24/25 PRMC Automotive Index

Review & Prospect

24/25 PRMC Automotive Index

Review & Prospect

Offering investors fresh perspective, seizing short-term volatility, and positioning for long-term growth in the automotive sector.

Intelligence Powers New Momentum,

Value Anchors the Future

In 2024, the automotive industry index reflected a complex landscape shaped by policy shifts, technological evolution, and capital dynamics. From the rising global penetration of new energy vehicles to the brink of large-scale adoption of intelligent driving technologies, market fluctuations underscored the sector’s deep transformation. The convergence of technological and product cycles drove valuation gains for select automakers, while industry leaders—especially in smart components and foundational hardware for electrification and robotics—demonstrated clear competitive advantages in niche segments.

Looking ahead to 2025, the industry stands at the intersection of globalization and regionalization, with electrification and intelligence remaining the primary drivers of index growth. However, market divergence will become more pronounced. Investment strategies will shift from short-term domestic market share expansion to long-term category diversification (e.g., low-altitude economy, humanoid robotics) and sustained growth in overseas markets. Companies benefiting from synchronized technology and product cycles are expected to outperform, driving index momentum.

For investors, 2025 will be a pivotal year to balance value and growth with strategic precision. From upstream resource consolidation to midstream intelligent manufacturing and downstream consumption upgrades, opportunities arising from supply chain localization and smart manufacturing will span the entire industry. Leading players in electrification and intelligence, leveraging both domestic expansion and global value chain integration, will emerge as key capital market favorites.

During this critical window, Premier focuses on key component stocks within the PRMC Automotive Index’s three sub-indices—Auto Supply (upstream), Auto Manufacturing (midstream), and Auto Service (downstream)—complemented by index trend analysis. This approach aims to provide investors with fresh perspectives, capturing short-term opportunities while strategically positioning for long-term growth.

DOWNLOADS

Lite Report (54 pages)

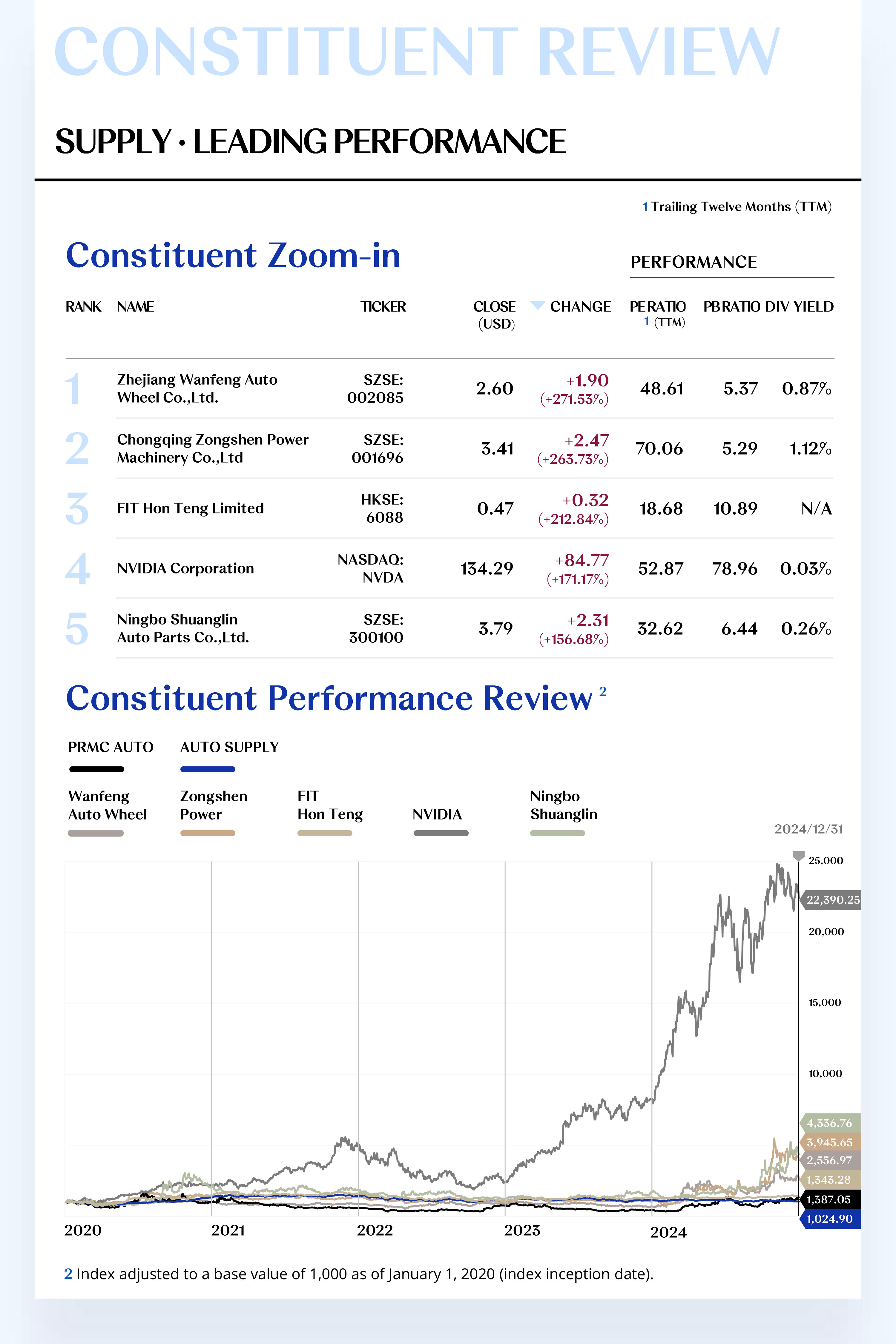

AUTO SUPPLY CONSTITUENT ZOOM-IN

From Robotics to Low-Altitude Economy:

