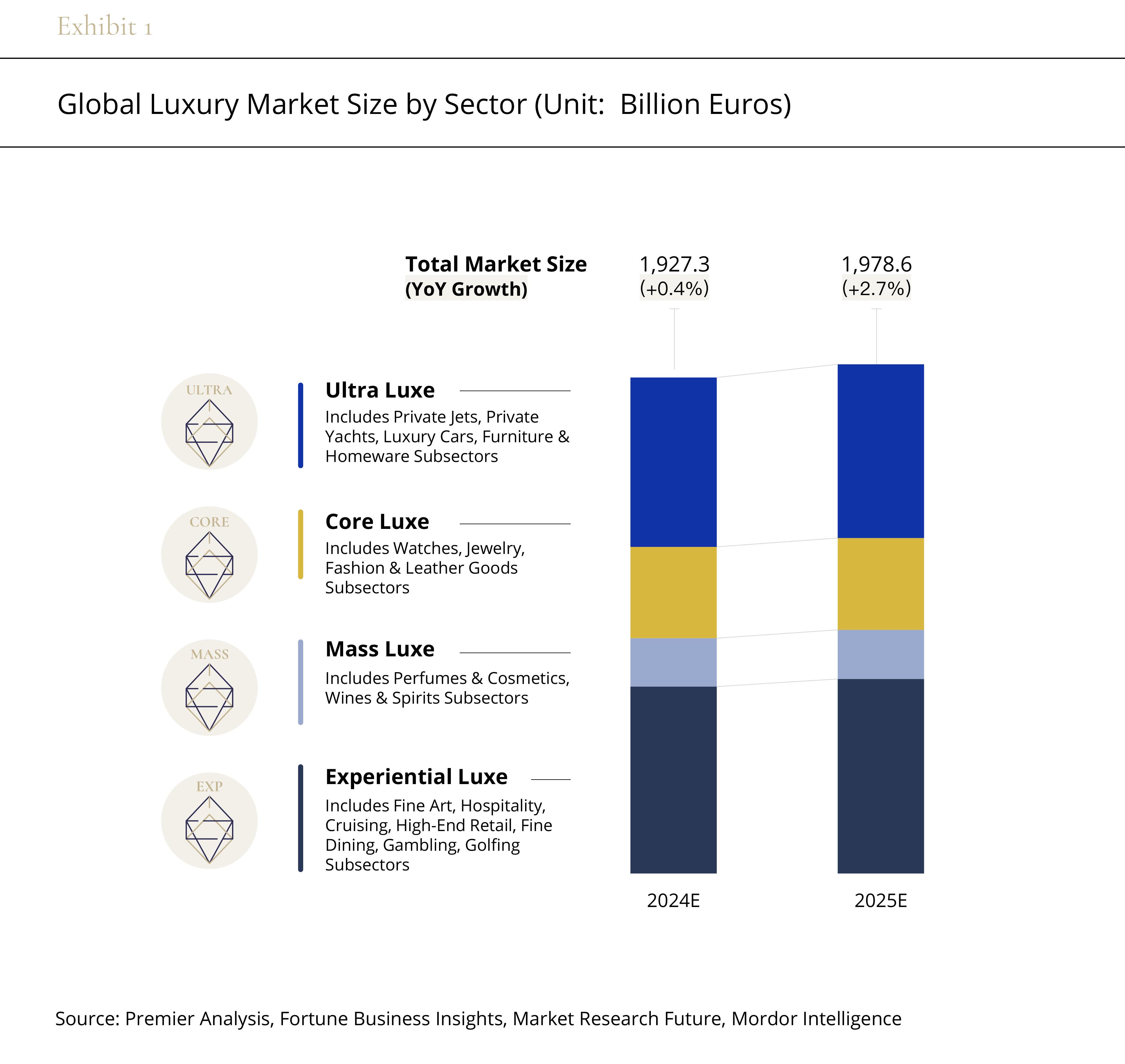

According to Premier's segmentation and estimation of the luxury goods market, in 2025, the global luxury market is expected to grow by 2.7%, primarily driven by the growing demand from high-net-worth individuals for holistic luxury experiences. In response, the Experiential Luxe sector, which includes luxury services such as hospitality, cruising, fine dining, gambling, and golfing, is becoming a key engine driving market growth.

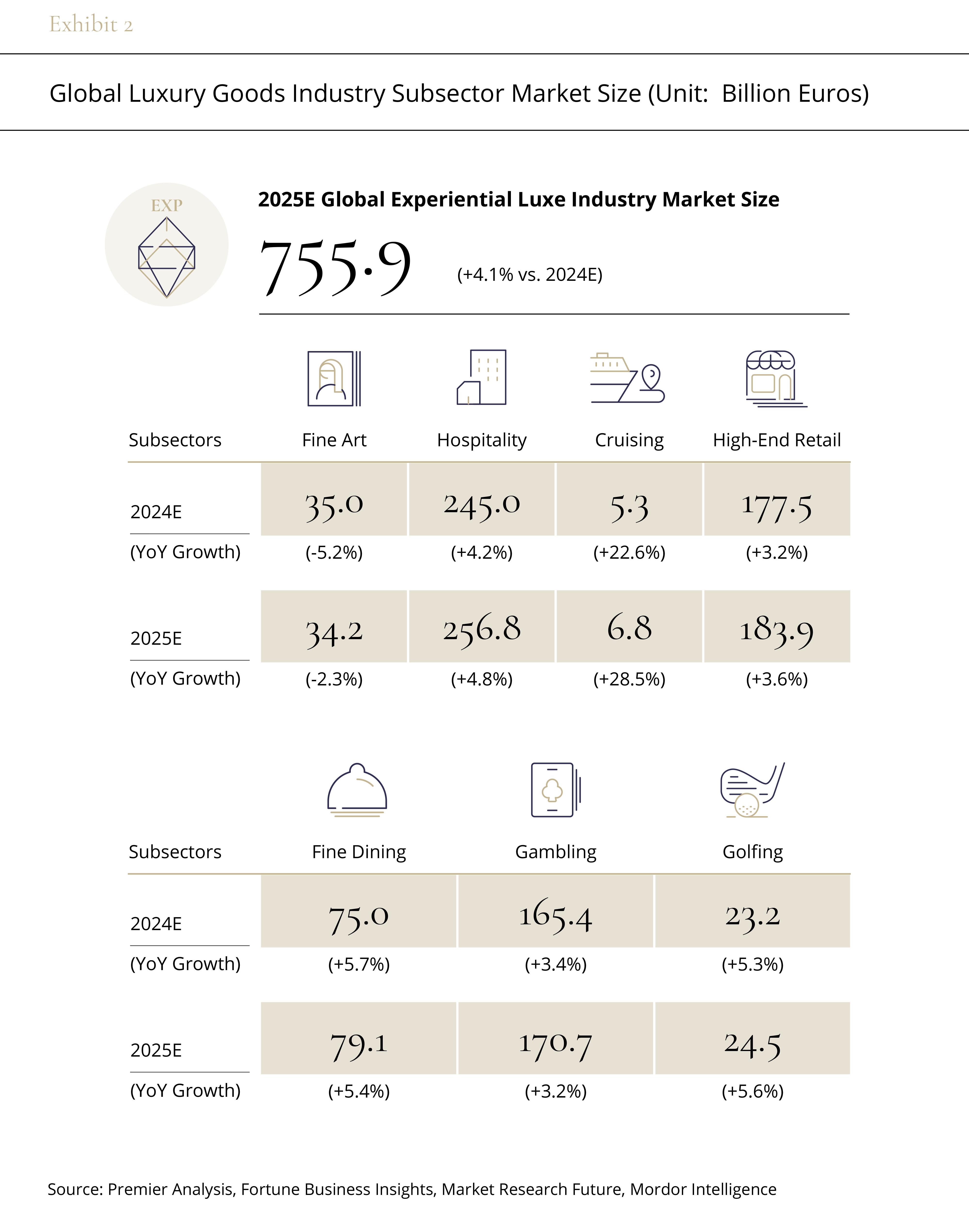

Delving into the subsectors, the Experiential Luxe segment is expected to reach a market size of €755.9 billion, growing by 4.1% year-on-year. Benefiting from the strong recovery of the global tourism industry and the rising consumer preference for high-end services; hospitality, fine dining and cruising have performed well, becoming the key drivers of growth.

