Resilience with Resolution:

Luxury’s Refined Path Through Turbulence

Resilience with Resolution:

Luxury’s Refined Path Through Turbulence

A strategic scan of the defining market forces shaping the luxury sector and A focused lens on directional trends and behavioral shifts, illustrated through defining luxury movements in H1 2025.

In the first half of 2025, the luxury market confronted a multifaceted environment marked by softening demand, geopolitical uncertainty, and evolving consumer expectations. Traditional revenue drivers faced headwinds from U.S. tariffs and cautious spending, compelling leading luxury brands to pivot from transactional sales toward experiential and emotional engagement.

In response, the industry exhibited refined resilience: doubling down on hyper-local storytelling, technology-enabled intimacy, and elevated direct-to-consumer channels to preserve desirability and margin integrity across a fragmented global terrain.

Looking ahead to the second half of the year, luxury’s path forward will be shaped by resolved intent and strategic conviction.

Heritage-led maisons such as Hermès and Chanel are set to deepen their investment in craftsmanship as a long-term anchor of brand value. Concurrently, Richemont will continue to elevate its focus on curating and narrating its savoir‑faire to convert artisanal mastery into enduring loyalty. Prada is expected to further amplify its “Made in Italy” identity as a core point of distinction, while groups like Kering stand at a pivotal juncture—tasked with demonstrating whether holistic reinvention can effectively counter market headwinds. LVMH, meanwhile, is to test whether family‑led centralization can leverage dynastic cohesion to sustain performance amid softening demand and external pressures.

Key themes on the horizon include the rise of “glocal” strategies that weave local cultural resonance into globally coherent narratives; the transition of technologies like blockchain and AI from novelty to necessity, underpinning authenticity and personalization; and a renewed emphasis on founder-led stewardship as a means of safeguarding brand DNA in an era marked by consolidation and scale.

True resilience in luxury will lie with who act with steady resolution to balance exclusivity with prevalency—preserving allure while extending reach, and embracing disruption as a springboard for transformation.

DOWNLOADS

Lite Report (37 pages)

SECTION1

Beyond Headwinds:

Recalibrated Forces to Galvanize The Next Cycle

A strategic scan of the defining market forces shaping the luxury sector in H1 2025

BUSINESS STRATEGIES

Reimagining Brand Narratives for Contemporary Relevance, Reinvigorating Business through Foundational Strength

In H1 2025, luxury maisons faced subdued consumer confidence and intensifying geopolitical headwinds, creating renewed urgency to safeguard loyalty among core high-value clients while reactivating growth across the broader aspirational base.

To that end, leading brands are reconfiguring their strategies—leveraging agile pricing, immersive storytelling, localized authenticity, and digital innovation to preserve margin integrity and brand desirability. By integrating these levers into their operating models, maisons are not merely withstanding short-term pressures, but also establishing resilient foundations for sustained performance and future expansion.

MERGES & AQUISITIONS

Scaling Strategic Ownership,

Securing Long-Term Brand Authority

Luxury groups are tightening their grip—investing across supply chains, media, and experiential assets to anchor value creation and reinforce maison-led control. The focus is shifting from scattered equity plays to integrated ecosystems that align operations with aspiration.

