Q3 2025 PRMC Forward Mobility Index

Review & Prospect

Q3 2025 PRMC Forward Mobility Index

Review & Prospect

Track the latest developments and market trends in the global automotive mobility industry, and gain insights into how intelligent and connected technologies are driving the evolution of the sector.

Trade Easing Boosts Confidence, Regional Divergence Becomes More Pronounced

[Primary Index Performance Review]

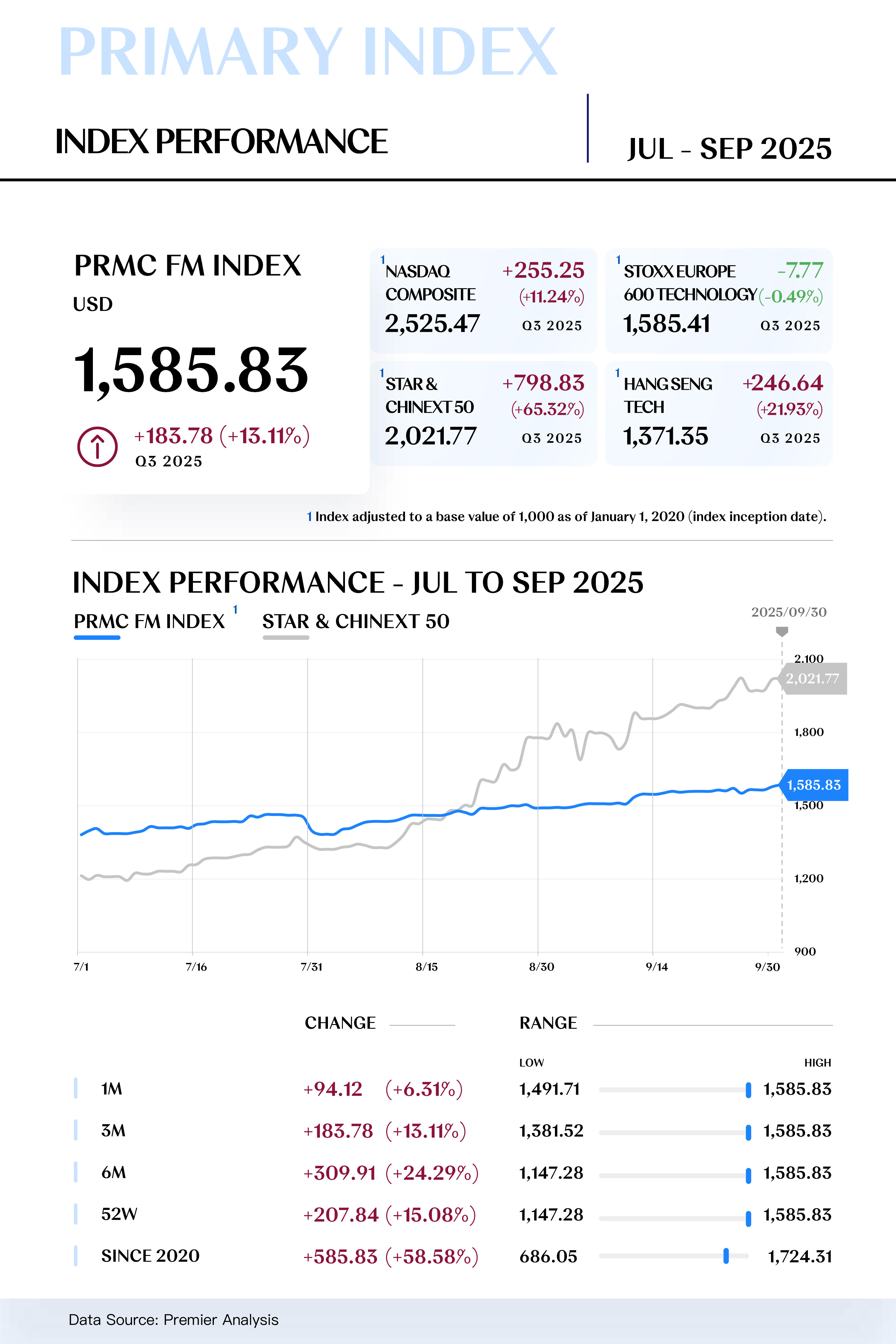

The PRMC Forward Mobility Index closed at 1,585.83 points in Q3 2025, rising by 183.78 points (+13.11%) during the quarter. The performance was weaker compared to the STAR & CHINEXT 50 (+65.32%) and HANG SENG TECH (+21.93%), but better than the NASDAQ COMPOSITE (+11.24%) and STOXX EUROPE 600 TECH (-0.49%).

[Secondary Index Performance Review]

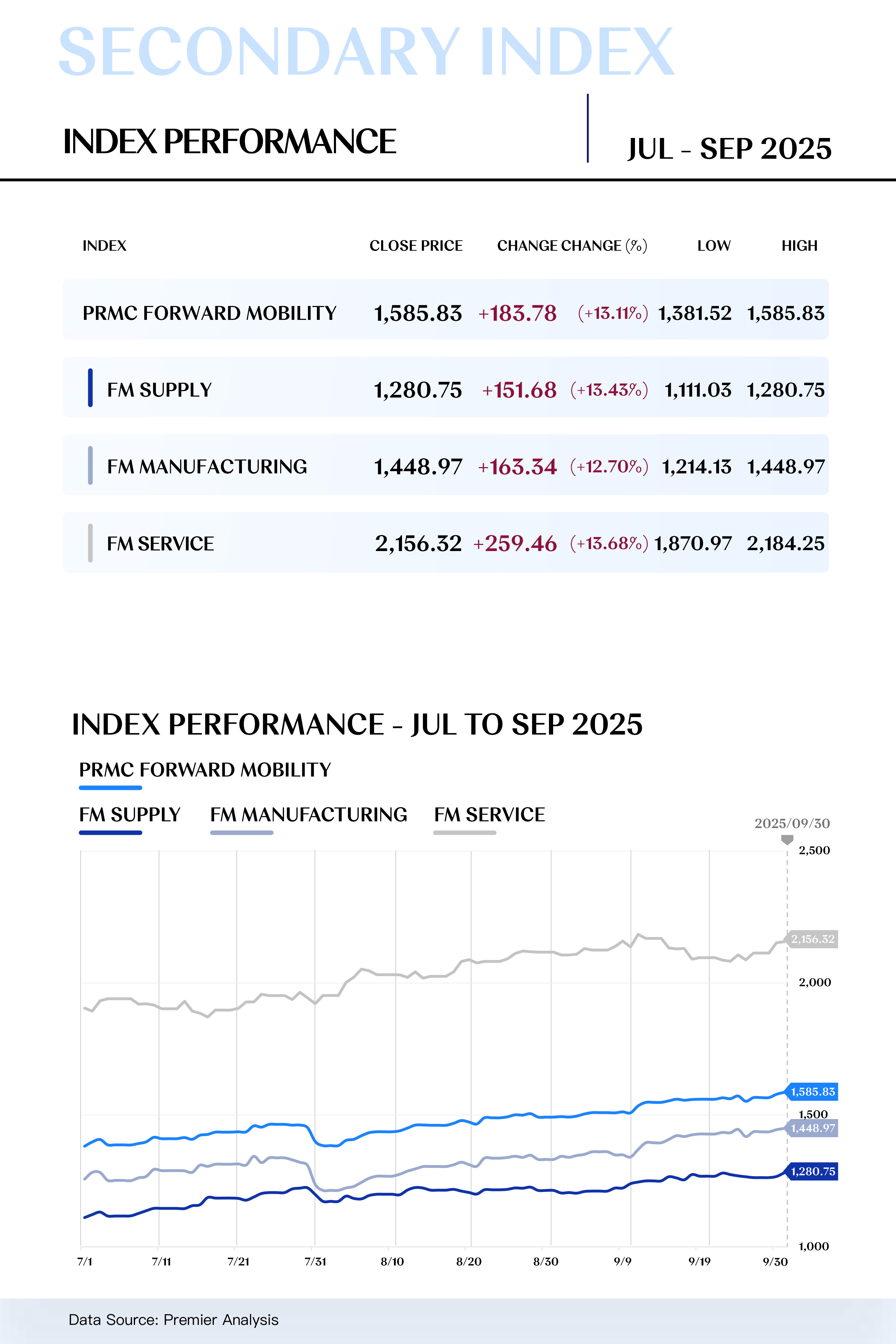

The PRMC Forward Mobility Supply Index closed at 1,280.75 points in Q3 2025, increasing by 151.68 points (+13.43%) during the quarter;

The PRMC Forward Mobility Manufacturing Index closed at 1,448.97 points in Q3 2025, rising by 163.34 points (+12.70%) during the quarter;

The PRMC Forward Mobility Service Index closed at 2,156.32 points in Q3 2025, up by 259.46 points (+13.68%) during the quarter.

[China Automotive Industry Review]

In the third quarter of 2025, with the central and local governments rolling out new "trade-in" policies, coupled with coordinated nationwide auto exhibitions and the intensive launch of new models, the overall activity in the automotive market significantly picked up, and the industry continued its steady growth trajectory, with new industry drivers accelerating their release.

By the end of the first three quarters, China’s automotive production and sales reached 24.33 million and 24.36 million units, respectively, representing year-on-year growth of 13.30% and 12.90%. The growth rates in production and sales were 0.8 and 1.5 percentage points higher compared to the first half of the year, indicating that the automotive industry’s sentiment continued to improve, with demand-side recovery and supply-side optimization forming a positive resonance.