SECTION2

High-Net-Worth Resilience Securing Demand

Exceptional Services as the Key to Rebound

In 2024, the performance of China's luxury goods market has attracted global attention. The main reason for the market downturn was the post-pandemic shift in consumer overseas spending, coupled with an overall trend of more rational consumer behavior, which has limited both consumer confidence and willingness to spend. The revival of international travel, with its advantages in exchange rates and price differences, has further worsened the situation, causing significant damage to the Chinese luxury goods market.

According to the Q3 financial reports of major luxury goods conglomerates in 2024, the Asia-Pacific region, including China, saw the largest declines. LVMH reported a 16% year-on-year drop in sales in its Asia-Pacific markets, excluding Japan. Kering's sales in the region fell by 30% due to a 35% decrease in Chinese customer numbers. Even brands like Hermès, known for their stable performance, admitted that the downturn in the Chinese market shows no signs of stopping.

Despite the overall market downturn, some brands are thriving against the odds. Brunello Cucinelli achieved double-digit growth in the Asia-Pacific region, driven by continuous penetration into high-net-worth individuals and strong customer loyalty, offering a bright spot amidst the downturn. Similarly, the Prada Group reported impressive results in China. Its CEO, Andrea Gritti, emphasized during the earnings call that the Chinese market plays a crucial role in the brand’s global strategy, and the company will continue to increase investments, optimizing its product mix and customer experience.

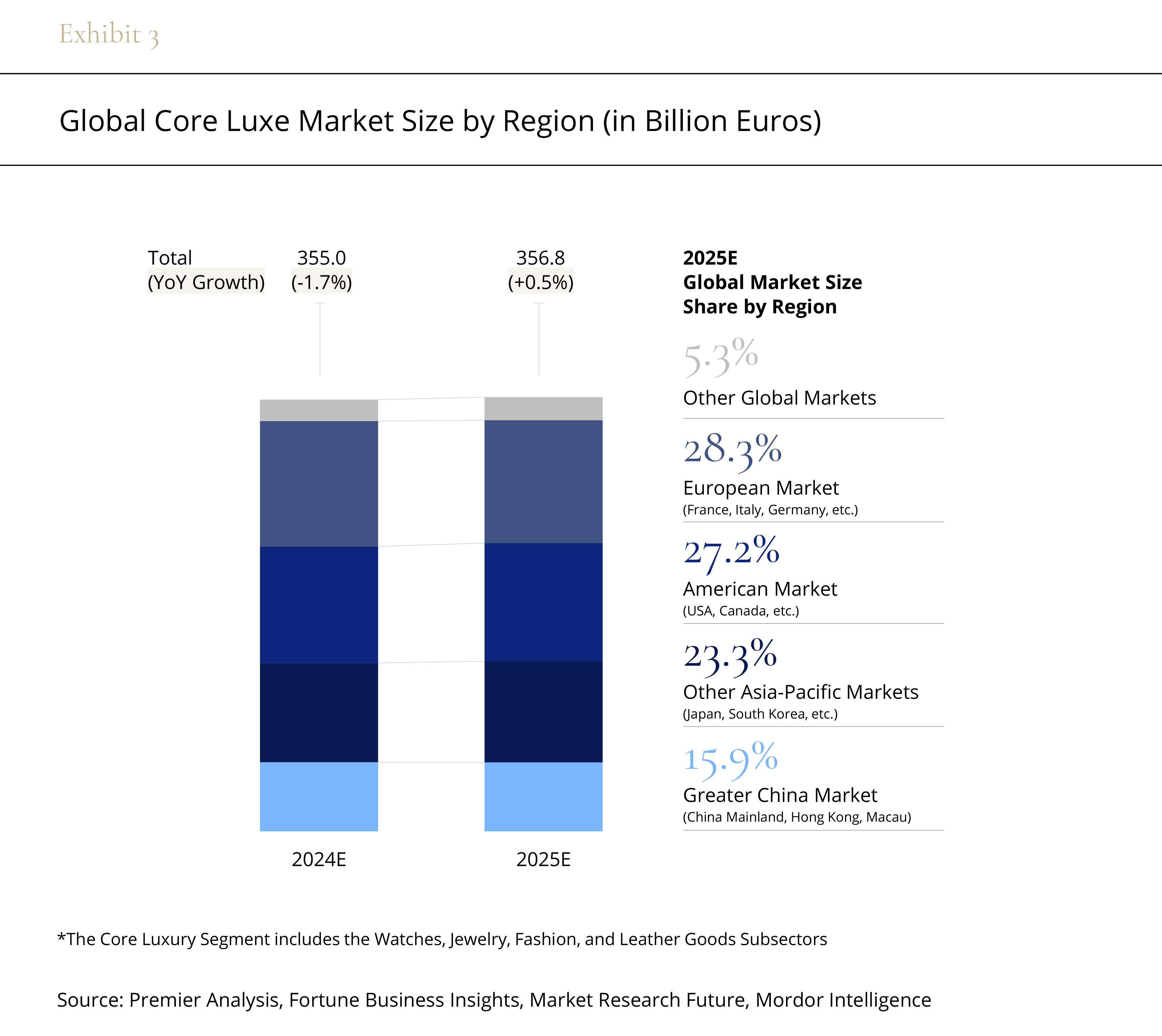

According to UBS‘s “Global Wealth Report 2024”, the number of ultra-high-net-worth individuals in the Asia-Pacific region is expected to grow at an annual rate of 13%, reaching one-third of the global total by 2027. Premier forecasts that the global high-end luxury market will reach €356.8 billion by 2025, with China (including Mainland China, Hong Kong, and Macau) maintaining a market share of 16%.

Despite a slowdown in growth, China’s contribution remains solid. Undoubtedly, it will continue to be a core focus for the global strategies of major luxury goods groups.

