Q2 2025 PRMC Luxe Index

Review & Prospect

Q2 2025 PRMC Luxe Index

Review & Prospect

Examining mid-year results and valuation dynamics to reveal resilience, strategic recalibration, and emerging opportunities in luxury markets.

Eased Policies & Market Momentum, Exp Luxe Reshape Recovery Pivot

In the second quarter of 2025, as the global monetary tightening cycle among major central banks gradually eased, marginal improvements in liquidity supported a rebound in asset prices. At the same time, a temporary easing of geopolitical tensions and an accelerated recovery in international travel flows laid the groundwork for a revival in global high-end consumer sentiment.

In China, the structural recovery trend persisted, underpinned by strengthened policy measures aimed at stimulating consumption and supporting the private sector. Combined with the resurgence of offline retail and outbound tourism during the May Day holiday, these factors delivered tangible benefits to the broader consumption recovery. However, medium- to long-term household income expectations remained subdued, limiting the pull-through effect on mid- to high-end consumer goods.

In the United States, expectations of a soft economic landing continued to solidify, with a rebound in service-sector activity driving increased travel and social engagements among high-net-worth individuals—partially restoring the high-end consumption chain. Nevertheless, the deceleration of the “disinflation” process, coupled with a persistently high interest rate environment, continued to suppress household spending power. Heightened tariff policy uncertainty pushed up end-product prices, further burdening consumers and reinforcing a trend toward cautious expenditure.

In Europe, overall economic recovery momentum remained tepid, with core economies’ PMIs entrenched in contractionary territory and consumer confidence lingering at low levels. While aggregate unemployment rates stayed relatively moderate, certain countries continued to face structural labor market pressures. Together with a sustained rise in living costs, this constrained disposable incomes and exerted a material drag on mid- to high-end consumption demand.

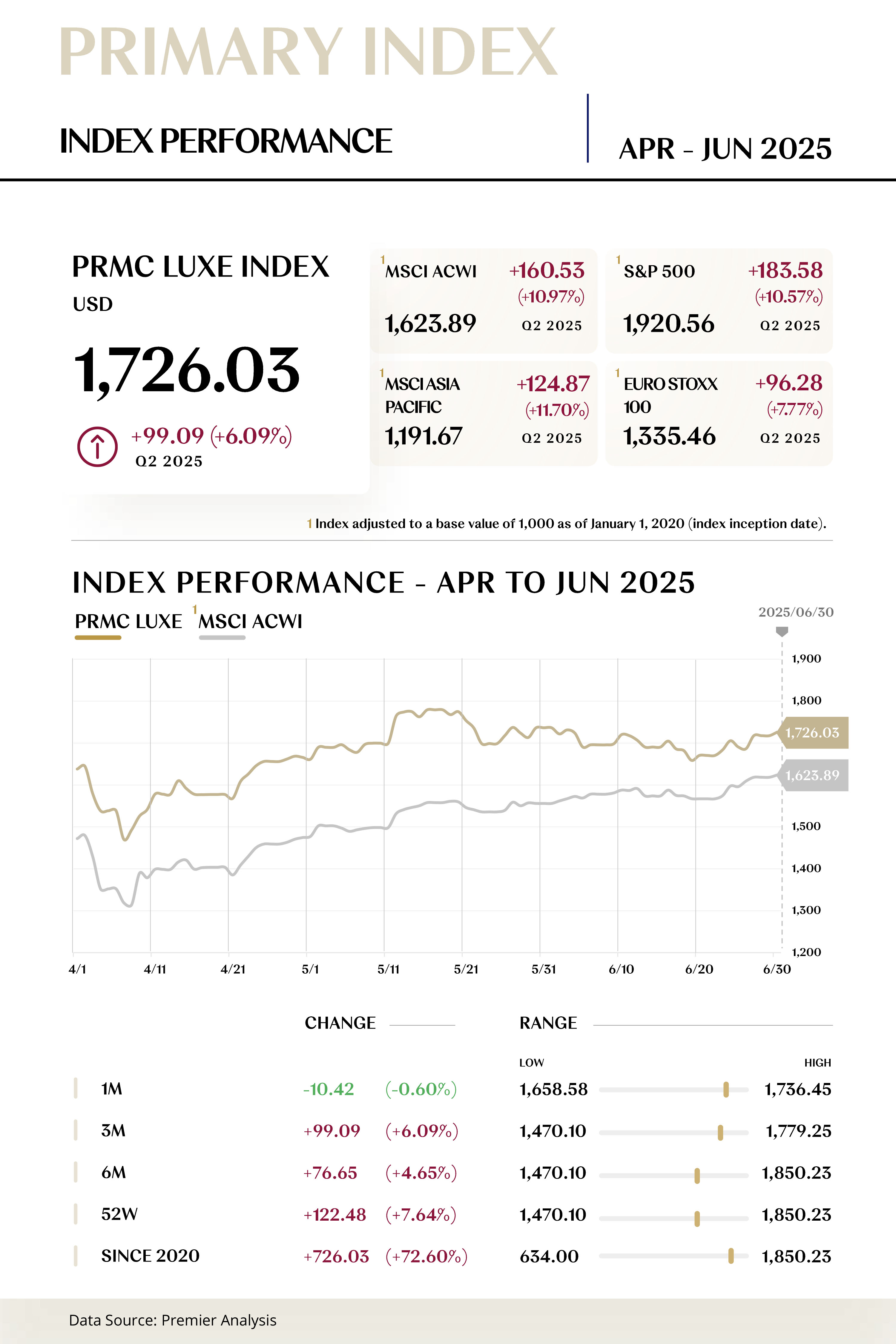

The PRMC Luxe Index closed the second quarter at 1,726.03 points, rising 99.09 points (+6.09%) over the period, yet underperforming key global benchmarks, including the MSCI Asia Pacific (+11.70%), MSCI ACWI (+10.97%), S&P 500 (+10.57%), and EURO STOXX 100 (+7.77%).

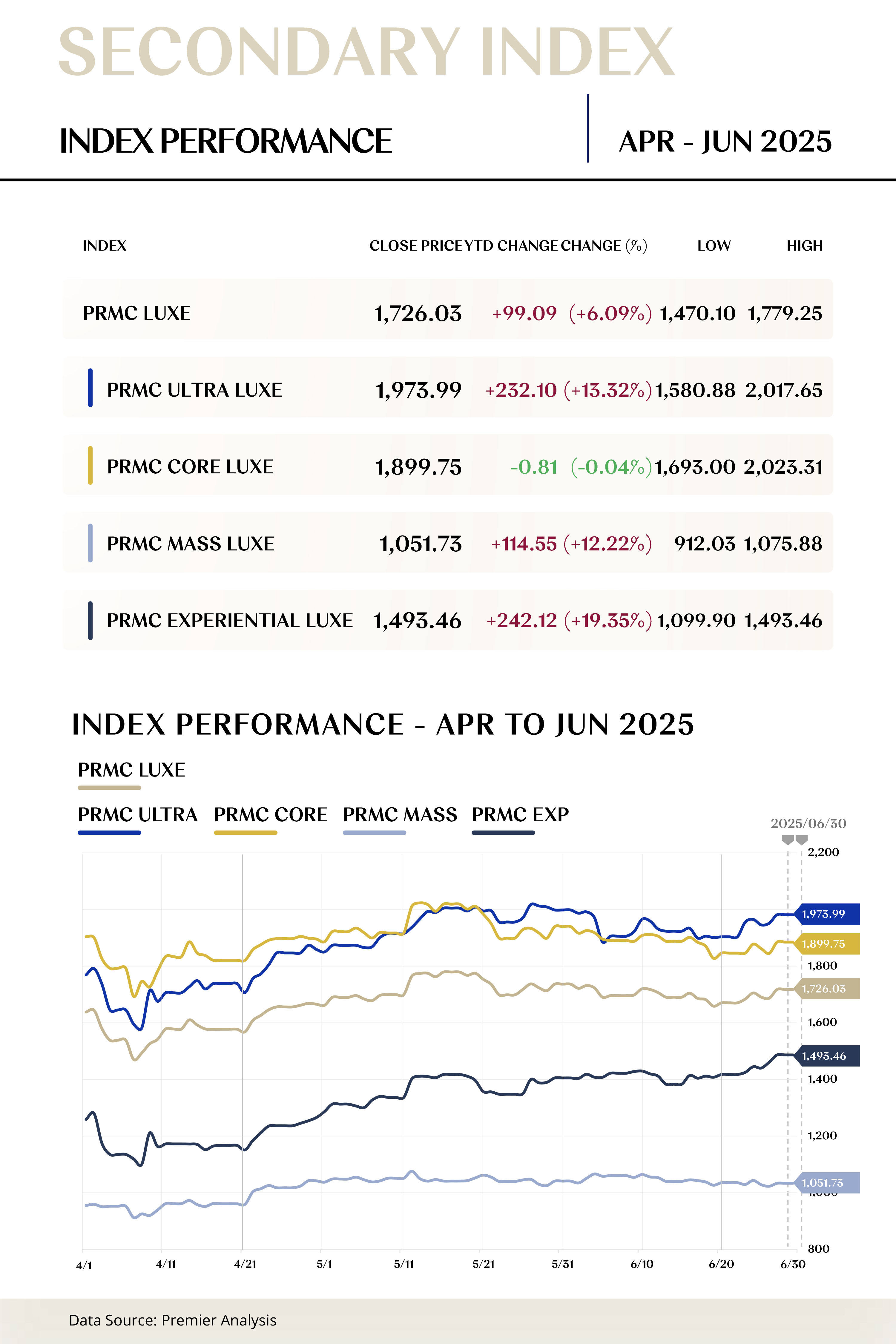

At the secondary index level, Experiential Luxe Index (+19.35%) posted a robust rebound, while the Ultra Luxe Index (+13.32%) and the Mass Luxe Index (+12.22%) also recorded significant gains. In contrast, the Core Luxe Index (-0.04%) remained broadly stable.

At the individual stock level, performance divergence among companies became increasingly evident during the quarter. Dassault Aviation, Richemont, and Hermès delivered strong results, with share prices rising notably, whereas Tesla, Burberry, and Rémy Cointreau underperformed relative to the beginning of the year.

Those who discern the trends prosper; those who capitalize on them advance. As the macroeconomic environment continues to evolve, global economic uncertainty is expected to intensify further in the second quarter, potentially leading to greater fluctuations in investor confidence. Index performance is likely to experience periodic volatility as a result. Meanwhile, Hermès has recently announced plans to raise prices across its U.S. portfolio in an effort to offset rising costs through pricing adjustments. As the impact of new tariff policies gradually takes hold, more luxury brands may follow suit by recalibrating their regional pricing strategies.

Looking ahead, whether global economic stability can be restored and whether the Federal Reserve maintains its tightening stance will be pivotal variables influencing luxury sector valuations and capital market sentiment. The ongoing evolution of index performance, shaped by macroeconomic policies and market expectations, remains a critical area for continued close observation.

DOWNLOADS

Lite Report (75 pages)