Exports also maintained strong growth. In the first three quarters of 2025, China’s total automotive exports reached 4.95 million units, growing by 14.80% year-on-year. Among these, new energy vehicles (NEVs) accounted for approximately 1.758 million units in exports, a remarkable year-on-year increase of 89.40%, making them the core driver of automotive export structure upgrades and enhancing global competitiveness.

[Macroeconomic Review and Outlook]

In the third quarter of 2025, the global automotive industry gradually regained confidence, supported by a calming of geopolitical tensions and improvements in trade policies. The stabilization of the Middle East situation and the positive shift in U.S.-China trade relations—marked by the resumption of high-level consultations and the signing of a new trade framework agreement—effectively alleviated supply chain uncertainties and reduced upward pressures on raw material and logistics costs, providing a more predictable external environment for the global automotive industry.

US market continued its weak trend, with high tariff policies and declining consumer confidence continuing to suppress end demand. The uncertainty surrounding tariffs disrupted vehicle and component import costs, leading to structural inventory accumulation among enterprises, and mainstream automakers have been slowing their production pace.

Europe market is undergoing structural adjustments, with overall demand recovery remaining sluggish. Ongoing tariff disputes continue to hinder cross-border supply chain efficiency, and the combination of weak manufacturing and high financing costs is squeezing corporate profit margins. While inflation easing has provided some relief for household consumption, consumer confidence has not significantly recovered, and the automotive market’s recovery pace remains slow.

China market continued its steady growth trajectory, becoming a major pillar for the global automotive industry. Policy measures such as "trade-in" programs, new energy vehicle subsidies for rural areas, and continued consumption incentives have been effective, further supported by domestic brands launching intelligent electric vehicles, leading to a clear market structure optimization. Although the consumer side remains influenced by localized price wars and the pace of confidence recovery, overall demand remains resilient.

Looking ahead to the fourth quarter of 2025, the global automotive market is expected to maintain moderate growth amidst a complex macroeconomic environment, though regional differentiation will become more pronounced. Market performance will largely depend on the policy direction and consumption recovery pace in each economy.

In US, the outlook for automotive market recovery remains pressured. Although the Federal Reserve is expected to continue lowering interest rates to stimulate consumption and business financing, persistent inflation, the marginal weakness of the labor market, and uncertain tariff policies will continue to constrain consumer confidence and business decisions.

In Europe, amid economic slowdown and structural transformation, the automotive market will continue to face both weak demand and supply pressures. The European Central Bank’s marginally accommodative monetary policy is expected to provide some support to credit and consumption, but the transmission of interest rate changes to the real economy remains delayed. High financing costs, weak corporate investment, and low consumer confidence will slow the pace of market recovery.

In China, the dual role of policy support and market momentum will continue to sustain the steady operation of the automotive market. It is expected that the government will further increase structural stimulus measures in Q4 to strengthen consumption recovery. The penetration rate of new energy vehicles is likely to increase further, driving both the expansion of the industrial supply chain and export growth, becoming the dual engines for both domestic and foreign demand.

DOWNLOADS

Lite Report (71 pages)

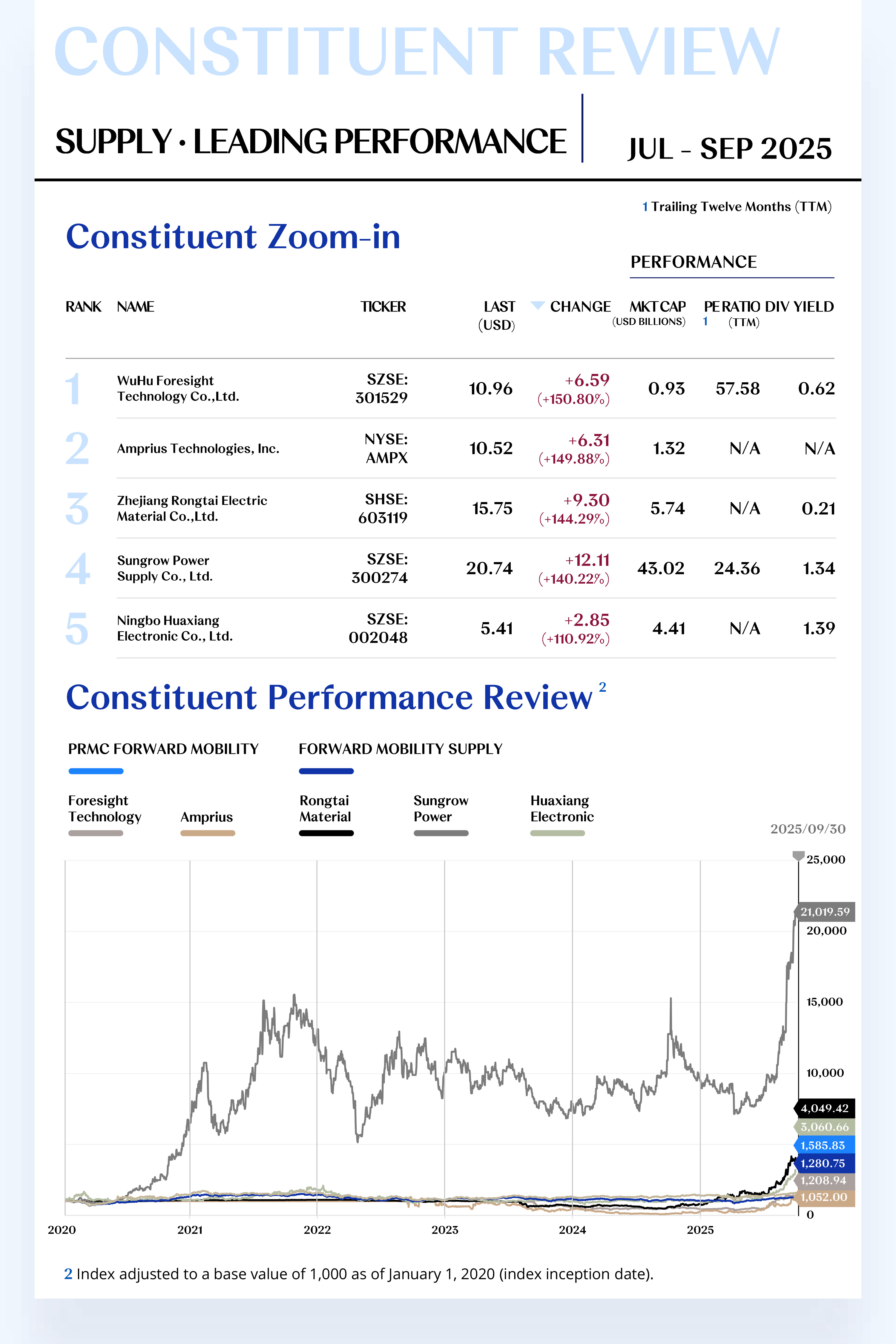

FM SUPPLY CONSTITUENT ZOOM-IN

Global Capacity Expansion Driving Growth,

Innovation Integration

Reinforcing Long-term Confidence

The Forward Mobility Supply Index comprises 143 stocks, with 121 rising and 22 declining.

Leading Performers

1. WuHu Foresight Technology Co.,Ltd. (SZSE: 301529)

Foresight Technology focuses on the R&D, production, and sale of automotive components, with a portfolio centered on interior assemblies such as air-conditioning outlets and cup holders, serving leading OEMs in China and overseas. In the third quarter of 2025, the company’s share price rose by USD 6.59 to close at USD 10.96, delivering a quarterly gain of 150.80%.

The strong share-price performance was underpinned by robust interim results and steady progress in globalization. In 1H2025, the Company recorded revenue of RMB 820 million (+35.41% YoY) and net profit attributable to shareholders of RMB 63.2954 million (+36.40% YoY), driven by the ramp-up and mass production of multiple new-model programs for core customers including BYD, Geely, Chery, and Nissan. The Company plans to distribute a cash dividend of RMB 1.2 (pre-tax) for every 10 shares, reflecting disciplined operations and a commitment to shareholder returns. In July 2025, it also completed an ESOP off-market transfer at RMB 16.40 per share with a maximum lock-up of 36 months—further reinforcing team incentives and confidence in medium- to long-term growth.

Looking to Q2, despite risks such as shareholder share reductions, the company’s continued investments in new energy vehicles, humanoid robots, and its leading position in the high-end spring market are expected to support performance growth. With global business expansion and rapid industry development, the company is positioned to maintain strong growth momentum.

Global execution continues apace. The third plant in Mexico is slated to commence operations in the second half, enhancing localized delivery capabilities in North America. The Company is actively engaging with international OEMs such as Ford, General Motors, and Stellantis, as well as tier-one suppliers including Draexlmaier and FORVIA (Faurecia), and expects to complete supplier qualification within the year.

Looking to the fourth quarter, as capacity at the Mexico facility ramps and onboarding of overseas customers accelerates, the Company’s global supply chain and order pipeline should further solidify. Expanding demand for NEV interior components and deeper collaboration with leading customers are expected to continue supporting revenue and earnings growth. The concurrent rollout of the ESOP and dividend policy should further bolster capital-market confidence, positioning Foresight Technology to sustain its growth trajectory and strengthen its leadership in the global automotive interior components space.

2. Amprius Technologies, Inc. (NYSE: AMPX)

Amprius focuses on the R&D and production of high-performance silicon-anode lithium-ion batteries, with broad applications in aerospace, new-energy vehicles, and consumer electronics. In the third quarter of 2025, the company’s share price rose by USD 6.31 to close at USD 10.52, delivering a quarterly gain of 149.88%.