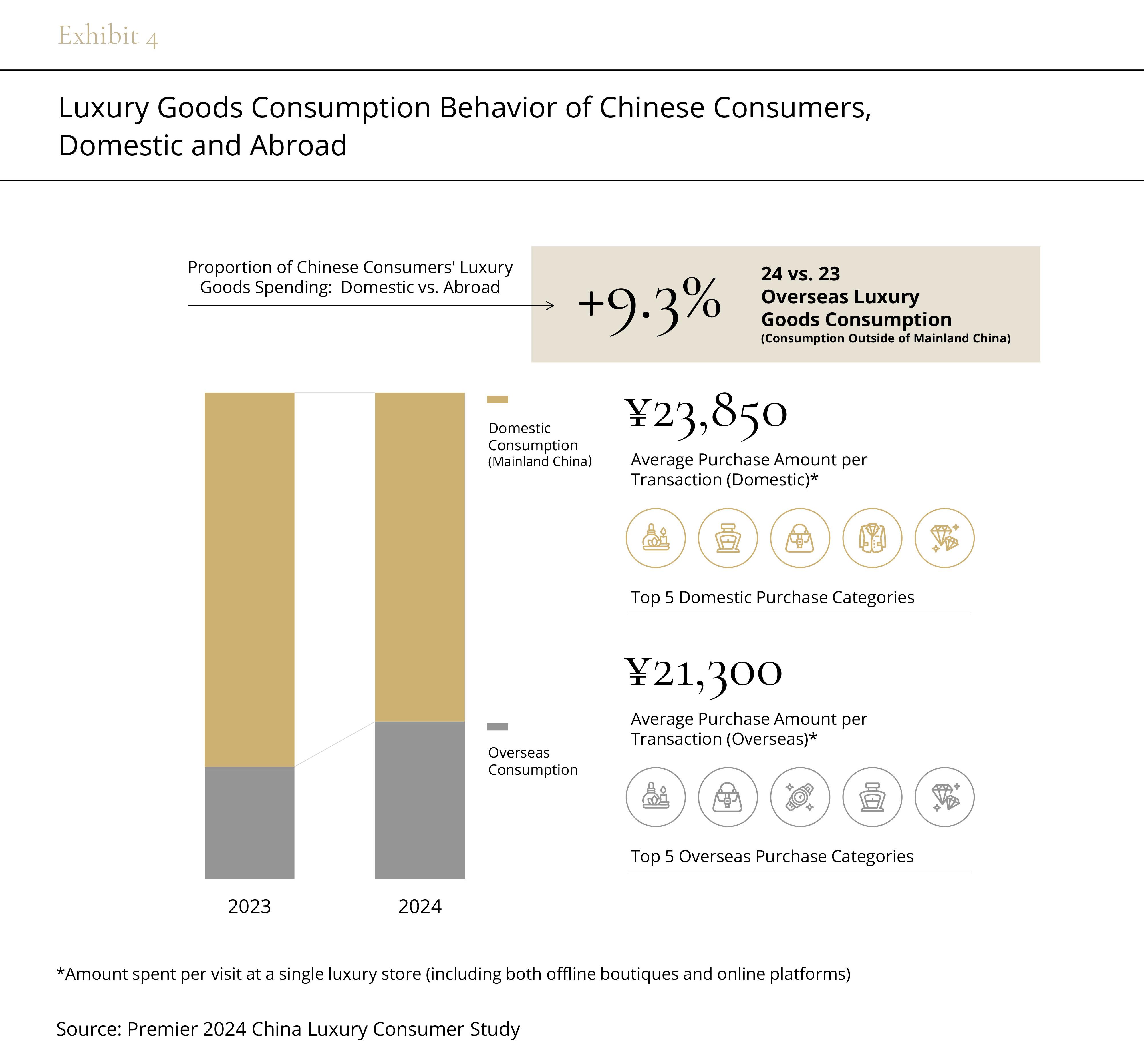

In the beginning of 2024, the loss of overseas consumption has become a significant concern for the stability of the Chinese market. According to Premier 2024 China Luxury Customer Behavior Research, over 30% of luxury goods consumption by Chinese consumers in 2024 occurred overseas, reflecting a 9.3 percentage point increase compared to 2023.

The driving factors behind overseas luxury goods consumption remain tax-free and price advantages. In particular, the continuous depreciation of the yen against the Chinese yuan, combined with the geographical proximity and friendly relations between Japan and China, has made Japan a major travel and shopping destination for high-net-worth and middle-class consumers from first- and second-tier Chinese cities. This has significantly diluted the domestic luxury goods market's share.

As outbound flight capacity gradually returns to pre-pandemic levels, the global mobility of luxury goods consumption has significantly increased. The price differences caused by exchange rate fluctuations are becoming more evident and may persist long-term, making dynamic global pricing strategies a key measure for luxury brands to tackle the challenge.

Quarterly global price adjustments are no longer sufficient to meet the rapidly changing price needs between regions. There is an increased reliance on precise exchange rate monitoring, efficient price adjustment mechanisms, and highly coordinated operational planning. Luxury companies must respond swiftly to maintain consistent brand value perception across different markets and take a proactive position in global regional revenue management.

Focusing on domestic consumption, the average single purchase amount for Chinese consumers in 2024 reached ¥23,850, 12% higher than the average spending on overseas purchases. This disparity is driven by both the impact of duty-free and price differences, as well as the domestic preference for high-priced categories such as fashion and jewelry. This trend is closely linked to the more intimate and reliable service in China, as well as the convenience of visiting stores after new arrivals.

Notably, Chinese consumers are placing increasing importance on in-store service experiences and quality. Long-term trusted purchasing channels have become more influential decision-making factors. At the same time, consumers are paying more attention to product availability, with a stronger desire for "instant gratification" in their purchases.

In other words, while the consumer base and demand remain robust, Chinese consumers are becoming more rational and cautious, and are now setting new expectations for luxury brands—expectations that were once defined by the brands themselves: more meaningful in-store service and product offerings that better align with customer needs.

The deliberate distance once created by international brand images and exclusive stores has gradually faded. For both high-net-worth individuals and the broader middle-class consumer group, brand premiums based solely on rarity no longer justify the steep prices of luxury goods. Only products that align with customer desires, coupled with a distinct brand connection, exceptional service, and personalized communication, can add true value to the brand, recreating the long lines seen in high-end shopping centers.

In a vast market with recovering consumer confidence, authentic and practical customer care and experiences have become key competitive advantages. They empower brands to capitalize on market recovery and take the lead in driving sales growth within China.

SECTION3

Sector-Spanning Investment

Fortifying Business Agility, with Titans Ramping Up Expansion

In 2024, with global economic growth slowing and the consumer market under pressure, the luxury goods industry saw a significant acceleration in capital restructuring and strategic adjustments. Brands facing challenges have created M&A opportunities for well-funded giants. Resources have increasingly concentrated in leading companies, highlighting the economies of scale in the industry, and raising the competitive barriers.

Luxury conglomerates have strengthened their market dominance by accelerating acquisitions, optimizing supply chains, and pursuing cross-industry investments, pushing the industry’s competitive landscape into further differentiation. Under pressure to maintain growth, major groups have relied on stable cash flows to focus their strategies on three core areas:

1.Mergers and Acquisitions to Expand Brand Portfolios

To unlock long-term growth, luxury groups have been increasing capital investment, focusing on high-potential sectors, and expanding their brand portfolios and market reach through acquisitions. The optimization of asset portfolios not only enhances the management of existing brands but also includes targeted investments in emerging brands, laying the foundation for sustained growth. These mergers and acquisitions have reshaped the industry’s competitive landscape and provided strong support for companies in gaining more influence in core markets.

Among them, LVMH has consolidated market leadership by continuously expanding brand portfolio, reinforcing its core influence in the global luxury sector with a “stronger gets stronger” strategy. The acquisition ambitions of the Arnault family go beyond short-term financial gains, focusing more on long-term control of the luxury industry’s discourse and steadily advancing its global expansion.

