24/25 PRMC Luxe Index

Review & Prospect

24/25 PRMC Luxe Index

Review & Prospect

Empowering investors to navigate evolving market trends, respond agilely to short-term fluctuations, capture key opportunities, and chart a new course for luxury growth guided by long-term value.

Luxury in Transition:

Defining the Next Chapter of Growth

In 2024, the luxury industry index reflected profound transformation amid the interplay of consumer upgrading, cultural integration, and capital flows. From the slowdown in consumer demand to the rise of emerging markets and the intensifying structural divergence within the global luxury sector, capital market performance underscored both the industry's resilience and challenges. The strong purchasing power of senior consumers, the widespread adoption of digital technologies, and the gradual implementation of sustainability initiatives drove innovation and transformation in the sector. Some brands demonstrated a distinct competitive edge in digital marketing and experiential consumption, leading to sustained valuation growth.

Looking ahead to 2025, the luxury industry is poised to enter a new phase where deepening globalization coexists with regional differentiation. The recovery of key global markets and the further expansion of emerging ones will provide continued momentum for industry growth. Meanwhile, "hyper-localization" and "digital co-creation" will emerge as central themes in luxury brand expansion. Investment strategies will increasingly focus on long-term trends, particularly category extensions and the continuous expansion of global market share among luxury brands. Companies that lead in mergers & acquisitions and supply chain innovation will gain a stronger competitive edge in 2025, becoming key drivers of index growth.

DOWNLOADS

Lite Report (64 pages)

ULTRA LUXE CONSTITUENT ZOOM-IN

Solid Core Operations,

Gradual Rebound in Premium Consumption

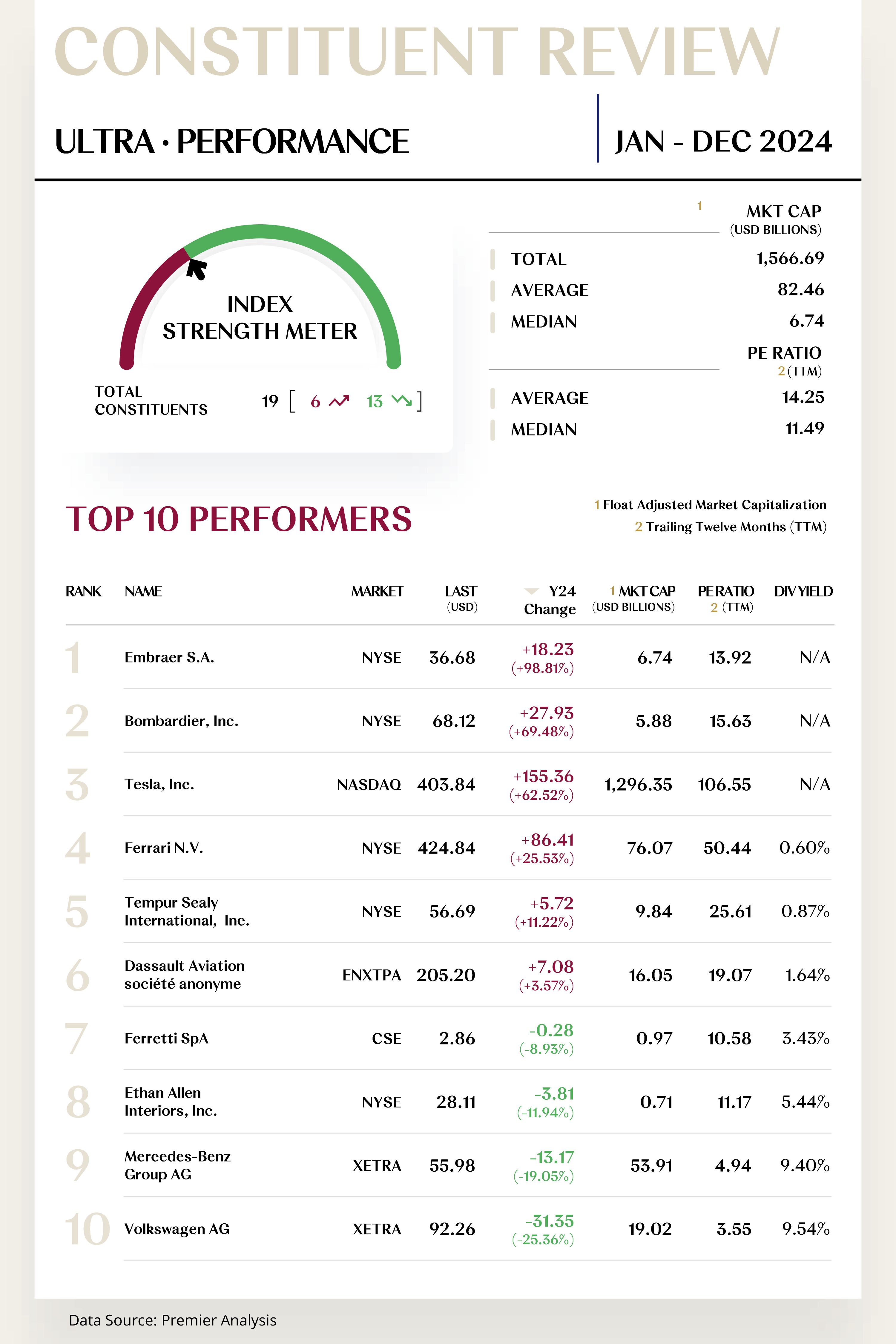

The Ultra Luxe Index comprises 19 stocks, with 6 rising and 13 falling.

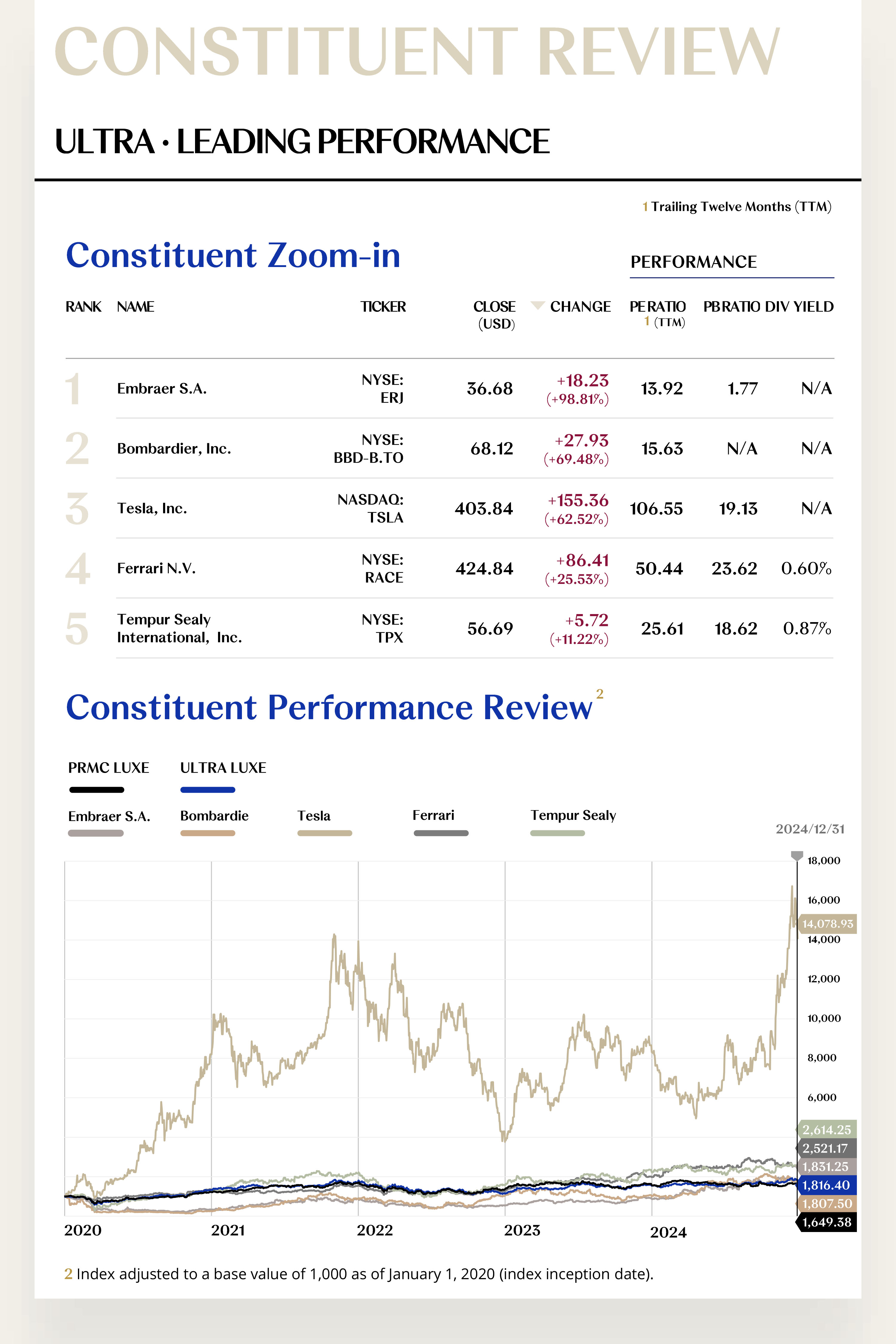

Leading Performers

1. Embraer S.A.

Embraer’s core business encompasses the design and manufacture of commercial, executive, and military aircraft, along with aviation services. As the world’s third-largest civil aircraft manufacturer, Embraer holds a significant position in the global aviation market. In Q3 2024, the company delivered 57 aircraft, marking a substantial year-over-year increase. Moreover, Embraer’s order backlog has reached its highest level in nearly seven years. The company also announced new agreements with several airlines, including Air Astana and Peace Aviation, further solidifying its market presence.