Empowering the Future of Mobility with Intelligence Driving

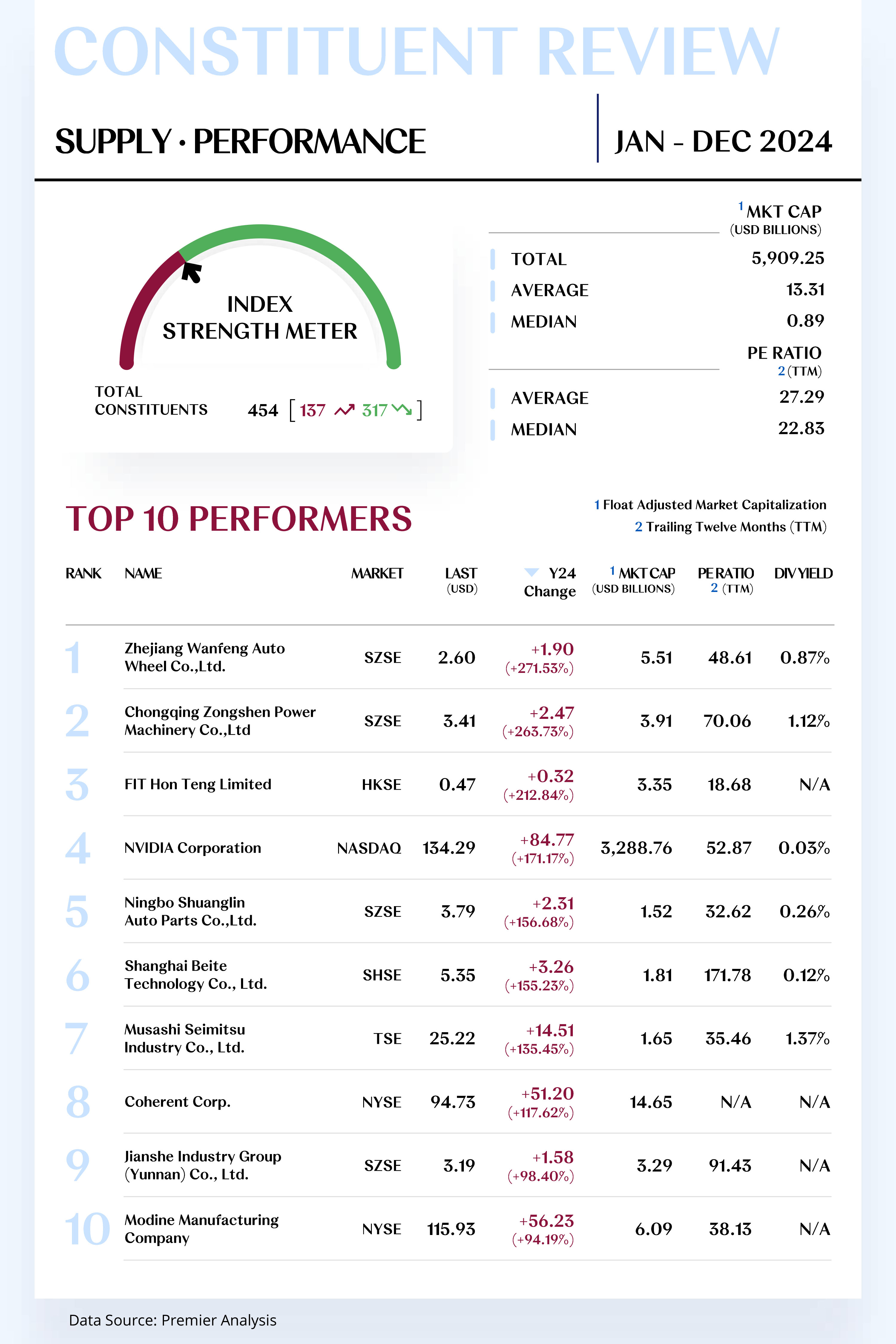

The Auto Supply Index comprises 454 stocks, with 137 rising and 317 declining.

Leading Performers

1. Zhejiang Wanfeng Auto Wheel Co.,Ltd.

Wanfeng Auto Wheel has long specialized in lightweight automotive components and general aviation, gradually establishing a global leadership position in magnesium and aluminum alloy parts manufacturing. In November 2024, the company announced the acquisition of eVTOL (electric vertical takeoff and landing) intellectual property from Volkswagen Group, covering key areas such as industrial design, interior and exterior components, human-machine interaction, and hardware-software integration. This strategic move not only strengthens its competitiveness in cutting-edge technologies but also reinforces its position as a leader in lightweight solutions.

Driven by strong performance in core markets such as aluminum alloy wheels and its deep integration with emerging industries like the low-altitude economy, Wanfeng Auto Wheel's stock surged 271.53% in 2024 to $2.60, making it the top-gaining component stock in the Auto Supply Index. Looking ahead to the first quarter of 2025, the continued expansion of the global new energy vehicle market is expected to provide solid support for its components business. Meanwhile, the company’s active exploration of lithium batteries and the low-altitude economy is set to further drive business growth and enhance market value.

2. Chongqing Zongshen Power Machinery Co.,Ltd

Zongshen Power specializes in the research, manufacturing, and sales of small thermal power machinery and select end products, with core operations spanning motorcycle engines and general machinery.

On the capital front, in March 2024, the company, together with its affiliate Chongqing Zongshen Investment Co., Ltd., established Chongqing Zongshen New Intelligent Manufacturing Technology Co., Ltd. Through this subsidiary, it participated in the restructuring investment of Loncin Group in July, demonstrating strategic foresight in industry consolidation and capital deployment.

In external partnerships, Zongshen Power signed a memorandum of understanding in February with Zero Motorcycles, a leading U.S. electric motorcycle brand. The collaboration aims to develop and market multiple competitive models, fostering deep cooperation in key areas such as technology development and market expansion.