Last year, LVMH's investment arm, L Catterton, made headlines with its acquisition of the Tod’s Group. Through its subsidiary, Crown Bidco Srl, L Catterton launched a voluntary tender offer for Tod’s shares, eventually securing over 90% of the company’s stock, prompting Tod’s delisting from the Milan Stock Exchange. This move is seen by industry insiders as a prelude to a full acquisition of Tod’s by LVMH. According to the deal structure, Tod’s retains 54% of shares, L Catterton indirectly holds 36%, and LVMH’s wholly owned subsidiary, Delphine SAS, holds 10%. This phased shareholding approach allowed the Arnault family to gain control over the Italian footwear giant, setting the stage for a future complete acquisition.

2. Vertical Supply Chain Integration to Enhance Resilience

Supply chain resilience has become a critical factor for luxury conglomerates to maintain their competitive edge in uncertain market environments. Through the extension of upstream raw material procurement and manufacturing links, as well as the integration of downstream retail channels, luxury giants are continually strengthening their vertical integration capabilities. This approach not only establishes capital barriers and optimizes cost structure but also ensures stable support for the preservation of the brand’s rare craftsmanship.

In August 2024, Chanel announced the acquisition of a 25% stake in independent watchmaker MB&F. Founded in 2005 by Maximilian Büsser, MB&F is renowned for its innovative and intricate watchmaking techniques. Frédéric Grangié, President of Chanel Watches & Fine Jewellery, stated that this move is part of the brand’s “long-term strategy to continue to preserve, develop and invest in specialist know-how and craftsmanship,” further deepening its expertise in high-end watchmaking and reinforcing its position in the luxury watch market.

Additionally, Chanel acquired JY BH, a French high-end ready-to-wear manufacturing group founded by Jean-Yves Bohère. The group’s four couture ateliers are known for their exceptional craftsmanship, specializing in high-end and luxury ready-to-wear, and have become crucial technical support for Chanel’s haute couture collections. This acquisition aligns closely with Chanel’s commitment to preserving artisanal techniques and complements its Le 19M workshop initiative.

3. Experience Economy Drives Cross-Industry Investments

In the context of the expanding experience economy, luxury brands are deeply penetrating the full lifestyle of high-net-worth individuals through cross-industry investments and diversified strategies. By offering multi-sensory and multidimensional interactive experiences, these brands convey their corporate and cultural values.

In June 2024, Louis Vuitton opened a pop-up store featuring its brand capsule collection at the Miami-based Casa Neos hotel. This pop-up not only showcased the LV by the Pool women’s resort collection but also featured a curated selection of leather goods, ready-to-wear, accessories, travel items, and lifestyle products, extending even to tableware and surfboards. By creating an immersive experience within the hotel’s living spaces, the brand offered a multi-sensory shopping journey, providing consumers with a comprehensive presentation of its values.

The luxury goods industry’s investments in commercial real estate, luxury hotels, and high-end dining optimize asset portfolios while establishing deeper emotional connections with consumers through immersive experiences. Whether embedding retail stores within hotel spaces or integrating brands into customized travel journeys, this full-lifestyle penetration is creating new growth engines for the luxury industry.

Agility has extended beyond management into capital investment, becoming a key strategic priority for leading luxury groups. In 2025, the reallocation of capital and resources will continue, with competition shifting from products to the depth of brand integration into consumers' lifestyles. The boundaries of luxury consumption have been redefined, and the battleground now extends far beyond traditional personal luxury goods.

Under the "stronger get stronger" economic paradigm, leading groups are accelerating expansion through their financial strength, while long-tail brands face greater challenges in carving out a niche within specialized segments. The evolving market landscape is already taking shape, reflected in the strategic investment moves of industry leaders.

SECTION4

Harmonizing Creative and Executive Leadership

into a Collective Powerhouse for High-Impact Growth

In 2024, the luxury industry witnessed a wave of leadership changes, from creative directors to top executives. This large-scale reshuffling reflects brands’ strategic responses to market headwinds and underscores their urgency in addressing the creative stagnation crisis and improving managerial efficiency under mounting performance pressures.

According to Premier, in the past 12 months alone, 20 creative director transitions have taken place across major international luxury brands. Amid macroeconomic challenges, frequent changes in creative leadership have become a common tactic for brand revitalization and revenue stimulation.

However, while these high-profile appointments bring immediate commercial appeal, they also pose long-term risks. The consistency of brand heritage weakens, the influence of signature design styles fosters creative homogenization, and the alignment between management efficiency and creative vision becomes increasingly complex and resource-intensive. These challenges place greater demands on organizational cohesion, potentially outweighing the difficulties of replacing a creative director itself.

On the other hand, the three major listed luxury groups (LVMH, Kering, and Richemont) are pursuing growth through senior leadership changes to enhance performance in 2025. This frequent organizational restructuring, driven by personnel shifts, is emerging as a key indicator of industry transformation.

In 2024, LVMH’s 48 major executive changes reflect the Group's long-term strategic intentions, further strengthening the family governance model, consolidating the stability of core businesses, and paving the way for future diversification. Among these adjustments, the Arnault family's consolidation of power within the Group is evident. Several executive role changes, including Frédéric Arnault being appointed CEO of the Watch Division, Alexandre Arnault becoming Deputy CEO of the Wines and Spirits Division, and the departure of long-time HR executive Chantal Gaemperle, underscore the family's strategic focus on both legacy and power consolidation, ensuring the Group’s long-term stability and growth.

Meanwhile, LVMH’s executive changes in the Hotel, Beauty, and Wines & Spirits sectors demonstrate the Group's determination for diversified expansion, reinforcing high-end business assets and differentiating itself from competitors. The positioning of the Wines & Spirits business, in particular, will become a key pillar of the Group’s future growth.

In 2024, under the pressure of continuous revenue declines from its core brands, Kering Group has actively responded to market challenges through a series of executive reshuffles and business optimizations. At the Group level, key leadership adjustments included changes to the Chief Brand Officer and the President & CEO of the Kering Beauté for the Americas, while CEO positions at its flagship brands, Gucci and Saint Laurent, also saw significant changes.

In response to the performance struggles of its core brands, Cédric Charbit transitioned from CEO of Balenciaga to CEO of Saint Laurent, while former Saint Laurent Chief Business Officer Gianfranco Gianangeli was promoted to CEO of Balenciaga. This internal management reshuffling aims to inject growth momentum into the brands by leveraging the Group’s scarce yet proven successful leadership experience. Additionally, Gucci’s executive restructuring has been more intensive, covering areas such as digital marketing, global communications, retail, and operations, signaling the Group’s strong commitment to revitalizing this core brand.

In 2024, Richemont implemented a series of high-frequency leadership changes within its high jewelry and watch divisions, reinforcing its commitment to the hard luxury sector. The Group's management reshuffles reflected a strong focus on internal promotions and stability, ensuring the continuity of brand heritage, craftsmanship, supply chain management, and the stewardship of scarce assets.

Notably, leadership transitions at Cartier, Van Cleef & Arpels, Vacheron Constantin, Jaeger-LeCoultre, and Buccellati were all internal promotions or reassignments. Nicolas Bos was promoted from CEO of Van Cleef & Arpels to CEO of Richemont Group; former Jaeger-LeCoultre CEO Catherine Rénier took over as CEO of Van Cleef & Arpels; Jerome Lambert, who previously held positions within Jaeger-LeCoultre, returned as its CEO; Vacheron Constantin appointed Laurent Perves as CEO through an internal promotion; and Buccellati named Nicolas Luchsinger, former President of Van Cleef & Arpels Asia Pacific, as its new CEO.