Driven by strong business performance, Embraer’s stock closed at $36.68 in 2024, reflecting a 98.81% year-on-year increase. Looking ahead to 2025, the company expects continued profit growth, fueled by the global aviation market’s recovery and the influx of new orders. Additionally, Embraer plans to launch its new E-Jet E2 series, which stands out for its fuel efficiency and environmental performance, likely attracting more customers. The company also intends to enhance its market competitiveness through technological innovation and cost control.

2. Bombardier, Inc.

Bombardier is an international transportation equipment manufacturer, with a diverse portfolio that spans business jets, railway locomotives, and urban transit systems. In Q2 2024, the company saw significant growth, with total revenue reaching $2.2 billion, a 32% year-over-year increase. Aircraft deliveries totaled 39 units, up 34% compared to the previous year. The company's aftermarket services also performed exceptionally well, contributing $507 million in revenue, a growth of 18%. Additionally, Bombardier successfully issued $750 million in senior notes to repay debt, significantly improving its financial position.

In 2024, Bombardier delivered an outstanding performance, with its stock price rising 69.48% to close at $68.12. Looking ahead to 2025, the company expects continued profit growth, driven by the global aviation market’s recovery and the increase in new orders. Through technological innovation and cost control measures, Bombardier aims to further enhance its market competitiveness. Furthermore, the ongoing growth in its aftermarket services and defense sectors will provide new sources of revenue for the company.

[For more insights, please download the full report]

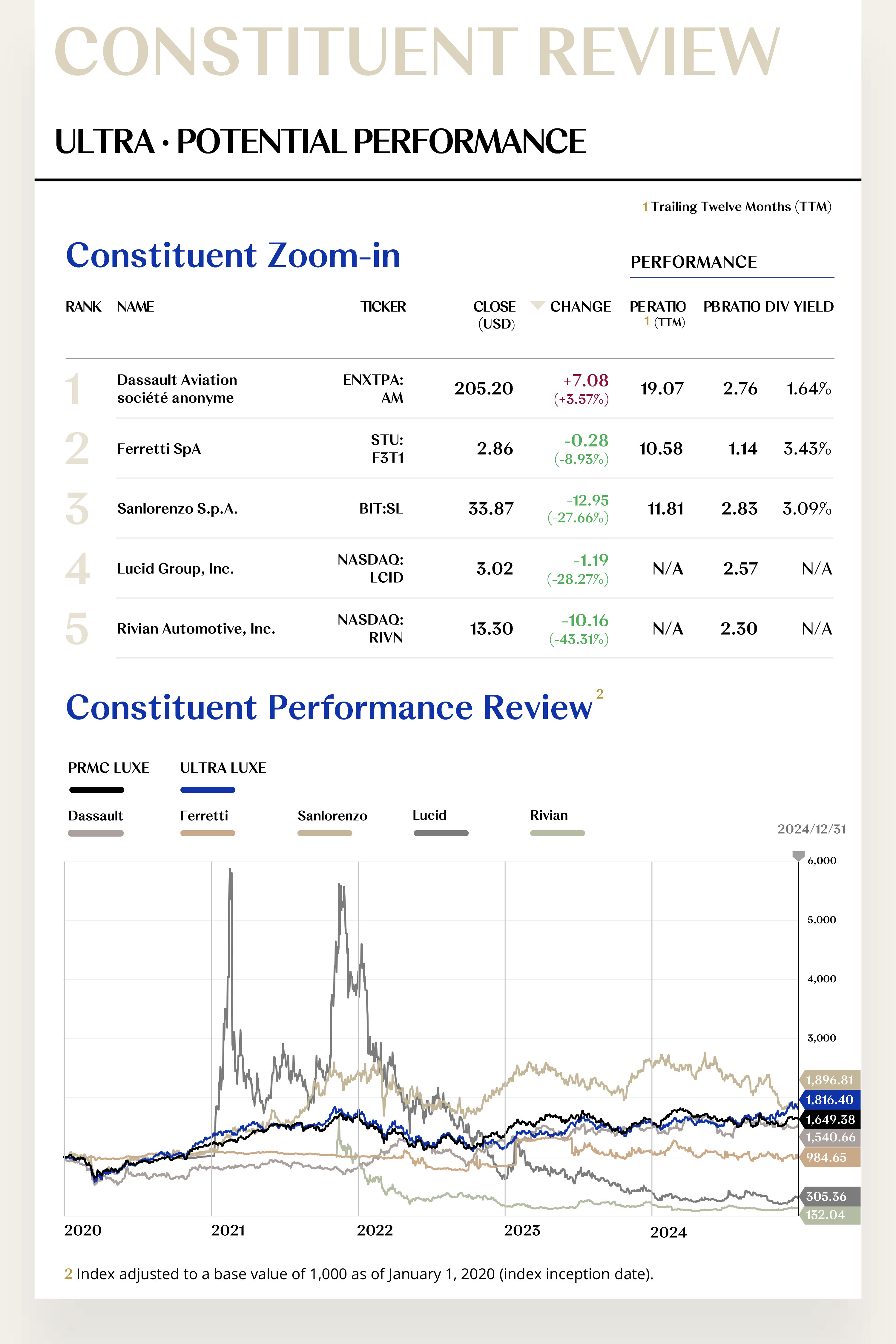

Potential Players

1. Dassault Aviation société anonyme

Dassault Aviation is primarily engaged in the design, manufacture, and sale of both military and civilian aircraft, with products including the Falcon business jets, Falcon support services, military aircraft, and military support services. In Q3 2024, the company exceeded market expectations, reporting net sales of $1.3 billion and a 6% increase in adjusted EBITDA, reaching $275 million. Furthermore, Dassault successfully delivered 21 Rafale fighter jets in 2024, surpassing market forecasts. Following this announcement, the company's stock rose by 3% on the same day.

In 2024, Dassault Aviation's stock rose by 3.57%, closing at $205.20. In 2025, the company plans to launch the new Falcon 6X and 10X business jets, which are expected to further enhance its market competitiveness. Additionally, Dassault's dividend policy has attracted investor attention, as the company plans to increase its dividend in 2025. This move will provide shareholders with more stable returns and strengthen investor confidence in the company’s long-term growth.

2. Ferretti SpA

Ferretti Group specializes in the design, manufacture, and sale of luxury yachts, targeting the high-end market. The group owns several prestigious brands, including Riva, Wally, Ferretti Yachts, Pershing, Itama, CRN, and Custom Line. In 2024, shareholder conflicts triggered by the Italian government’s excessive use of “golden powers,” combined with the group’s own financial challenges, attracted significant investor attention and negatively impacted its stock price.

In 2024, Ferretti Group’s stock declined by 8.93%, closing at $2.86. Looking ahead to 2025, with a clearer strategic direction following management changes and a more stable internal governance structure, the group is expected to regain investor confidence. Additionally, the tensions between Chinese shareholders and the Italian government over “golden powers” are likely to ease with moderate policy adjustments, creating a more favorable environment for the company’s operations and decision-making. Finally, benefiting from its expanded channels and deepened localization strategy in the Asia-Pacific market, the group’s global presence is expected to further enhance its overall revenue and profitability.

[For more insights, please download the full report]