The surge was driven by tangible breakthroughs in commercialization. In July 2025, Amprius announced that its pilot line in Fremont, U.S., had successfully delivered SiCore® battery products to multiple advanced-UAV customers, including 450 Wh/kg cells for AALTO—an Airbus subsidiary—powering the Zephyr high-altitude, long-endurance platform. With lower mass, higher energy density, and longer cycle life, the product has emerged as a preferred power solution for stratospheric endurance missions. In September, the Company showcased its SiCore® and SiMaxx® series at drone exhibitions in Las Vegas, San Francisco, and London, highlighting strategic use cases across government, defense, and aerospace.

As capacity at the Fremont line expands and more than 1.8 GWh of global partner capacity comes online, Amprius is poised to consolidate its leadership in premium UAV and electric-aviation markets. In parallel, the Company is advancing initiatives in eVTOL and electric vehicles, setting the stage for diversified growth. Leveraging deep expertise in silicon-anode materials and disciplined execution of its globalization strategy, Amprius is well positioned to sustain strong momentum into the fourth quarter.

[For more insights, please download the full report]

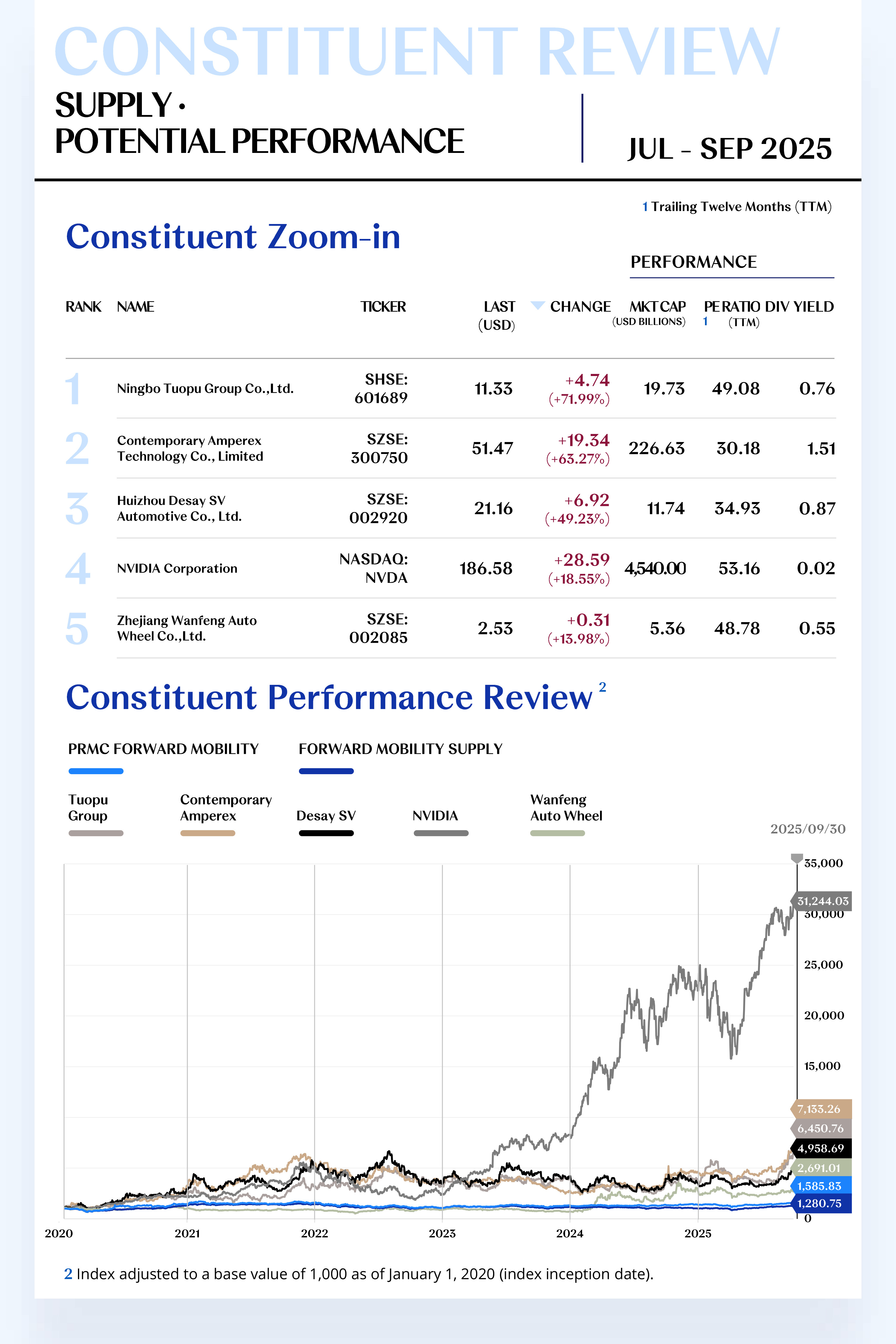

Potential Players

1. Ningbo Tuopu Group Co., Ltd. (SHSE: 601689)

Tuopu Group specializes in automotive power–chassis systems, interior systems, and intelligent driving control systems, with end-to-end capabilities spanning materials R&D, product design, and system integration. In the third quarter of 2025, the company’s share price rose by USD 4.74 to close at USD 11.33, delivering a quarterly gain of 71.99%.

The stock’s strong performance was chiefly driven by breakthrough progress in two frontier arenas: robot actuators and data-center liquid-cooling. According to the Company’s 1H2025 report, its robotics program is advancing smoothly—core components such as linear actuators, rotary actuators, and dexterous-hand motors have undergone multiple customer sample deliveries and are tightly aligned with the mass-production cadence of Tesla’s Optimus Gen3 humanoid robot. In parallel, Tuopu has successfully entered the AI liquid-cooling track: key products including liquid-cooling pumps and temperature-pressure sensors have secured initial orders from leading domestic and global customers—among them Huawei, NVIDIA, and Meta—with an aggregate value of approximately RMB 1.5 billion. This marks a cross-sector step-change from “automotive components” to “intelligent technology equipment,” opening new headroom for growth.

Looking ahead, as Tesla’s humanoid robot approaches mass-production milestones and global investment in AI compute infrastructure accelerates—driving a surge in liquid-cooling demand—Tuopu’s new-business orders are expected to convert at pace and contribute meaningful incremental earnings. Meanwhile, rising volumes at domestic NEV customers such as Seres and Geely should continue to underpin the Company’s legacy businesses. With strategic positioning across high-end manufacturing, intelligent components, and the convergence of cutting-edge technologies, Tuopu Group is well placed to sustain simultaneous growth in both volume and profitability.

2. Contemporary Amperex Technology Co., Limited (SZSE: 300750)

CATL is a global leader in lithium-ion battery R&D and manufacturing, focused on the development, production, and sale of power-battery systems for new-energy vehicles and energy-storage systems. In the third quarter of 2025, the company’s share price rose by USD 19.34 to close at USD 51.47, delivering a quarterly gain of 63.27%.

The strong share-price performance was driven by better-than-expected profitability, sustained technology breakthroughs, and effective international capital-markets execution. According to the 1H2025 report, net profit attributable to shareholders increased 33.33% year on year, while second-quarter net margin reached a record high—demonstrating robust earnings resilience and cost discipline. On May 20, 2025, the Company successfully listed on the Main Board of the Hong Kong Stock Exchange, raising approximately HKD 41 billion to support global capacity expansion and ongoing R&D.

Looking ahead to the coming months, the Hong Kong listing provides a stable, long-term international financing platform that will help accelerate overseas projects, including capacity build-outs in Debrecen (Hungary), Thuringia (Germany), and sites in Spain. As next-generation products scale and overseas capacity ramps, revenue and earnings are expected to remain on a high-growth trajectory. Leveraging systemic advantages in technology, cost, and customer mix, CATL is well positioned to continue leading the global new-energy industry cycle and to support further share-price appreciation.

[For more insights, please download the full report]