Looking ahead to 2025, agility and stability have emerged as the twin guiding principles in luxury management following a year of leadership transitions and adjustments. In a challenging market environment, both creative visionaries and senior executives play a crucial role in driving transformation and identifying new avenues for growth.

The company’s commitment to strategic direction and seamless internal collaboration are essential to overcoming the crisis of brand creativity and strengthening organizational resilience. For every leader at the helm, the shared mission is clear: to navigate the path back to growth together.

SECTION5

Silver Economy Surge

Tapping into Untapped Consumer Potential

The senior consumer segment is emerging as a powerful force in the luxury market. Positioned at a life stage of financial stability and ample leisure time, they possess both the economic means to indulge in personal interests and the disposable time to drive the rapid rise of the silver economy.

According to the latest UN population projections, the global population aged 60 and above will exceed 1 billion by 2025 and is expected to grow at an annual rate of 3.3% over the next five years, reaching 1.2 billion—18.7% of the total population. As the baby boomer generation (born 1962–1973) enters retirement, their consumption habits and financial capacity will far surpass those of the previous generation, establishing them as a key driver of global luxury market growth.

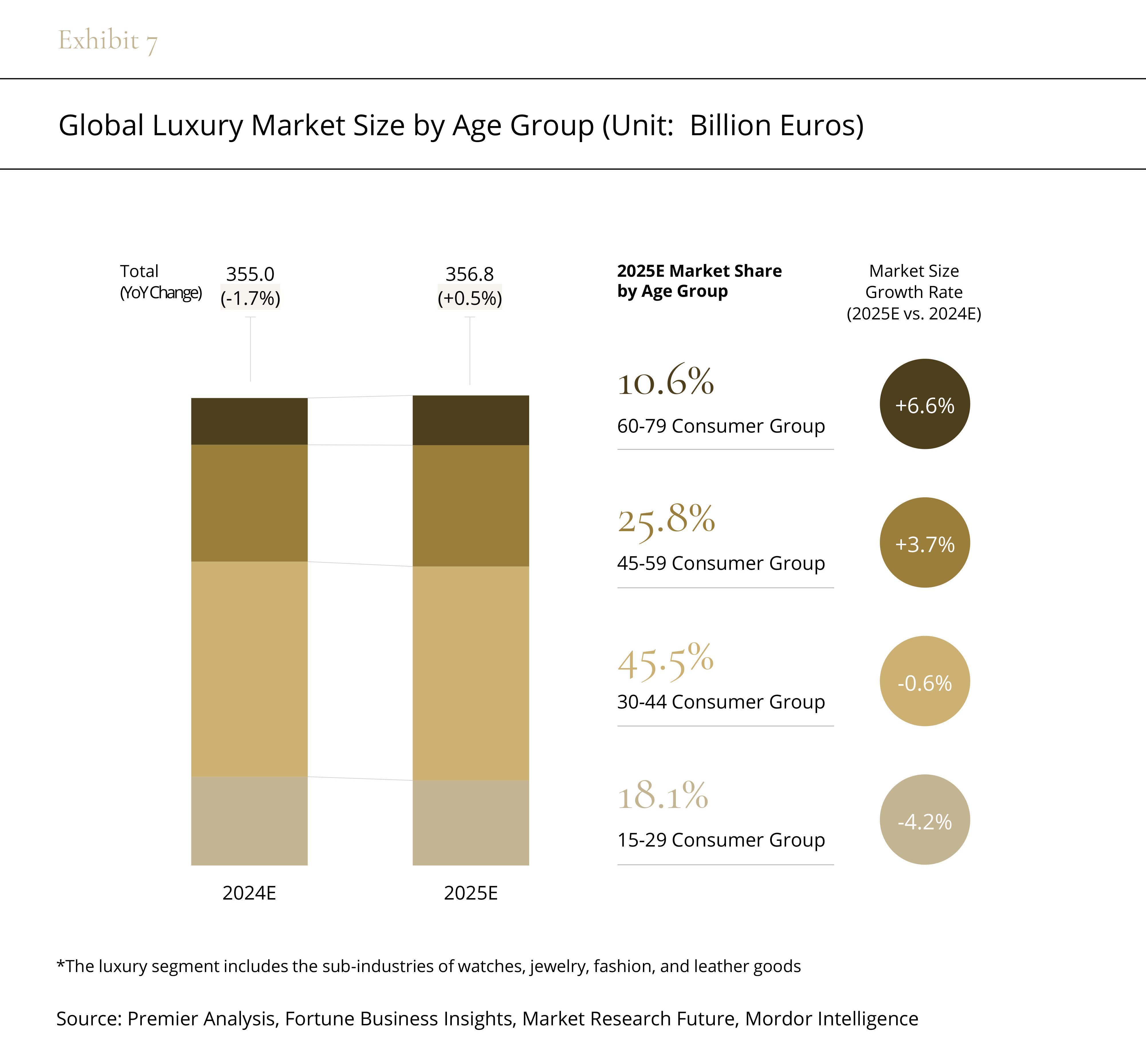

The generational landscape of luxury consumption is undergoing a notable shift. While Gen Z and Gen Y were once expected to be the primary growth engines, post-pandemic consumption patterns have reshaped market dynamics. Instead, the senior segment (ages 60–79) has emerged as the leading driver of luxury market expansion.

According to Premier estimates, by 2025, the senior segment will experience a 6.6% year-on-year increase in the global high-end luxury market—the fastest growth rate among all age groups. Their market share is projected to rise to 10.6%, solidifying their position as an indispensable force in luxury consumption.

The strong desire to save and cautious consumer mindset make it challenging for the senior segment to make purchases. The key for luxury brands in engaging within the silver economy lies in transcending the products themselves, delving into the brand’s philosophy while intertwining humanistic care with the needs of this demographic. For senior consumers, identity recognition, respect, and emotional connection are essential. In the era of experiential consumption, they increasingly value the emotional benefits and personalized expression that their purchases offer.

In recent years, the luxury industry has begun to actively respond to this trend. In 2024, senior models appeared frequently on the runways of Balmain's Fall/Winter, Miu Miu's Fall/Winter, and Proenza Schouler's Spring collections, honoring the elegance of middle-aged and older women. Loewe even invited 89-year-old Maggie to feature in their 2024 Spring/Summer pre-sale campaign, not only as a marketing highlight but also as a testament to the brand’s forward-looking understanding of consumer demographics.

Senior consumers hold high standards for quality and craftsmanship, with particular attention to the fine craftsmanship of luxury leather goods, jewelry, and watches. They are not only concerned with the tangible value of precious materials but also deeply appreciate the cultural heritage embedded in a brand’s narrative.

Driven by the dual growth of travel willingness and consumption spending among seniors, the luxury sector is also witnessing a new wave of development opportunities.

Founded over 70 years ago, Saga centers its services on the 50+ demographic. By meeting their diverse travel and vacation needs, the company has driven the synergistic development of its core businesses, building a strong brand presence. As its corporate slogan states, "Saga exists to deliver exceptional experiences every day." Through detailed insights into the senior demographic, Saga has developed a systematic consumer segmentation and service strategy, providing a benchmark practice for the industry.