[For more insights, please download the full report]

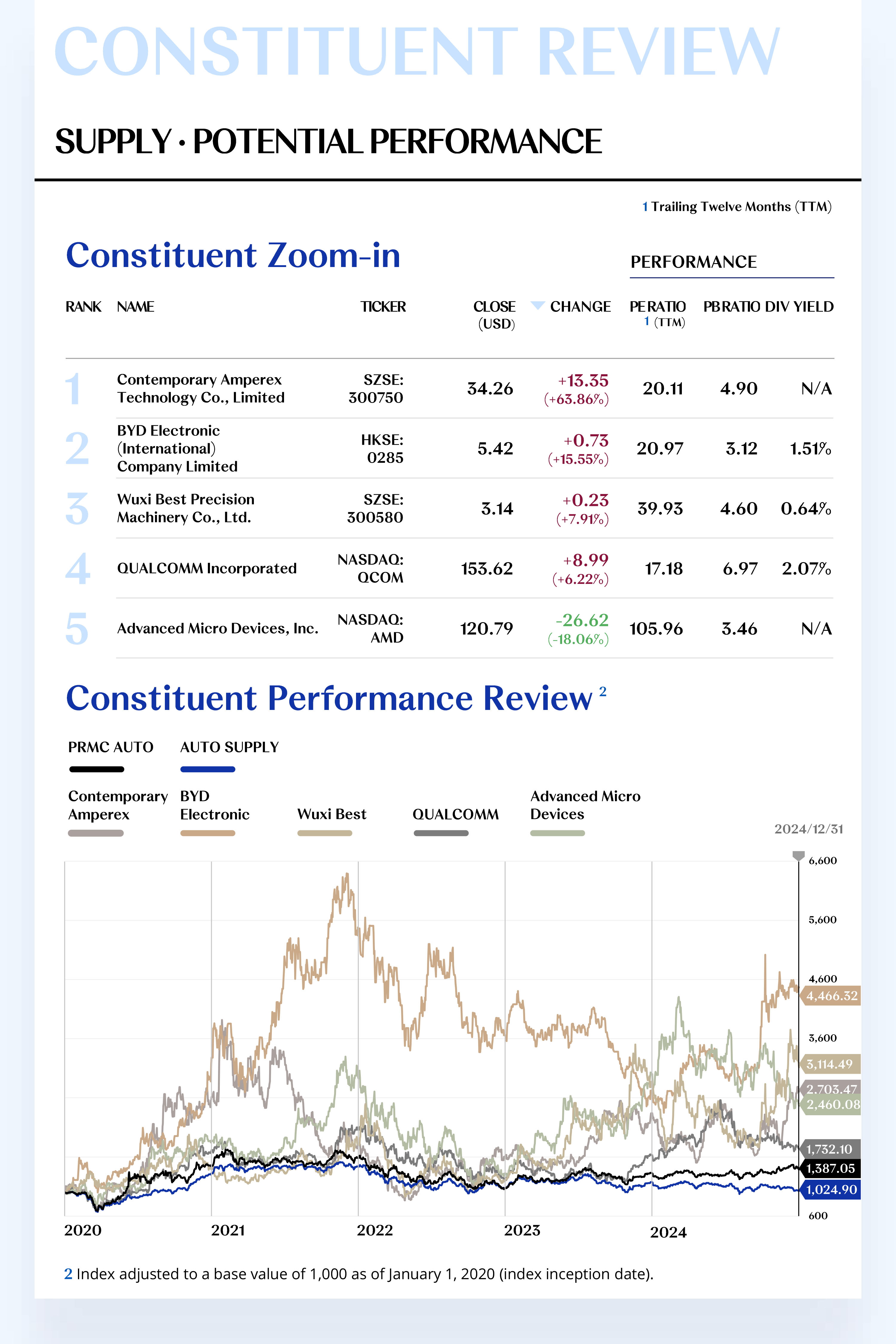

Potential Players

1. BYD Electronic (International) Company Limited

BYD Electronic (International) Co., Ltd. specializes in the design, development, manufacturing, logistics, and after-sales service of mobile intelligent terminal components and modules. Its product portfolio spans smartphones, tablets, emerging smart devices, automotive intelligent systems, and medical health equipment.

In 2024, the company’s consumer electronics segment saw significant growth, driven by the expansion of product categories from major overseas clients and the recovery of demand for high-end Android smartphones. Meanwhile, in the second half of the year, active suspension systems entered mass production, while smart cockpits, intelligent driving systems, and thermal management solutions continued stable shipments, maintaining a steady gross margin.

Fueled by strong performance in core businesses, BYD Electronic’s stock rose 15.55% in 2024, closing at $5.42. Looking ahead to 2025, increasing automation in manufacturing is expected to further improve gross margins in its overseas client business, while assembly operations are set to expand into higher-end categories, unlocking new profit streams. Additionally, high-value automotive electronics, such as smart cockpits, are projected to contribute significantly to annual profits, with automotive electronics revenue expected to exceed RMB 30 billion. AI-related components and assembly businesses are also entering a rapid growth phase, providing strong support for future revenue expansion, with the stock poised for steady appreciation.

2. Contemporary Amperex Technology Co., Limited

CATL specializes in the research, production, and sales of new energy vehicle power batteries and energy storage systems, with a product portfolio covering power battery systems, energy storage battery systems, and related materials. Its solutions are widely used in electric passenger vehicles, electric commercial vehicles, and stationary energy storage systems. Recently, the company released its 2024 earnings forecast, projecting annual revenue of RMB 356-366 billion, a year-over-year decline of 8.7%-11.2%, primarily due to lower product prices driven by falling lithium carbonate costs. However, net profit attributable to shareholders is expected to reach RMB 49-53 billion, reflecting 11.1%-20.1% growth, demonstrating resilient profitability despite revenue pressure.

[For more insights, please download the full report]