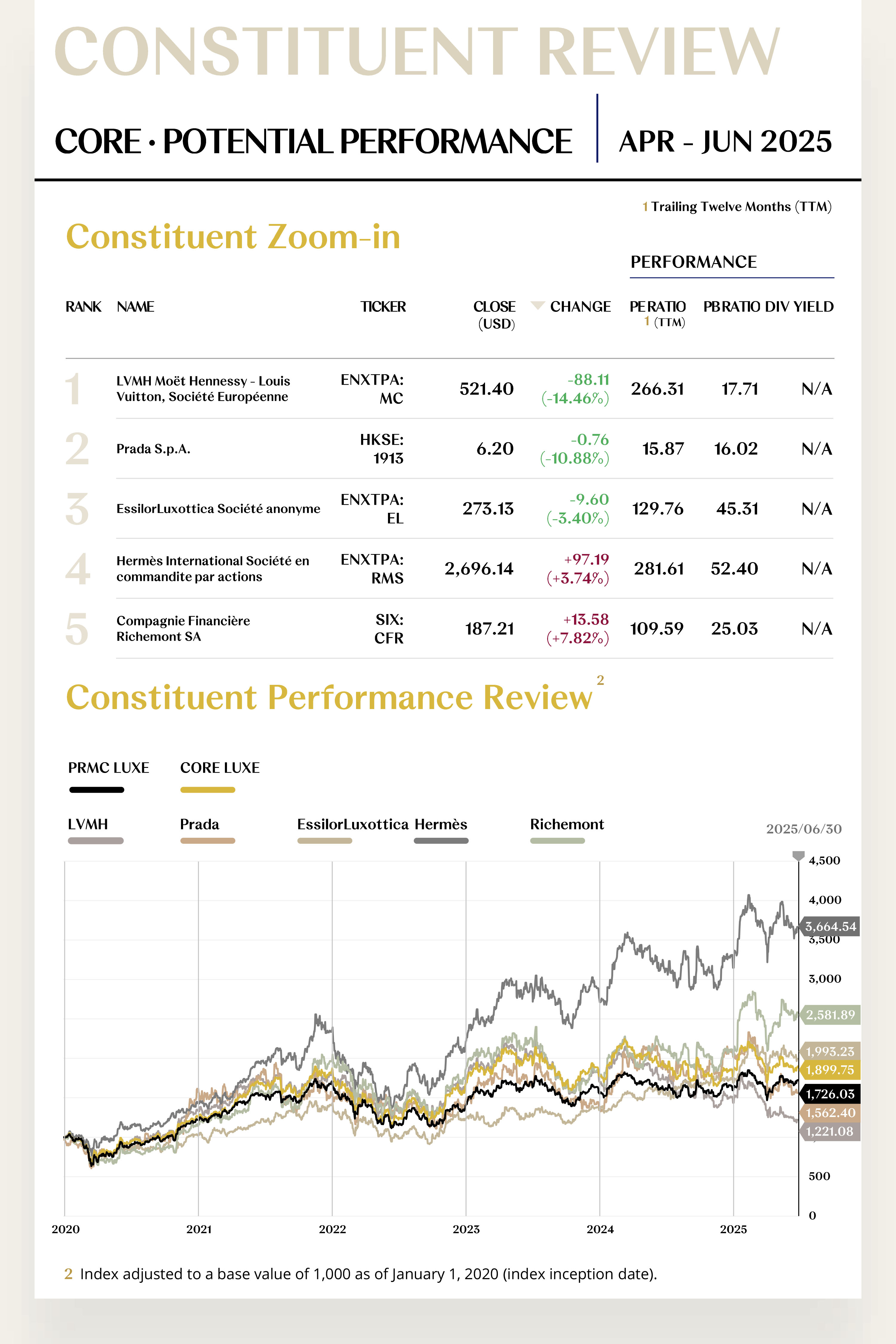

CORE LUXE CONSTITUENT ZOOM-IN

Strategic Overhaul Solidifies Capital Foundation,

Improved Sell-Through Lifts Industry Confidence

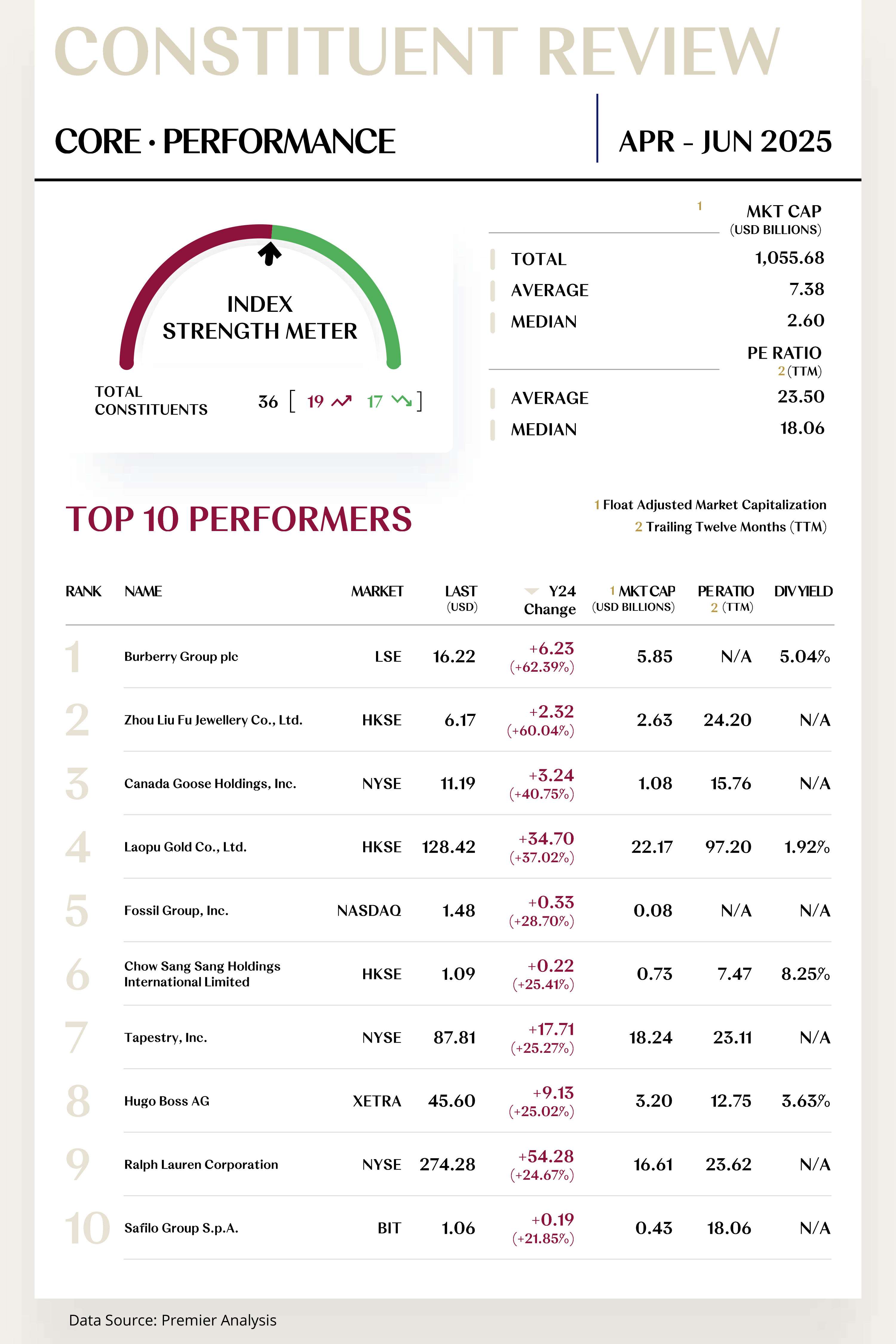

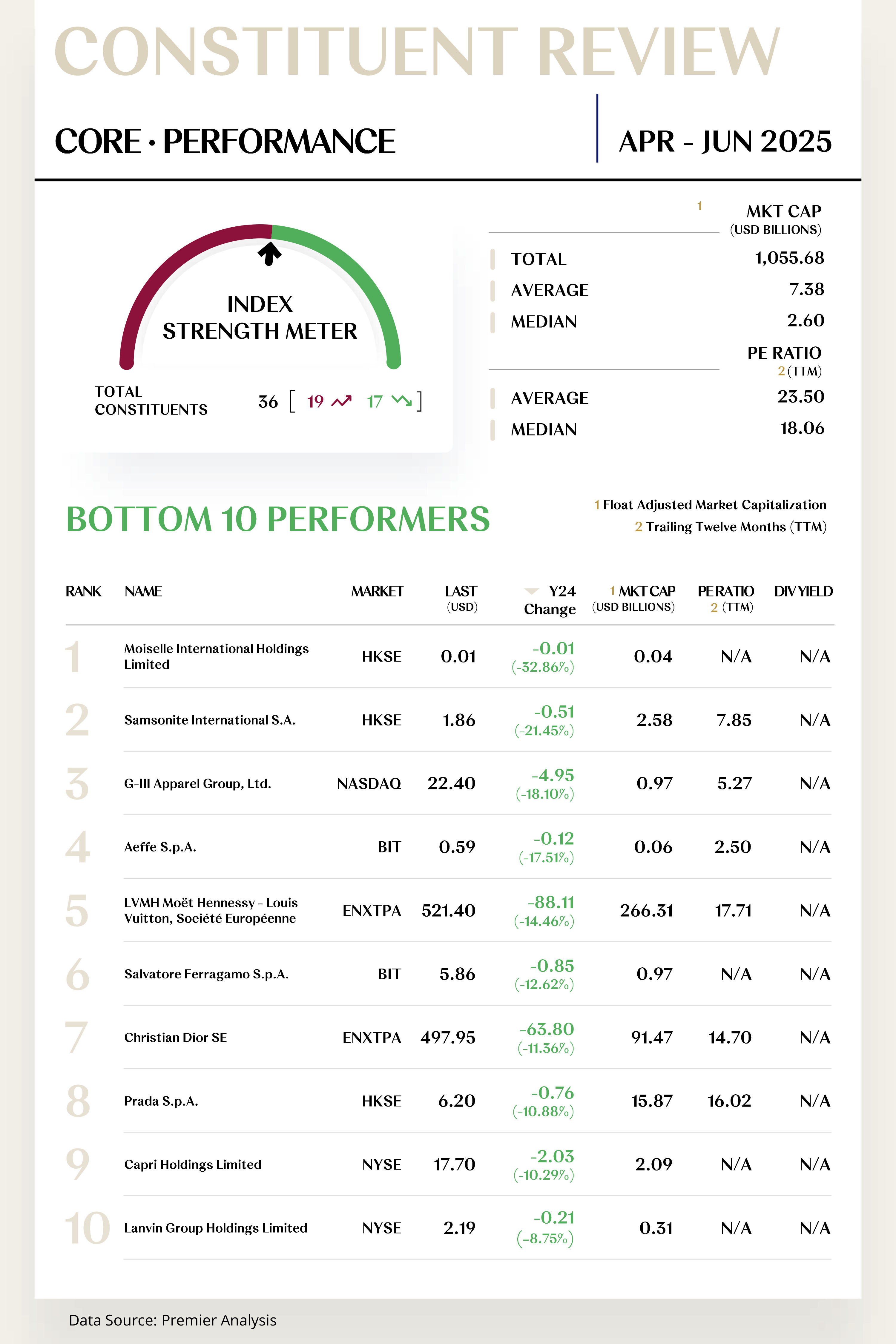

The Core Luxe Index comprises 36 stocks, with 19 rising and 17 falling.

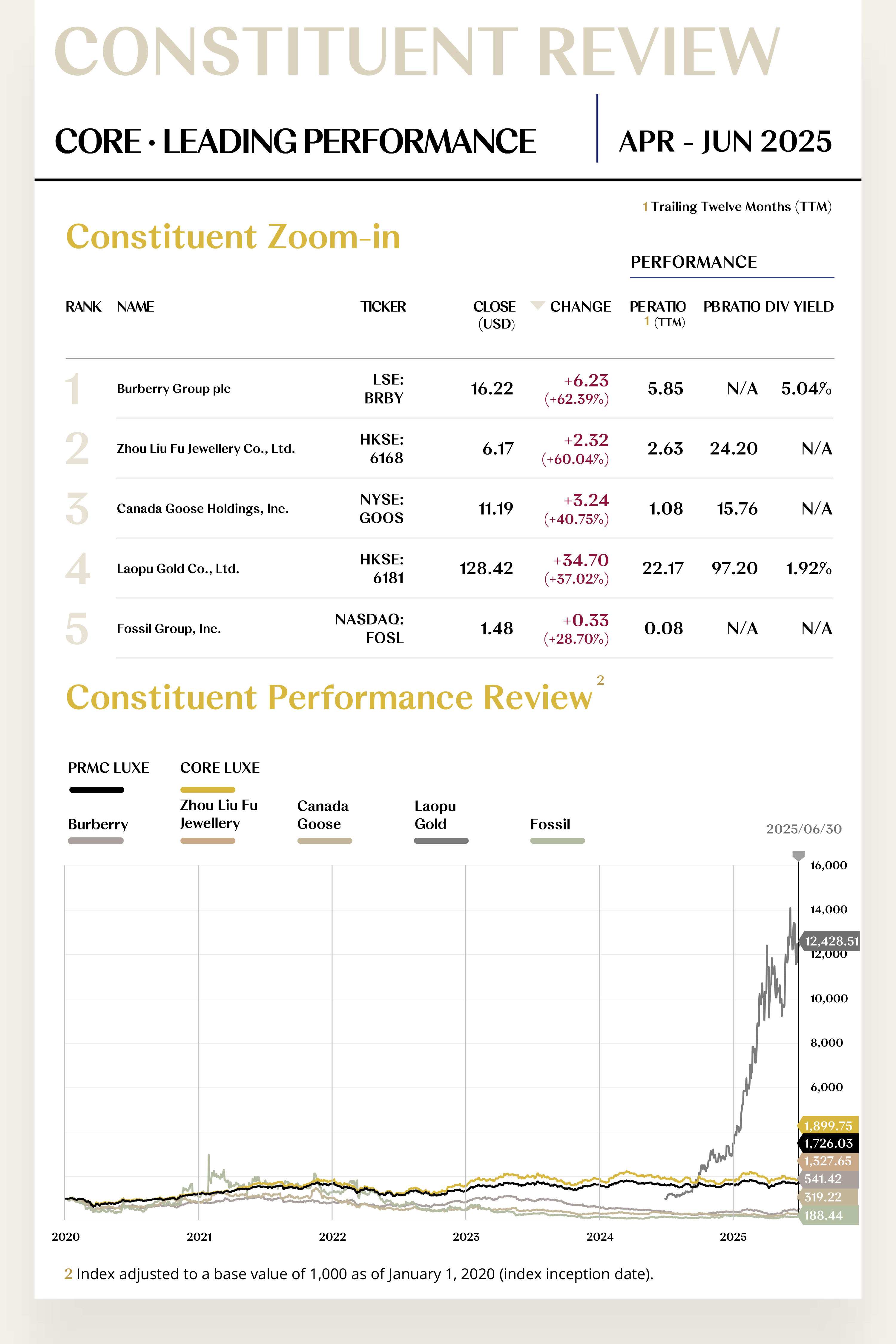

Leading Performers

1. Burberry Group plc (LSE: BRBY)

Burberry is renowned for its quintessential British heritage, iconic check patterns, and timeless design language. Its product portfolio spans trench coats, leather goods, footwear, accessories, and fragrances. In the second quarter of 2025, its share price delivered a strong performance, rising by $2.63 to close at $16.22, representing a quarterly increase of 62.39%.

During the second quarter of 2025, Burberry continued to advance its brand repositioning strategy and actively leveraged the creative influence of Daniel Lee. Following the late-2024 launch of its first new collection under Lee, the second complete collection released during the period garnered wide attention. The overall market valuation anticipates the brand’s ability to blend traditional heritage elements with modern premium craftsmanship, attracting global media coverage and consumer discussion.

At the same time, the Group accelerated its store network expansion in key premium retail locations, opening new flagship stores in high-end destinations such as Wuhan SKP. It also integrated localized cultural elements into its retail formats to further strengthen the emotional connection between the brand and target consumer groups in key markets.

With brand repositioning steadily advancing, Burberry’s valuation recovery momentum has become increasingly clear. In the third quarter, the company is expected to maintain sales growth, particularly through sustained progress in key dynamic markets, supporting further gains in the Group’s share price.

2. Zhou Liu Fu Jewellery Co., Ltd. (HKSE: 6168)

Zhou Liu Fu is one of China’s most recognized jewelry brands, specializing in the design, production, and sale of diamond, gold, platinum, and gemstone jewelry. In the second quarter of 2025, its share price rose by $2.32 to close at $6.17, marking a quarterly increase of 60.04%.