CORE LUXE CONSTITUENT ZOOM-IN

Brand Resilience as a Competitive Moat,

Profit Visibility Ensures Sustainable Growth

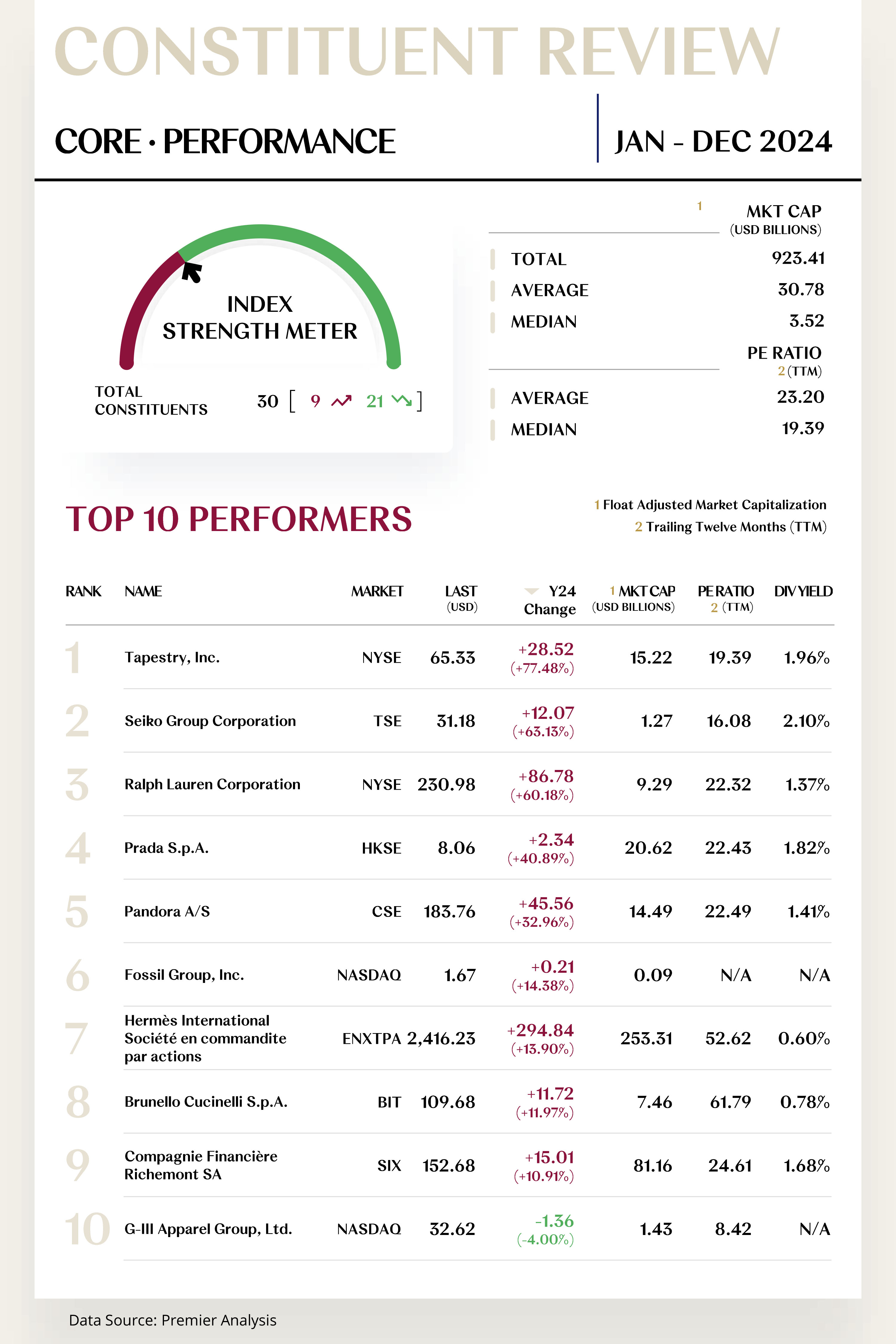

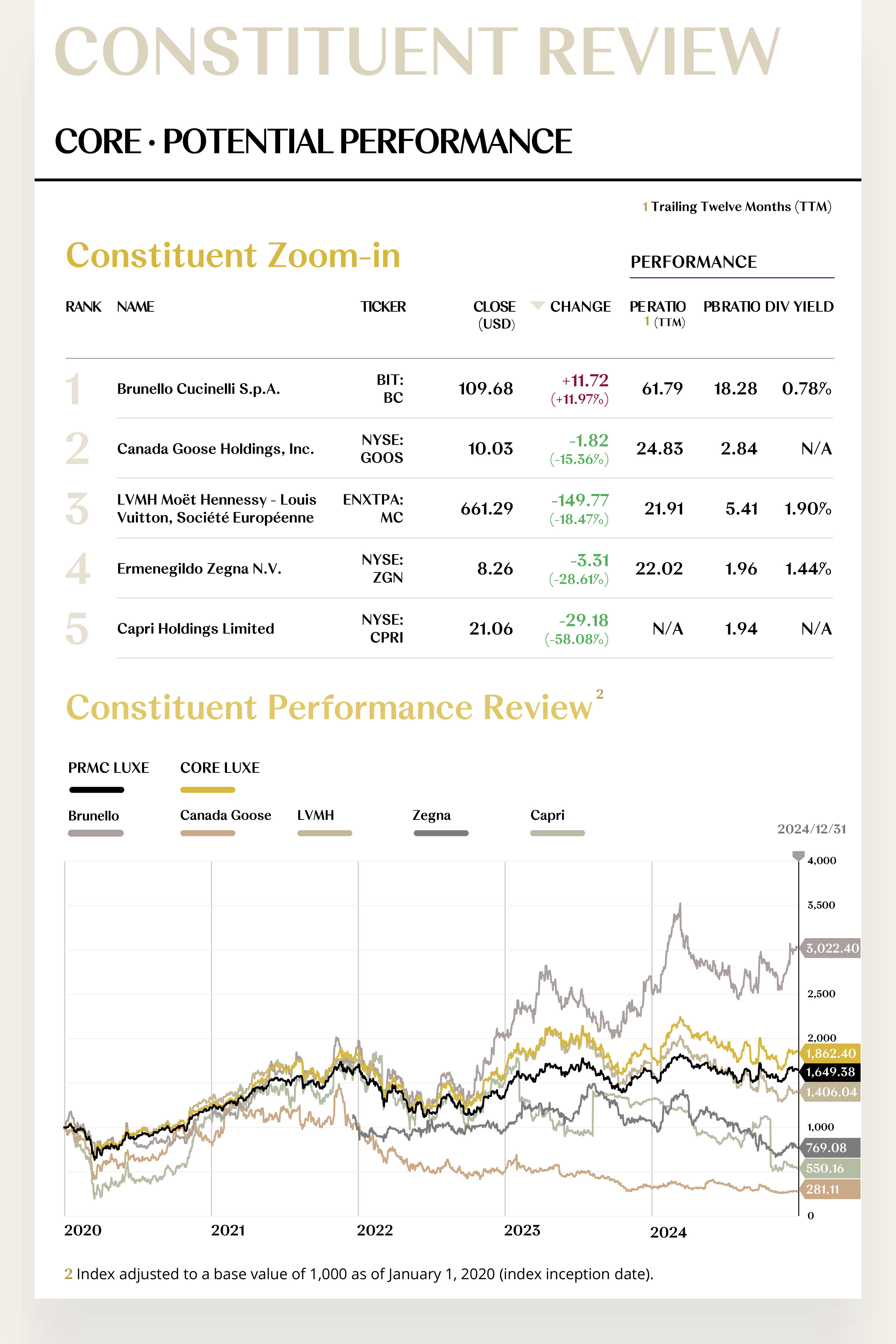

The Core Luxe Index comprises 30 stocks, with 9 rising and 21 falling.

Leading Performers

1. Tapestry, Inc.

Tapestry, home to renowned brands Coach, Kate Spade, and Stuart Weitzman, offers a broad range of luxury accessories and gifts for both men and women, including handbags, footwear, apparel, jewelry, and more. In fiscal year 2024, the company achieved total revenue of $6.67 billion, marking a 1% growth at constant currency rates. For Q4, revenue reached $1.59 billion, down 2% year-over-year but exceeding analyst expectations of $1.57 billion. In November 2024, Tapestry terminated its $8.5 billion merger with Capri Holdings, a decision that was met with a positive market response, resulting in a stock price surge of over 10%.

As a result, Tapestry's stock price rose 77.48% in 2024, closing at $65.33. Looking ahead to 2025, the company expects fiscal year revenue to surpass $6.75 billion, a 2% increase, higher than the previously forecasted 1% growth. Additionally, Tapestry has raised its EPS forecast for fiscal year 2025 from $4.40-$4.45 to $4.50-$4.55. The company continues to innovate with new product releases, such as the latest collection of the Coach Quilted Chain Tabby handbag, which will be launched globally. Furthermore, Tapestry plans to resume its previously paused share buyback program, further enhancing shareholder value.

2. Seiko Group Corporation

Seiko Group operates across various sectors, including watches, equipment solutions, system solutions, and clocks. Its watch division, home to renowned brands such as Seiko and Grand Seiko, is the core of the company, enjoying global recognition. In 2024, Seiko launched several new watch models, particularly in the high-end market. The new styles in the Grand Seiko Blue Lion series received strong consumer approval, driving sales growth. Additionally, the introduction of the new Spring Drive movement technology enhanced the accuracy and performance of their timepieces, further solidifying Seiko's leadership in precision watchmaking.

In 2024, Seiko Group's stock price surged by 63.13%, closing at $31.18. Looking ahead to 2025, the company plans to introduce a new smart watch series featuring advanced health monitoring capabilities, tapping into the rapidly growing wearable technology market. Seiko is also actively expanding in emerging Asian markets, such as China and India, with expectations for significant sales growth driven by enhanced digital marketing efforts and an increase in brand-specific stores. Furthermore, the production process optimizations and supply chain improvements implemented in 2024 are expected to yield benefits in early 2025, further boosting operational efficiency and profitability.

[For more insights, please download the full report]

Potential Players

1. Brunello Cucinelli S.p.A.

Brunello Cucinelli is an Italian luxury brand renowned for its exceptional cashmere. The company specializes in the manufacturing of high-end ready-to-wear apparel for both men and women, with products ranging from cashmere sweaters and coats to shirts and accessories.

In 2024, Brunello Cucinelli's stock performed admirably, rising by 11.97% for the year, closing at $109.68. In the third quarter of 2024, the company saw a 9.2% increase in revenue, reaching €300 million, slightly surpassing the €298 million forecast by Equita analysts. Additionally, the company’s fiscal 2024 operating income grew by 12.2% year-over-year to €1.2784 billion, or 12.4% when adjusted for constant currency, exceeding the revised expectations of 11-12% growth in December. These robust financial results drove the stock price upward.

Looking ahead to 2025, the company anticipates a revenue growth of approximately 10%. As Brunello Cucinelli continues to invest in its digital transformation and the expansion of its global retail network, its brand influence and market share are expected to grow further.

2. Canada Goose Holdings, Inc.

Canada Goose is a globally recognized high-end performance apparel brand, founded in 2013 and headquartered in Canada. The company specializes in the design, manufacturing, and sale of high-performance outerwear, accessories, and footwear. In 2024, Canada Goose’s stock experienced notable volatility, ultimately closing at $10.03, down 15.36% year-over-year. While the company's gross profit declined by 5% in the first quarter of fiscal 2025, revenue grew by 4% year-over-year to CAD 88.1 million. Regionally, the Chinese mainland market showed strong performance, whereas revenue in North America declined by 3% and the EMEA region saw an 11% drop. On the leadership front, the appointment of Haider Ackermann as Creative Director marked a significant step in the company’s brand evolution and luxury retail execution strategy.

Looking ahead to 2025, as the global economy gradually recovers—particularly with rising consumer spending in China and the U.S.—Canada Goose is expected to benefit from improved consumer confidence and a rebound in luxury demand. The company will continue to drive growth through product innovation and market expansion, introducing new collections and marketing initiatives to attract a broader consumer base.