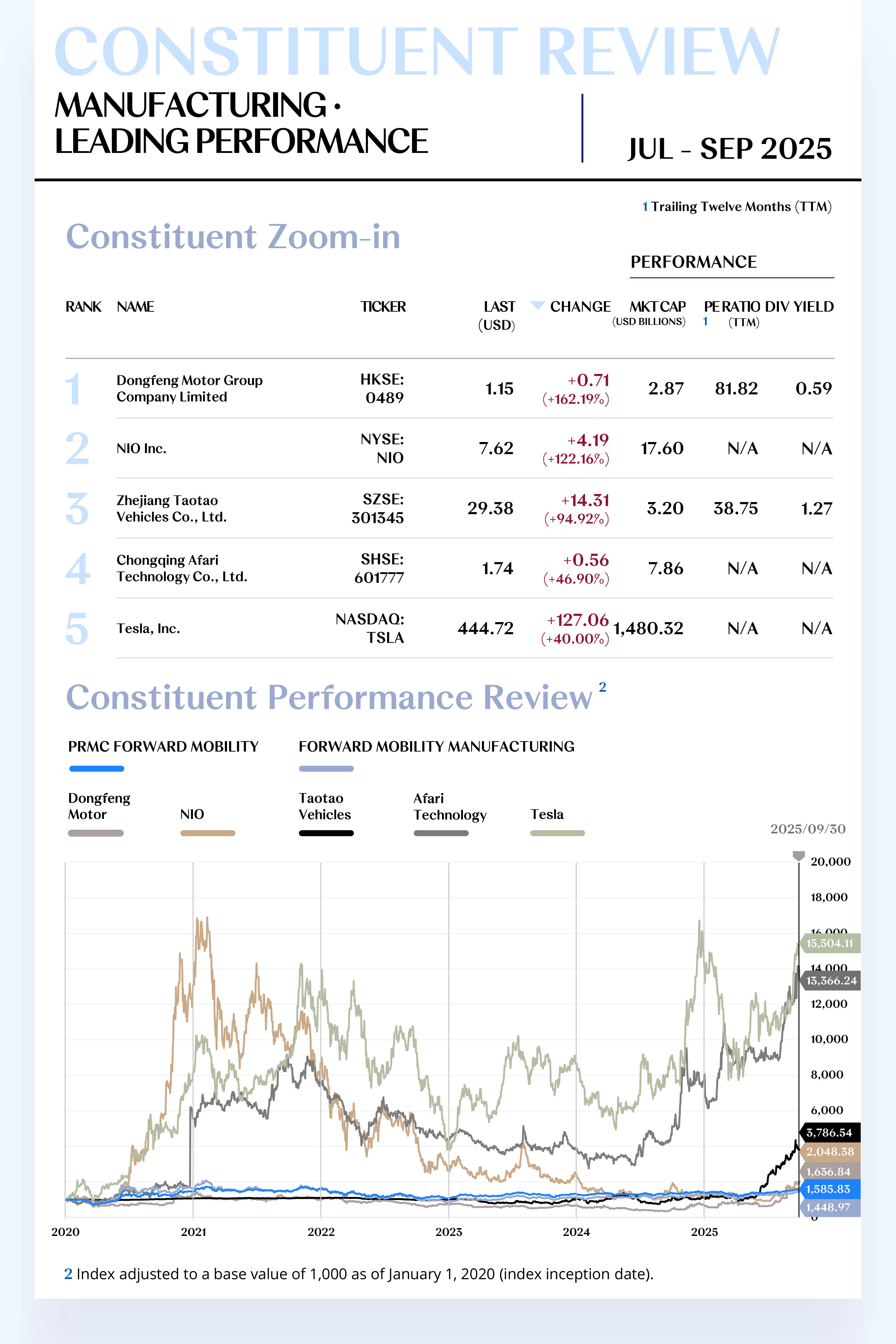

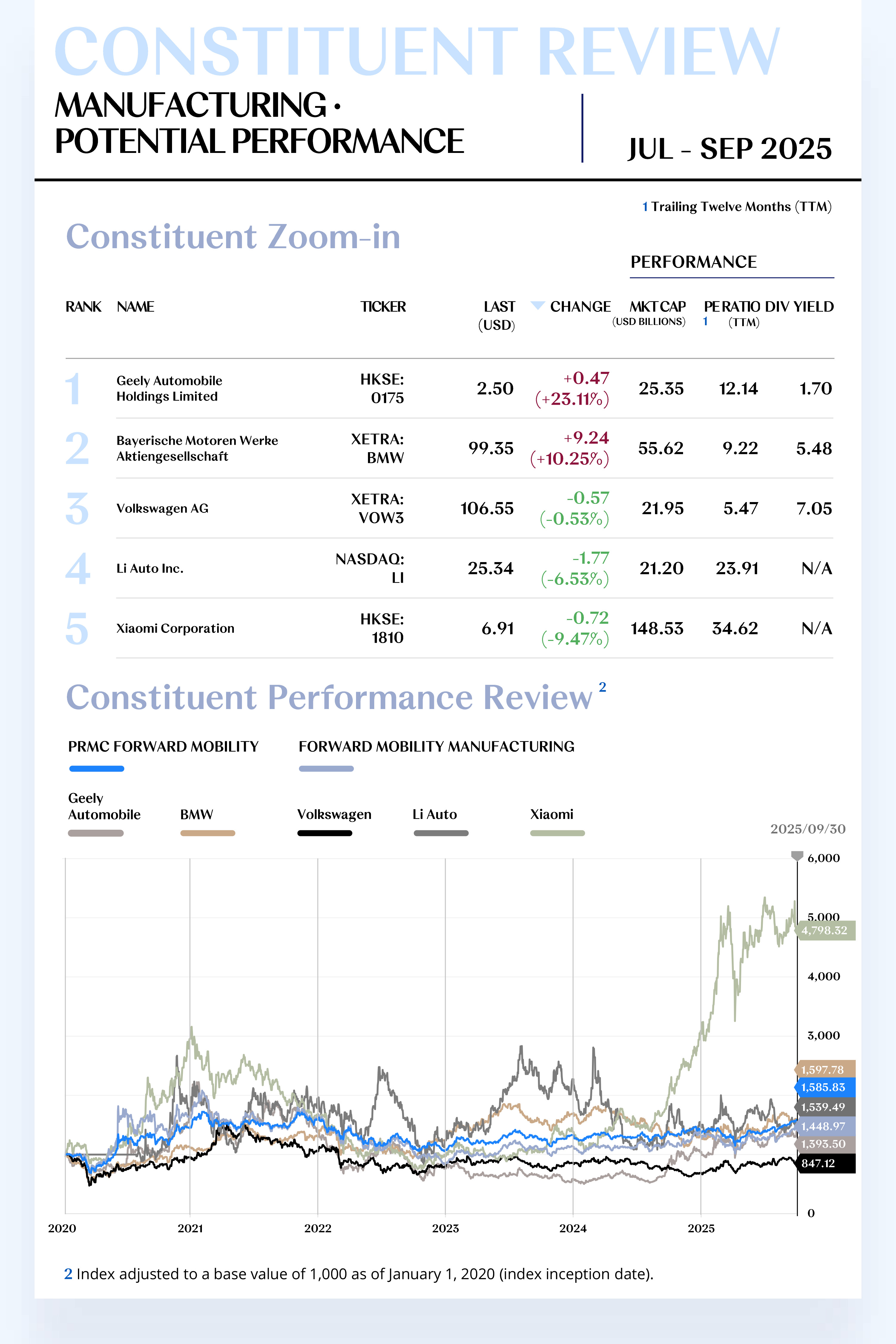

FM MANUFACTURING CONSTITUENT ZOOM-IN

Strengthened Partnerships Extending Market Frontiers,

Leading Products Fueling Performance Rebound

The Forward Mobility Manufacturing Index comprises 79 stocks, with 54 rising and 25 declining.

Leading Performers

1. Dongfeng Motor Group Company Limited (HKSE: 0489)

Dongfeng Motor Group is one of China’s major state-owned automakers, with businesses spanning the R&D, production, and sale of commercial vehicles, passenger vehicles, and new-energy vehicles (NEVs). In the third quarter of 2025, the company’s share price rose by USD 0.71 to close at USD 1.15, delivering a quarterly gain of 162.19%.

The strong performance was driven by solid volume growth and breakthroughs in core intelligent and electrification technologies. In August and September 2025, Dongfeng’s NEV sales exceeded 100,000 units in consecutive months, up 36% and 20.4% year on year, respectively—an impressive showing. On the technology front, the Group in September successfully commissioned its next-generation “Mach” engine, achieving a record thermal efficiency of over 48%, underscoring leadership in powertrain R&D. In the same month, Dongfeng also signed a strategic cooperation agreement with Tencent to deepen collaboration in intelligent driving and intelligent cockpit. In addition, in August 2025 the Group announced that its subsidiary Voyah will list in Hong Kong by way of introduction, while the Group itself will pursue a privatization and delisting via an “equity distribution + absorption merger” structure, at an offer price of HKD 10.85 per share. As Dongfeng’s premium NEV marque, Voyah has delivered strong performance and is poised to unlock further market value.

Looking ahead to the coming months, the momentum from the traditional “Golden September, Silver October” sales season, together with the progressive rollout of intelligent-tech partnerships, should support elevated NEV sales into the fourth quarter. Continued investment in frontier areas such as solid-state batteries and lightweighting will reinforce long-term growth prospects, and the share price is expected to maintain its upward trajectory in Q4.

2. NIO Inc. (NYSE: NIO)

NIO is a leading player in China’s intelligent EV market, dedicated to delivering high-performance smart electric vehicles and a comprehensive user experience. In the third quarter of 2025, the company’s share price rose by USD 4.19 to close at USD 7.62, registering a quarterly gain of 122.16%.

The rally was primarily driven by the successful completion of a large-scale equity financing and heightened expectations for a return to profitability. On September 10, 2025, NIO completed a USD 1.0 billion follow-on equity offering, attracting participation from multiple long-only global investors and providing solid capital support for R&D in core intelligent technologies and the expansion of its charging and battery-swap network. The raise meaningfully alleviated investor concerns around liquidity and strengthened confidence in NIO’s long-term trajectory. In early September, Founder and CEO William Li stated that the Company aims to achieve break-even in the fourth quarter; coupled with robust demand for new models such as the LeDao L90 and next-generation ES8, the market has grown more optimistic about a fundamental turnaround.

In addition, at NIO Day 2025 held in Hangzhou on September 20, the Company unveiled the third-generation ES8 and launched the ET9 Horizon Special Edition, further reinforcing its premium positioning in the high-end EV segment. The ES8’s presale price is notably lower than that of its predecessor and the model adopts the NT3.0 platform and a 900V high-voltage architecture. Presales have outperformed those of the sub-brand LeDao L90, bolstering expectations for NIO’s future sales performance.

Looking ahead, with the USD 1.0 billion capital raise in place, NIO’s R&D and market expansion are set to be strongly supported. Deliveries are expected to reach a new high in the fourth quarter, while a greater mix of higher-priced models should lift gross margin—making the Company’s Q4 break-even target increasingly attainable.