In the first half of 2025, as the overall Chinese consumer market rebounded, demand for gold jewelry and related products rose markedly, providing solid support for Zhou Liu Fu’s business performance. The company continued to adapt to evolving consumer trends, launching a variety of innovative co-branded series targeting younger demographics, and leveraging its global retail network to integrate cultural creativity with traditional cultural symbolism in high-end marketing scenarios. These initiatives have furthered the company’s “New Cultural Creativity” brand positioning, enhancing brand appeal and cultural recognition.

Operationally, Zhou Liu Fu advanced its “Smart Retail” strategic upgrade, with plans to introduce big data analytics and AI technology to enhance personalized in-store experiences. At the same time, the company accelerated its penetration into lower-tier cities, expanding store coverage in third- and fourth-tier markets to capture new consumer demand. Multiple positive developments and proactive signals are expected to drive the company’s share price to further growth in the third quarter.

[For more insights, please download the full report]

Potential Players

1. LVMH Moët Hennessy – Louis Vuitton, Société Européenne (ENXTPA: MC)

LVMH is the world’s largest luxury goods group, with a diversified portfolio covering fashion and leather goods, watches and jewelry, perfumes and cosmetics, as well as wines and spirits. Its flagship brands include Louis Vuitton, Christian Dior, and Tiffany & Co. In the second quarter of 2025, its share price fell by $81.10 to close at $521.40, marking a quarterly decline of 13.46%.

On April 16, the Group released its Q1 2025 results, reporting revenue growth of only 2% in its fashion and leather goods division, lower than the 3–4% growth in the broader market. This was partly due to subdued sales momentum for Louis Vuitton and Christian Dior in the Asia-Pacific region and in the U.S. market. Entering the second quarter, the Group announced that it would strengthen management in its North American business, while increasing investment in the development of beauty products to address demand shifts in mature markets. Facing macroeconomic uncertainty and weaker-than-expected market recovery, the Group’s ability to maintain high asset turnover in its core divisions became a key factor influencing performance.

Despite the challenges of macroeconomic headwinds and localized demand softness, LVMH’s diversified product portfolio and strong brand equity underpin its leading position in the global luxury industry. With the gradual recovery of global consumption, coupled with ongoing brand strategy adjustments, investor sentiment is expected to improve, supporting potential share price stabilization in the second half of the year.

2. Prada S.p.A (HKSE: 1913)

Prada is one of the most influential players in the global luxury industry, with a brand portfolio including Prada, Miu Miu, Versace, Church’s, and Car Shoe. In the second quarter of 2025, its share price fell by $0.76 to close at $6.20, representing a quarterly decline of 10.88%.

According to the Group’s Q1 results released on May 8, although overall revenue growth remained steady—driven primarily by the Prada brand—its Miu Miu label saw a slowdown in Hong Kong and Macau sales, falling short of industry expectations. This has heightened market concerns over the brand’s ability to sustain recent momentum. In its earnings call, management reiterated its commitment to enhancing retail network capabilities and marketing execution to strengthen brand visibility. While this strategy is expected to support medium- to long-term brand building, the near-term outlook is constrained by margin pressures and slower sales in certain regions.

Looking ahead, Prada aims to reinforce its market leadership by launching new collections for both the Prada and Miu Miu brands in the third quarter, alongside more aggressive digital and omnichannel marketing. If market demand stabilizes and product cycle strategies progress as planned, the Group’s operational recovery is expected to accelerate in the second half of the year, potentially boosting investor confidence and supporting a rebound in share prices.

[For more insights, please download the full report]