Additionally, Saga continues to innovate in product development, expanding its diverse portfolio to meet varying needs. From group tours, customized trips, and private small-group travel to cultural-themed tours, all-inclusive vacations, hotel resort stays, and cruise experiences, Saga has built deep expertise across these segments. Each travel offering is further refined to more precisely reach different senior consumer groups. For example, its signature cruise experiences, known for their attentive service and comfort, have become particularly popular among senior travelers, serving as a key driver of business growth.

Amid the global aging trend, the senior economy is emerging as a new growth avenue in the luxury market. Brands must adapt accordingly, fostering connections with the senior demographic by leveraging cultural affinity and emotional value to build differentiated competitive advantages.

Through sharper consumer insights, a more diverse range of high-quality offerings, personalized service experiences, and deeper brand resonance, brands can cultivate strong relationships with senior consumers. This not only fuels short-term growth but also creates opportunities for intergenerational brand advocacy, laying the groundwork for long-term, sustainable expansion.

SECTION6

Little Indulgence Momentum

Reigniting Focus on Entry-Level Luxury

During economic downturns, factors such as rising inflation in essential goods and increased job market competition place greater financial pressure on non-high-net-worth individuals. While overall spending power is constrained, this large consumer segment continues to purchase luxury goods within reasonable limits as a form of self-reward and emotional gratification.

This "rational impulse spending" tends to favor moderately priced, small luxury items that serve as both a status symbol and a means of self-indulgence amid economic pressures.

The traditional "Lipstick Economy" refers to the resilience of beauty and fragrance sales during economic slowdowns. In contrast, the "Little Indulgence" consumption mindset is more aligned with entry-level products in luxury fashion and leather goods. These more affordable items not only provide instant gratification but also offer a more immersive boutique experience, fostering a stronger emotional connection between consumers and luxury brands. For instance, small leather goods (such as keychains and mini bags) and fashion accessories (such as hair clips and silk scarves) are becoming key categories for brands to attract new customers and re-engage lapsed consumers.

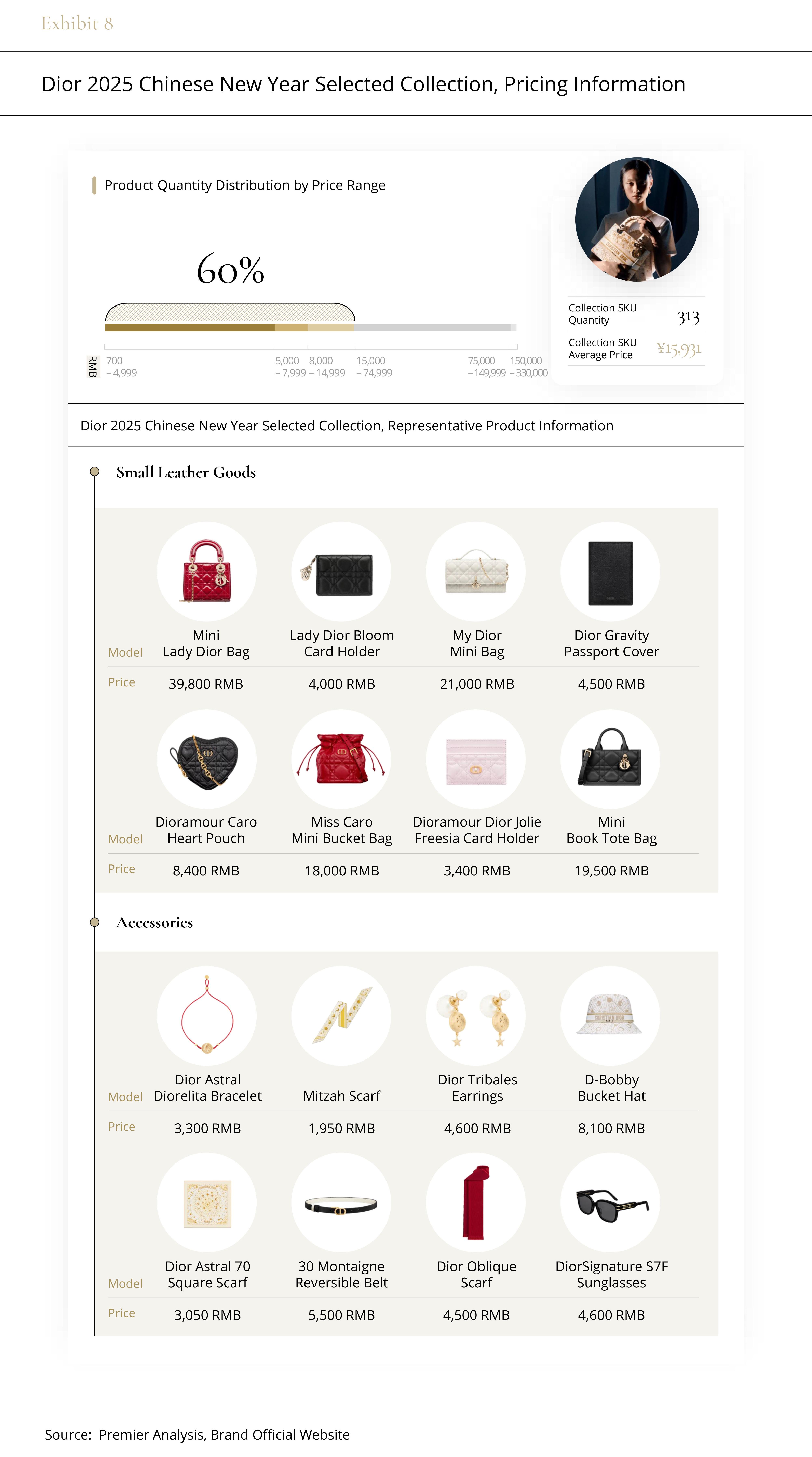

Festive seasons and key emotional moments present ideal opportunities for brands to activate the "Little Indulgence" trend. In recent limited-edition collaborations and holiday capsule collections, luxury brands have strategically increased the proportion of entry-level products to strengthen their appeal to a broader audience. In some brands' Chinese New Year collections, SKUs priced below RMB 10,000 accounted for more than 50% of the assortment.

How can brands convert "Little Indulgence" emotional spending into actual purchases? One potential solution lies in a more targeted consumer incentive mechanism that aligns with the needs of the audience. For instance, during the LV × Takashi Murakami limited-time pop-up event in Shanghai, the brand introduced a reward system (spend over 15,000 RMB for a chance to enter a lottery), which successfully boosted sales of small items, quickly selling out the inventory.

The non-high-net-worth segment comprises a large consumer base. According to Credit Suisse’s Global Wealth Report, the global middle-class population is projected to reach 113 million in 2024. Even amidst economic pressures, this group has not completely forsaken luxury goods consumption, and brands are unlikely to sever ties with them.

The customer attrition caused by continuous price increases has already been reflected in the slowdown of growth in major luxury groups’ financial reports. In 2025, luxury brands will further reconnect with this core consumer group by optimizing product strategies and refining communication methods. Entry-level items will serve as key traffic drivers. With the support of omnichannel marketing, brands will leverage a consumer’s first post-purchase interaction to rebuild emotional connections and reignite their interest.

Following a "Little Indulgence" purchase, brands must seize every opportunity for subsequent interactions with consumers, using deeper insights into their evolving needs to drive higher-value conversions. This helps expand the brand's reach, broaden the consumer's purchase scope, and establish a stronger, more enduring brand memory.