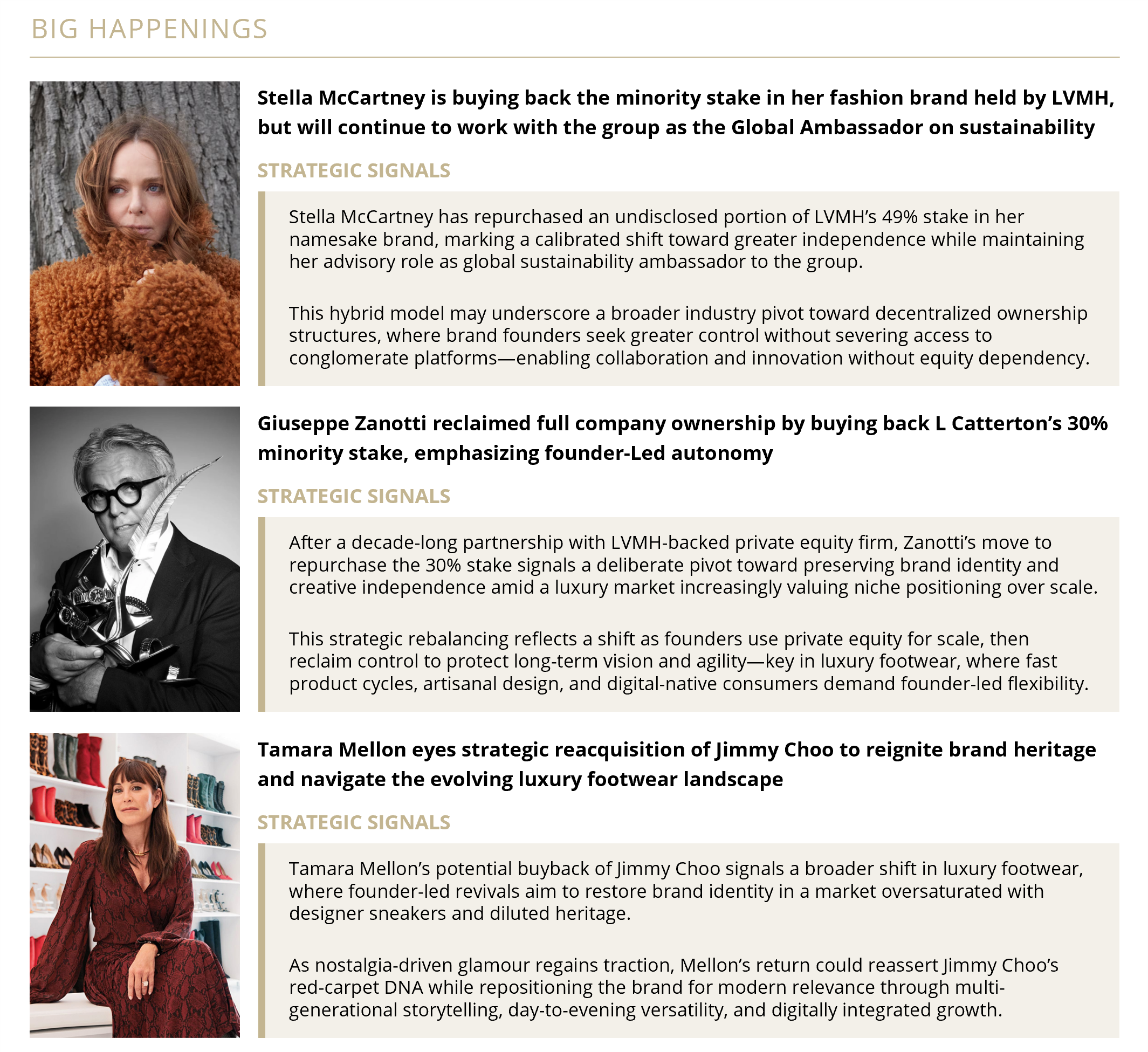

At the same time, founders are stepping back in—reclaiming equity stakes to preserve creative authorship and protect the soul of their brands, as scale, identity, and storytelling jostle for primacy in an evolving luxury landscape.