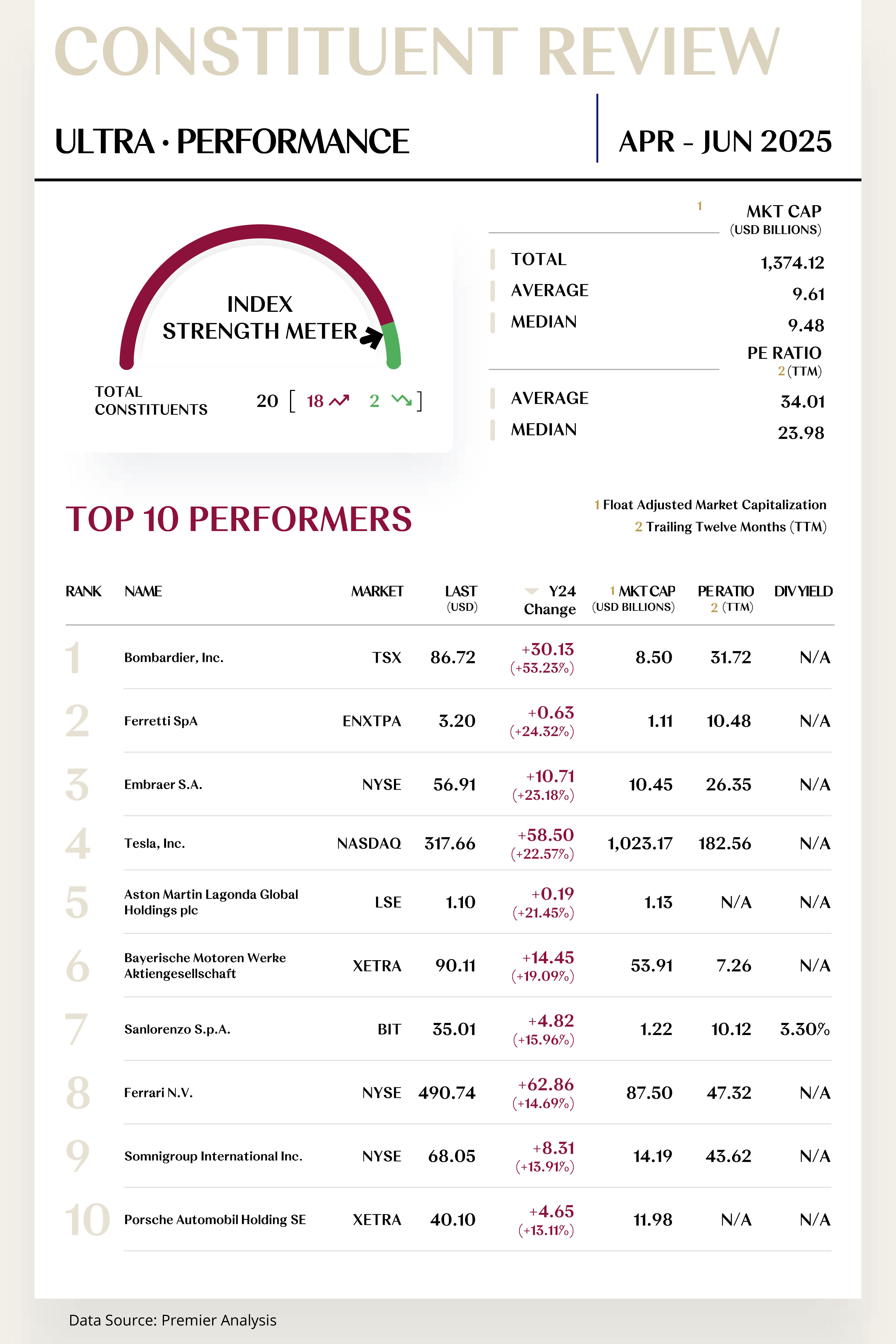

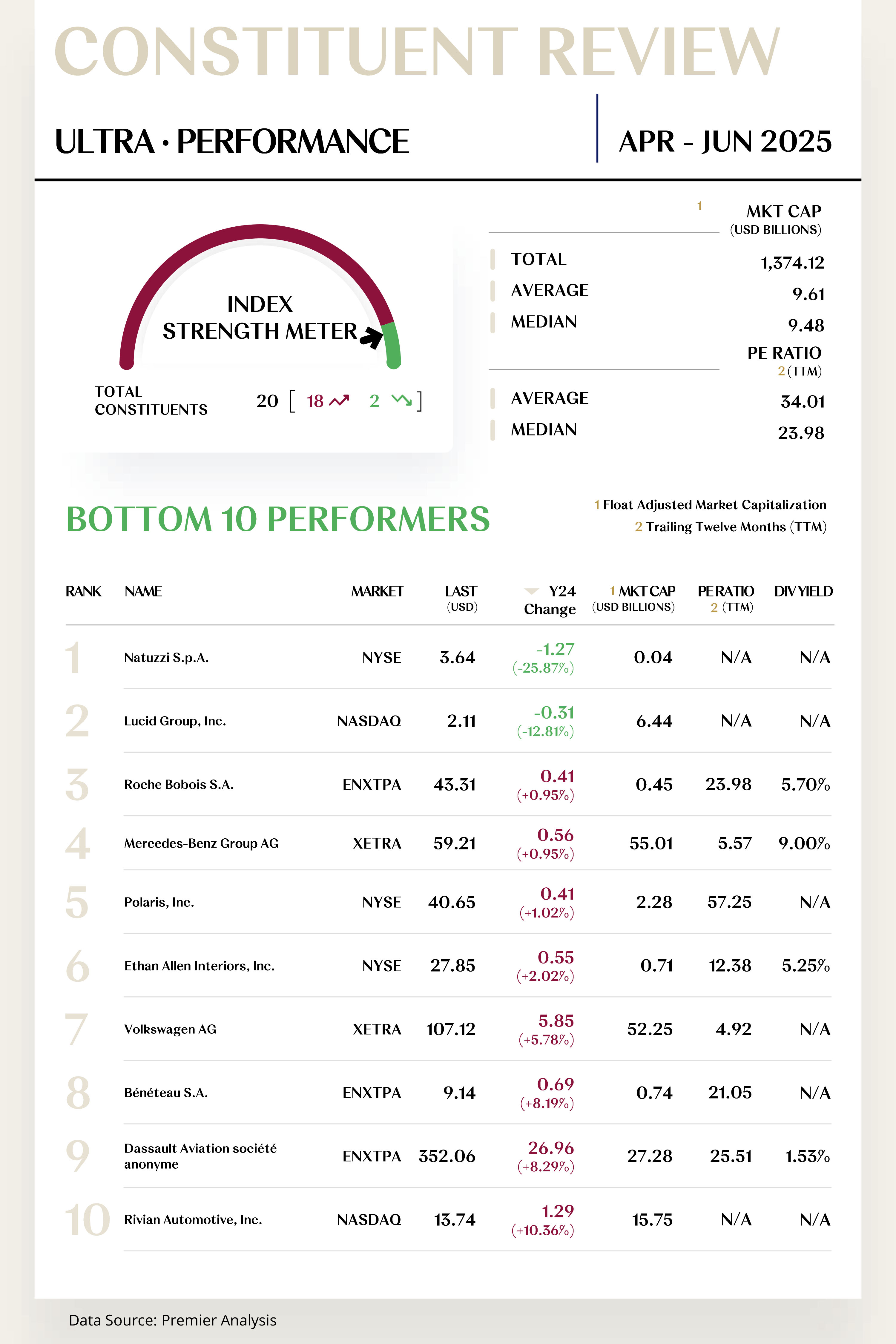

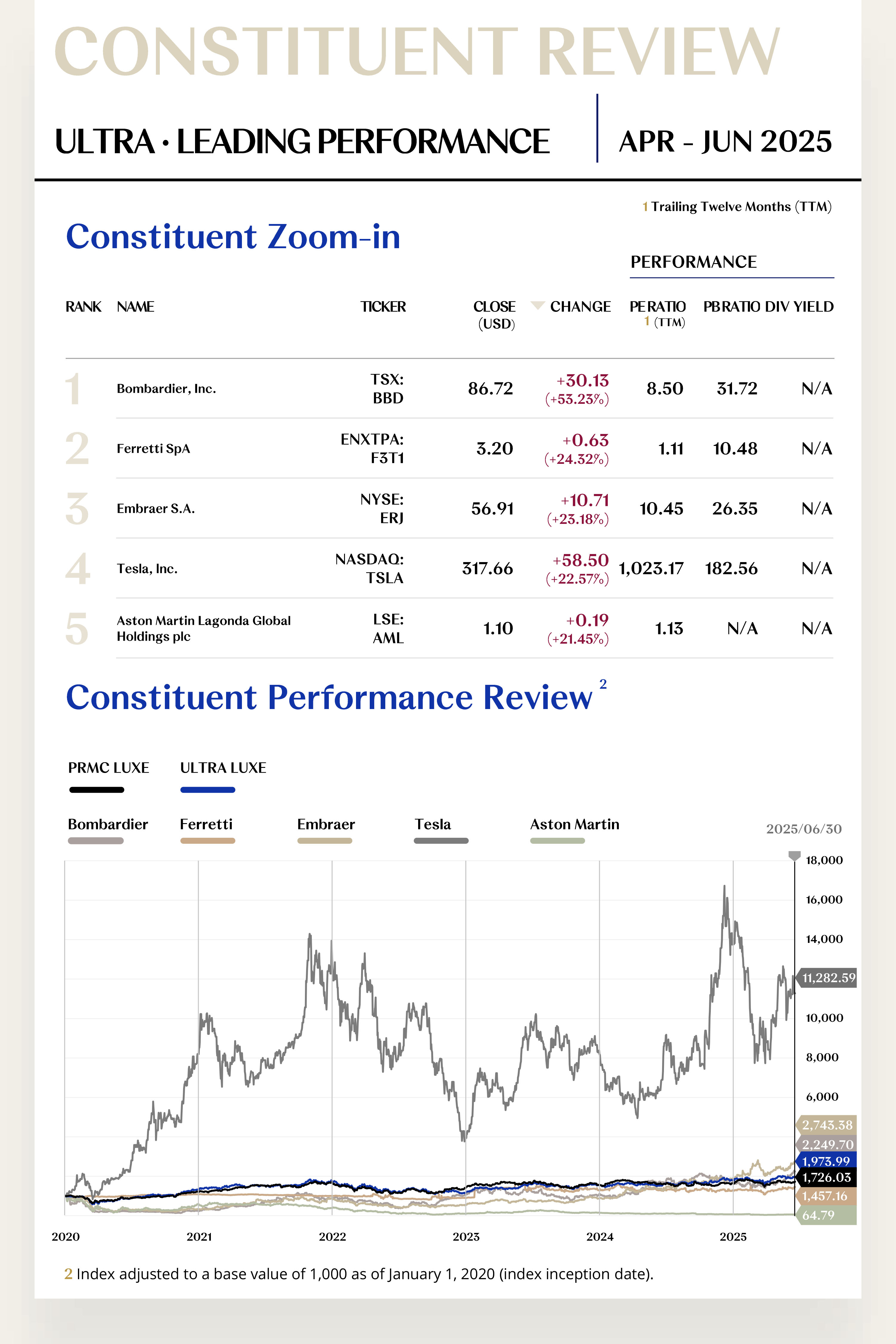

ULTRA LUXE CONSTITUENT ZOOM-IN

Supply Restoration Tempers Sentiment Shifts,

Secured Orders Anchor Sustained Expansion

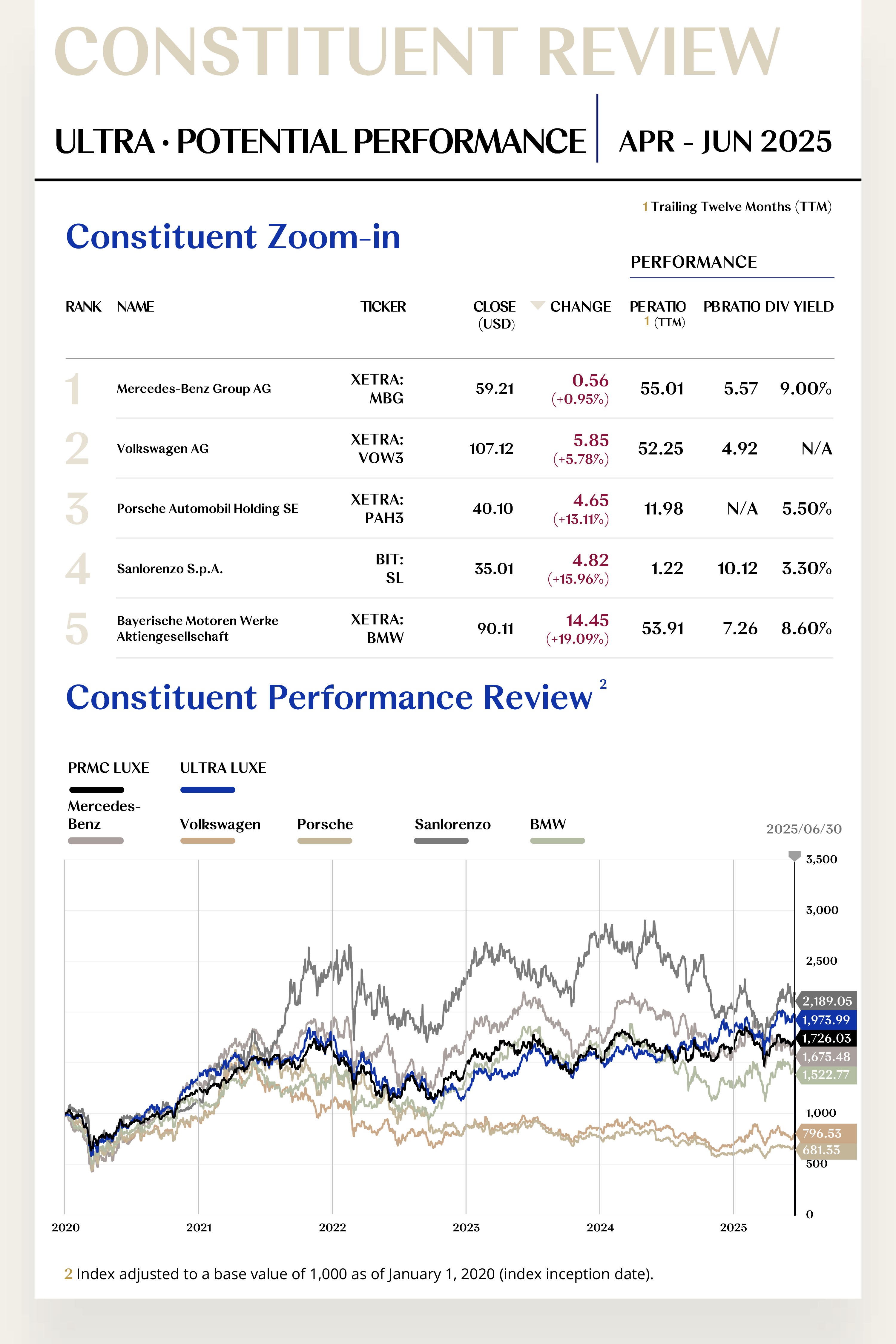

The Ultra Luxe Index comprises 20 stocks, with 18 rising and 2 falling.

Leading Performers

1. Bombardier Inc. (TSX: BBD)

Bombardier operates in the global business aviation market, specializing in the design, manufacture, and sale of high-performance business jets. In the second quarter of 2025, its share price rose by $30.13 to close at $86.72, marking a quarterly increase of 53.23%.

On May 2, the company released its Q1 2025 results, which exceeded market expectations. During the reporting period, business jet deliveries increased by 25% year-on-year, with average transaction value per aircraft reaching a historic high of USD 30 million. Supported by strong delivery data and profitability in aftermarket services, Q1 adjusted EBITDA margin expanded to 18.5%. In related news, the company announced the sale of a pre-owned Global 7500 aircraft to a key Middle Eastern client, a deal valued at USD 200 million including associated service contracts—securing substantial forward order visibility.

Looking ahead, Bombardier is expected to continue strengthening its market position in the high-end business jet segment through strategic capacity optimization and cash flow improvement, providing a solid foundation for long-term growth. As global wealth recovery and private aviation demand sustain their upward trajectory, the company’s record-breaking backlog should continue to support revenue visibility, reinforcing its role as a key driver of share price performance.

2. Ferretti S.p.A. (ENXTPA: F3T1)

Ferretti Group is a global leader in the luxury yacht manufacturing industry, with a portfolio that includes Riva, Ferretti Yachts, Pershing, Custom Line, CRN, Itama, and Wally. In the second quarter of 2025, its share price rose by $0.63 to close at $3.20, up 24.32% for the quarter.

According to its Q1 2025 results released on May 13, order momentum remained strong, with significant breakthroughs in key Middle Eastern and Asian markets pushing the Group’s order book to EUR 1.8 billion by the end of the quarter—a new record in company history. This growth highlights the brand’s strong appeal among ultra-high-net-worth clients.

Ferretti continues to advance its innovation and design strategy. During Milan Design Week, the company unveiled several hybrid-powered yacht concepts, showcasing its forward-looking approach to sustainable luxury. It also announced a partnership with a leading interior design firm to develop bespoke yacht interiors, further enhancing personalization and exclusivity for its flagship brands.

Looking ahead, Ferretti’s record order backlog provides a solid foundation for sustained future revenue growth. The Group’s ongoing investments in innovation and product diversification are expected to attract younger generations of affluent clients, supporting steady long-term share price appreciation.

[For more insights, please download the full report]

Potential Players

1. Mercedes-Benz Group AG (XETRA: MBG)

Mercedes-Benz is a global leader in luxury automobile manufacturing, with a portfolio that includes Mercedes-Benz, Mercedes-AMG, Mercedes-Maybach, and other high-end marques. In the second quarter of 2025, its share price rose by $0.56 to close at $59.21, marking a quarterly gain of 0.95%.

According to the Group’s Q1 2025 results released on April 30, overall performance remained solid, although structural shifts were evident. The S-Class, G-Class, AMG, and other large luxury vehicle segments continued to deliver stable results, becoming key profit contributors. However, the core entry-level and mid-sized segments were affected by intensified competition and margin pressures. The Group’s revenue increased by 1.8% year-on-year, with adjusted EBIT margin at 13.5%, slightly lower than the same period last year.

Looking ahead, Mercedes-Benz’s focus on high-margin segments remains a strategic priority, helping to offset profitability pressure from the electrification transition. With the launch of more hybrid and fully electric models, product mix optimization is expected to continue. Brand equity and pricing power should remain resilient, supporting long-term growth despite a more complex macro environment.

2. Volkswagen AG (XETRA: VOW3)

Volkswagen is one of the world’s largest automobile manufacturers, with a brand portfolio including Volkswagen, Audi, Porsche, Bentley, Lamborghini, and Bugatti, spanning the premium segment and offering a full range of products from traditional combustion to new energy vehicles. In the second quarter of 2025, its share price rose by $5.85 to close at $107.12, marking a quarterly increase of 5.78%.

According to its Q1 2025 results released on April 28, performance exceeded market expectations, driven by strong profitability and efficiency improvements in the Group’s luxury brands, particularly Porsche and Audi. The Group recorded 4.5% year-on-year revenue growth and an operating margin of 7.8%.

Since the beginning of the year, Volkswagen has accelerated its electrification strategy in China. The newly appointed head of R&D for China emphasized the importance of local smart EV development capabilities and market responsiveness. In June, Audi launched its new Q6 e-tron series, while Porsche’s new PPE platform received positive early feedback from the market.

Looking ahead, Volkswagen’s luxury brand portfolio is expected to deliver stable profitability, supported by its strong resilience through market cycles. In China, the Group’s “In China, for China” strategy and the launch of its next-generation EV platforms are likely to further strengthen its competitive position in one of its most critical markets.

[For more insights, please download the full report]