[For more insights, please download the full report]

Potential Players

1. Geely Automobile Holdings Limited (HKSE: 0175)

Geely Automobile is a leading private automaker in China. Beyond its strong domestic position, the Company is accelerating globalization and the shift toward intelligent and electrified mobility, aiming to deliver innovative electric-mobility solutions to consumers worldwide. In the third quarter of 2025, the company’s share price rose by USD 0.47 to close at USD 2.50, registering a quarterly gain of 23.11%.

The share-price appreciation was chiefly supported by encouraging progress in global expansion. On July 3, 2025, Geely released its mid-year results, reporting global vehicle sales of 1.409 million units, up more than 47% year on year; NEV sales reached 725,000 units, up 126% year on year. This strong growth underscores robust demand in the new-energy segment and provides a solid market foundation for the Company’s international footprint. Meanwhile, overseas production is advancing steadily, with local lines in markets such as Indonesia and Egypt already in operation, strengthening supply-chain support for international growth.

That said, Geely’s second-quarter 2025 report (released in mid-August) noted that, despite solid new-model volumes, the Zeekr brand recorded a per-vehicle loss of approximately RMB 4,000, primarily due to capitalization-related depreciation and amortization—an item that weighed somewhat on investor sentiment. Even so, upcoming launches—including the Galaxy M9, Lynk & Co 10 EM-P, Zeekr 9X, and Galaxy Xingyao 6—are expected to push new frontiers in the market and further reinforce the Company’s competitive position.

2. Bayerische Motoren Werke Aktiengesellschaft (XETRA: BMW)

BMW Group is a global leader in premium automotive manufacturing, with a portfolio encompassing BMW, MINI, and Rolls-Royce. In the third quarter of 2025, the company’s share price rose by USD 9.24 to close at USD 99.35, registering a quarterly gain of 10.25%.

Share-price appreciation was driven primarily by innovation in new-energy vehicles (NEVs) and a disciplined global strategy. On July 15–16, 2025, BMW hosted its Investor & Analyst Day, providing an in-depth update on innovation progress—particularly in relation to China’s industry dynamics—and outlining the Company’s roadmap for the electrification transition. By month-end, 1H2025 results showed rising EV penetration and improved margins, underscoring the early effectiveness of BMW’s electrification strategy.

Overall, BMW has delivered tangible gains in NEV innovation and market penetration, with its focused strategy in China poised to reinforce a steady growth trajectory. As electrification accelerates, the Company is expected to continue broadening its global EV portfolio and sustain robust growth momentum.

[For more insights, please download the full report]

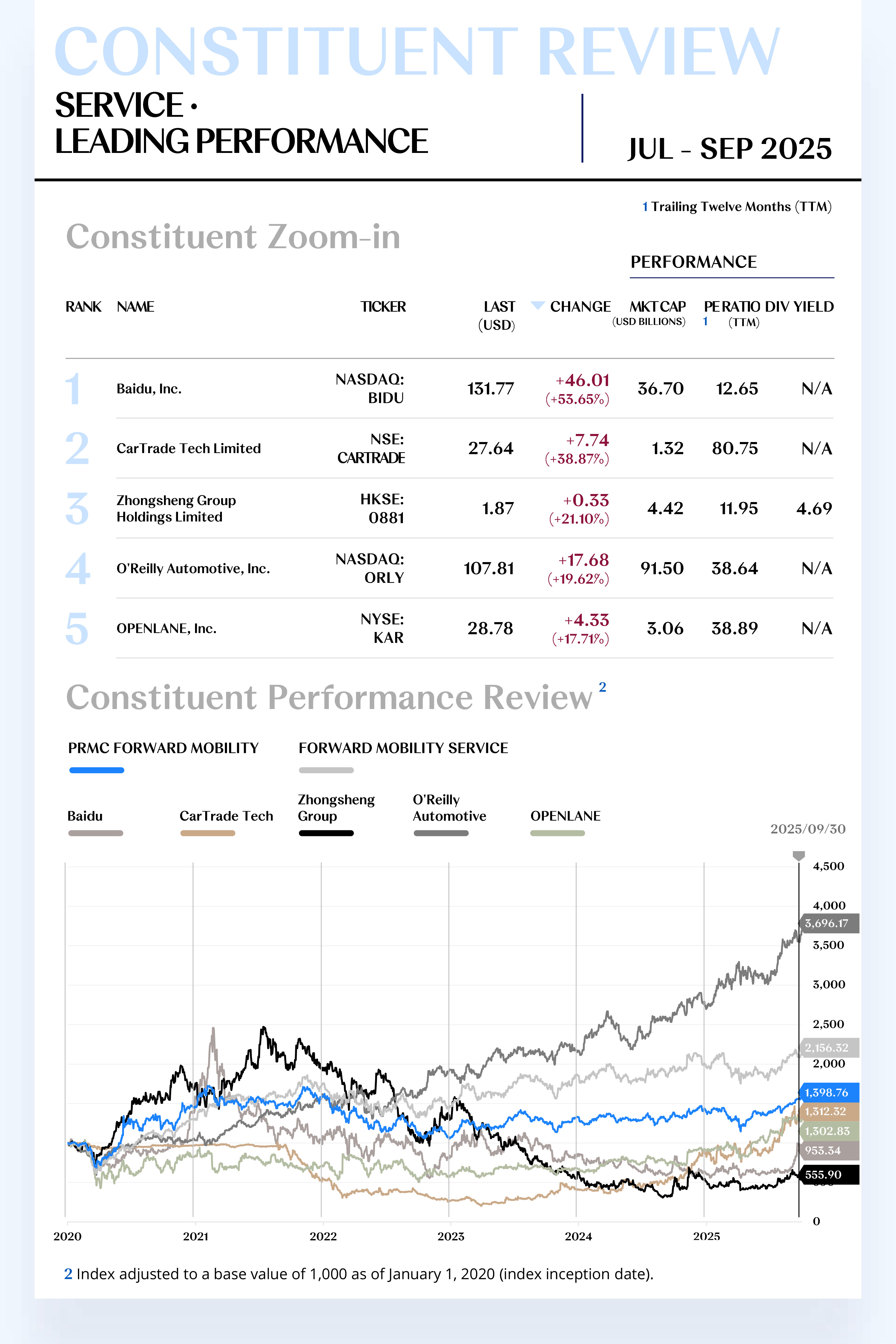

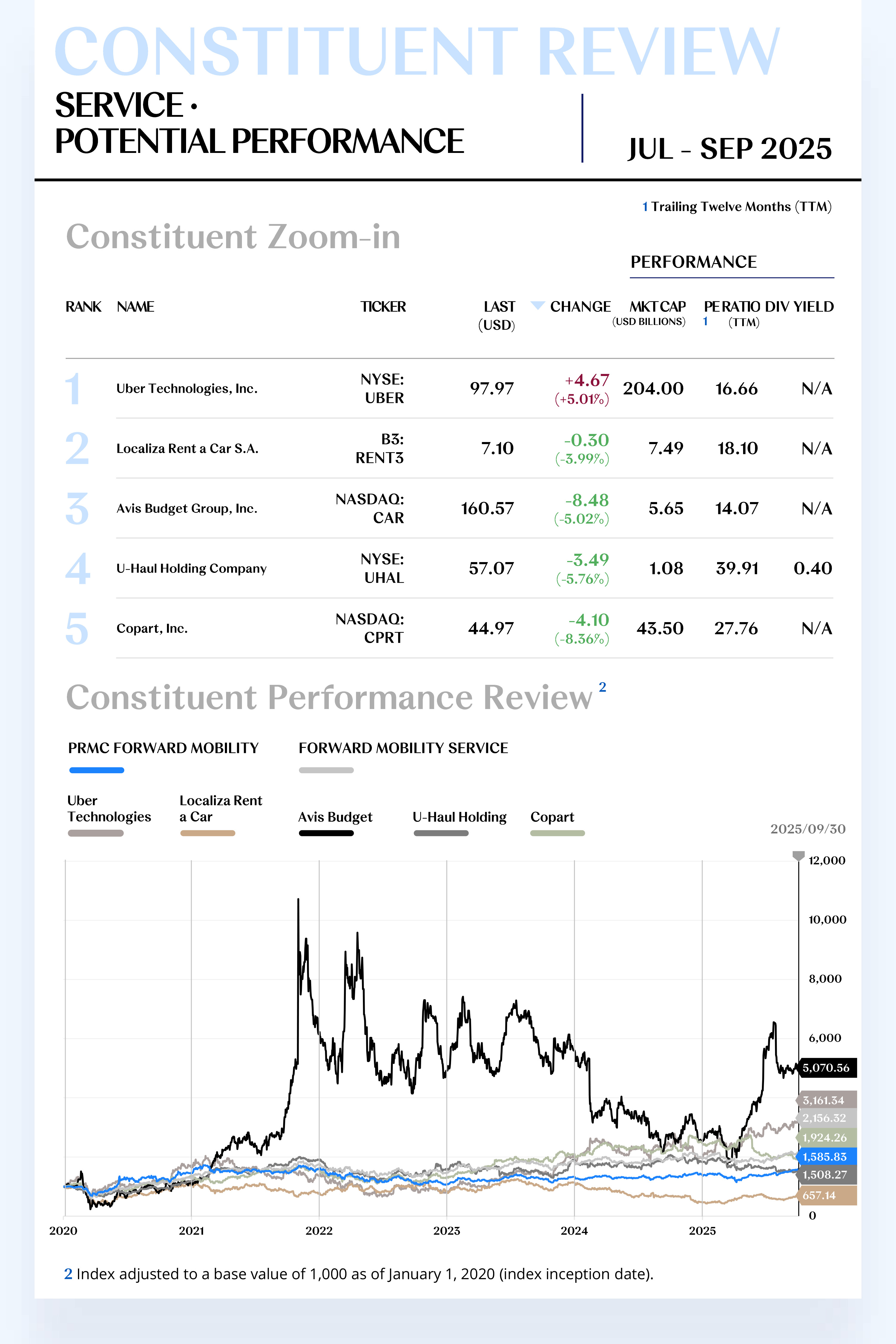

AUTO SERVICE CONSTITUENT ZOOM-IN

Improved Financial Performance

Driving Valuation Repair,

Strengthened Balance Sheet Enhancing Outlook

The Forward Mobility Service Index comprises 37 stocks, with 15 rising and 22 declining.