[For more insights, please download the full report]

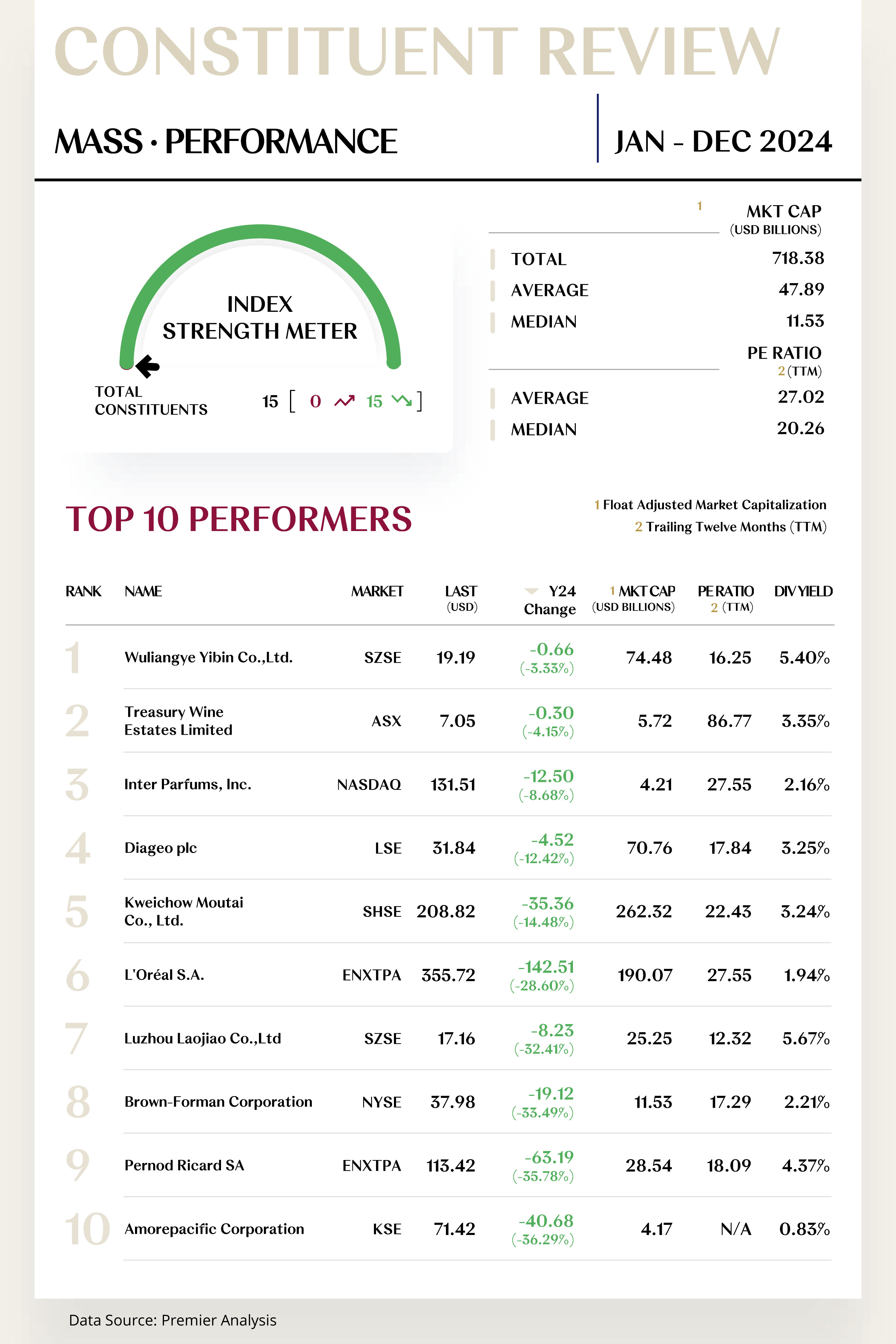

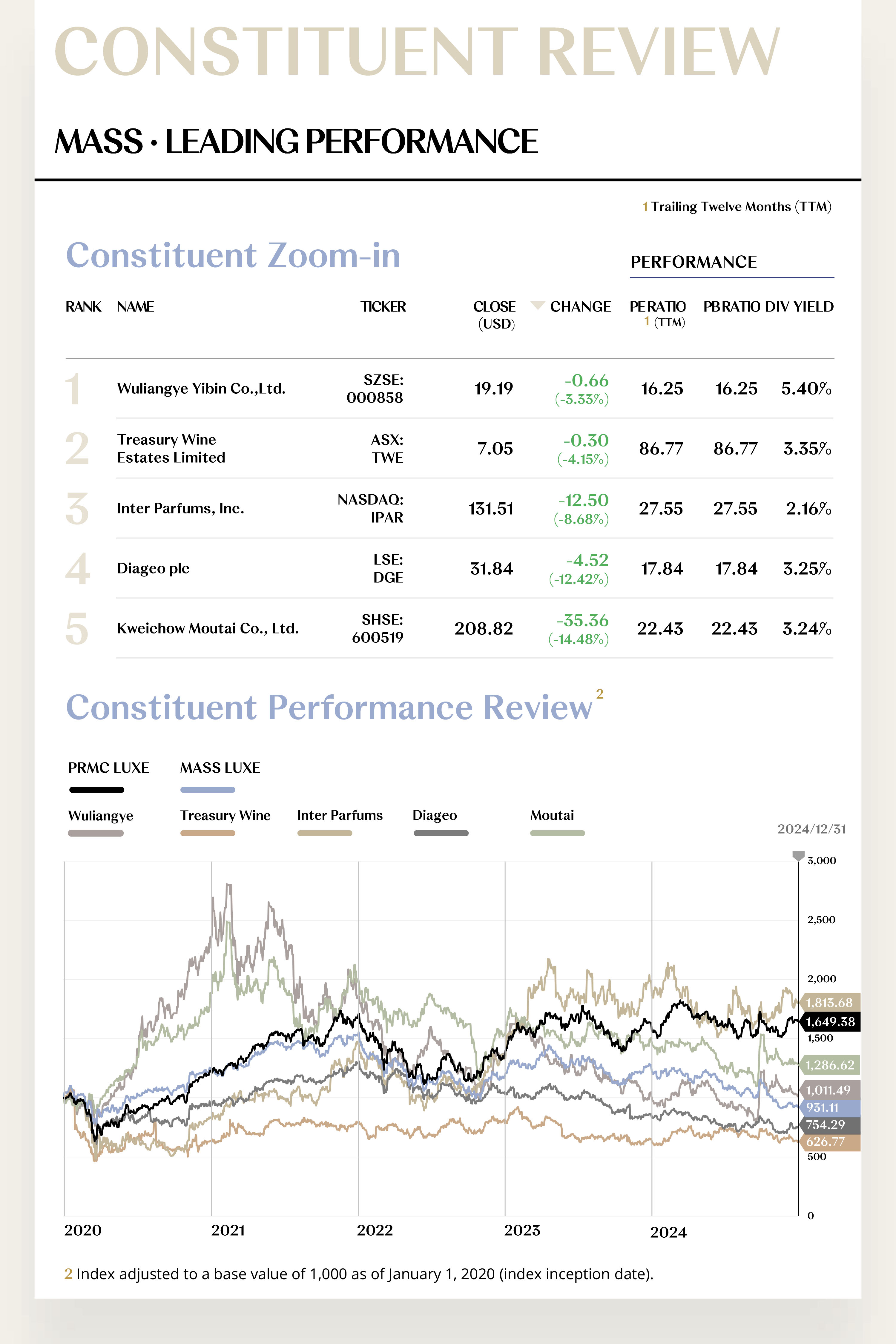

MASS LUXE CONSTITUENT ZOOM-IN

Policy Implementation Accelerates Growth Trajectory,

Strategic M&A Reshapes the Capital Landscape

The Mass Luxe Index comprises 15 stocks, all of which posted year-over-year declines.

Leading Performers

1. Wuliangye Yibin Co.,Ltd.

Yibin Wuliangye focuses on the production and sales of baijiu, with its flagship product, "Wuliangye Liquor," serving as a quintessential representative of China's strong-aroma baijiu. In 2024, despite achieving a revenue of RMB 67.916 billion in the first three quarters, marking a year-on-year (YoY) growth of 8.60%, the company's quarterly revenue and net profit growth rates exhibited a continuous decline. In Q1 to Q3 of 2024, Wuliangye’s revenue YoY growth rates were 11.86%, 10.08%, and 1.39%, respectively, while net profit growth rates stood at 11.98%, 11.50%, and 1.34%, respectively.

Meanwhile, the company’s inventory continued to rise, reaching RMB 17.54 billion by the end of Q3 2024, reflecting a YoY increase of 12.22%. At the end of September, spurred by a series of economic stimulus policies introduced by the Chinese government, long-suppressed domestic investment appetite rebounded rapidly, driving Wuliangye’s stock price upward. However, due to weak industry fundamentals, the company's stock price experienced continued fluctuations and declines throughout Q4.

For the full year of 2024, Yibin Wuliangye Co., Ltd.'s stock price fell by 3.33%, closing at $19.19. Looking ahead to 2025, the company aims to maintain double-digit revenue growth for the year, potentially surpassing the RMB 100 billion revenue milestone. To achieve this goal, Wuliangye plans to implement several adjustments to its channel strategy, including optimizing the contractual volume plans for exclusive stores and channel operators to control and absorb inventory in traditional distribution channels. Additionally, the company will employ measures such as halting supply and raising prices to stabilize market pricing, enhance brand equity, and strengthen product competitiveness.

2. Treasury Wine Estates Limited

Treasury Wine Estates (TWE) is renowned for producing premium wines and boasts a portfolio of prestigious brands, including Penfolds, Wolf Blass, and Lindeman's. Its operations span vineyard management, wine production, and global sales, with a strategic focus on expanding its product offerings and market reach to meet the growing demand for high-end wines worldwide.

On the leadership front, the company has announced the appointment of Judy Liu as a new director, effective January 1, 2025, alongside the granting of new performance rights to CEO Tim Ford—moves that could influence market expectations regarding the company’s future performance.