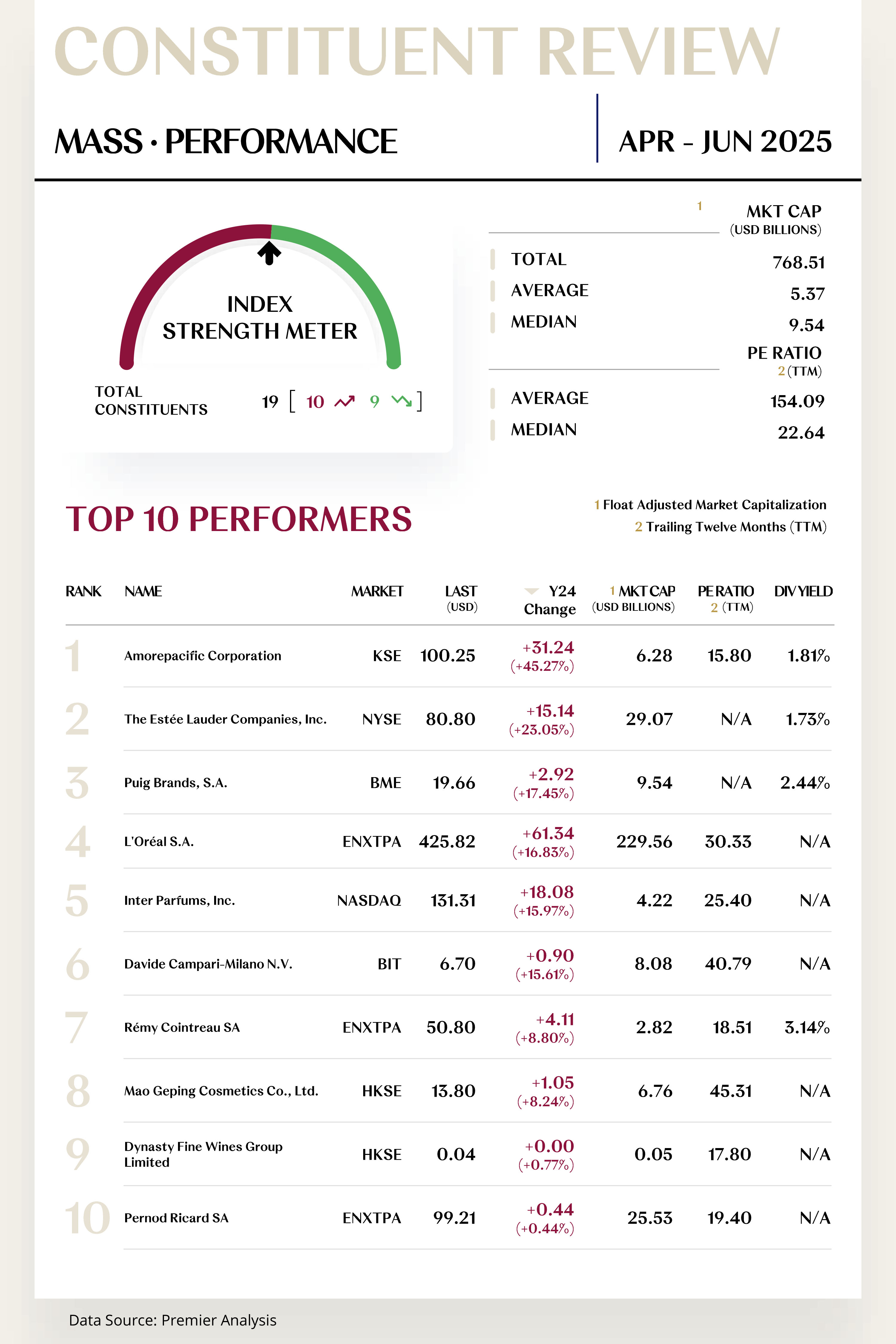

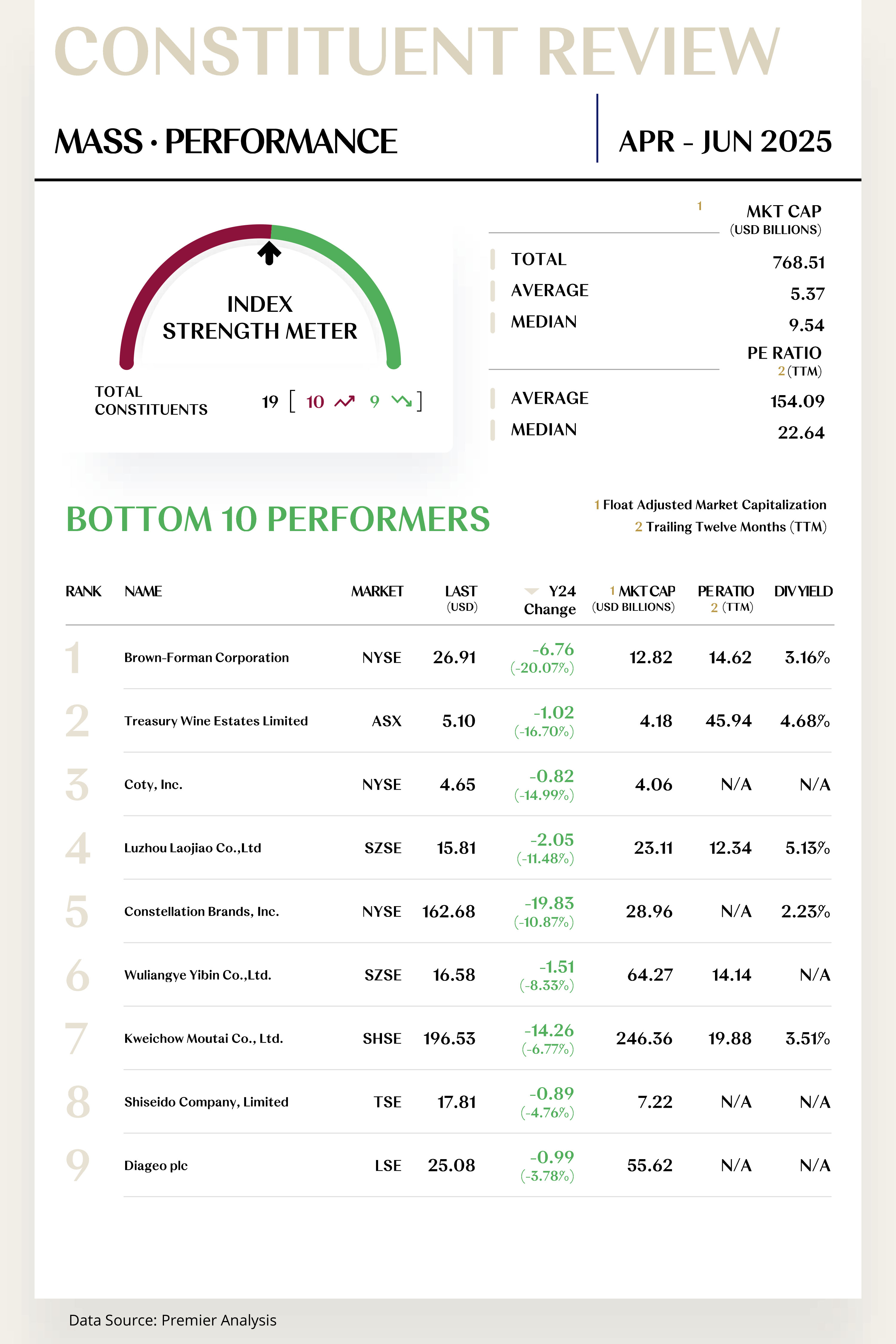

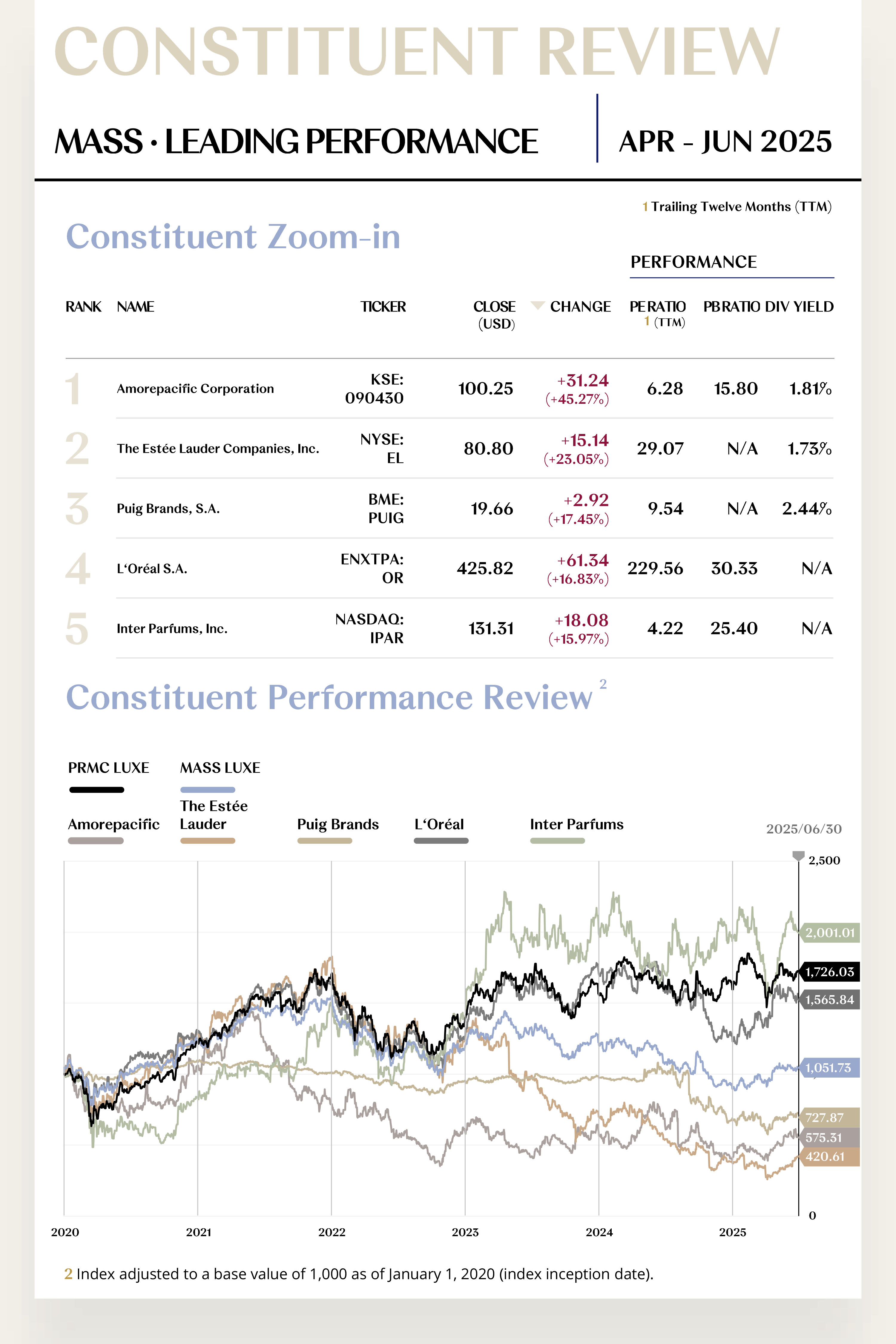

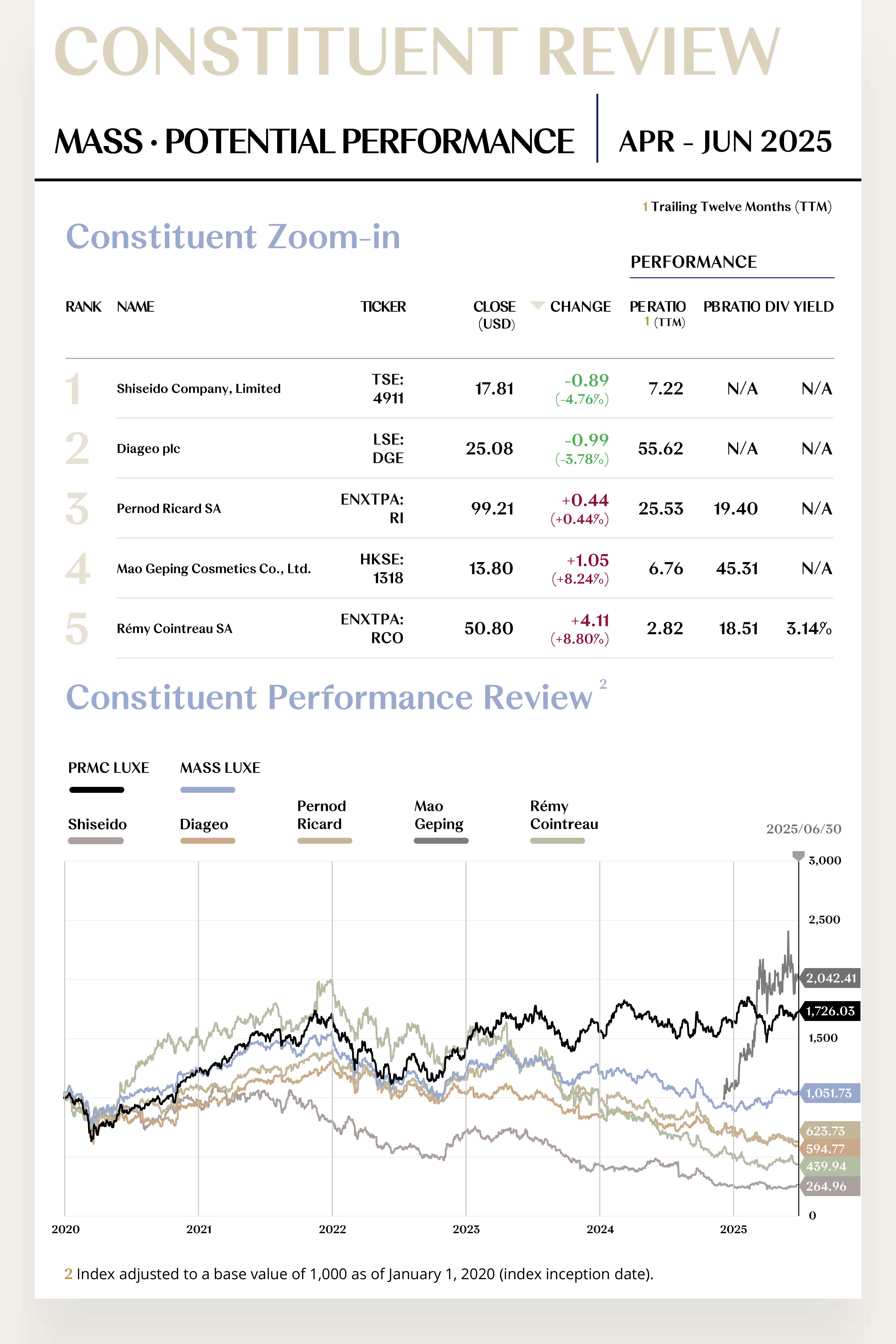

MASS LUXE CONSTITUENT ZOOM-IN

Core Market Revival Hints at Growth,

Upbeat Guidance Strengthens Valuation Floor

The Mass Luxe Index comprises 19 stocks, with 10 rising and 9 falling.

Leading Performers

1. Amorepacific Corporation (KRX: 090430)

Amorepacific is one of Asia’s largest cosmetics groups, with a portfolio including Sulwhasoo, Laneige, and Innisfree. Its products span skincare, makeup, and personal care. In the second quarter of 2025, its share price rose by $31.24 to close at $100.25, marking a quarterly increase of 45.27%.

The rally was driven by positive investor sentiment toward a potential turnaround in business performance. According to its Q1 results, group sales rose 11.2% year-on-year to KRW 1.152 trillion, with operating profit increasing 175.2% to KRW 211 billion, surpassing market expectations. The performance was primarily fueled by strong momentum in the Chinese market, where sales rose 41%, and in EMEA, where sales climbed 52%, while the domestic Korean market also showed signs of stabilization.

Looking ahead, Amorepacific’s ongoing global restructuring strategy is beginning to yield results. The company will continue focusing on its core brands, particularly Sulwhasoo, in high-growth beauty markets, while expanding its international distribution footprint. Investor sentiment remains positive on the back of structural improvement prospects, supporting expectations for sustained medium-term share price momentum.

2. The Estée Lauder Companies Inc. (NYSE: EL)

Estée Lauder is a globally renowned beauty group with brands including Estée Lauder, La Mer, and Jo Malone London. Its portfolio covers skincare, makeup, and fragrance. In the second quarter of 2025, its share price rose by $15.14 to close at $80.80, representing a quarterly gain of 23.05%.

The strong share price performance was supported by confidence in the company’s profit recovery trajectory and operational improvements. For the third quarter of fiscal 2025 (ended March 31), net sales rose 5% year-on-year to USD 3.94 billion, exceeding analyst expectations and signaling a gradual recovery in travel retail. Profit recovery initiatives boosted margins, particularly in Asia-Pacific markets, while growth in travel retail sales in mainland China and Hong Kong was a key driver.

Looking ahead, Estée Lauder reiterated its full-year profit recovery guidance for fiscal 2025–2026. Management remains focused on accelerating travel retail recovery, sustaining cost-control measures, and improving margins. With travel demand expected to strengthen in the second half of the year, these initiatives provide a solid foundation for a continued medium- to long-term share price rebound.

[For more insights, please download the full report]

Potential Players

1. Shiseido Company, Limited (TSE: 4911)

Headquartered in Tokyo, Japan, Shiseido is a leading global beauty group with a business portfolio covering skincare, makeup, fragrances, and beauty devices. The company owns over 20 brands, including Shiseido, Clé de Peau Beauté, and Ipsa. In the second quarter of 2025, its stock price fell by $0.89, closing at $17.81, a 4.76% decline for the quarter.

According to the company’s first-quarter earnings report, sales were down 3.1% year-over-year, while core operating profit plunged 66.5% to 4.27 billion yen, significantly below market expectations. Although the domestic Japanese market performed steadily, persistent weakness in mainland China and travel retail channels severely impacted overall performance. The company is actively pursuing its "WIN 2025 and Beyond" transformation strategy, focusing on improving profitability. However, measures such as structural reforms and the divestiture of non-core assets are putting short-term pressure on profits.