AUTO MANUFACTURING CONSTITUENT ZOOM-IN

Innovate in Product & Technology,

Deepen Industry Collaboration to Navigate Market Competition

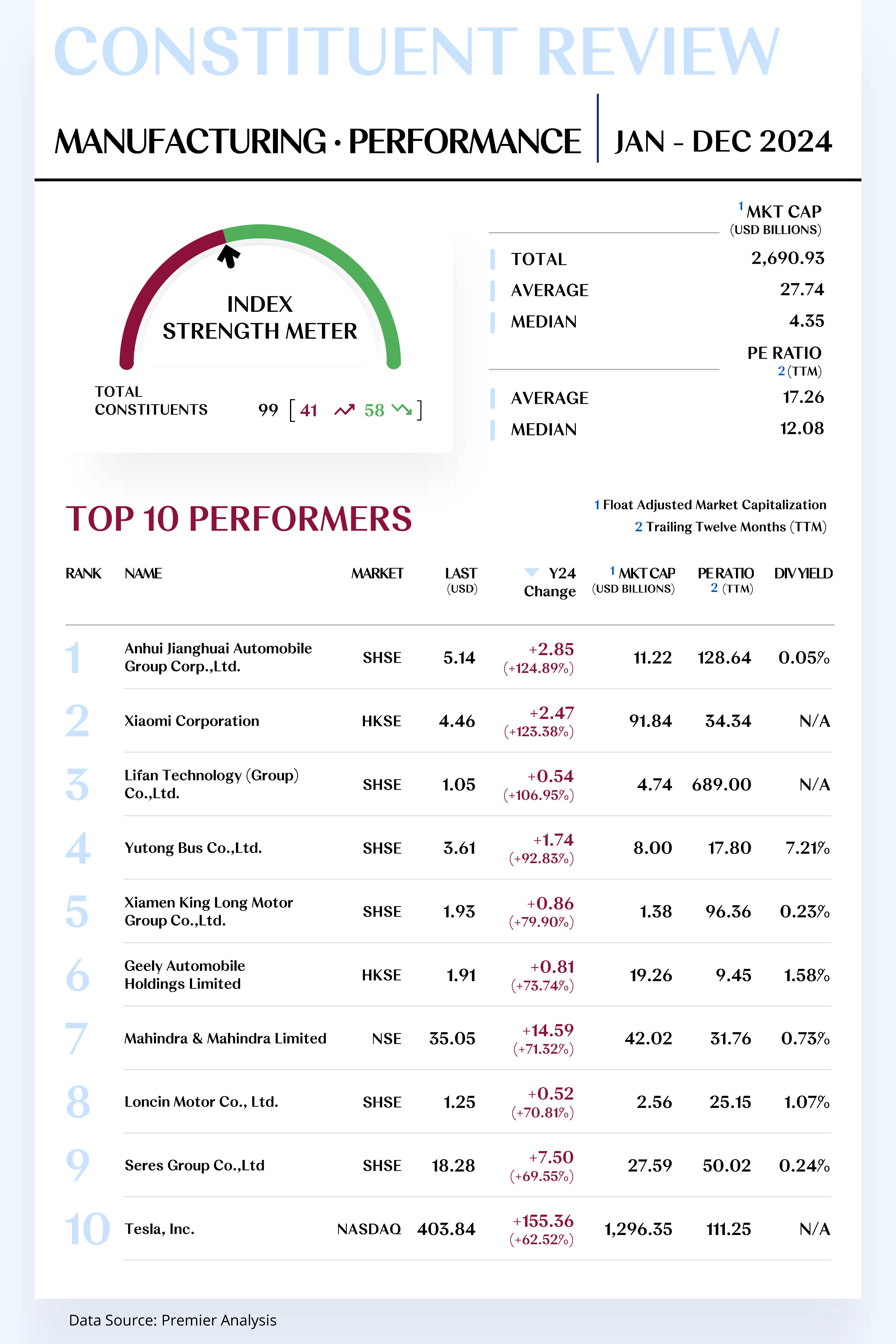

The Auto Manufacturing Index comprises 99 stocks, with 41 rising and 58 declining.

Leading Performers

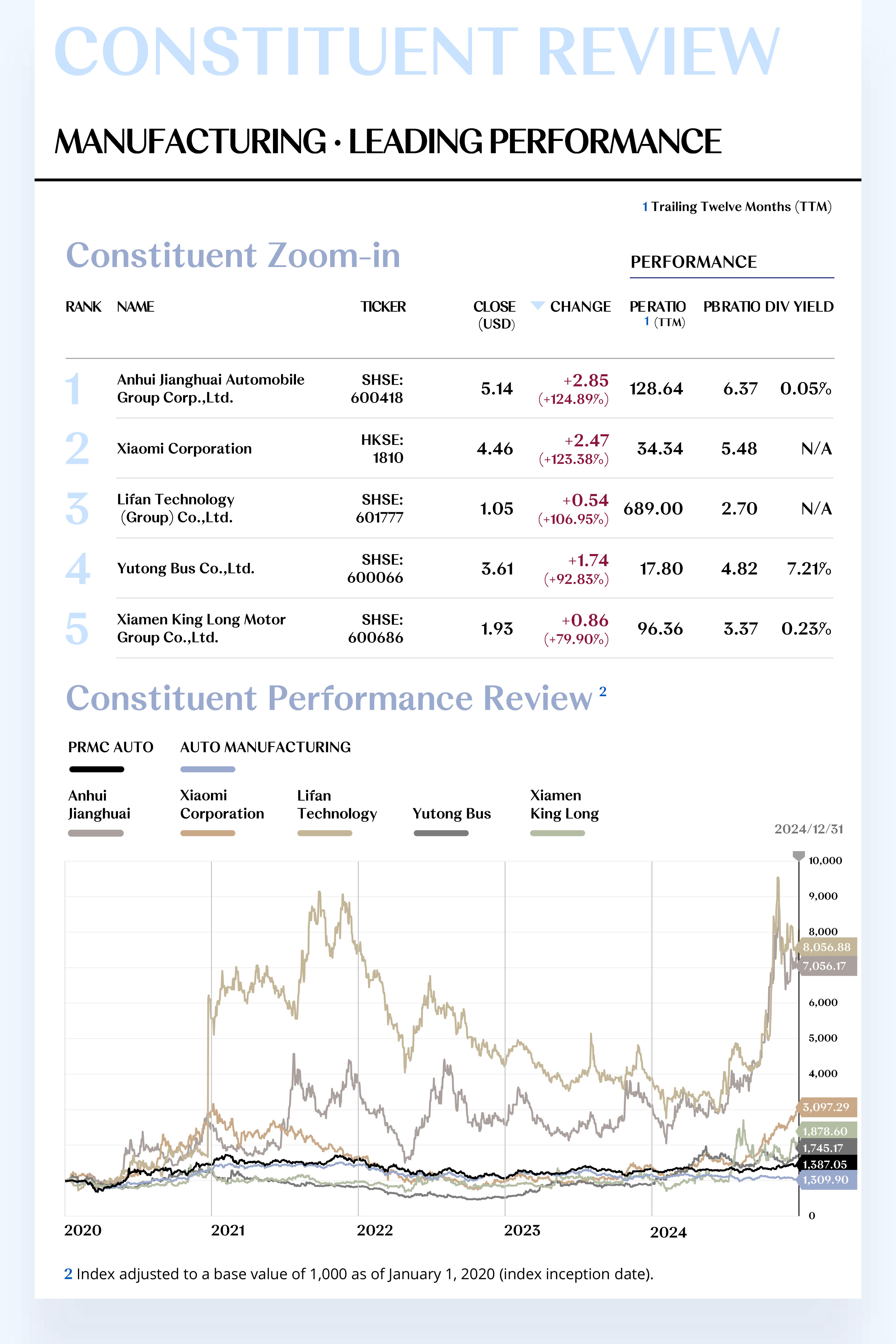

1. Anhui Jianghuai Automobile Group Corp.,Ltd.

JAC Motors is a comprehensive automotive manufacturer engaged in the research, production, and sales of commercial vehicles, passenger cars, and powertrains. Its brand portfolio includes Yiwei, Sehol, Refine, and JAC, covering a diverse range of products such as light and heavy trucks, SUVs, MPVs, and new energy vehicles (NEVs).