Financially, TWE delivered robust growth in the third quarter of the 2024 fiscal year, with net sales revenue rising 10.3% year-on-year to AUD 1.284 billion. Thanks to its relatively high dividend payout ratio, the company’s stock price remained relatively stable, declining 4.15% over the year to close at $7.05.

[For more insights, please download the full report]

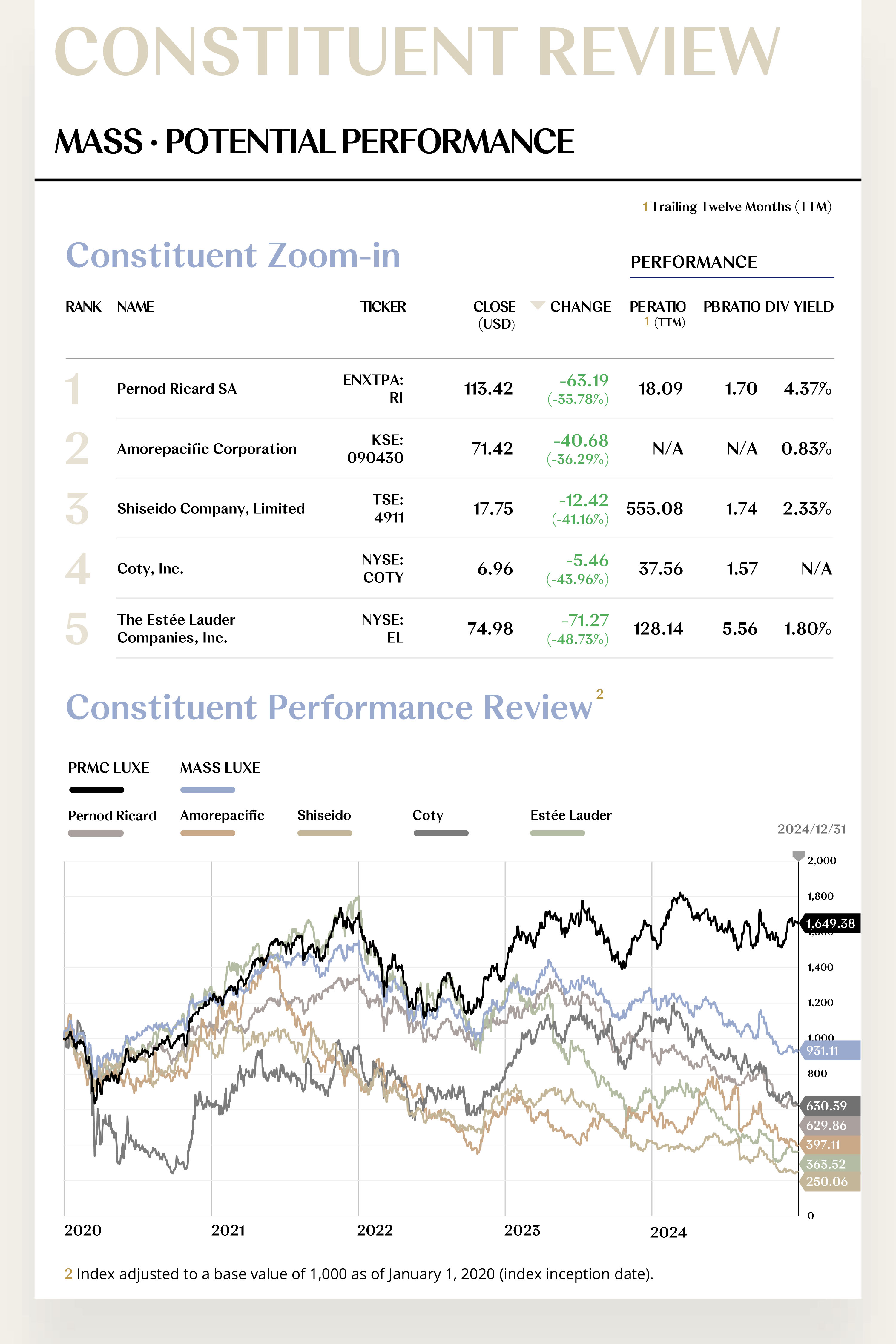

Potential Players

1. Pernod Ricard SA

Pernod Ricard, the world’s second-largest spirits and wine group, owns a portfolio of renowned brands, including Martell, Ballantine’s, Chivas Regal, and Absolut Vodka. In fiscal year 2024, the company reported net sales of €11.598 billion, down 4% year-over-year, with organic sales declining 1% after adjusting for currency fluctuations and acquisitions. In the first half of FY2024, sales reached €6.59 billion, reflecting a 7% reported decline and a 3% organic decline, with currency volatility accounting for a €576 million negative impact.

In the first quarter of FY2025, organic net sales fell 5.9%, while reported sales declined 8.5%, primarily due to weak demand in China, adverse weather conditions in Europe, and timing adjustments in India. Additionally, fluctuations in the U.S. dollar, Turkish lira, Chinese yuan, and Argentine peso further weighed on sales performance. Organic net sales of strategic wine brands declined 11%, mainly due to weak performance in the U.S., U.K., and Canadian markets.

In 2024, Pernod Ricard’s stock price fell 35.78% to $113.42. Despite the 5.9% decline in organic net sales in Q1 FY2025, the company maintained its full-year guidance of 2-3% organic sales growth with stable profit margins. It also expects gradual improvement in the U.S. market after Q1 and strong growth in India. Meanwhile, the company has completed brand portfolio optimization by divesting certain wine brands, reinforcing its strategic focus on premium and ultra-premium spirits.

2. Amorepacific Corporation

Amorepacific, South Korea’s leading cosmetics company, operates across skincare, makeup, fragrance, and haircare. Its brand portfolio includes Laneige, Innisfree, and Hera. In the third quarter of 2024, the group reported sales of KRW 1.0681 trillion (approximately CNY 5.522 billion), marking a 10.9% year-over-year increase, with an operating profit of KRW 75 billion. Despite revenue growth, concerns persist over the company’s long-term outlook amid global economic uncertainties. Additionally, weaker-than-expected performance in Greater China further dampened investor confidence.

In 2024, Amorepacific’s stock price declined 36.29% to $71.42. To address market challenges and drive future growth, the company plans to expand its global presence in 2025, with a particular focus on emerging markets to boost sales. It will also continue launching innovative products and accelerate the expansion of its premium tech-driven skincare brand AP Yanyan in China to meet rising consumer demand for high-quality cosmetics. As the global economy recovers, particularly with increasing consumption in the Asia-Pacific region, Amorepacific is well-positioned to benefit from improving consumer confidence and growing demand, providing strong support for its future business development.

[For more insights, please download the full report]

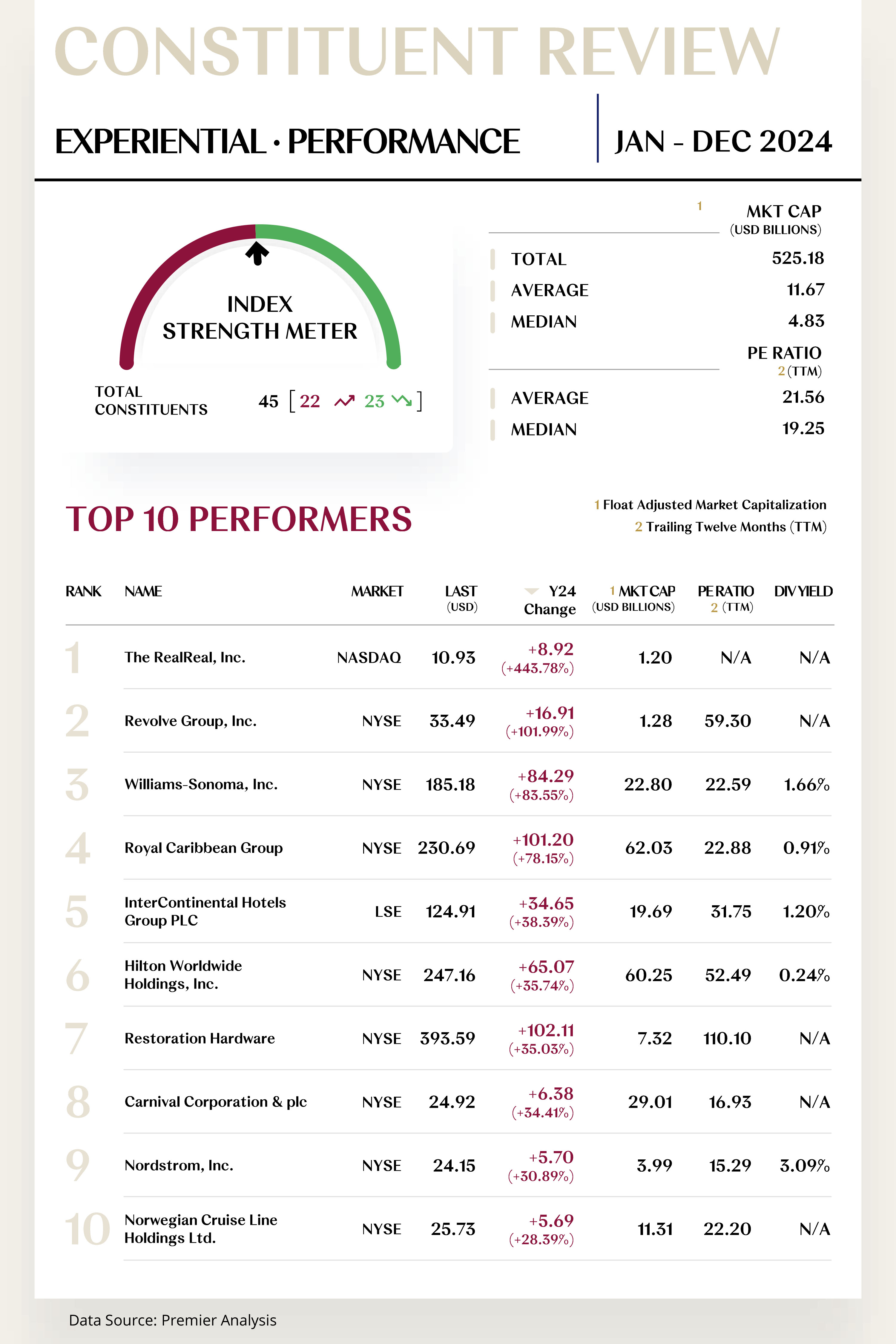

EXP LUXE CONSTITUENT ZOOM-IN

Experiential Consumption Fuels Demand Diversification,

Digital Technologies Transform Retail Channels

The Experiential Luxe Index comprises 45 stocks, with 22 rising and 23 falling.