Leading Performers

1. Baidu, Inc. (NASDAQ: BIDU)

Baidu is a leading Chinese internet technology company focused on search and the development and application of artificial intelligence. In recent years, it has expanded into emerging areas such as autonomous vehicles and robotaxi services, leveraging its Apollo autonomous-driving platform to advance intelligent mobility. In the third quarter of 2025, the company’s share price rose by USD 46.01 to close at USD 131.77, delivering a quarterly gain of 53.65%.

The rally was driven primarily by Baidu’s internationalization of autonomous-driving technology and consecutive milestones in commercialization of core capabilities. On September 24, 2025, its Apollo Go (Luobo Kuaipao) platform received the first autonomous-driving test license (No. 001) issued by Dubai’s Roads and Transport Authority (RTA), marking the Company’s formal entry into the Middle East. Earlier in the year, Baidu signed an agreement with the UAE to deploy more than 1,000 fully driverless vehicles in Dubai and reached a strategic partnership in March with Abu Dhabi–based Autogo.

Looking ahead, as Apollo Go deepens cooperation with global platforms such as Uber and Lyft and extends its footprint across the Middle East and the broader Eurasian region, Baidu’s autonomous-mobility services are poised to scale commercially. Rapid growth in AI cloud and cost advantages from in-house chips should provide additional support to fourth-quarter results, positioning the share price to continue its upward trajectory.

2. CarTrade Tech Limited (NSE: CARTRADE)

CarTrade Tech is an India-based online platform offering multi-brand automotive and motorcycle trading services across new and used vehicles, valuation, financing, and insurance. In the third quarter of 2025, the company’s share price rose by USD 7.74 to close at USD 27.64, delivering a quarterly gain of 38.87%.

The rally was driven primarily by record performance at its OLX business and tailwinds from India’s GST (Goods and Services Tax) reduction. According to disclosures on September 2, 2025, OLX India achieved its highest-ever monthly revenue in July and August, propelling approximately 15% year-on-year growth in second-quarter revenue. In addition, the Indian government’s decision in the second half of 2025 to lower GST rates on vehicles spurred a surge of more than 25% in traffic on CarTrade’s flagship platforms, CarWale and BikeWale, with the market anticipating a meaningful uplift in new- and used-vehicle transactions and overall platform engagement.

Looking ahead, continued normalization of GST cuts through the fourth quarter—coinciding with India’s festive-season peak—should further stimulate automotive consumption. As a leading online marketplace, CarTrade Tech stands to benefit directly from higher transaction volumes, supporting robust fourth-quarter results and providing additional impetus for the share price.

[For more insights, please download the full report]

Potential Players

1. Uber Technologies, Inc. (NYSE: UBER)

Uber is a leading global mobility technology platform offering a diversified suite of services—including ridesharing, food delivery, and freight logistics—via its mobile app across roughly 70 countries and more than 15,000 cities. In the third quarter of 2025, the company’s share price rose by USD 4.67 to close at USD 97.97, up 5.01% for the quarter.

The share-price advance was supported by proactive expansion in autonomous mobility and continued innovation in delivery. On July 17, 2025, Uber announced a USD 300 million joint investment with Lucid Motors to co-develop a robotaxi program, aiming to deploy purpose-built autonomous EVs exclusive to the Uber platform—further reinforcing its strategic positioning at the intersection of autonomy and services. In its second-quarter results released on August 6, revenue grew 18% year on year, beating market expectations, and management raised third-quarter guidance—signals of a healthy, diversified operating model that helped lift the stock over the following two weeks. Subsequently, on September 25, Uber Eats announced a partnership with the ALDI supermarket chain to meet rising demand for convenient grocery delivery, extending the platform’s reach within the last-mile ecosystem.

Looking ahead, Uber is positioned to sustain steady growth as it innovates across autonomous mobility, delivery, and broader transportation services. In particular, progress on the robotaxi initiative and continued expansion of delivery partnerships are expected to provide durable growth catalysts into the fourth quarter, supporting further share-price momentum.

2. Localiza Rent a Car S.A. (B3: RENT3)

Localiza is a Brazil-based car rental company and one of the largest car rental platforms in Latin America. The Company offers short-term car rentals for individuals and businesses, long-term fleet leasing for corporate clients, and used-car sales. In the third quarter of 2025, the company’s share price fell by USD 0.30 to close at USD 7.10, marking a quarterly decline of 3.99%.

The decline in share price was primarily due to the Company’s second-quarter 2025 results, which were released on August 12. While revenue grew by 9.4% year on year—above the industry average—this increase fell slightly short of market expectations, leading to a short-term drop in stock price following the earnings announcement. In response to enhance liquidity and expand its fleet, Localiza announced its 19th and 20th bond issuances under Localiza Fleet S.A. While this move aims to bolster liquidity, it also raised concerns about the Company’s debt levels, contributing to significant stock price volatility.

Despite the short-term impact from earnings disclosures and capital actions, Localiza’s long-term rental business remains fundamentally sound and sustainable. As the Brazilian economic environment gradually stabilizes and the Company continues to expand its car rental and fleet management services, it is expected to maintain steady growth moving forward.

[For more insights, please download the full report]

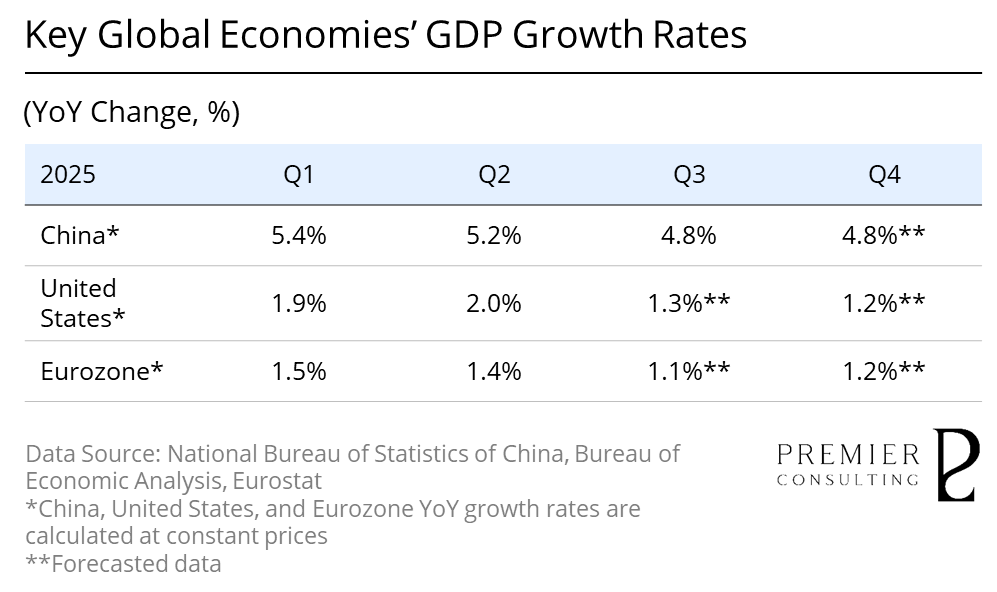

MACROECONOMY UPDATES

Intensifying Protectionist Measures,

An Obscured and Fragile Global Recovery Path

Global: A Tangle of Trade and Geopolitical Risks, Uncertain Economic Outlook

In the third quarter of 2025, global economic recovery continued its weak and uneven pace, with major economies facing a complex situation of slowing growth and structural risks.

The International Monetary Fund (IMF), in its latest World Economic Outlook, forecasts global economic growth of 3.0% in 2025. While this marks a slight recovery from 2024, it remains significantly below pre-pandemic average levels, highlighting the fragile and underpowered global recovery. The policy divergence among major economies has exacerbated imbalances in growth: developed economies are constrained by high interest rates and weak demand, while emerging markets are sustaining relative resilience through fiscal stimulus and domestic demand expansion.

The foremost challenge for the global economy continues to stem from the intersection of trade and geopolitical frictions. Although U.S.-China trade relations have shown signs of temporary easing, long-term uncertainty surrounding tariff policies still has a profound impact on global manufacturing and supply chain strategies. Disagreements between the U.S. and EU on issues such as green subsidies and carbon border adjustment mechanisms persist, while the reshuffling of industrial supply chains in Japan, South Korea, and Southeast Asia is increasing the risk of a reshaped global trade landscape. At the same time, geopolitical conflicts, energy price fluctuations, and policy expectations in financial markets are intensifying the asymmetry of global inflationary pressures, weakening corporate investment confidence and the stability of cross-border capital flows.