In 2024, JAC deepened its NEV strategy and strengthened collaborative innovation with strategic partners. On November 26, the company officially launched Zunjie, a high-end brand developed in partnership with Huawei, with its first model, Zunjie S800, debuting at the Huawei Mate Brand Event. Additionally, the Refine RF8 became the world’s first MPV equipped with Huawei’s HarmonyOS Smart Cockpit, further solidifying JAC’s technological edge in intelligent vehicles. In the commercial vehicle segment, JAC’s light truck sales remained among the top nationwide, providing a strong foundation for overall performance.

Boosted by these positive developments, JAC’s stock surged 124.89% in 2024, closing at $5.14. The launch of Zunjie S800 marks a pivotal step into the high-end intelligent EV market, leveraging the X6 platform, which supports large sedans, SUVs, and MPVs. This platform expansion is expected to open a new product cycle, driving both sales growth and brand premiumization. Recently, JAC announced plans to raise RMB 4.9 billion to develop a high-end intelligent EV platform, aiming to accelerate the rollout of next-generation smart vehicles and further optimize its NEV industry strategy.

2. Xiaomi Corporation

Xiaomi Corporation is a technology company centered on smartphones, smart hardware, and IoT platforms, with a diverse product portfolio spanning smartphones, smart home devices, wearables, and intelligent electric vehicles. In recent years, Xiaomi has aggressively expanded into the intelligent EV market, aiming to build a seamless smart mobility ecosystem.

In March 2024, Xiaomi launched its first electric vehicle, the SU7, which quickly gained market traction. Monthly sales continued to climb, with annual deliveries exceeding 130,000 units. Meanwhile, Xiaomi maintained steady performance in smartphones and rapid expansion in smart home and IoT ecosystems.

Driven by the rapid growth of its automotive business, Xiaomi’s stock surged 123.38% in 2024, closing at $4.46. Looking ahead to 2025, the all-new SUV model, SU8, is set for launch in March, while SU7 production capacity is expected to scale up, targeting 300,000 deliveries within the year. The EV business is poised to become a long-term growth driver for the group. Additionally, Xiaomi’s strong competitive edge in smart home ecosystems is expected to drive further expansion in this market.

[For more insights, please download the full report]

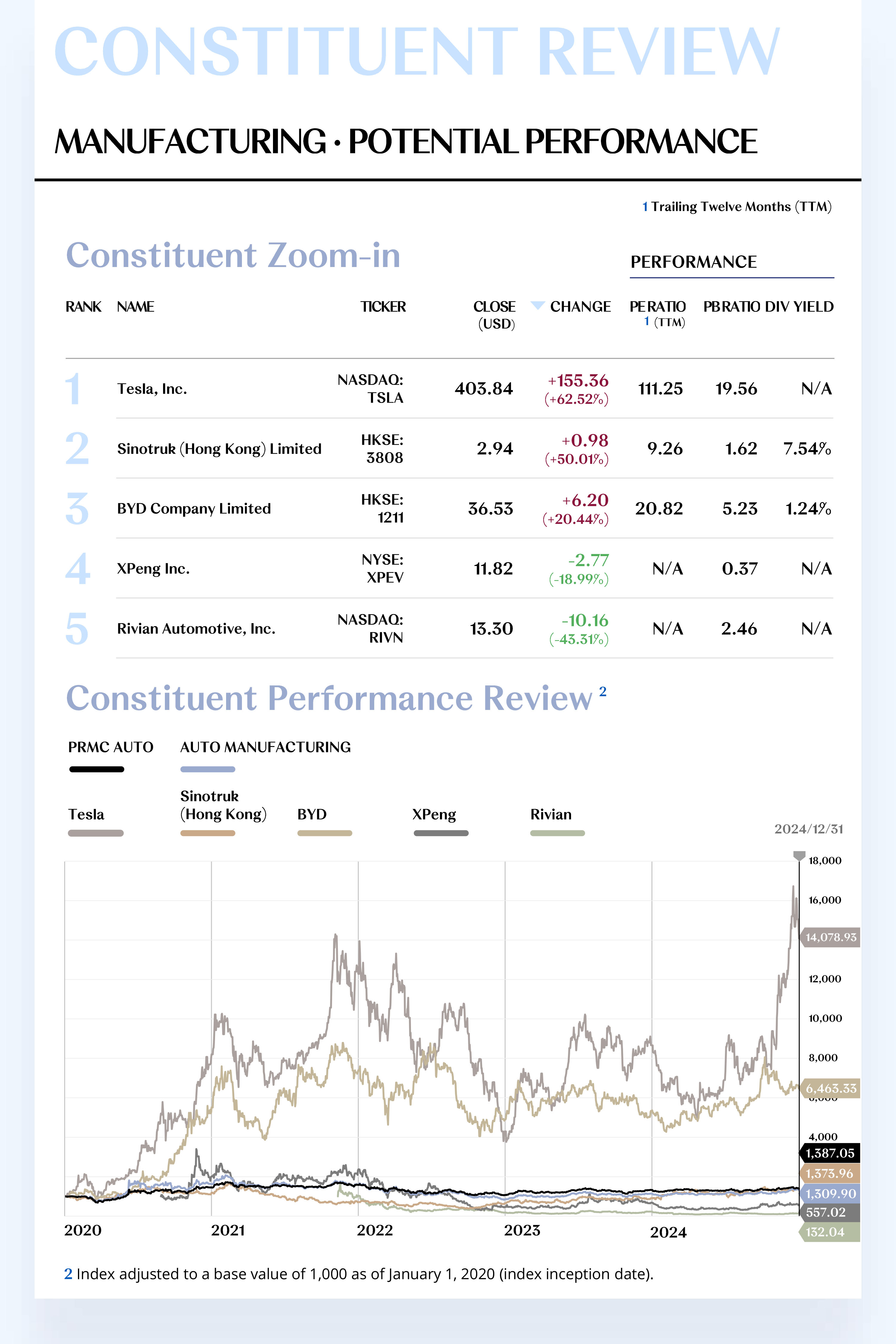

Potential Players

1. Tesla, Inc.

Tesla focuses on the design, manufacturing, and sales of electric vehicles and energy storage systems, with a product lineup that includes Model S, Model 3, Model X, and Model Y, as well as Powerwall, Powerpack, and Megapack storage solutions.