Leading Performers

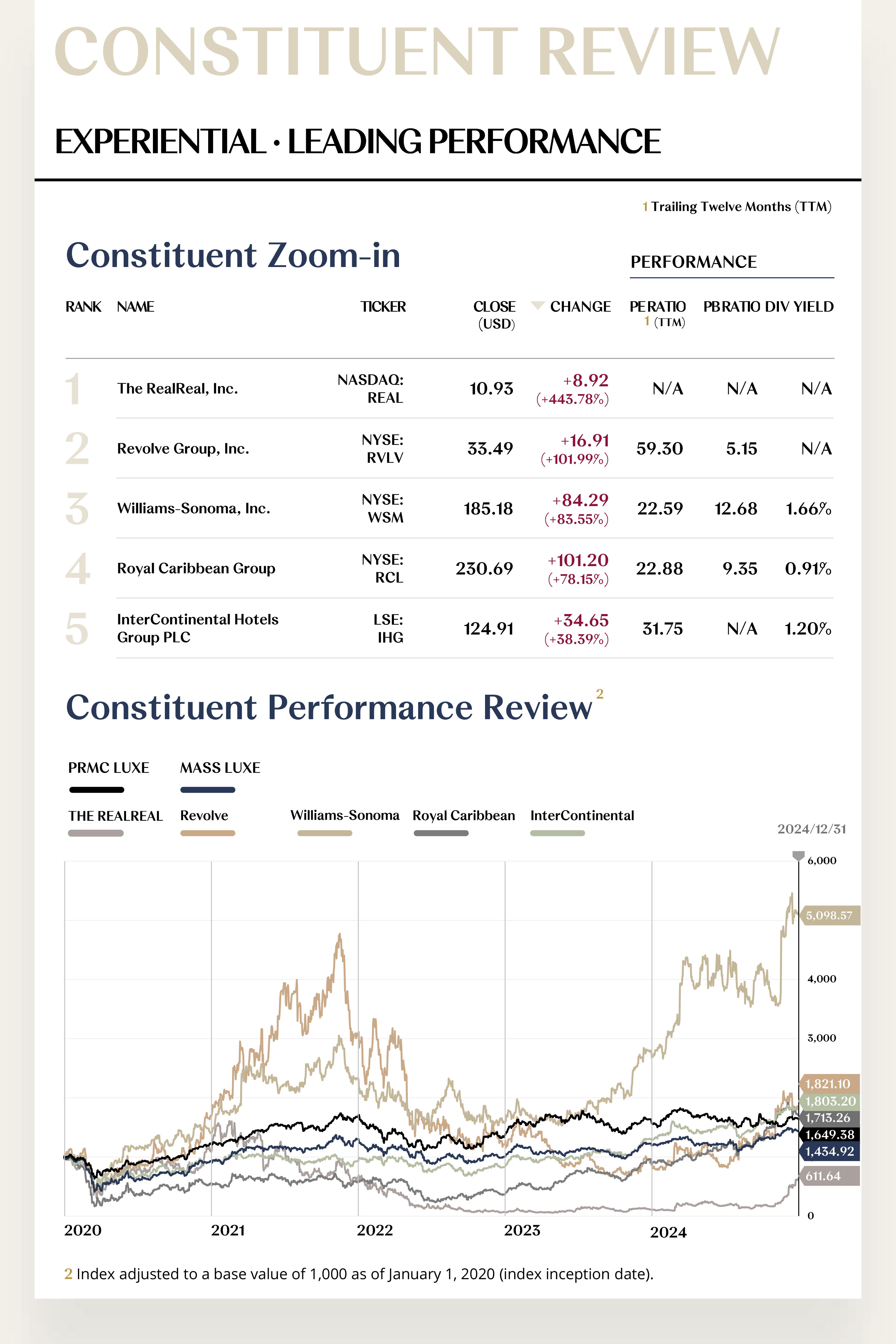

1. The RealReal, Inc.

The RealReal is a leading global online luxury consignment company, specializing in the sale of authenticated pre-owned luxury goods, including handbags, jewelry, and apparel. Its business model integrates authentication, cleaning, restoration, and shipping services to ensure product authenticity and quality.

On October 28, 2024, the company appointed co-founder Rati Sahi Levesque as the new CEO, succeeding the departing John Koryl. Previously serving as President and Chief Operating Officer, Levesque’s appointment boosted investor confidence. On November 4, The RealReal released its third-quarter earnings report, showing a 6% increase in gross merchandise value (GMV) to $433 million, an 11% rise in revenue to $148 million, and an adjusted EBITDA of $2.3 million, marking its second consecutive quarter of profitability. These strong financial results exceeded market expectations and reinforced confidence in the company’s long-term profitability. Additionally, the company revised its full-year 2024 guidance, forecasting GMV between $1.81 billion and $1.826 billion, total revenue of $595 million to $602 million, and adjusted EBITDA between $4.5 million and $7.5 million.

In 2024, The RealReal’s stock surged 443.78%, closing at $10.93. Under Levesque’s leadership, the company has implemented a series of profitability-driven strategies, including a rigorous assessment of market revenue quality and business portfolio optimization, aimed at improving operational efficiency and profitability. The RealReal currently maintains a strong gross margin of 74.42%, and with further margin improvements, it is well-positioned for continued financial strength in 2025. Additionally, the company is exploring new initiatives, such as offering return insurance for final sale items, to enhance liquidity and elevate the user experience.

2. Revolve Group, Inc.

Revolve is a retailer catering to millennial and Gen Z consumers, selling women's apparel, handbags, shoes, and beauty products through its platforms, Revolve and FWRD. Its business model encompasses over 49,000 apparel, footwear, accessory, and beauty products, connecting millions of consumers, thousands of global fashion influencers, and more than 1,000 emerging, established, and private-label brands.

On November 6, 2024, Revolve Group reported third-quarter earnings, with net sales rising 10% year-over-year to $283 million and net income surging to $11 million. Diluted earnings per share reached $0.15, a significant increase from $3 million in the prior year. Adjusted EBITDA grew 85% to $18 million. On December 2, despite major shareholder MMK Development selling $9.38 million worth of shares, the stock remained unaffected, underscoring market confidence in the company’s outlook.

[For more insights, please download the full report]

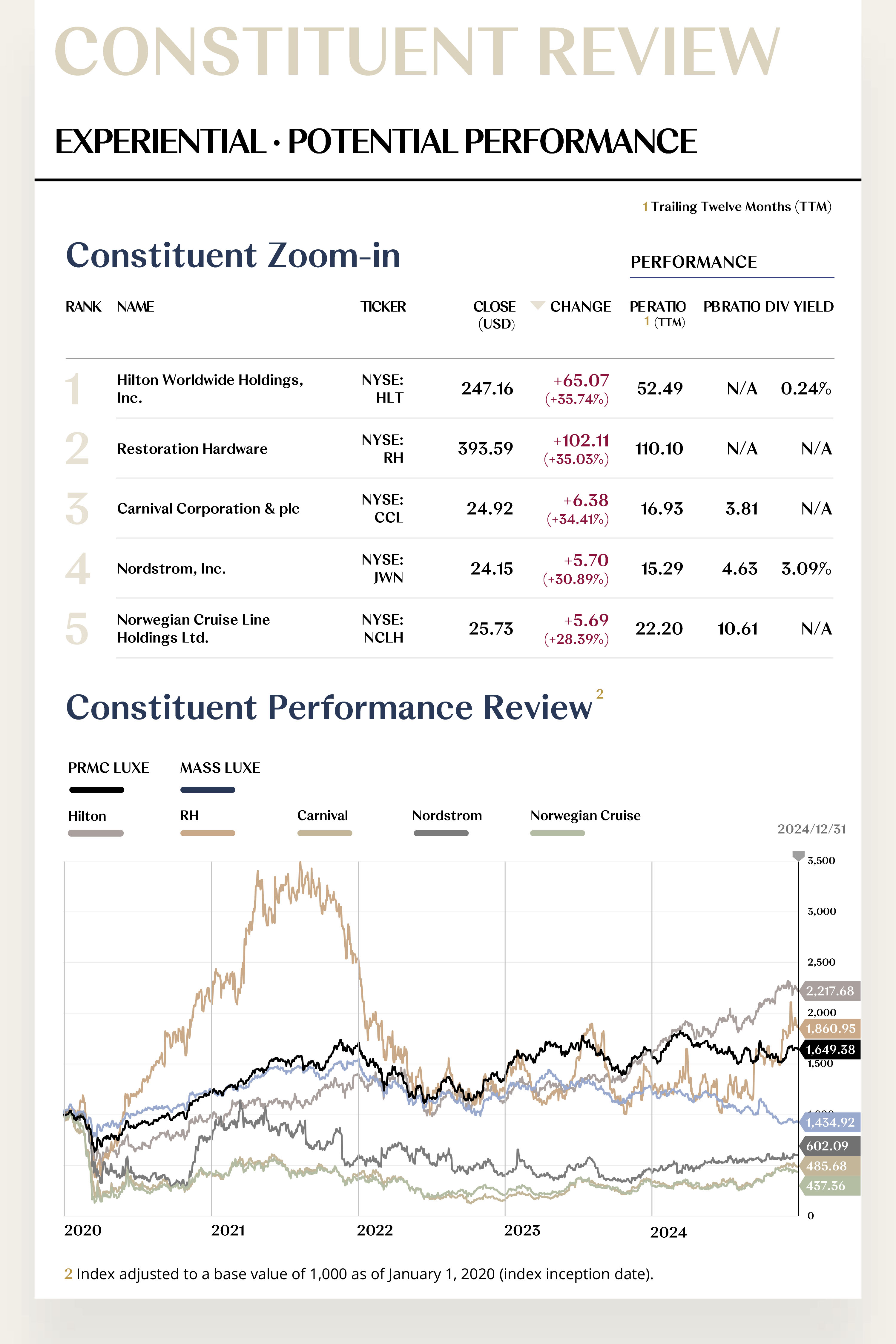

Potential Players

1. Hilton Worldwide Holdings, Inc.

Hilton operates a portfolio of renowned brands, including Hilton Hotels, Waldorf Astoria Hotels & Resorts, and Conrad Hotels & Resorts.