Looking ahead to the third quarter of 2025, Shiseido is expected to return to the moderate recovery seen in Q1. The strong performance of its two core brands, Anessa and Elixir, in both the Chinese and global markets validates the effectiveness of the company's brand repositioning and channel optimization strategies. Additionally, IFP's investment and management adjustments in the Americas signal the company's continuous efforts to optimize its governance structure and strengthen strategic execution, which is expected to further boost investor confidence.

2. Diageo plc (LSE: DGE)

Diageo is a world-leading premium beverage alcohol company with a product portfolio spanning spirits and beer. Its brands include Johnnie Walker, Smirnoff, Baileys, Guinness, and Shuijingfang. In the second quarter of 2025, its stock price fell by $0.99, closing at $25.08, a 3.78% decline for the quarter.

According to Diageo's interim financial report for the first half of fiscal year 2024/2025 (ending December 31, 2024), released earlier this year, the group's organic net sales decreased by 0.6% year-over-year. Sales in Latin America and the Caribbean plummeted by 23%, and the North American market also saw a 1.5% decline, which dragged down overall performance. Despite relatively stable performance in the European and Asian markets, weakness in the Americas raised investor concerns about the company's growth prospects, a sentiment that persisted throughout the second quarter.

Looking ahead, company management expects organic sales growth to rebound in the second half of the fiscal year. Supported by its powerful brand portfolio, global channel resources, and leading position in the premium spirits sector, the company still holds long-term growth potential. However, in the short term, the market will closely monitor the pace of recovery in its core markets, which will be a crucial variable for the stock price to stabilize and rebound.

[For more insights, please download the full report]