The global economy is likely to remain in a "low-growth, high-volatility" mode. Potential shocks from trade frictions and supply chain reallocation may further increase corporate cost pressures, hindering the recovery of investment and consumption. The cooling trend in labor markets is becoming more evident, compounded by the continuation of high interest rates, weakening demand-side support. Geopolitical tensions and energy price uncertainties may dampen market risk appetite, increasing financial market volatility.

In this context, the policy direction of major economies will play a crucial role in determining the future trajectory of the global economy. The U.S. Federal Reserve and European Central Bank may maintain cautious monetary policies, seeking a balance between controlling inflation and stabilizing growth, while emerging markets like China are expected to continue offsetting external pressures through active fiscal policies and structural reforms.

[For more insights, please download the full report]

Manufacturing Purchasing Managers' Index Review

China: Recovery Persists, but Domestic Demand Needs Re-energizing

In the third quarter of 2025, China’s manufacturing sentiment continued to improve, with the sector trending steadily upward. Although activity remains slightly below the boom–bust threshold, momentum is gradually building: the manufacturing PMI rose to 49.80 in September—its highest reading since Q2—signaling ongoing improvement in industrial output and a steady repair on the supply side.

On production and supply, manufacturing activity accelerated and supply-chain efficiency continued to improve. The production sub-index climbed for a second consecutive month, indicating higher operating rates and steadily rising output. Supplier delivery times remained in expansionary territory, reflecting better raw-material flows and stronger coordination across the industrial chain. While new orders and employment stayed in contraction, their declines narrowed notably, suggesting early signs of order recovery and marginal improvement in hiring demand. Inventories edged up again, pointing to a turn in corporate expectations and the gradual onset of a restocking cycle.

By firm size, expectations at large enterprises improved markedly, with the September PMI up 0.2 points to 51.00. Medium and small firms, however, still face pressures from insufficient orders and elevated financing costs, and business confidence will take time to rebuild.

[For more insights, please download the full report]

Retail Sales Growth Review & Outlook

China: Continued Progress in Building a Unified Market, Stabilizing Recovery in Automotive Consumption

In the first three quarters of 2025, China’s total retail sales of consumer goods reached RMB 36.5877 trillion, growing by 4.50% year-on-year. Among this, retail sales of automotive products totaled RMB 3.5923 trillion, a growth of 0.60%, which lagged behind the overall retail growth rate. However, with automotive consumption showing a 1.60% growth in September, the sector is gradually stabilizing and recovering.

Regarding price indices, the Consumer Price Index (CPI) rose by 0.1% month-on-month in September but fell by 0.3% year-on-year. The core CPI, excluding food and energy, increased by 1.0% year-on-year, marking its fifth consecutive month of growth. The Producer Price Index (PPI) remained flat month-on-month and dropped by 2.3% year-on-year, but the rate of decline narrowed by 0.6 percentage points compared to the previous month.

[For more insights, please download the full report]

INDUSTRY KEY FIGURES

Solid Industry Advancement in Q3,

Strong Dual-Drive of EV Production & Sales

The automotive industry in Q3 2025 continued steady progress, with production and sales maintaining double-digit growth.

From January to September 2025, China’s automotive production and sales reached 24.33 million and 24.36 million units, respectively, representing year-on-year growth of 13.30% and 12.90%. The growth rates in production and sales were 0.8 and 1.5 percentage points higher than in the first half of the year, respectively.

In September, China’s automotive production and sales were 3.276 million and 3.226 million units, respectively, with month-on-month growth of 16.40% and 12.90%, and year-on-year growth of 17.10% and 14.90%. For the first time in history, monthly automotive production and sales exceeded 3 million units, and the year-on-year growth rate has maintained double digits for five consecutive months.

[For more insights, please download the full report]

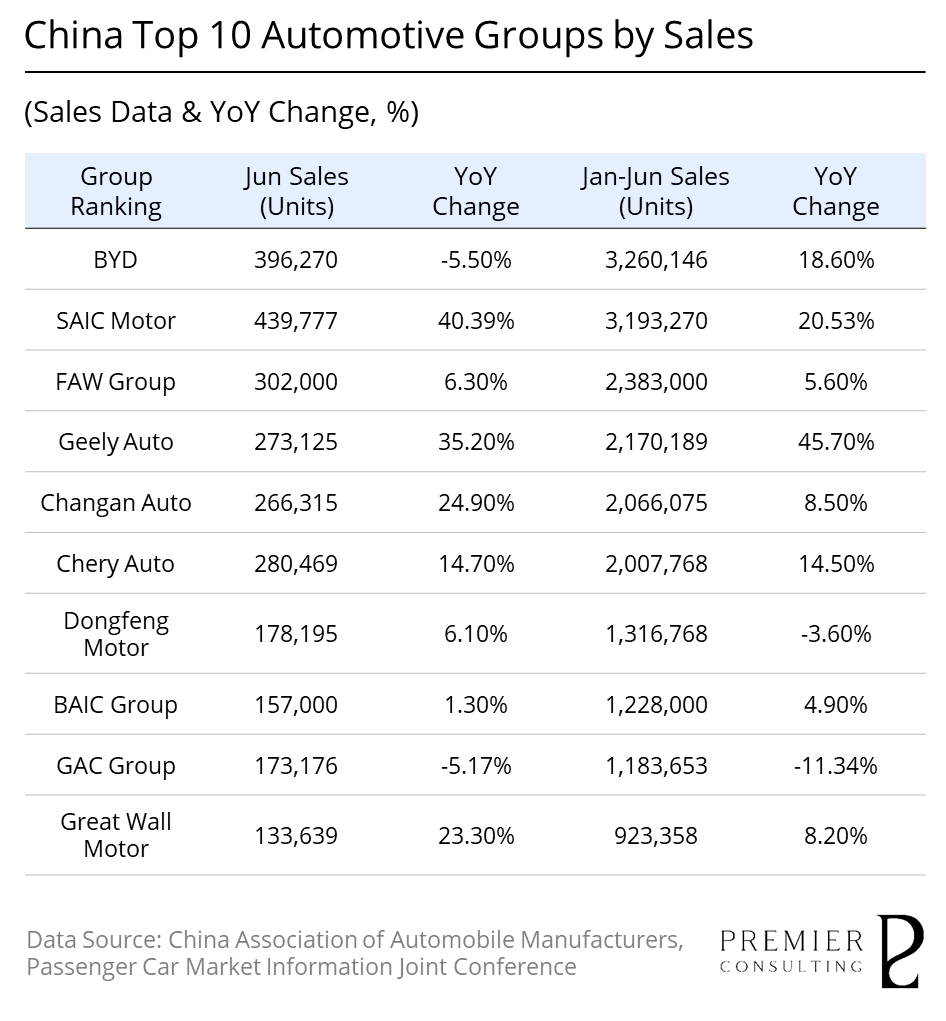

BYD Leads Cumulative Sales, While SAIC Group Shows Strong Monthly Recovery and Geely Maintains Double-Digit Growth

Looking at the Chinese automotive market in the first three quarters of 2025, leading automakers have performed well overall. BYD maintained its market-leading position with nearly 3.3 million units sold year-to-date and a 18.60% year-on-year growth rate. SAIC Group has shown a strong recovery, with September sales reaching 439,777 units, up 40.39% year-on-year. This boosted its year-to-date total to nearly 3.2 million units, challenging the top spot with over 20% year-on-year growth.

Meanwhile, Geely Automotive saw a 35.20% increase in monthly sales, with year-to-date sales approaching 2.2 million units, up 45.70% year-on-year, surpassing Changan and Chery and further solidifying its market position. In contrast, GAC Group saw a decline in both September and year-to-date cumulative sales, impacted by weaker performance from its core brands, GAC Honda and GAC Aion, and has yet to fully recover.

[For more insights, please download the full report]

PRIMARY INDEX REVIEW & PROSPECT

Stable Momentum Across the Quarter,

Index Registers Consecutive Monthly Gains

In the third quarter of 2025, the PRMC Forward Mobility Index closed at 1,585.83 points, marking an increase of 183.78 points, or 13.11%. Geopolitical and international trade conditions continued to improve in the third quarter of 2025, boosting global automotive industry confidence. The easing of tensions in the Middle East and the ceasefire agreement between Israel and Iran reduced global risk aversion, preventing a systemic rise in oil prices and stabilizing energy and logistics costs. This provided strong cost support for the automotive supply chain. Additionally, U.S.-China trade tensions showed signs of a positive shift as high-level consultations between the two nations were resumed, and a new trade framework agreement was reached, alleviating concerns about supply chain disruptions and creating a more stable external environment for global automotive companies’ strategic planning and cost control.

Looking ahead to the fourth quarter of 2025, the automotive index is expected to maintain a steady upward trend, with regional differentiation becoming increasingly evident.

In US, despite a rebound in August inflation data, signs of weakening in the labor market have emerged, and recent comments by Federal Reserve Chairman Jerome Powell have strengthened market expectations for an interest rate cut in October. If the rate cut materializes, it would help marginally ease the pressures on automotive consumption and manufacturing financing. However, uncertainties remain around trade policies such as "reciprocal tariffs," and ongoing challenges in corporate cost control and supply chain deployment are expected to result in a weak recovery pace in the U.S. market, limiting its ability to drive global automotive sector growth.

In Europe, inflationary pressures have further eased, and ECB officials have recently pointed out that the path to returning inflation to the 2% target is stabilizing, creating conditions for further accommodative policies. Marginal improvements in the monetary environment are expected to boost automotive demand in the region. However, the pace of recovery remains constrained by the slow recovery of industrial momentum in key countries like Germany and uneven economic recovery across member states, meaning the overall automotive market may continue to experience a “low-level fluctuation and gradual recovery” pattern.