In October 2024, Tesla unveiled several innovative products and technologies at an event in California, including the autonomous Robotaxi, self-driving Robovan, and humanoid robot Optimus, highlighting its advancements in autonomous driving and artificial intelligence. In December 2024, the company released FSD (Full Self-Driving) Version 13, a major software update with a near-complete code rewrite. According to Tesla’s engineering team, FSD V13.2 significantly enhances intelligent driving capabilities, improving precise maneuvering from a parked position, reversing, and automated parking. It also optimizes image processing, speed configuration flexibility, and decision-making efficiency, further solidifying Tesla’s leadership in autonomous driving technology.

Boosted by these technological advancements and favorable policies under the new U.S. administration, Tesla’s stock surged 62.52% in 2024, closing at $403.84. In 2025, the company plans to launch more competitively priced models. Additionally, its autonomous taxi business is expected to gradually enter commercial operation, creating a new revenue stream. Notably, Elon Musk’s close ties with the new U.S. government could bring additional policy incentives, further strengthening Tesla’s market position in new energy and smart driving technologies.

2. Sinotruk (Hong Kong) Limited

Sinotruk (Hong Kong) Limited specializes in the R&D, manufacturing, and sales of heavy-duty, medium-duty, and light trucks, buses, and key components. The company operates well-known brands, including Huanghe, Sitrak, and Howo, with products widely used in logistics and infrastructure construction.

In 2024, Sinotruk made significant strides in the new energy truck segment, launching multiple electric and hydrogen-powered heavy trucks. The company sold 245,031 units, achieving a 4.6% year-over-year increase. For the first three quarters of 2024, revenue reached RMB 33.59 billion, up 9.2%, while net profit attributable to shareholders rose 42.5% to RMB 930 million. Excluding non-recurring items, net profit increased 34.1% to RMB 860 million.

[For more insights, please download the full report]