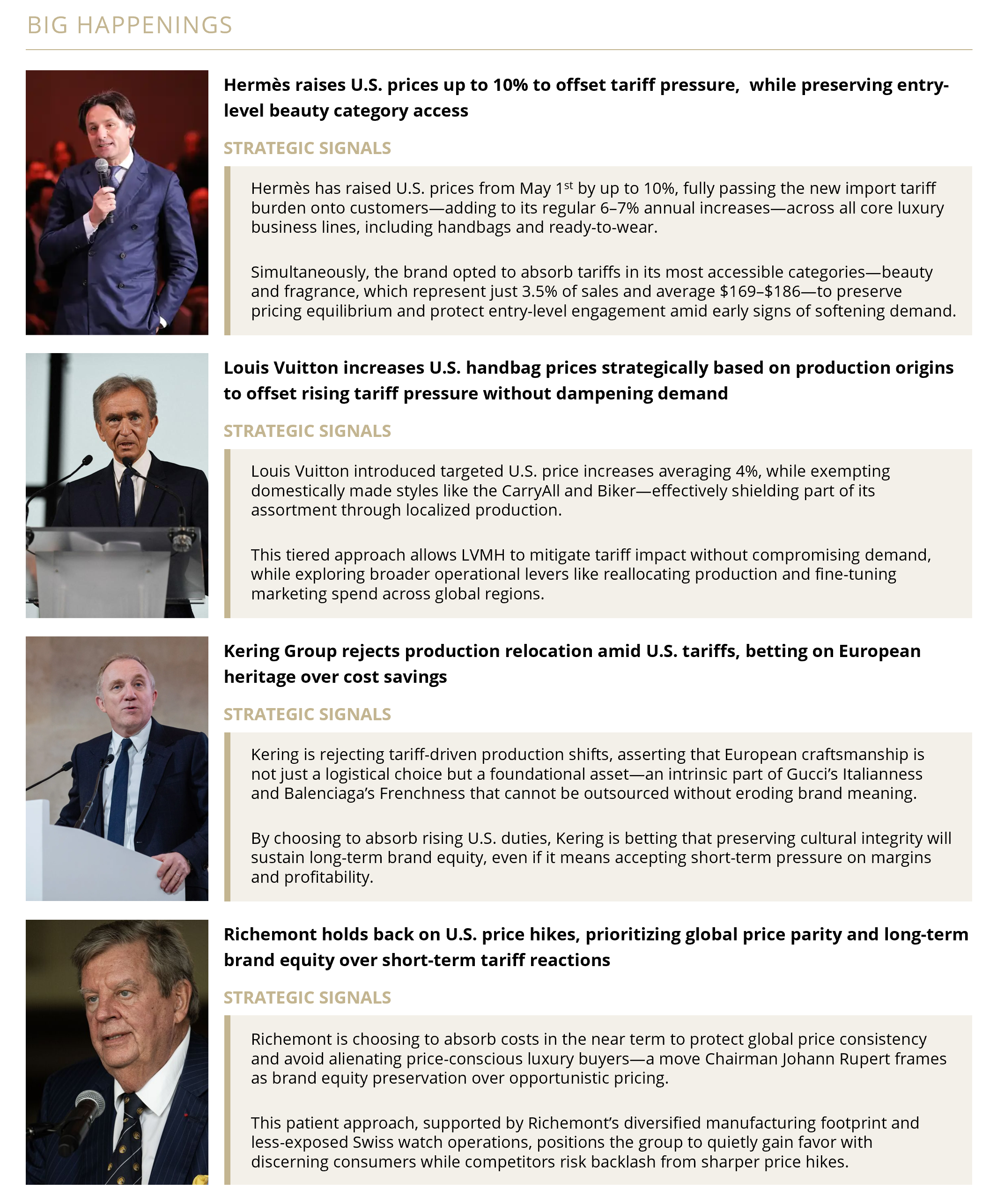

PERSONNEL SHIFTS

Empowering Creative Innovation,

Reinforcing Executive Resilience

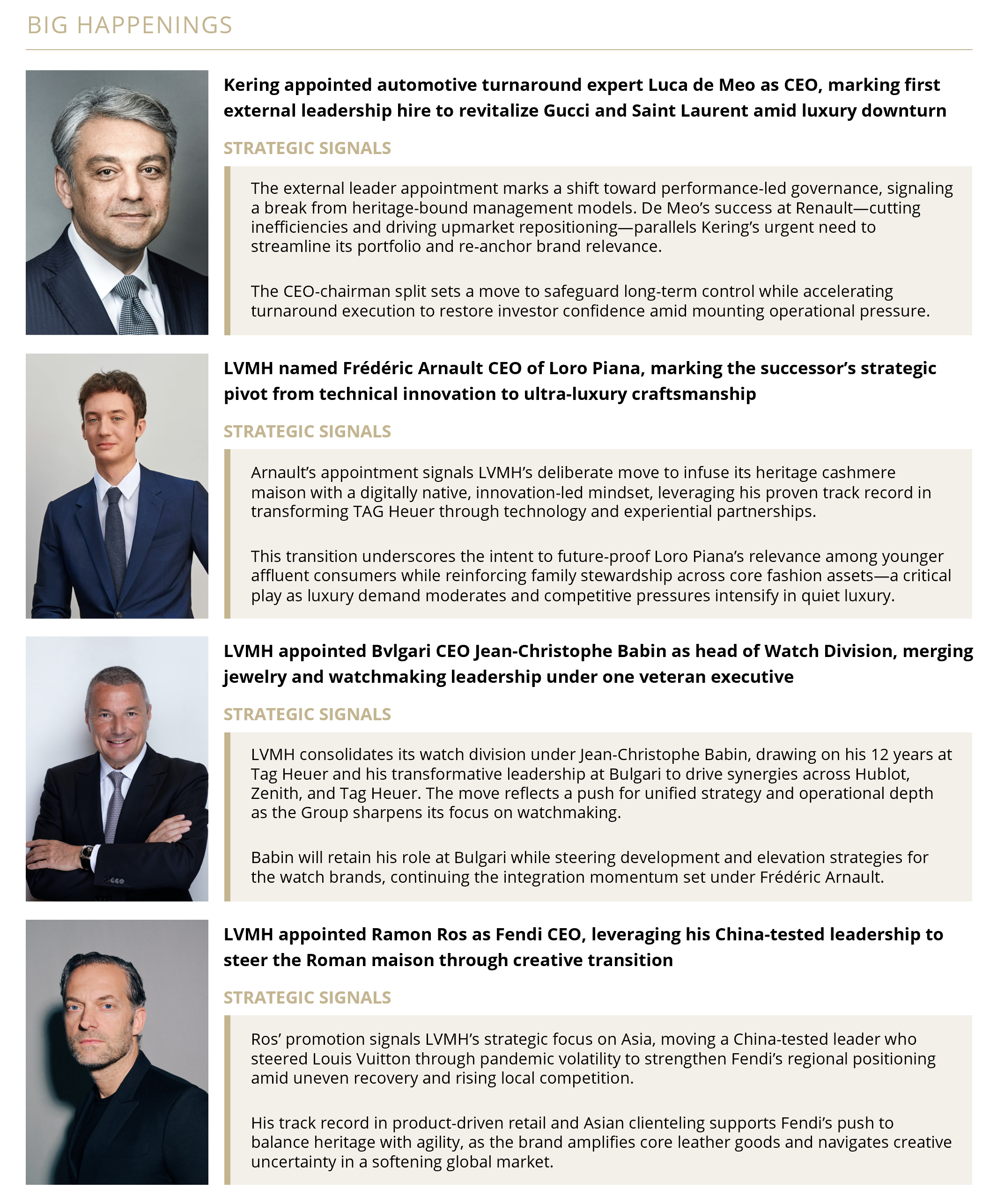

In an era where distinction and agility define success, luxury houses are charting a course that marries artistic daring with steadfast leadership.

By investing in visionary design minds, brands aim to kindle a fresh wave of collections that captivate discerning clientele. Simultaneously, deliberate executive restructuring ensures that decision-making remains both nimble and disciplined—capable of navigating unforeseen headwinds without sacrificing long-term vision.

SECTION2

Emerging Signals:

Strategic Currents Shaping Tomorrow’s Luxury Terrain

A focused lens on directional trends and behavioral shifts, illustrated through defining luxury movements in H1 2025

Hyper-localized Identity Synergy

Amid intensified global-local dynamics, luxury brands embrace hyper-localization to crystallize cultural resonance. By intricately intertwining global brand heritage with authentic local craftsmanship, maisons strategically amplify emotional relevance, driving loyalty and differentiation. These culturally fluent engagements become scalable blueprints, securing enduring affinity in sophisticated, diverse consumer landscapes.

Tech-Enabled Operational Craftsmanship

Luxury maisons increasingly integrate cutting-edge technologies to fortify their operational rigor and elevate narrative precision. Through blockchain authenticity, AR-enhanced storytelling, and AI-powered data mastery, brands refine craft integrity, amplify traceability, and bolster strategic intelligence. This digitally anchored approach enhances efficiency, underpins brand transparency, and strengthens future-proof market advantage.