On October 23, 2024, the company reported third-quarter earnings, with total revenue reaching $2.867 billion, a 7.26% year-over-year increase, while net income attributable to shareholders declined 8.75% to $344 million. Despite the decline in net income, Hilton exceeded earnings expectations and achieved a record-breaking net increase of 33,600 rooms, reflecting a 7.8% net room growth. Additionally, the company expanded its stock repurchase program by $3.5 billion, bringing the total available for buybacks to approximately $4.8 billion—a move that underscores confidence in its business and enhances shareholder value.

In 2024, Hilton’s stock rose 35.74%, closing at $247.16. The company’s strong third-quarter performance, particularly its significant room expansion and revenue per available room (RevPAR) growth, highlights its competitiveness and profitability in the global hospitality market. Looking ahead to 2025, Hilton expects annual net room growth of 7% to 7.5%, with plans to accelerate global expansion over the next five years. Notably, the company aims to quadruple its hotel footprint in India, capitalizing on the country’s booming domestic travel market and narrowing the gap with competitors.

2. Restoration Hardware

Restoration Hardware (RH) operates a portfolio of brands, including RH Modern, RH Baby & Child, and RH Teen, catering to various segments from modern design to children's and teen furniture.

On December 13, RH reported third-quarter earnings, with total demand growing by 13%. The company also noted an increase in revenue, driven by strong demand for its proprietary furniture brands. While the rollout of new products was slower than expected, leading RH to lower its full-year 2024 sales and adjusted EBIT guidance, this adjustment did not significantly impact investor confidence.

In 2024, RH's stock performed well, rising 35.03% to close at $393.59. The strong third-quarter results, particularly sustained demand growth, underscore its competitiveness and profitability in the luxury home furnishings market. Looking ahead to 2025, RH plans to introduce a series of new collections, including 89 RH Interiors lines and 8 RH Outdoor collections, further strengthening its market position. Additionally, the company is expanding its global footprint with new store openings in key European markets. With a solid financial position, RH has the resources to support its expansion plans. Analysts, including Guggenheim, have raised their price targets and reiterated buy ratings.

[For more insights, please download the full report]

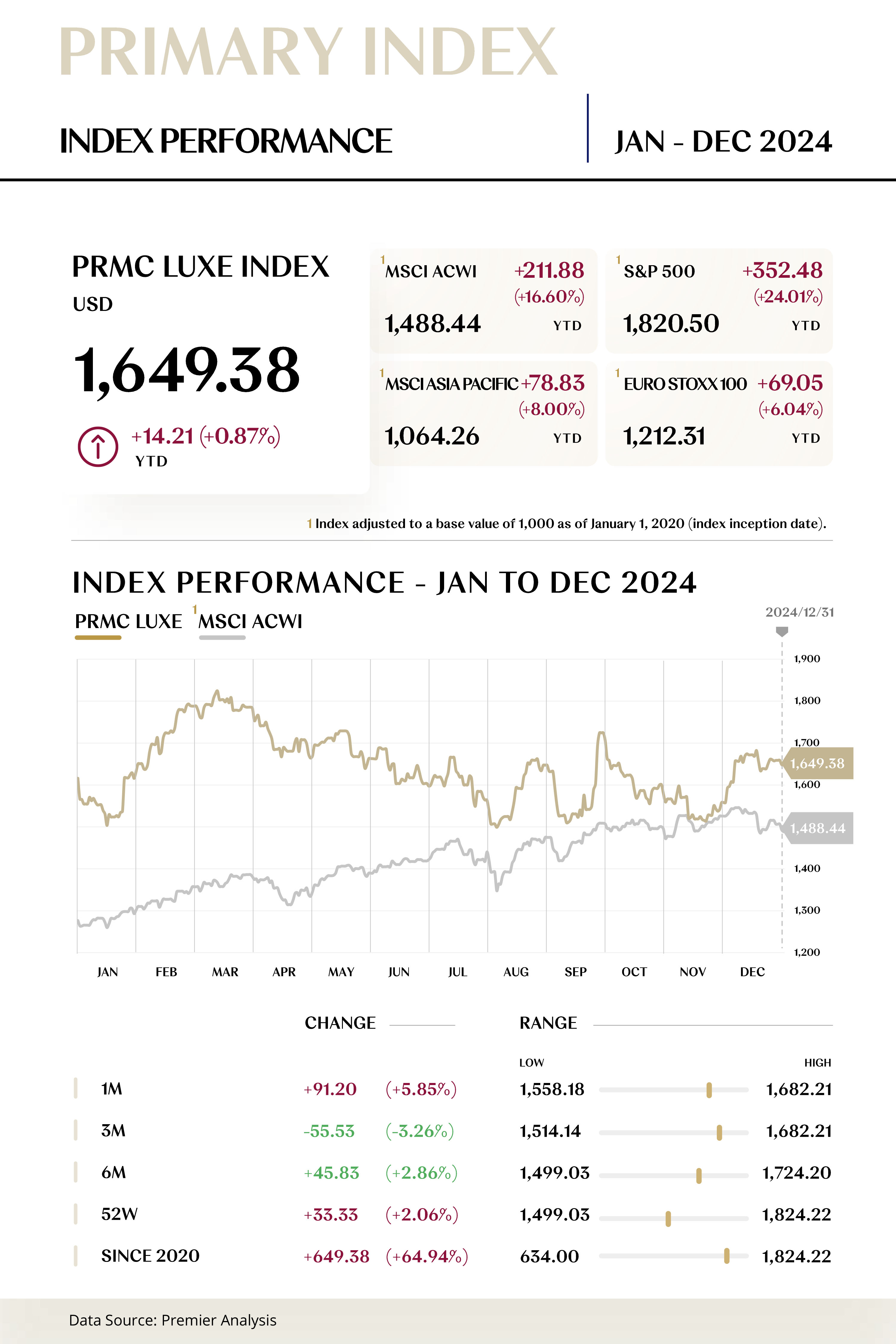

PRIMARY INDEX REVIEW & PROSPECT

Early Gains Followed by Pressure:

A Year Marked by Surges and Corrections

In 2024, the PRMC Luxe Index closed at 1,649.38 points, rising 14.21 points from the beginning of the year, representing a year-over-year increase of 0.87%. The index's performance throughout the year can be divided into three phases:

Phase 1: Jan - Mar 2024

At the start of the year, the luxury sector index continued its downward trajectory from Q4 2023, struggling amid a global economic slowdown and weakened consumer demand. In early January, the Federal Reserve signaled a cautious stance on rate cuts, dashing market expectations for improved liquidity and putting pressure on global equities. In China, consumer confidence remained subdued, with a decline in spending willingness among high-end consumers further weighing on the luxury market. These factors contributed to a significant drop in the PRMC Luxe Index in the first half of the month.

From February to March, improving economic data from major global economies lifted market sentiment. In the U.S., nonfarm payrolls and manufacturing PMI rebounded into expansion territory, signaling economic recovery. Meanwhile, the People’s Bank of China injected long-term liquidity through a broad-based reserve requirement ratio (RRR) cut, reducing corporate financing costs and bolstering market confidence. Additionally, as luxury companies began releasing their full-year 2023 earnings, most exceeded market expectations, further strengthening investor sentiment. Driven by these positive factors, the luxury index gradually rebounded, surpassing the 1,800-point mark by mid-March.

Phase 2: Apr - Jul 2024

In April, escalating geopolitical tensions became the primary market risk. Israel’s airstrike on the Iranian embassy in Syria heightened instability in the Middle East, while Ukraine's new conscription law intensified military confrontation with Russia, further escalating the Russia-Ukraine conflict. These geopolitical events triggered a surge in risk aversion, leading to a sharp decline in the PRMC Luxe Index, which dropped to around 1,700 points.

From May to July, luxury companies released their first-quarter earnings, which largely fell short of market expectations, deepening concerns about the sector’s growth prospects. Additionally, second-quarter sales data from luxury brands indicated weak demand, prompting multiple groups to lower their full-year profit forecasts. This led investors to adopt a more cautious stance, pushing the index into a downward trajectory. At the end of July, the Bank of Japan unexpectedly announced the end of its ultra-loose monetary policy, intensifying market concerns over global liquidity tightening. Under mounting pressure, the luxury index fell sharply, nearing 1,500 points by late July.

Phase 3: Aug - Dec 2024

In early August, after touching 1,500 points, the PRMC Luxe Index began a gradual recovery, driven by a shift toward looser monetary policies among major global economies. The Federal Reserve implemented its first rate cut in years, lowering the federal funds target range to 4.75%-5.00%. The European Central Bank, following its June rate cut, further reduced the deposit facility rate by 25 basis points to 3.5% in September. Meanwhile, in late September, the Chinese government introduced a series of policies to support consumption and economic growth, including a broad-based reserve requirement ratio (RRR) cut, adjustments to mortgage rates, and a reduction in down payment ratios. These measures alleviated concerns over economic downturns and reinforced expectations for a rebound in high-end consumption, helping the index climb back to 1,700 points by the end of September.