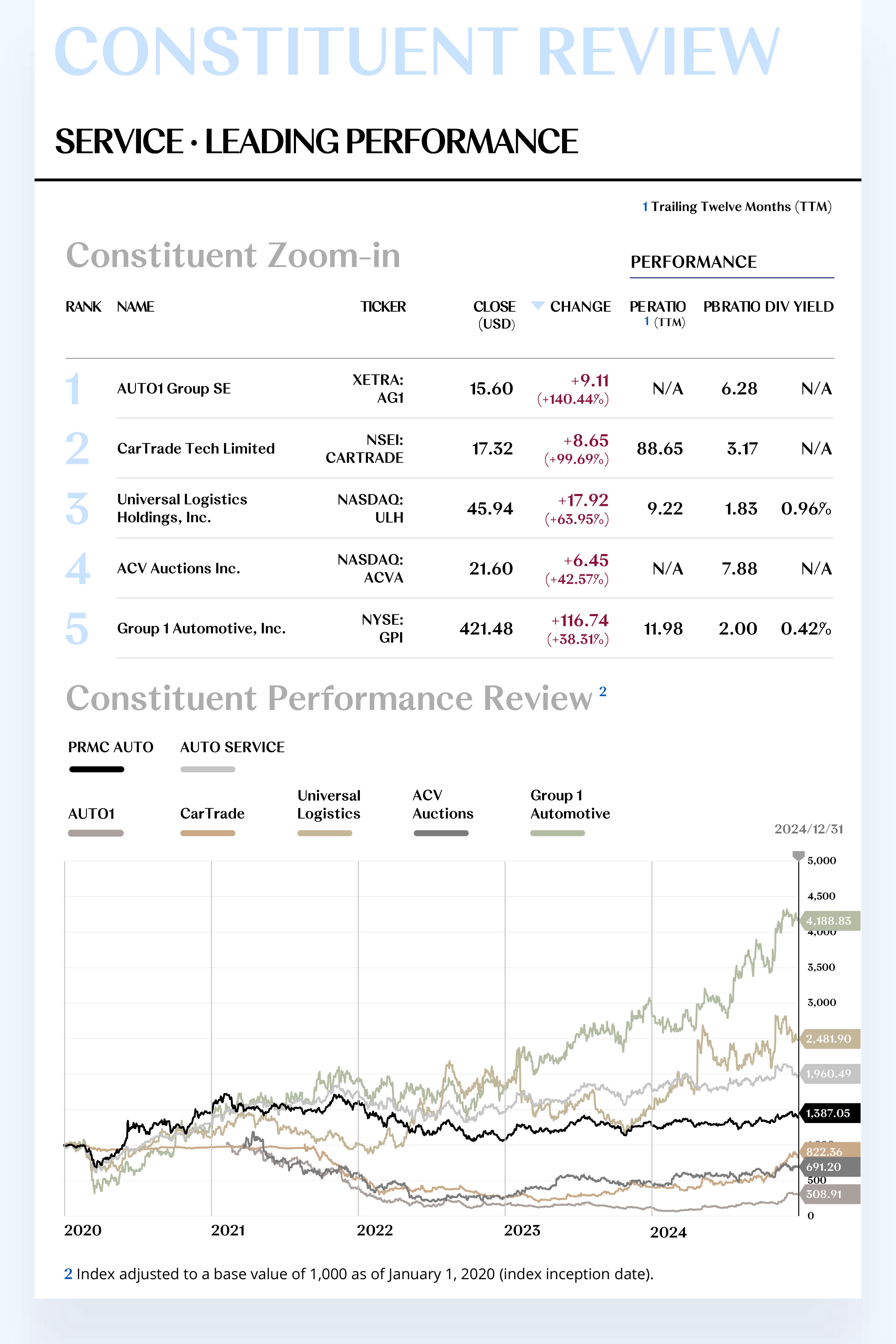

AUTO SERVICE CONSTITUENT ZOOM-IN

Improved Earnings, Coupled with Dividend Payouts,

Reinforcing A Positive Cycle of Investor Confidence

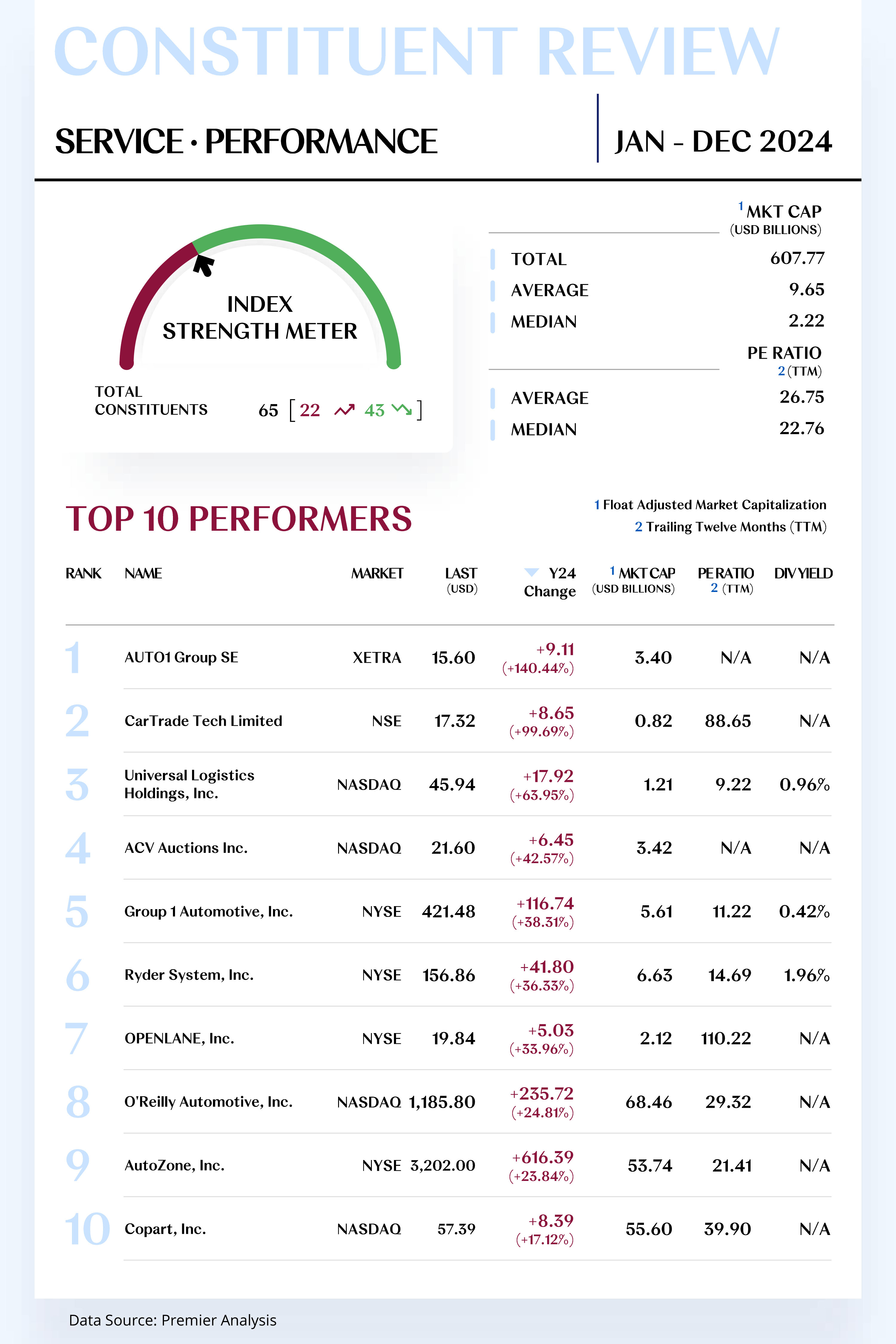

The Auto Service Index comprises 65 stocks, with 22 rising and 43 declining.

Leading Performers

1. AUTO1 Group SE

AUTO1 focuses on creating a seamless online platform for buying, selling, and financing used cars. Through brands like Autohero, the company offers fast and convenient transaction services for both consumers and dealers.

In 2024, AUTO1’s strong financial performance and improved market outlook drove a significant stock rally. The company projected adjusted EBITDA breakeven for the first time, signaling enhanced operational efficiency and profitability. Additionally, strategic initiatives such as cost optimization, higher unit margins, and accelerated market share growth in the Merchant segment further strengthened investor confidence.

As a result, AUTO1’s stock surged 140.44% in 2024, closing at $15.60. Looking ahead to 2025, AUTO1’s EBITDA performance is expected to exceed market expectations. The company aims to accelerate Merchant segment growth through strategies such as expanding its encrypted branch network and increasing online penetration.

2. CarTrade Tech Limited

CarTrade Tech operates across multiple vehicle categories and value-added services, managing a diverse portfolio of brands, including CarWale, CarTrade, Shriram Automall, BikeWale, CarTradeExchange, Adroit Auto, and OLX India. Through these platforms, the company provides a comprehensive digital automotive ecosystem for consumers, dealers, banks, and insurance companies.

In Q2 2024, CarTrade Tech delivered results exceeding market expectations, with EBITDA surpassing forecasts by 20%. The company also strengthened its digital marketing strategies and platform capabilities, further solidifying its leadership in the online automotive market.

CarTrade Tech’s stock surged 199.69% in 2024, closing at $17.32. Looking ahead to 2025, the stock is expected to maintain its upward trajectory, driven by ongoing technological advancements and targeted marketing efforts to expand its customer base and market share. Additionally, with the continued growth of India’s automotive market, CarTrade Tech is well-positioned to achieve sustained revenue growth, leveraging its multi-brand strategy and strong platform capabilities. The better-than-expected profitability of its independent consumer business, along with effective cost management in used car sales and OLX operations, is expected to further support its financial performance.