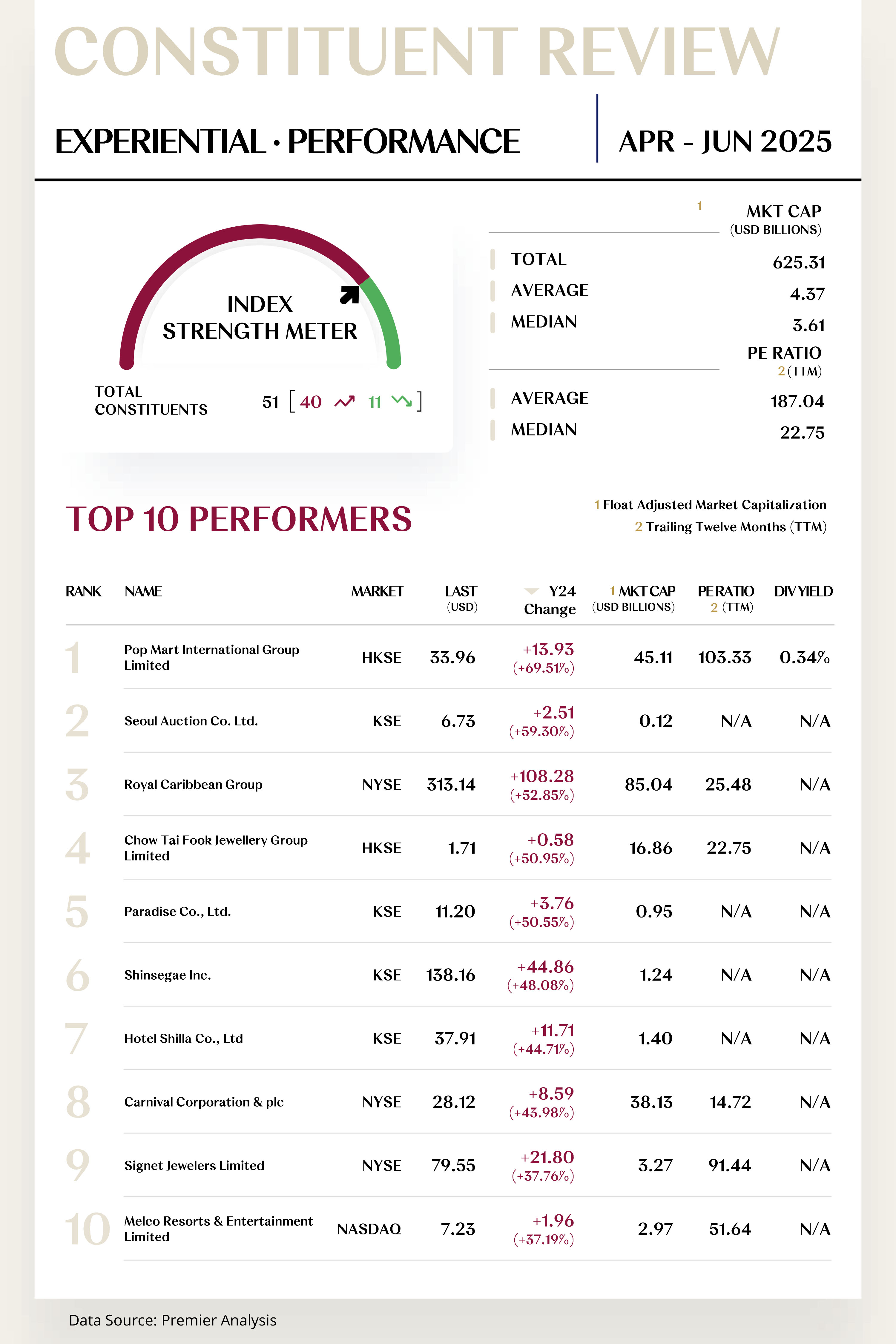

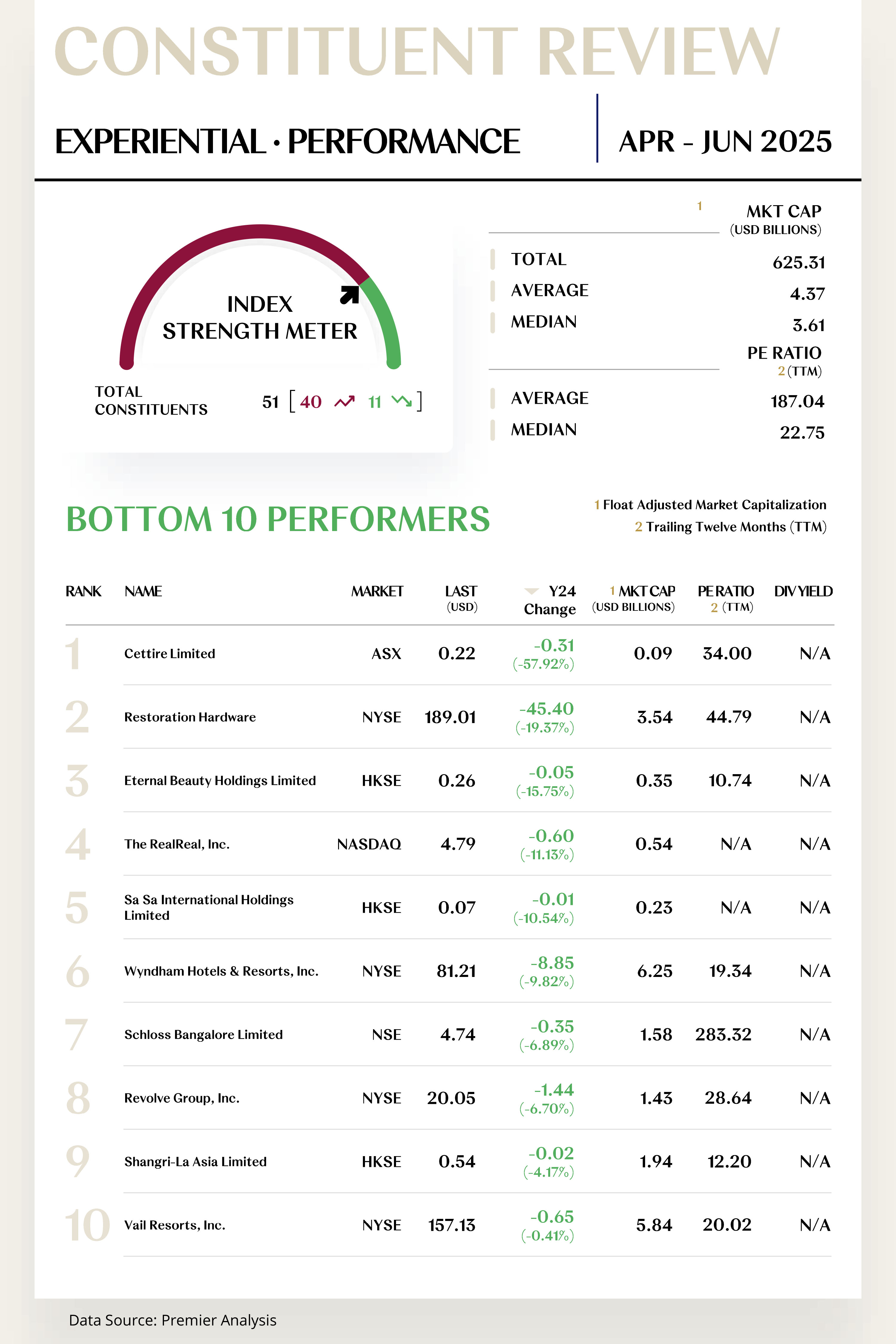

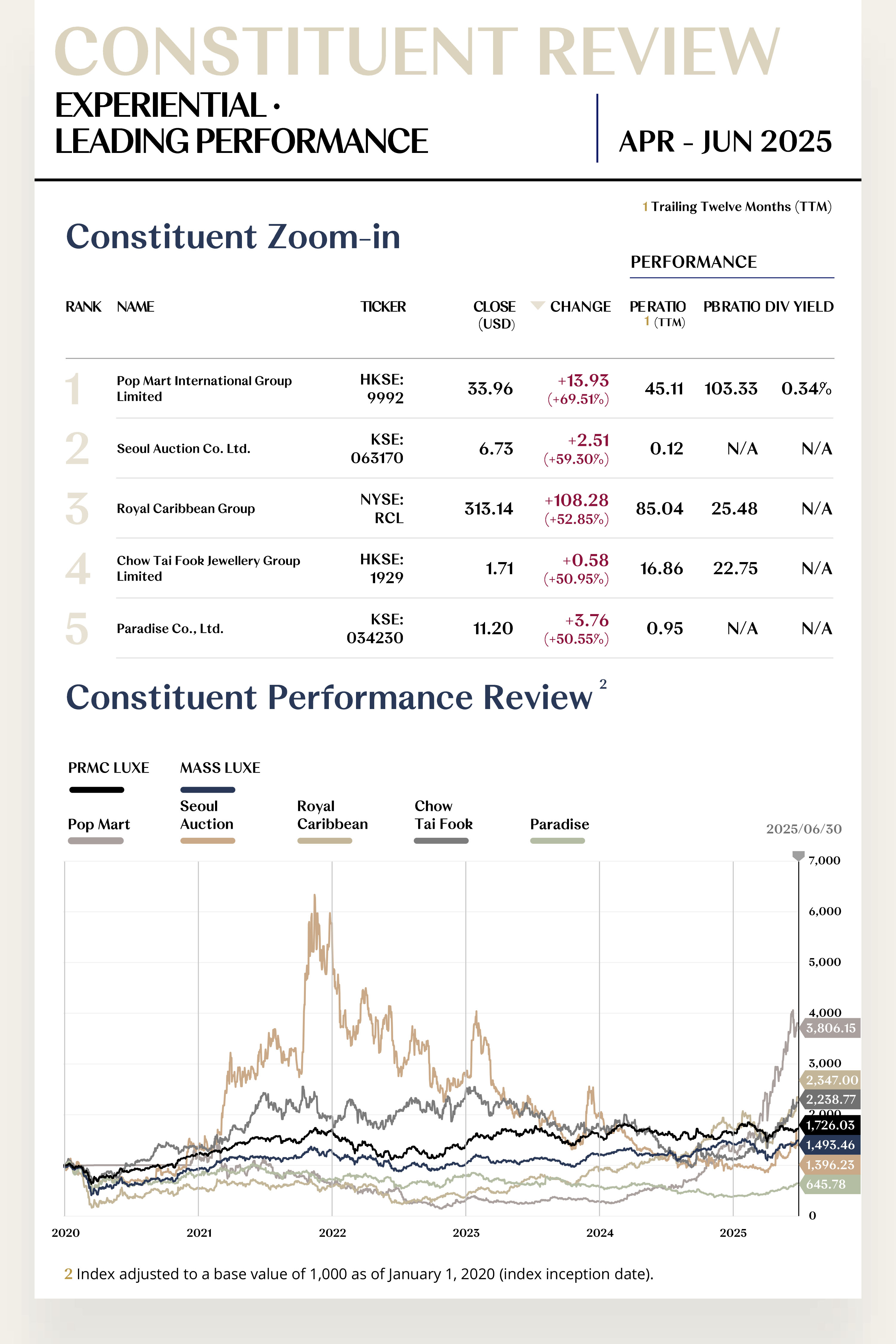

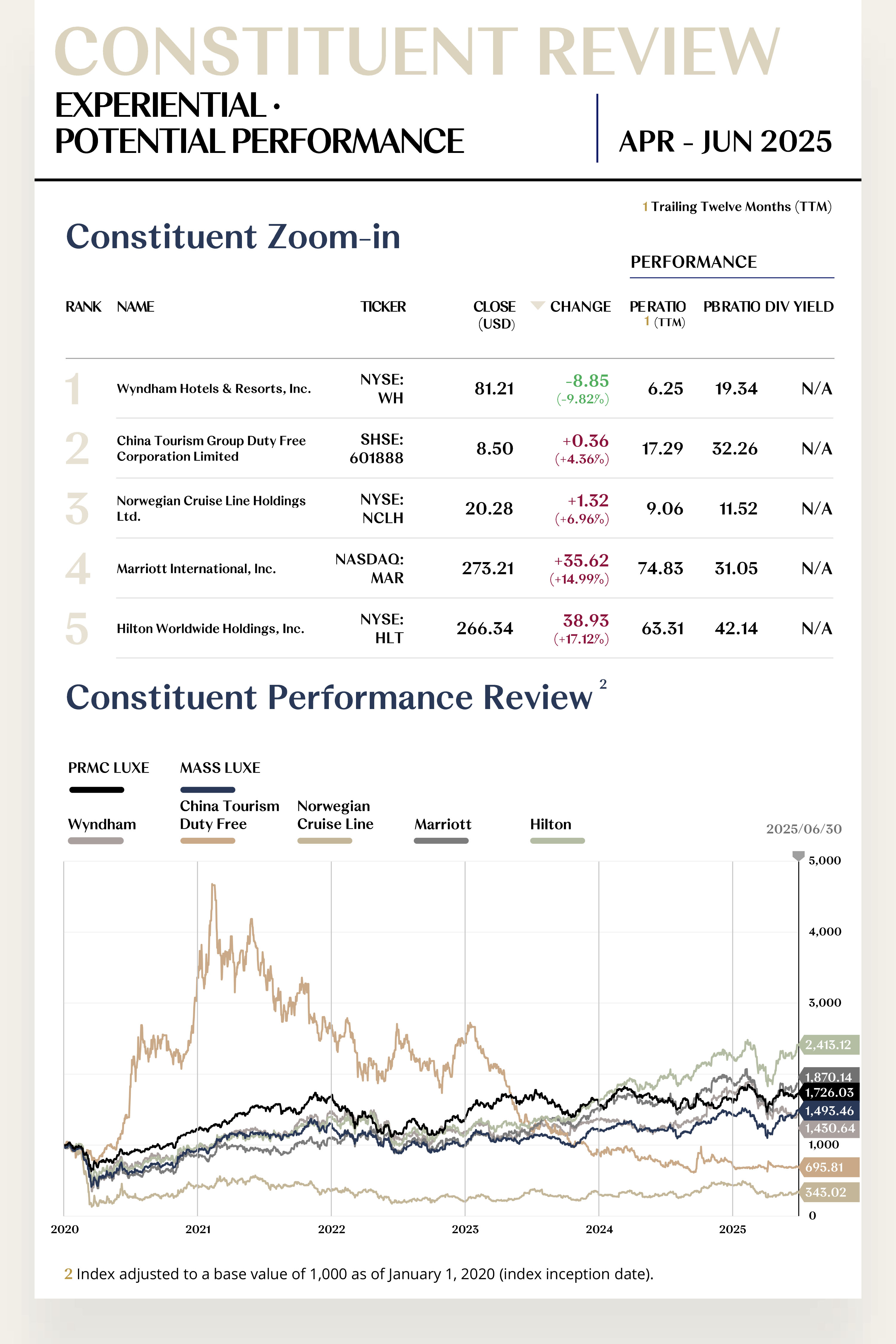

EXP LUXE CONSTITUENT ZOOM-IN

Sub-Sector Upswing Fuels Earnings Revival,

Best-Selling Products Bolster Market Trust

The Experiential Luxe Index comprises 51 stocks, with 40 rising and 11 falling.

Leading Performers

1. Pop Mart International Group Ltd. (HKSE: 9992)

Pop Mart is a leading Chinese trendy toy brand and operator, renowned for its business model that combines “IP-driven trendy toys with a retail ecosystem.” The company focuses on creating and operating original and collaborative IPs, such as Molly, Dimoo, and Skullpanda. In 2025 Q2, its stock price surged by $13.93, closing at $33.96, a remarkable quarterly gain of 69.51%.

The company's outstanding stock performance in Q2 was primarily driven by explosive growth in its overseas business and better-than-expected profitability. According to the company’s 2024 full-year earnings report released in March 2025, revenue from its Hong Kong, Macao, Taiwan, and international businesses soared by 134.9% YOY, now accounting for nearly 30% of total revenue.

This year, the company has accelerated its global expansion, with new flagship stores in the UK, France, and the Middle East drawing enthusiastic crowds and long queues. Bolstered by the global popularity of its Labubu series, the company projects its revenue for the first half of 2025 to increase by over 200%, with net profit growth of at least 350%.

Looking ahead, Pop Mart's growth engine is expected to be increasingly driven by international markets. The company explicitly stated in its earnings report that it will accelerate its global expansion and plans to launch more collaborations with internationally renowned IPs in 2025. The market generally believes that Pop Mart has successfully validated the global scalability of its business model, positioning it to become a global platform for trendy culture and providing solid support and ample room for continued stock price appreciation.

2. Seoul Auction Co., Ltd. (KOSDAQ: 063170)

Seoul Auction is a leading art auction house in South Korea, primarily engaged in consignment auctions of artworks. It also provides art-related consulting, exhibitions, and storage services, playing a vital role in the Korean art market. In the second quarter of 2025, its stock price surged by $2.51, closing at $6.73, a substantial quarterly gain of 59.30%.

The significant stock price increase in Q2 is closely tied to the strong recovery of the Korean art market and strategic breakthroughs by the company. As the macroeconomic environment stabilized and high-net-worth individuals accelerated the diversification of their asset portfolios, the domestic Korean art market experienced a notable recovery in Q2, boosting overall industry sentiment.

According to the company’s Q1 earnings report released on May 15, 2025, both operating revenue and net profit achieved triple-digit year-over-year growth, significantly exceeding market expectations. This marks a clear sign that the company's business has emerged from the slump of previous years.

Looking ahead, as the global art market continues to recover and the influence of domestic Korean artists grows in the international market, Seoul Auction, as an industry leader, is well-positioned to benefit.

[For more insights, please download the full report]

Potential Players

1. Wyndham Hotels & Resorts, Inc. (NYSE: WH)

Wyndham Hotels & Resorts is a globally recognized hotel management company with a wide portfolio of brands, including Super 8, Days Inn, and Wyndham. In the second quarter of 2025, its stock price dropped by $8.85, closing at $81.21, a quarterly decline of 9.82%.

The fall in the company's stock price during Q2 primarily reflects market concerns about a slowdown in the U.S. economy and its potential impact on Wyndham's core business. According to its first-quarter 2025 earnings report, the company’s global revenue per available room (RevPAR) grew by only 1%, with the largest market, the U.S., seeing a 2% year-over-year decline in RevPAR due to weakening demand. Additionally, the company's Q2 and full-year earnings guidance, also released in the report, fell below general market expectations, serving as another key factor suppressing the stock price.

Looking ahead, Wyndham's stock performance will be closely tied to its ability to recover performance in its domestic U.S. market. The company is responding to external pressures by strengthening its loyalty programs and accelerating its digital transformation. However, with macroeconomic uncertainty still high, investors remain cautious about its short-term growth prospects. Any stock price rebound will depend on the performance of the U.S. economy and a substantive recovery in RevPAR growth.

2. China Tourism Group Duty Free Corporation Limited (SHSE: 601888)

China Tourism Group Duty Free Corp. (CTG Duty Free) is the largest travel retail operator in China, operating duty-free stores at major airports, border crossings, and in Hainan‘s offshore duty-free market, selling goods such as cosmetics, luxury items, tobacco, and alcohol. In 2025 Q2, its stock price increased by $0.36, closing at $8.50, a modest quarterly gain of 4.36%.

The moderate increase in the company's stock price in Q2 reflects initial signs of business stabilization, though market concerns about profit margins have not been fully alleviated. According to its first-quarter 2025 earnings report, operating revenue grew by 9.45% year-over-year, but net profit attributable to the parent company declined by 12.6%.

The steady recovery of outbound and inbound tourism this year has led to a noticeable improvement in sales at the company’s airport duty-free channels. However, intense competition and increased promotional spending in the Hainan market have put pressure on gross profit margins. The coexistence of revenue growth and declining profits has led to cautious market sentiment, keeping the stock price relatively stable.

Looking ahead, CTG Duty Free's core growth drivers will be the sustained recovery of inbound and outbound travel and the expansion of new business models, such as downtown duty-free stores. The company is focused on optimizing its procurement structure and improving operational efficiency to restore profitability.

[For more insights, please download the full report]

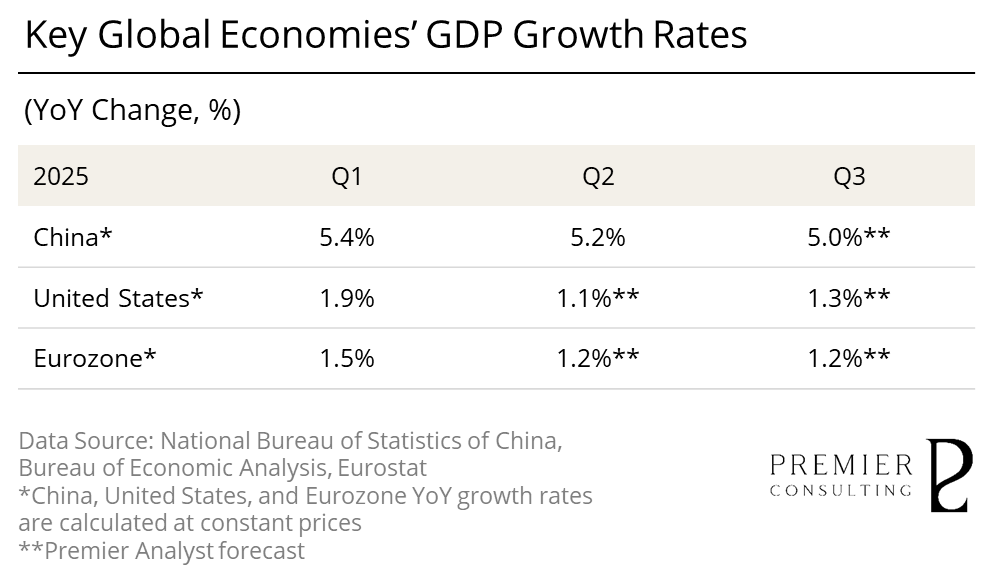

MACROECONOMY UPDATES

Trade Frictions Heighten Uncertainty,

Global Economic Downturn Intensifies

Global Economy Growth

Global: Trade Friction Intensifies Uncertainty, Global Economic Downward Pressure Strengthens

In the second quarter of 2025, the global economy continued its weak trajectory under multiple shocks. Trade tensions have continued to escalate, coupled with periodic adjustments in financial markets, making the economic outlook increasingly cautious. Although inflation levels have generally declined globally and commodity prices have stabilized, providing some buffer space for certain developing countries, consumption momentum within major developed economies has weakened, corporate capital expenditure willingness has retreated, dragging down overall global growth momentum.

Meanwhile, frequent geopolitical conflicts, tightening technology export controls, and the expansion of new trade barriers have further disrupted the stability of global industrial and supply chains, creating greater uncertainty for business operations and cross-border investment. At the policy level, major central banks worldwide have generally maintained a wait-and-see attitude, with limited fiscal space constraining the countercyclical capabilities of macroeconomic regulation. Looking ahead to the third quarter, downside risks facing the global economy are expected to rise further. The uncertainty of tariff policies and their impact on medium- to long-term trade patterns will become a core focus of concern. Tariff negotiations between countries and the competition and progress of regional economic cooperation mechanisms may become key variables for international trade stabilization, having a substantial impact on the pace of global economic recovery.

[For more insights, please download the full report]

Consumer Confidence Index

China: Domestic Demand Recovery Momentum Strengthens, Policy Effects Accelerate Transmission

In the second quarter of 2025, China's Consumer Confidence Index showed a moderate recovery trend, recording 87.80 in April and rising to 88.00 in May, achieving consecutive month-on-month increases for two months. Behind this confidence recovery is the coordinated effort of multiple pro-growth policies:

First, ultra-long-term special government bonds and local special bonds accelerated implementation, providing over 150 billion yuan in interest subsidies for the "trade-in-old-for-new" program for automobiles and home appliances, enhancing bulk consumption vitality.

Second, green and smart consumption subsidies expanded to cover home furnishings, 3C products, and outdoor equipment, combined with e-commerce platform promotions, driving a substantial 36% year-on-year growth in online home appliance retail sales in June.

Third, intensive distribution of summer cultural and tourism consumption vouchers stimulated travel demand release, with railway and civil aviation passenger traffic in May-June increasing 18% compared to the same period in 2019.

Although real estate-related chains continued to face pressure, creating certain restraints on durable goods consumption, policy support effects have begun to emerge, driving total retail sales of consumer goods to maintain monthly scales above 4 trillion yuan for three consecutive months.