From October to December, market sentiment stabilized, leading to a correction of the earlier rapid gains. Meanwhile, global monetary easing continued. The Federal Reserve implemented two consecutive 25-basis-point rate cuts in November and December, while the European Central Bank lowered key interest rates in both October and December. Additionally, the Chinese government intensified its efforts to stimulate consumption, introducing stronger trade-in policies for consumer goods, which provided a moderate boost to luxury spending. Driven by these favorable factors, the luxury index rebounded above 1,600 points by mid-November, ending the year above its starting level.

Looking ahead to the first quarter of 2025, the PRMC Luxe Index is expected to fluctuate around the 1,600-point range, influenced by the continuation of policy support, recovering market demand, and external uncertainties. On one hand, the effects of rate cuts by the Federal Reserve and the European Central Bank at the end of 2024 will continue to unfold, alongside the sustained impact of China’s consumption stimulus policies, providing ongoing support for the high-end consumer market. On the other hand, structural divergence within the luxury sector may exert pressure on the index, with leading brands expected to drive growth through strong global performance, while smaller brands may struggle with profitability challenges and shifting consumer preferences. Additionally, geopolitical risks in the Middle East, Eastern Europe, and the Asia-Pacific, along with economic recovery uncertainties, could heighten short-term market volatility and limit the index’s upward momentum.

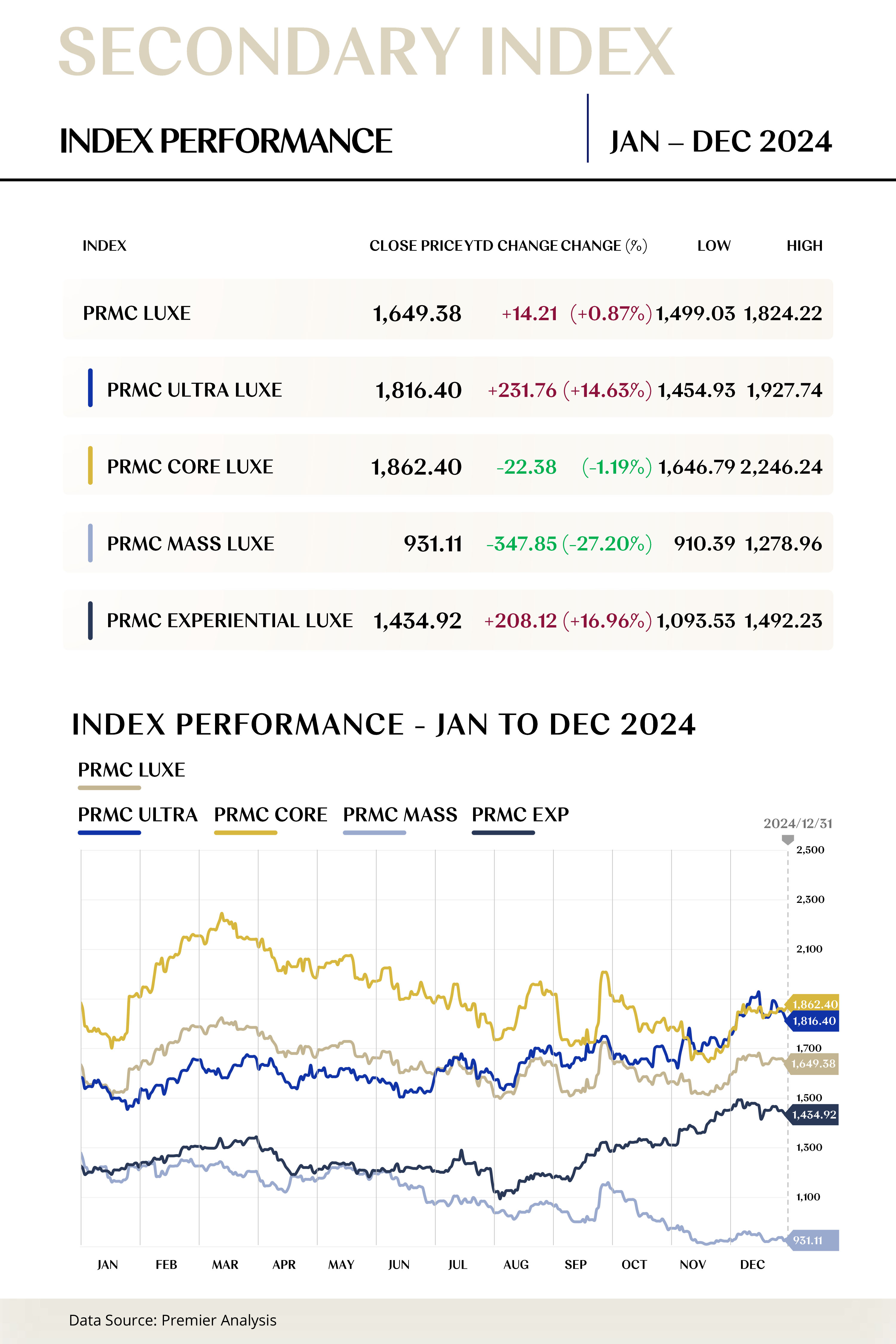

SECONDARY INDEX REVIEW & PROSPECT

Market Volatility Persists: Mass Under Pressure,

While Ultra, Core & Exp Show Upward Momentum

The Ultra Luxe Index closed the year at 1,816.40 points, up 231.76 points from the beginning of the year, marking a 14.63% year-over-year increase. Throughout the year, the index exhibited a steady upward trend with mild fluctuations from January to July, oscillating between 1,500 and 1,700 points. From August onward, driven by the recovery in the private jet and yacht industries, the index gained momentum, steadily rising past the 1,700 and 1,800-point thresholds.

The Core Luxe Index closed the year at 1,862.40 points, down 22.38 points from the beginning of the year, marking a 1.19% year-over-year decline. Driven by corporate earnings reports, the index rose steadily from February to March, surpassing 2,200 points in mid-March. However, amid a broader slowdown in global luxury demand, it entered a downward trajectory from April onward. Between August and September, optimistic market expectations surrounding new policy measures led to a rebound in heavyweight stocks such as LVMH and Hermès, briefly pushing the index back above 2,000 points. Yet, as market sentiment cooled and consumer recovery fell short of expectations, stock prices retreated, leaving the index weak overall. Despite a modest rebound from mid-November as sentiment improved, the index ended the year slightly below its starting level.

The Mass Luxe Index closed the year at 931.11 points, down 347.85 points from the beginning of the year, marking a 27.20% year-over-year decline, the largest drop among secondary indices. From January to May, the index remained stable. However, starting in June, escalating trade tensions between China and the EU, coupled with declining sales and inventory buildup in the beauty sector, led to broad weakness in component stocks. Although a brief rebound occurred in late September due to policy support, persistent industry headwinds pushed the index below 1,100 points in November, where it continued to trade at low levels, ending the year with a weak performance.

The Experiential Luxury Index closed the year at 1,434.92 points, up 208.12 points from the beginning of the year, marking a 16.96% year-over-year increase, the largest gain among secondary indices. Driven by the global rise of experiential consumption, strong performances from publicly listed companies in the cruise and retail sectors fueled stock price gains, boosting the index. Although geopolitical tensions from April to August temporarily dampened market confidence, leading to a brief pullback, the index entered a steady upward trajectory from September as the global economy recovered and consumer demand rebounded, nearing the 1,500-point threshold in December.

In the first quarter of 2025, the Ultra Luxury Index is expected to experience a volatile pullback, driven by a slowdown in private jet and yacht demand, as well as a more stable spending pace among high-net-worth individuals, limiting short-term upward momentum.

The Core Luxury Index may also face fluctuations, as while leading brands remain attractive due to new product launches and market expansion, the slow recovery of global luxury demand and uncertainties in certain regional markets could weigh on overall performance.

The Mass Luxury Index is likely to bottom out and see a mild rebound, supported by a potential easing of trade tensions between China and the EU, which may aid the recovery of the spirits industry. However, inventory pressure and weak demand could cap the extent of the rebound.

In contrast, the Experiential Luxury Index is expected to continue its steady ascent, driven by sustained enthusiasm for experiential consumption globally, with strong growth momentum in the cruise and high-end travel sectors.

24/25 PRMC Luxe Index

Review & Prospect

Feb 02, 2026

Empowering investors to navigate evolving market trends, respond agilely to short-term fluctuations, capture key opportunities, and chart a new course for luxury growth guided by long-term value.

Luxury in Transition:

Defining the Next Chapter of Growth

In 2024, the luxury industry index reflected profound transformation amid the interplay of consumer upgrading, cultural integration, and capital flows. From the slowdown in consumer demand to the rise of emerging markets and the intensifying structural divergence within the global luxury sector, capital market performance underscored both the industry's resilience and challenges. The strong purchasing power of senior consumers, the widespread adoption of digital technologies, and the gradual implementation of sustainability initiatives drove innovation and transformation in the sector. Some brands demonstrated a distinct competitive edge in digital marketing and experiential consumption, leading to sustained valuation growth.

Looking ahead to 2025, the luxury industry is poised to enter a new phase where deepening globalization coexists with regional differentiation. The recovery of key global markets and the further expansion of emerging ones will provide continued momentum for industry growth. Meanwhile, "hyper-localization" and "digital co-creation" will emerge as central themes in luxury brand expansion. Investment strategies will increasingly focus on long-term trends, particularly category extensions and the continuous expansion of global market share among luxury brands. Companies that lead in mergers & acquisitions and supply chain innovation will gain a stronger competitive edge in 2025, becoming key drivers of index growth.