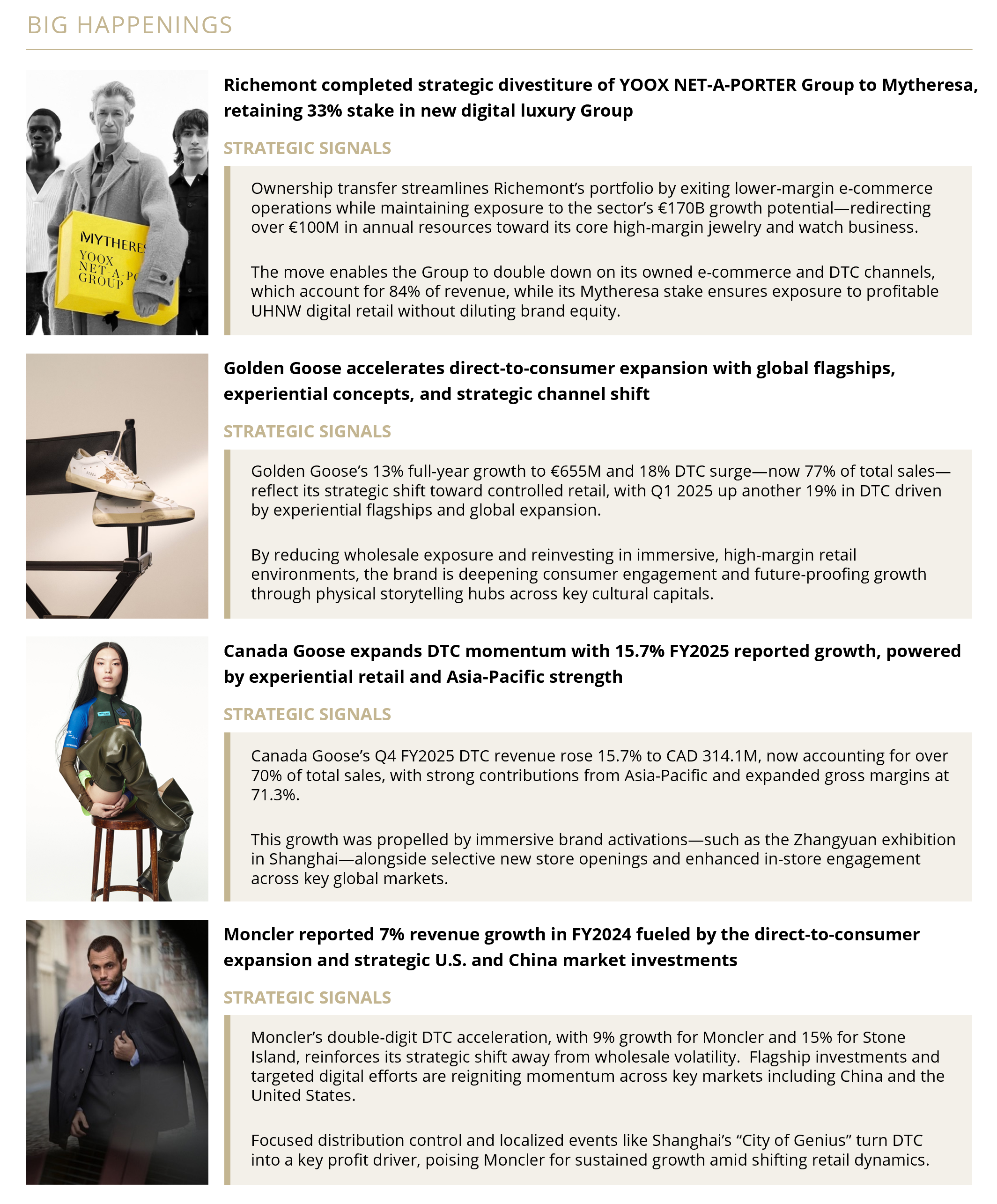

Trust-Centric Price Sovereignty

Navigating intensified geopolitical pressures and tariff volatility, luxury houses prioritize pricing prudence over sweeping increases. By selectively calibrating price points, reassessing supply chain tactics, and absorbing targeted costs, brands sustain consumer trust, desirability, and profitability. This deliberate, trust-aligned pricing discipline underscores strategic resilience amid turbulent market dynamics.

Brand-Mastered Growth Architecture

Luxury maisons orchestrate strategic growth by consolidating flagship retail experiences, refining proprietary digital ecosystems, and amplifying direct consumer engagement. Transitioning away from wholesale dependence, maisons reclaim brand sovereignty, deepen client intimacy, and cultivate durable relationships. This cohesive architecture secures desirability, profitability, and sustained competitive agility in shifting retail paradigms.

Craftsmanship as Brand Code

Craftsmanship emerges prominently as luxury’s foundational narrative—a compelling anchor for differentiation, authenticity, and enduring desirability. Maisons increasingly leverage artisanal excellence in immersive cultural storytelling, transforming legacy craftsmanship into contemporary brand engines. This reinvigorated narrative elevates craft from heritage reverence into future-facing brand distinction.

Multi-Pronged Stronghold Investment

Luxury conglomerates fortify strategic market positions through diversified investments spanning upstream production, media integration, experiential hospitality, and cross-category assets. This multidimensional investment strategy mitigates external volatility, unlocks synergistic value creation, and fortifies comprehensive control across affluent consumer lifestyles—laying the groundwork for sustained industry ascendancy.