SECTION7

Hyper-Localization Boom

Authentic Cultural Engagement to Cement Contemporary Brand Equity

As luxury brands expand and deepen their global regional presence, hyper-localization has become a key strategy for building emotional connections and cultural resonance.

Unlike the superficial use of cultural symbols seen in the past, hyper-localization now focuses on uncovering the deeper cultural connotations of specific regions. It integrates global luxury brand values with the unique urban culture, creating a brand experience that resonates emotionally with consumers.

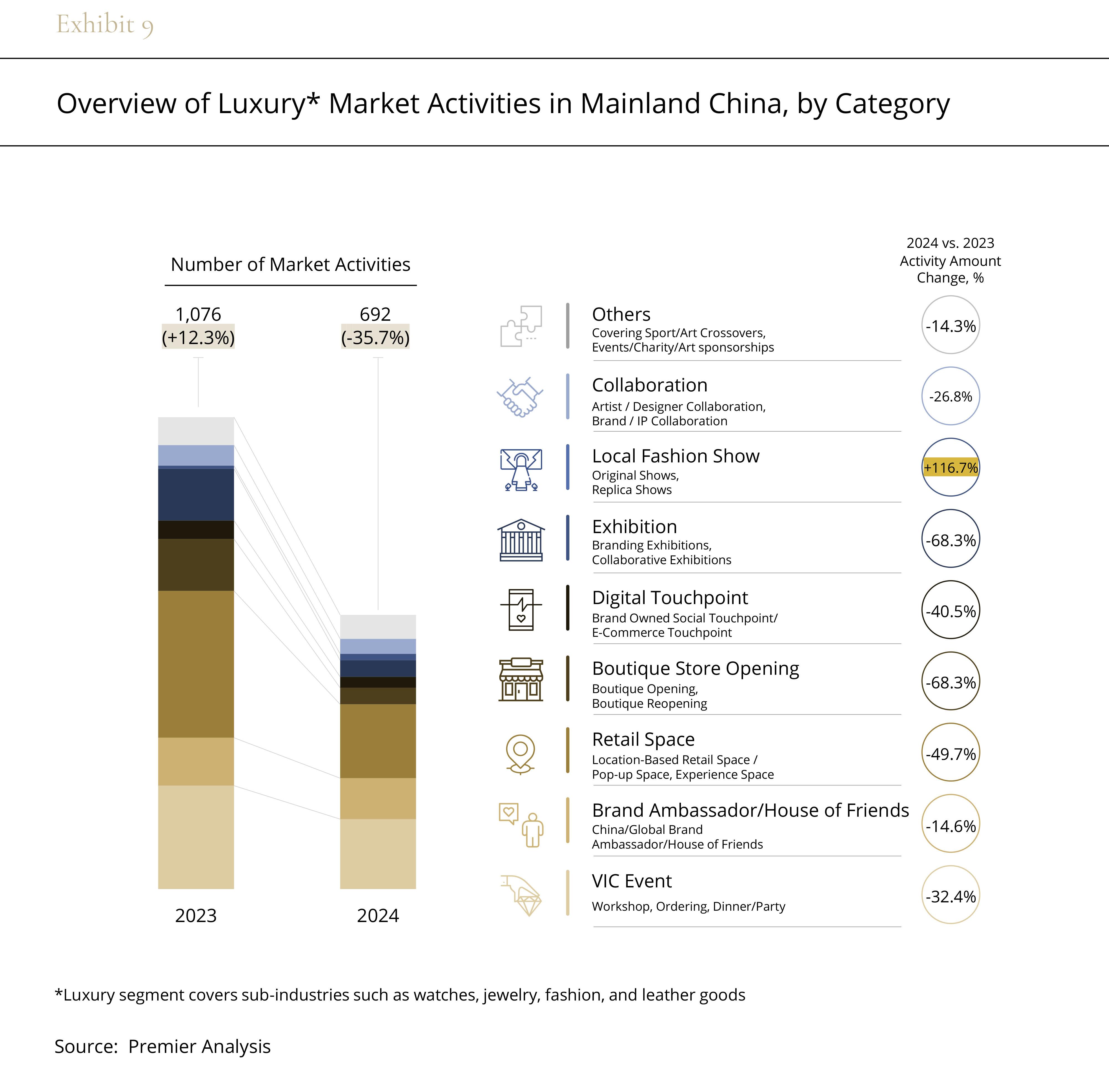

According to Premier's data, the total number of luxury brand events in Mainland China in 2024 decreased by over 30% compared to the previous year. With more carefully allocated budgets, brands are now focusing on key events and enhancing Very Important Client (VIC) experiences.

Despite the reduction in event number, Mainland China is becoming a prime location for global debuts. In 2024, top international luxury brands such as CHANEL, Louis Vuitton, Balenciaga, and Moncler all chose China as the stage for their global launches, underscoring the brands' strong emphasis on the Chinese market.

In 2025, as the focus on “hyper-localization” deepens, luxury brands must strike a delicate balance between creativity and heritage. While hyper-localization offers opportunities for enhancing cultural resonance and market penetration, four key considerations must not be overlooked in the execution process:

Understand Regional Differences, Tailor to Local Needs

Gain a deep understanding of the consumer diverse preferences within a region, and develop customized strategies based on the cultural backgrounds and consumption habits of different communities. Avoid one-size-fits-all solutions that may limit effectiveness.

Balance Localization with Global Brand Identity

While ensuring relevance in local markets, maintain the overall consistency of the brand. Skillfully integrate local culture with the global brand tone to achieve a win-win between individuality and unity.

Optimize Operational Management for Enhanced Efficiency

From supply chain coordination to maintaining local partnerships, strengthen technology and resource allocation, streamlining operational complexities to provide effective support for the hyper-localization strategy.

Focus on Long-Term Investment for Sustainable Growth

View hyper-localization as a long-term strategy, investing robustly in resources and making a long-term commitment to drive lasting cultural connections and market expansion.

When advancing a hyper-localization strategy, brands should focus on culture as the core, technology as the enabler, and long-term planning as the framework. With precise cultural insights, flexible resource allocation, and deep consumer connections, hyper-localization brings not only intensified regional sales but also provides lasting vitality to the brand’s value.

SECTION8

Prioritizing Measurable Economic Gains

Through Tech-Enabled Operational Excellence

In recent years, the luxury goods sector has remained at the forefront of the AI-driven technological wave.

Unlike the slowdown in performance growth, luxury companies have maintained a high rate of investment in AI. According to GlobalData research, the cumulative investment in AI by the luxury industry over the past three years has exceeded $360 million, with a year-on-year increase of 79%. Premier forecasts that from 2024 to 2028, the compound annual growth rate (CAGR) of AI-related investments in the luxury sector will reach 12.7%, with enterprise-level AI investments expected to surpass $2.7 billion by 2028—equivalent to 1‰ of the global luxury goods market size during the same period.