In China, domestic demand recovery remains a key policy focus. With industrial product prices weak and deflationary pressures not fully alleviated in the first half of the year, it is expected that both central and local governments will ramp up structural stimulus measures in the fourth quarter, focusing on activating lower-tier markets and unlocking the potential of new energy consumption. Driven by both “consumption boost” and “new productivity,” the Chinese automotive market is likely to be a key support for the upward movement of the index in Q4.

[For more insights, please download the full report]

SECONDARY INDEX REVIEW & PROSPECT

Broad-Based Gains in Secondary Index,

Supply Index Leads with Smart Tech,

Manufacturing Index Driven by Brand Power,

Service Index Reshaped by New Models

In the third quarter of 2025, the PRMC Forward Mobility Supply Index closed at 1,280.75 points, increasing by 151.68 points, or 13.43%.

The strong performance of the upstream index in Q3 was primarily driven by the combined forces of the smart electrification trend and breakthroughs in AI technology.

First, the smart electrification wave led to structural prosperity in upstream segments of the supply chain. The rapid rise of domestic vehicle brands with high sales growth created opportunities for local component suppliers that possess technological responsiveness and cost advantages. Companies like Tuopu Group, Desay SV, and XinQuan maintained high new order volumes, shortened product iteration cycles, and improved industry concentration, supporting performance expansion and valuation recovery in the sector.

Second, breakthroughs in AI large models injected new momentum into upstream industries. The mass production of humanoid robots marked a milestone year, with core component companies specializing in precision manufacturing and customer retention quickly entering the AI and robotics space, opening a "second growth curve." This not only expanded the application boundaries of traditional automotive parts but also strengthened long-term growth expectations for the industry, driving the revaluation of related companies and capital inflows.

Additionally, improvements in the external environment created conditions for the index's rise. Positive signals from U.S.-China and China-EU trade talks eased tariff pressures in the short term, reducing the uncertainty around cross-border component procurement and exports. This significantly boosted business confidence and risk appetite. At the same time, accelerating demand in the Middle East and Southeast Asia markets drove strong export volumes for Chinese components, further enhancing industry profitability.

In the third quarter of 2025, the PRMC Forward Mobility Manufacturing Index closed at 1,448.97 points, up by 163.34 points, or 12.70%.

The strong performance of the manufacturing sector was driven by the continued rise in global new energy vehicle penetration and robust demand from the Chinese market.

China's strong consumer potential and policy support have provided a global demonstration effect for the automotive industry. Leading companies such as BYD, Geely, and Chery have continued to expand market share through product diversification and channel integration. The performance of new energy vehicle brands has been particularly remarkable—XPeng Motors saw a 95% year-on-year increase in September deliveries, and Homage AI’s holiday pre-orders surpassed 40,000 units, reflecting the widespread demand for smart electrification. This growth has not only strengthened domestic industry chain collaboration but also increased global automakers' dependence on China's supply and innovation systems.

On the international front, the electrification transformation of the automotive industry has been accelerating. Global automakers such as Tesla, Ford, and Hyundai have continued to optimize their multinational production layouts, further improving capacity utilization. Notably, with the collaborative expansion of key manufacturing hubs in Europe and China, global electric vehicle production and export capabilities have significantly increased.

In the third quarter of 2025, the PRMC Forward Mobility Service Index closed at 2,156.32 points, increasing by 259.46 points, or 13.68%.

The strong performance in the downstream services sector was driven by the accelerating development of the global smart mobility ecosystem and the flourishing growth of the energy replenishment sector.

Globally, multiple governments launched consumer stimulus and green mobility policies in Q3, driving a continuous rise in new energy vehicle sales and simultaneously expanding the automotive finance, insurance, and maintenance markets. The acceleration of the electrification process also sped up the development of charging and energy replenishment infrastructure. In Europe, the “Fit for 55” initiative strengthened public charging network deployment, while China continued to advance the construction of “charging stations in communities” and “intercity highway energy networks.” The U.S. expanded its energy network coverage through the Infrastructure Bill.

At the same time, the commercialization of AI-powered autonomous driving progressed significantly. In Q3, Robotaxi services began demonstration operations in several key cities across Europe, the U.S., and the Asia-Pacific region, with technology applications rapidly extending from closed environments to urban roads. The reshaping of the smart mobility ecosystem is fostering new collaboration models among shared mobility platforms, service operators, and autonomous driving technology companies. Traditional mobility companies are accelerating their transformation into the “smart driving + mobility” model through data assets and service capabilities, bringing higher traffic and monetization efficiency to the downstream industry.

[For more insights, please download the full report]

.jpg)

Review & Prospect

Charting Future Mobility

Through Regulatory Foresight

Q3 2025 PRMC Forward Mobility Index

Review & Prospect

Feb 02, 2026

Track the latest developments and market trends in the global automotive mobility industry, and gain insights into how intelligent and connected technologies are driving the evolution of the sector.

Trade Easing Boosts Confidence, Regional Divergence Becomes More Pronounced

[Primary Index Performance Review]

The PRMC Forward Mobility Index closed at 1,585.83 points in Q3 2025, rising by 183.78 points (+13.11%) during the quarter. The performance was weaker compared to the STAR & CHINEXT 50 (+65.32%) and HANG SENG TECH (+21.93%), but better than the NASDAQ COMPOSITE (+11.24%) and STOXX EUROPE 600 TECH (-0.49%).

[Secondary Index Performance Review]

The PRMC Forward Mobility Supply Index closed at 1,280.75 points in Q3 2025, increasing by 151.68 points (+13.43%) during the quarter;

The PRMC Forward Mobility Manufacturing Index closed at 1,448.97 points in Q3 2025, rising by 163.34 points (+12.70%) during the quarter;

The PRMC Forward Mobility Service Index closed at 2,156.32 points in Q3 2025, up by 259.46 points (+13.68%) during the quarter.

[China Automotive Industry Review]

In the third quarter of 2025, with the central and local governments rolling out new "trade-in" policies, coupled with coordinated nationwide auto exhibitions and the intensive launch of new models, the overall activity in the automotive market significantly picked up, and the industry continued its steady growth trajectory, with new industry drivers accelerating their release.

By the end of the first three quarters, China’s automotive production and sales reached 24.33 million and 24.36 million units, respectively, representing year-on-year growth of 13.30% and 12.90%. The growth rates in production and sales were 0.8 and 1.5 percentage points higher compared to the first half of the year, indicating that the automotive industry’s sentiment continued to improve, with demand-side recovery and supply-side optimization forming a positive resonance.

Exports also maintained strong growth. In the first three quarters of 2025, China’s total automotive exports reached 4.95 million units, growing by 14.80% year-on-year. Among these, new energy vehicles (NEVs) accounted for approximately 1.758 million units in exports, a remarkable year-on-year increase of 89.40%, making them the core driver of automotive export structure upgrades and enhancing global competitiveness.

[Macroeconomic Review and Outlook]

In the third quarter of 2025, the global automotive industry gradually regained confidence, supported by a calming of geopolitical tensions and improvements in trade policies. The stabilization of the Middle East situation and the positive shift in U.S.-China trade relations—marked by the resumption of high-level consultations and the signing of a new trade framework agreement—effectively alleviated supply chain uncertainties and reduced upward pressures on raw material and logistics costs, providing a more predictable external environment for the global automotive industry.

US market continued its weak trend, with high tariff policies and declining consumer confidence continuing to suppress end demand. The uncertainty surrounding tariffs disrupted vehicle and component import costs, leading to structural inventory accumulation among enterprises, and mainstream automakers have been slowing their production pace.

Europe market is undergoing structural adjustments, with overall demand recovery remaining sluggish. Ongoing tariff disputes continue to hinder cross-border supply chain efficiency, and the combination of weak manufacturing and high financing costs is squeezing corporate profit margins. While inflation easing has provided some relief for household consumption, consumer confidence has not significantly recovered, and the automotive market’s recovery pace remains slow.

China market continued its steady growth trajectory, becoming a major pillar for the global automotive industry. Policy measures such as "trade-in" programs, new energy vehicle subsidies for rural areas, and continued consumption incentives have been effective, further supported by domestic brands launching intelligent electric vehicles, leading to a clear market structure optimization. Although the consumer side remains influenced by localized price wars and the pace of confidence recovery, overall demand remains resilient.

Looking ahead to the fourth quarter of 2025, the global automotive market is expected to maintain moderate growth amidst a complex macroeconomic environment, though regional differentiation will become more pronounced. Market performance will largely depend on the policy direction and consumption recovery pace in each economy.

In US, the outlook for automotive market recovery remains pressured. Although the Federal Reserve is expected to continue lowering interest rates to stimulate consumption and business financing, persistent inflation, the marginal weakness of the labor market, and uncertain tariff policies will continue to constrain consumer confidence and business decisions.

In Europe, amid economic slowdown and structural transformation, the automotive market will continue to face both weak demand and supply pressures. The European Central Bank’s marginally accommodative monetary policy is expected to provide some support to credit and consumption, but the transmission of interest rate changes to the real economy remains delayed. High financing costs, weak corporate investment, and low consumer confidence will slow the pace of market recovery.

In China, the dual role of policy support and market momentum will continue to sustain the steady operation of the automotive market. It is expected that the government will further increase structural stimulus measures in Q4 to strengthen consumption recovery. The penetration rate of new energy vehicles is likely to increase further, driving both the expansion of the industrial supply chain and export growth, becoming the dual engines for both domestic and foreign demand.