Founder Equity Reclaiming

Founder-led equity repurchases signal an industry recalibration toward creative autonomy, strategic agility, and long-term brand stewardship. These deliberate ownership restructurings enable brand leaders to reassert direct influence over creative vision and commercial direction, reinforcing authenticity and cultivating deeper consumer alignment amidst intensified market scrutiny.

Brand-Bound Creative Renewal

Amid evolving market conditions, luxury brands strategically refresh creative leadership to balance innovation with intrinsic brand heritage. These calibrated appointments—focused on continuity yet infused with new vision—revitalize maison desirability and resonance. Such controlled renewal positions brands for revitalized market traction without sacrificing historical DNA or institutional coherence.

High-Stakes Power Shuffle

Luxury conglomerates enact strategic executive reshuffles, reflecting intensified focus on governance, operational efficacy, and decisive leadership. By appointing externally sourced and strategically aligned talent, maisons reinforce market responsiveness, operational rigor, and institutional agility. These high-stakes transitions proactively position brands for performance-driven resilience in a dynamically evolving market environment.

SECTION3

Closing Remarks

As the luxury industry navigates the complex currents, the path forward demands not just resilience, but resolute actions anchored in the strategic imperatives defined in the first half of the year.

This mandate unfolds across three pivotal arenas:

- Redefining client engagement through dynamic commercial levers—from agile pricing and digital innovation to immersive storytelling and localized authenticity;

- Selectively refining portfolios via strategic alignments that reinforce both brand autonomy and market footholds;

- Elevating leadership frameworks to balance creative audacity with disciplined stewardship.

Together, these levers transform conceptual intent into operational momentum, ensuring each maison is equipped to translate vision into lasting impact.

Encouragingly, the market has shown glimpses of revival: high-net-worth travelers are returning to bespoke experiences, region‑infused storytelling is reigniting desire, and cutting‑edge platforms are deepening trust and personal connection. Yet optimism without disciplined execution is a fragile currency. Brands must move with surgical clarity—fine‑tuning pricing strategies, expanding controlled ecosystems, and weaving heritage into a living narrative that evolves with tomorrow’s consumer.

Let resolution be the compass — through surging tides and unfolding dawns, the industry charts a course toward a reborn era of captivating relevance, timeless desirability, and enduring allure.

Review & Prospect

A New Chapter in Experiential Luxury Business

How Brunello Cucinelli Masters Technology to Preserve Craftsmanship?

Review & Prospect

Resilience with Resolution:

Luxury’s Refined Path Through Turbulence

Feb 02, 2026

A strategic scan of the defining market forces shaping the luxury sector and A focused lens on directional trends and behavioral shifts, illustrated through defining luxury movements in H1 2025.

In the first half of 2025, the luxury market confronted a multifaceted environment marked by softening demand, geopolitical uncertainty, and evolving consumer expectations. Traditional revenue drivers faced headwinds from U.S. tariffs and cautious spending, compelling leading luxury brands to pivot from transactional sales toward experiential and emotional engagement.

In response, the industry exhibited refined resilience: doubling down on hyper-local storytelling, technology-enabled intimacy, and elevated direct-to-consumer channels to preserve desirability and margin integrity across a fragmented global terrain.

Looking ahead to the second half of the year, luxury’s path forward will be shaped by resolved intent and strategic conviction.

Heritage-led maisons such as Hermès and Chanel are set to deepen their investment in craftsmanship as a long-term anchor of brand value. Concurrently, Richemont will continue to elevate its focus on curating and narrating its savoir‑faire to convert artisanal mastery into enduring loyalty. Prada is expected to further amplify its “Made in Italy” identity as a core point of distinction, while groups like Kering stand at a pivotal juncture—tasked with demonstrating whether holistic reinvention can effectively counter market headwinds. LVMH, meanwhile, is to test whether family‑led centralization can leverage dynastic cohesion to sustain performance amid softening demand and external pressures.

Key themes on the horizon include the rise of “glocal” strategies that weave local cultural resonance into globally coherent narratives; the transition of technologies like blockchain and AI from novelty to necessity, underpinning authenticity and personalization; and a renewed emphasis on founder-led stewardship as a means of safeguarding brand DNA in an era marked by consolidation and scale.

True resilience in luxury will lie with who act with steady resolution to balance exclusivity with prevalency—preserving allure while extending reach, and embracing disruption as a springboard for transformation.