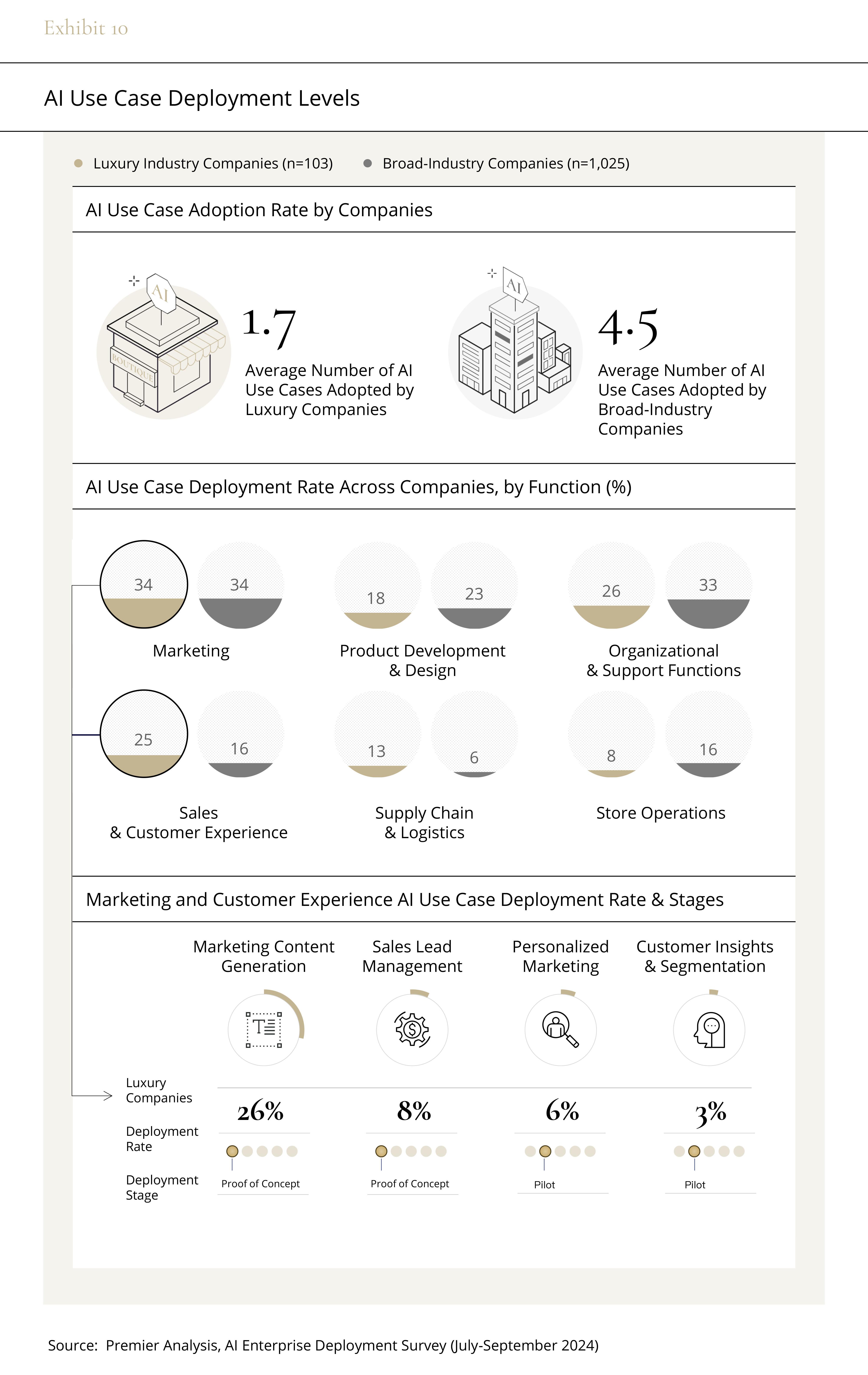

Although the overall adoption rate of AI use cases in luxury goods companies is lower than in other industries, luxury brands have already achieved leadership in the areas of marketing, sales, and customer management.

In 2025, under the shared industry focus of revitalizing performance, "tangible economic benefits" will become a key objective for technological empowerment. Consequently, technology applications will further extend into enhancing store operations and optimizing supply chains, providing substantial technical support for lean management.

Empowering In-Store Services: From Sales Space to Intelligent Brand Theater

Post-pandemic, the growth of in-store sales has slowed, while digital retail now influences approximately 70% of consumer interactions. As a result, physical stores are transforming from mere transaction channels into crucial spaces for brand experience and loyalty building.

As previously mentioned, in-store services have become a key decision factor for both cross-channel and international consumption. Stores are no longer just places for transactions but immersive environments that showcase a brand's culture and values. Brands must leverage intelligent layout design and the integration of digital technologies to create their own "brand theaters," offering consumers a more engaging and meaningful in-store experience.

Technology plays a pivotal role in enhancing customer interactions. By equipping employees with digital tools and training, sales staff can provide greater value during customer interactions. For example, AI-driven real-time recommendation systems can optimize the buying experience, while automation tools relieve backend tasks, allowing sales teams to focus on customer service and thereby increasing conversion rates and loyalty.

Inventory and Supply Chain Optimization: Agile Responses to Enhance Profitability

Inventory management has long been a core issue in the luxury industry. According to reports by the Financial Times, the fashion industry generated between 250 million and 500 million excess items of inventory in 2023. These unsold goods not only tie up significant capital but also increase storage and handling costs, directly impacting companies' financial performance. In 2024, this issue remains unresolved, with data showing a 5% increase in average discount rates during the first half of the year, indicating that brands are paying a higher price to clear inventory. For example, brands like Versace and Burberry have offered discounts of up to 50% in the Chinese market to address slow sales and inventory build-up.

By 2025, under the constraints of sustainability regulations (such as bans on stock destruction), brands will further push for end-to-end supply chain optimization. Digital tools will play a crucial role in operational upgrades. With AI technologies to accurately predict consumer demand, brands can refine inventory planning and reduce the risk of overstock. At the same time, multi-channel strategies and flexible distribution plans will improve product distribution efficiency, boosting supply chain agility and supporting long-term sustainable growth.

While applying technology in operations, luxury brands must also integrate technological advancements with their craftsmanship, ensuring brand values are preserved while unlocking technology-driven growth opportunities. Through flexible human guidance and rigid technological support, brands can continue their stories, refresh customer experiences, and drive sustainable innovation.

Luxury Industry Outlook 2025

Feb 02, 2026

Eight key trends empowering luxury brands to navigate industry volatility with strategic foresight and enduring progress.

Thriving Amid Flux – A Resilient Path Forward

The luxury goods sector, long sheltered from broader economic shifts, is now facing the impact of macroeconomic fluctuations.

After three years of growth following the pandemic, the luxury industry’s rapid expansion abruptly slowed in 2024. According to Premier’s analysis, less than 40% of publicly listed luxury companies that reported financial results for the first three quarters of the year showed positive revenue growth.

Facing performance challenges, the industry has seen an unprecedented turnover in creative director positions, contributing to internal instability. Simultaneously, key players have continued their expansion efforts, signaling a strong commitment to recovery through organizational adjustments, preparing for the year ahead.

In 2025, while opportunities may be on the horizon, uncertainty remains. Geopolitical tensions persist, and the evolving demands of both the elite and the middle class create additional challenges. The global market has entered a phase of heightened competition, with an ever-shifting landscape. Moving forward, brands must prioritize understanding customer needs to sustain loyalty and optimize operations to enhance brand value—challenges that all companies, regardless of size, will face in the coming year.

Leveraging ongoing industry analysis and in-depth expertise, Premier presents eight key trends shaping the luxury sector in 2025. By examining critical data and events, we offer actionable insights that will help brands navigate uncertainty, foster resilience, and capitalize on opportunities amidst a dynamic market environment.