[For more insights, please download the full report]

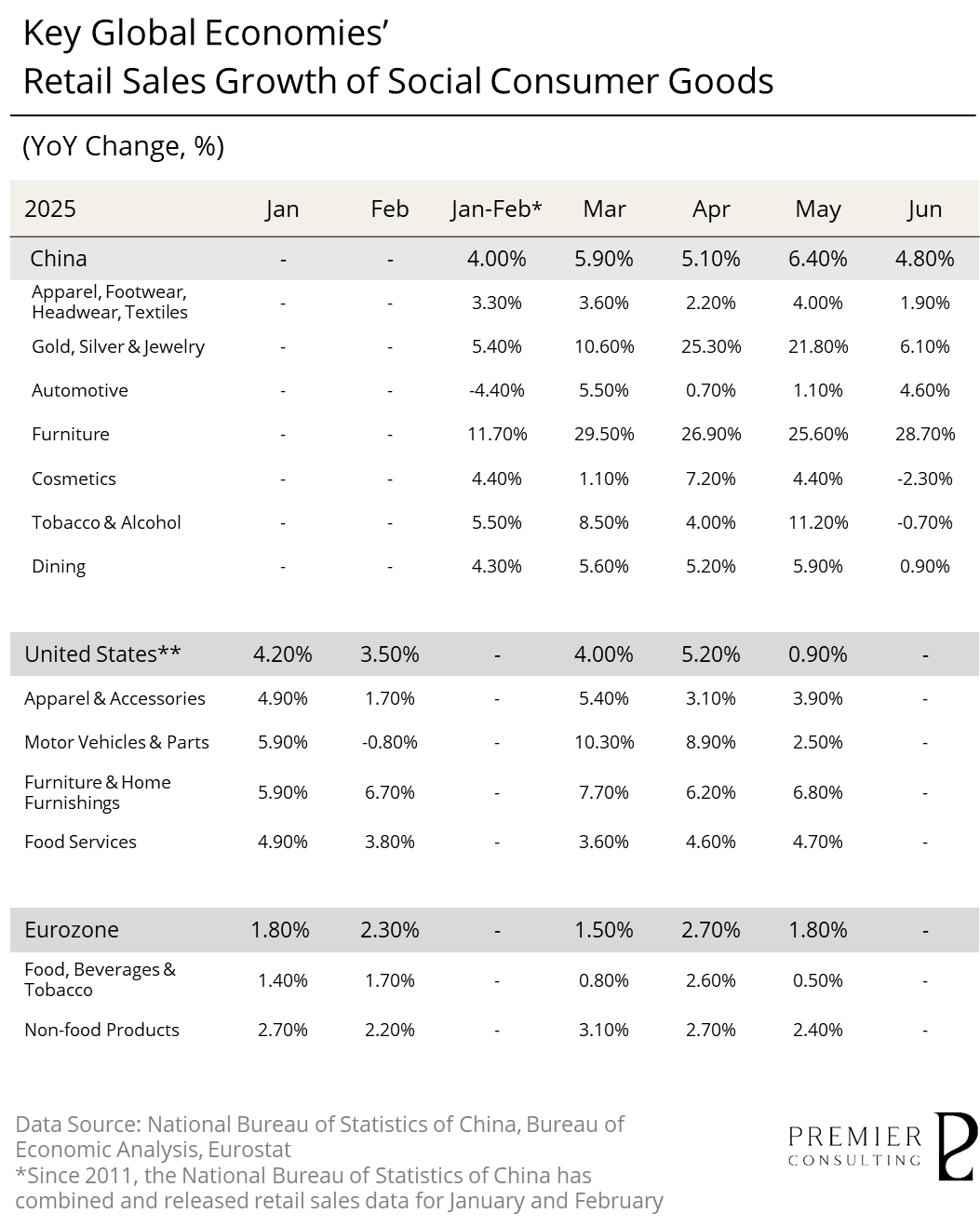

Retail Sales Growth Review & Outlook

China: Consumer Stimulus Policies Show Results, Market Vitality Accelerates Release

In the first half of 2025, national total retail sales of consumer goods reached 24.5458 trillion yuan, growing 5.00% year-over-year. Among this, June retail sales achieved 4.2287 trillion yuan, with a 4.80% year-over-year growth. Overall, driven by consumption structure optimization and holiday economy effects, service consumption continues to serve as an important engine driving China's domestic demand. In the first five months of this year, service retail sales grew 5.20% year-over-year, accelerating by 0.1 percentage points from the first four months and exceeding goods retail sales growth by 0.1 percentage points during the same period. Driven by the holiday economy, residents' travel remained active, with cultural tourism, leisure, and dining consumption growing rapidly. May dining revenue increased 5.90%, reaching the highest growth rate since April 2024.

Looking at subcategories, gold, silver, and jewelry performed most remarkably, recording growth rates of 25.30% and 21.80% in April and May respectively, with cumulative first-half growth reaching 11.30%. This category's growth was mainly driven by demand for investment-grade jewelry with significant value-preservation attributes, limited-edition watches, and other high-end luxury goods consumption. Meanwhile, furniture maintained strong growth momentum, with second-quarter growth rates staying above 25% for three consecutive months, achieving cumulative first-half growth of 22.90%. Consumption upgrade trends were significant, manifesting in rapid expansion of high-end custom furniture, imported brand products, and smart home systems, particularly strong demand for whole-house customization solutions priced above 100,000 yuan.

Although overall automotive growth was relatively moderate, it showed clear structural differentiation. Luxury vehicle models priced above 500,000 yuan saw sales grow over 15% year-over-year, while new energy vehicles and high-end SUVs also maintained steady growth, reflecting consumers' continued demand for quality transportation experiences.

[For more insights, please download the full report]

PRIMARY INDEX REVIEW & PROSPECT

Early-Quarter Decline Under Pressure,

Late-Month Stabilization and Rebound

In the second quarter of 2025, the PRMC Luxe Index closed at 1,726.03 points, rising 99.09 points during the quarter with a gain of 6.09%. During the period, the index experienced significant declines due to escalating global trade frictions and intensifying Israeli conflicts. However, as geopolitical risks gradually eased and China and the U.S. reached preliminary consensus on tariff issues, the index began to stabilize and recover from late April, entering a short-term stable range in mid-May. After entering June, constrained by the lack of obvious improvement in the macroeconomic environment and rising market wait-and-see sentiment ahead of earnings season, the index shifted to volatile movement, temporarily ending its upward trend.

This round of index rebound was primarily driven by dual forces of valuation recovery and improved policy expectations. On one hand, deep market adjustments in the first quarter pushed many leading companies' stock prices to historical valuation bottoms, with targets like LVMH and Kering Group experiencing technical oversold rebounds.

On the other hand, despite continued pressure on industry fundamentals, market sentiment showed marginal improvement. Citi data showed that U.S. high-end jewelry and leather goods consumption warmed month-over-month in May, and China's retail data also exceeded expectations, with investors increasingly judging that the most pessimistic phase had passed.

Meanwhile, major luxury brands actively adjusted their business strategies, including pricing system optimization, product line extension and downward expansion, and creativity-driven updates—"self-repair" measures that positively impacted market expectations.

Looking ahead to the third quarter of 2025, the PRMC Luxe Index will maintain volatile operation.

At the macro level, the Federal Reserve's monetary policy path remains uncertain, the medium- to long-term impact of Trump's new round of tariff policies awaits assessment, and the evolution of China-U.S. trade relations will continue to affect consumer confidence in these two core markets. At the industry level, overall valuations have returned to relatively reasonable ranges, but constrained by slow terminal demand recovery and lagged consumer confidence restoration, companies face significant pressure to deliver performance results.

[For more insights, please download the full report]

SECONDARY INDEX REVIEW & PROSPECT

Core Luxe Remains Resilient, Exp Luxe Accelerates;

Ultra-Luxe and Broader Segments Both Exhibit Renewal

The Core Luxe Index closed at 1,899.75 points, declining slightly by 0.81 points during the quarter, a decrease of 0.04%, essentially flat compared to the previous quarter's performance. The Core Luxe sector continued its "K-shaped" differentiation structural characteristics in the second quarter, demonstrating relative resilience against a backdrop of macroeconomic uncertainty. In the early quarter, market sentiment was still affected by first-quarter performance slowdown, with comprehensive giants like LVMH and Prada facing valuation pressure due to Asian market weakness.

However, benefiting from outstanding performance in subdivided sectors, the index stabilized and recovered 21.33 points (+1.13%) in June alone. Particularly, the jewelry sector gained capital favor due to its safe-haven and value-preservation attributes, with targets like Richemont Group and Lao Pu Gold performing prominently. The apparel sector performed steadily, with Burberry and Canada Goose successfully achieving valuation recovery through strategic transformation, while Hermès demonstrated the steady resilience of a top-tier brand.

Looking ahead to the third quarter, the Core Luxe index is expected to maintain a volatile consolidation pattern. In an environment of intensifying consumption differentiation, targets with strong brand moats and clear recovery logic will continue to receive market premiums, while companies lacking core competitiveness may again face valuation reassessment pressure.

The Ultra Luxe Index closed at 1,973.99 points, surging 232.10 points during the quarter, a gain of 13.32%, making it the second-largest gaining sector this quarter. The Ultra Luxe sector emerged from a strong fundamentals-driven rally, becoming one of the quarter's biggest highlights. At the beginning of the quarter, market sentiment was ignited by a series of better-than-expected earnings reports.

The core narrative of first-quarter earnings clearly pointed to unprecedented strong demand from ultra-high-net-worth individuals for top-tier "hard assets." Both private jet manufacturers and ultra-luxury yacht producers disclosed that their order backlogs had reached record levels, providing extremely high certainty for revenue growth in coming years and greatly boosting investor confidence.

Looking ahead to the third quarter, the Ultra Luxe sector is expected to continue the strong performance from the second quarter. Record order backlogs in the aviation and marine sectors constitute a solid "moat" against potential macroeconomic volatility, with their performance delivery being a market focus. Related company stock prices are expected to continue releasing growth momentum.

The Mass Luxe Index closed at 1,051.73 points, rising 114.55 points during the quarter, a gain of 12.22%. Overall, the Mass Luxury sector ended its previous long-term low-level volatility in the second quarter, showing a moderate recovery trend, though internal differentiation within the sector remained significant.

On one hand, the beauty and fragrance sector became the market's absolute leader, with companies represented by Amorepacific and Estée Lauder seeing initial success from their profit recovery plans and global reorganization strategies. Strong performance in overseas high-growth markets successfully offset weakness in some regions, driving their stock prices to achieve retaliatory rebounds. However, the spirits sector's continued slump formed a stark contrast.

Looking ahead to the third quarter, the recovery momentum of beauty companies is expected to be further consolidated, but structural problems facing the spirits sector are unlikely to see fundamental improvement in the short term. Therefore, against the backdrop of core consumer demand not yet fully recovering, the Mass Luxe index is expected to continue narrow-range volatility in the current zone, with investor sentiment remaining cautious and more focused on discovering individual stock opportunities with clear recovery logic.

The Experiential Luxe Index closed at 1,493.46 points, surging 242.12 points during the quarter, a gain of 19.35%, making it the largest gaining sector this quarter. The strong performance of this sector was mainly driven by explosive growth in global consumer demand for top-tier experiential and collectible consumption. Leading companies in experiential services such as cruises and international tourism, as well as collectible categories like trendy art and jewelry, achieved far-better-than-expected performance through strong pricing power and global appeal, with consumer spending correspondingly accelerating concentration toward leading brands.

Looking ahead to the third quarter, the positive trend in the Experiential Luxe sector is expected to continue. Against the backdrop of continued macroeconomic uncertainty, investors will continue to focus on industry leaders with clear growth logic. Meanwhile, the hospitality and cruise travel industries will usher in a new round of upward momentum, with their performance significantly influencing the future direction of the index.

[For more insights, please download the full report]

Review & Prospect

A New Chapter in Experiential Luxury Business

How Brunello Cucinelli Masters Technology to Preserve Craftsmanship?

Q2 2025 PRMC Luxe Index

Review & Prospect

Feb 02, 2026

Examining mid-year results and valuation dynamics to reveal resilience, strategic recalibration, and emerging opportunities in luxury markets.

Eased Policies & Market Momentum, Exp Luxe Reshape Recovery Pivot

In the second quarter of 2025, as the global monetary tightening cycle among major central banks gradually eased, marginal improvements in liquidity supported a rebound in asset prices. At the same time, a temporary easing of geopolitical tensions and an accelerated recovery in international travel flows laid the groundwork for a revival in global high-end consumer sentiment.

In China, the structural recovery trend persisted, underpinned by strengthened policy measures aimed at stimulating consumption and supporting the private sector. Combined with the resurgence of offline retail and outbound tourism during the May Day holiday, these factors delivered tangible benefits to the broader consumption recovery. However, medium- to long-term household income expectations remained subdued, limiting the pull-through effect on mid- to high-end consumer goods.

In the United States, expectations of a soft economic landing continued to solidify, with a rebound in service-sector activity driving increased travel and social engagements among high-net-worth individuals—partially restoring the high-end consumption chain. Nevertheless, the deceleration of the “disinflation” process, coupled with a persistently high interest rate environment, continued to suppress household spending power. Heightened tariff policy uncertainty pushed up end-product prices, further burdening consumers and reinforcing a trend toward cautious expenditure.

In Europe, overall economic recovery momentum remained tepid, with core economies’ PMIs entrenched in contractionary territory and consumer confidence lingering at low levels. While aggregate unemployment rates stayed relatively moderate, certain countries continued to face structural labor market pressures. Together with a sustained rise in living costs, this constrained disposable incomes and exerted a material drag on mid- to high-end consumption demand.

The PRMC Luxe Index closed the second quarter at 1,726.03 points, rising 99.09 points (+6.09%) over the period, yet underperforming key global benchmarks, including the MSCI Asia Pacific (+11.70%), MSCI ACWI (+10.97%), S&P 500 (+10.57%), and EURO STOXX 100 (+7.77%).

At the secondary index level, Experiential Luxe Index (+19.35%) posted a robust rebound, while the Ultra Luxe Index (+13.32%) and the Mass Luxe Index (+12.22%) also recorded significant gains. In contrast, the Core Luxe Index (-0.04%) remained broadly stable.

At the individual stock level, performance divergence among companies became increasingly evident during the quarter. Dassault Aviation, Richemont, and Hermès delivered strong results, with share prices rising notably, whereas Tesla, Burberry, and Rémy Cointreau underperformed relative to the beginning of the year.

Those who discern the trends prosper; those who capitalize on them advance. As the macroeconomic environment continues to evolve, global economic uncertainty is expected to intensify further in the second quarter, potentially leading to greater fluctuations in investor confidence. Index performance is likely to experience periodic volatility as a result. Meanwhile, Hermès has recently announced plans to raise prices across its U.S. portfolio in an effort to offset rising costs through pricing adjustments. As the impact of new tariff policies gradually takes hold, more luxury brands may follow suit by recalibrating their regional pricing strategies.

Looking ahead, whether global economic stability can be restored and whether the Federal Reserve maintains its tightening stance will be pivotal variables influencing luxury sector valuations and capital market sentiment. The ongoing evolution of index performance, shaped by macroeconomic policies and market expectations, remains a critical area for continued close observation.