[For more insights, please download the full report]

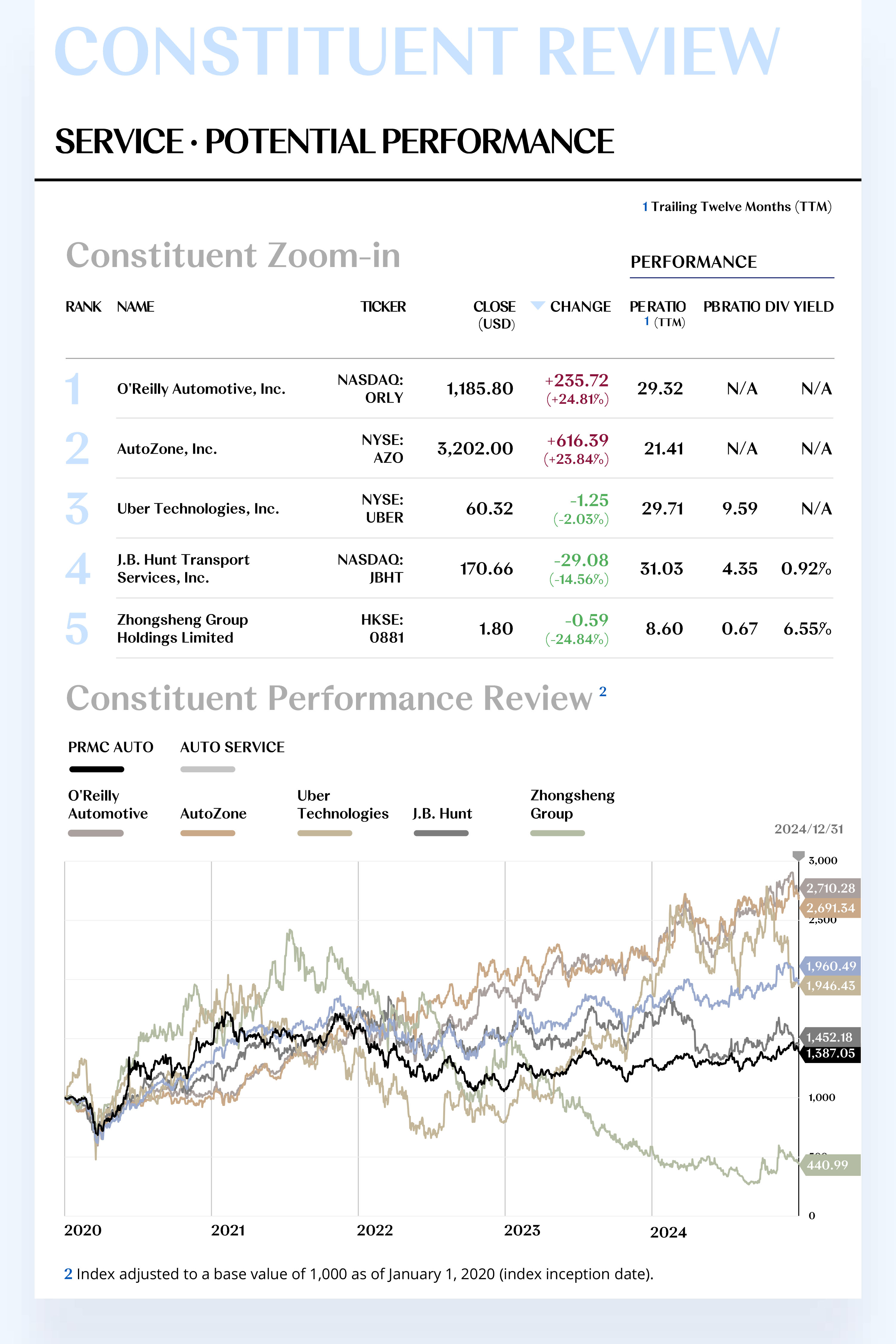

Potential Players

1. O'Reilly Automotive, Inc.

O'Reilly Automotive is a leading automotive aftermarket parts supplier, specializing in the retail and distribution of auto parts, tools, equipment, and accessories. With an extensive sales network across the United States, the company serves both professional repair technicians and DIY vehicle owners, offering a comprehensive selection of parts for various makes and models.

In Q3 2024, O'Reilly delivered strong performance, with comparable store sales outperforming competitors, showcasing market resilience, despite EPS coming in slightly below expectations. Additionally, the company expanded its share repurchase program by $2 billion, signaling confidence in its future growth and contributing to stock price appreciation.

As a result, O'Reilly’s stock rose 24.81% in 2024, closing at $1,185.80. Looking ahead to 2025, the company expects 8%-10% revenue growth, driven by continued store expansion and stable same-store sales. Furthermore, with cost control initiatives and product mix optimization, net profit margins are projected to remain between 15%-17%. O'Reilly also plans to expand its market presence by opening new stores in additional regions, creating further growth opportunities and reinforcing stock performance.

2. AutoZone, Inc.

AutoZone is a leading automotive aftermarket retailer and distributor, specializing in replacement parts and accessories for cars, SUVs, vans, and light trucks. Its product offerings include new and remanufactured auto components, repair items, accessories, and non-automotive products.

In Q1 2024, AutoZone reported 2% year-over-year revenue growth, reaching $4.28 billion. Although slightly below analyst expectations, the company maintained a steady growth trajectory. Additionally, AutoZone announced a $1.5 billion share repurchase program, aimed at enhancing EPS and driving stock performance. By optimizing supply chains and improving operational efficiency, the company sustained strong profit margins, earning an overweight rating from Morgan Stanley and other institutions.

As a result, AutoZone’s stock rose 23.84% in 2024, closing at $3,202.00. Looking ahead to 2025, the company anticipates modest sales improvement in Q1, with stronger performance in Q2 and Q3. AutoZone also plans to expand its international presence, targeting 200 new store openings annually by 2028. Additionally, the appointment of Kenneth Jaycox as Senior Vice President, overseeing commercial and customer satisfaction, is expected to further enhance customer experience and drive business growth.

[For more insights, please download the full report]

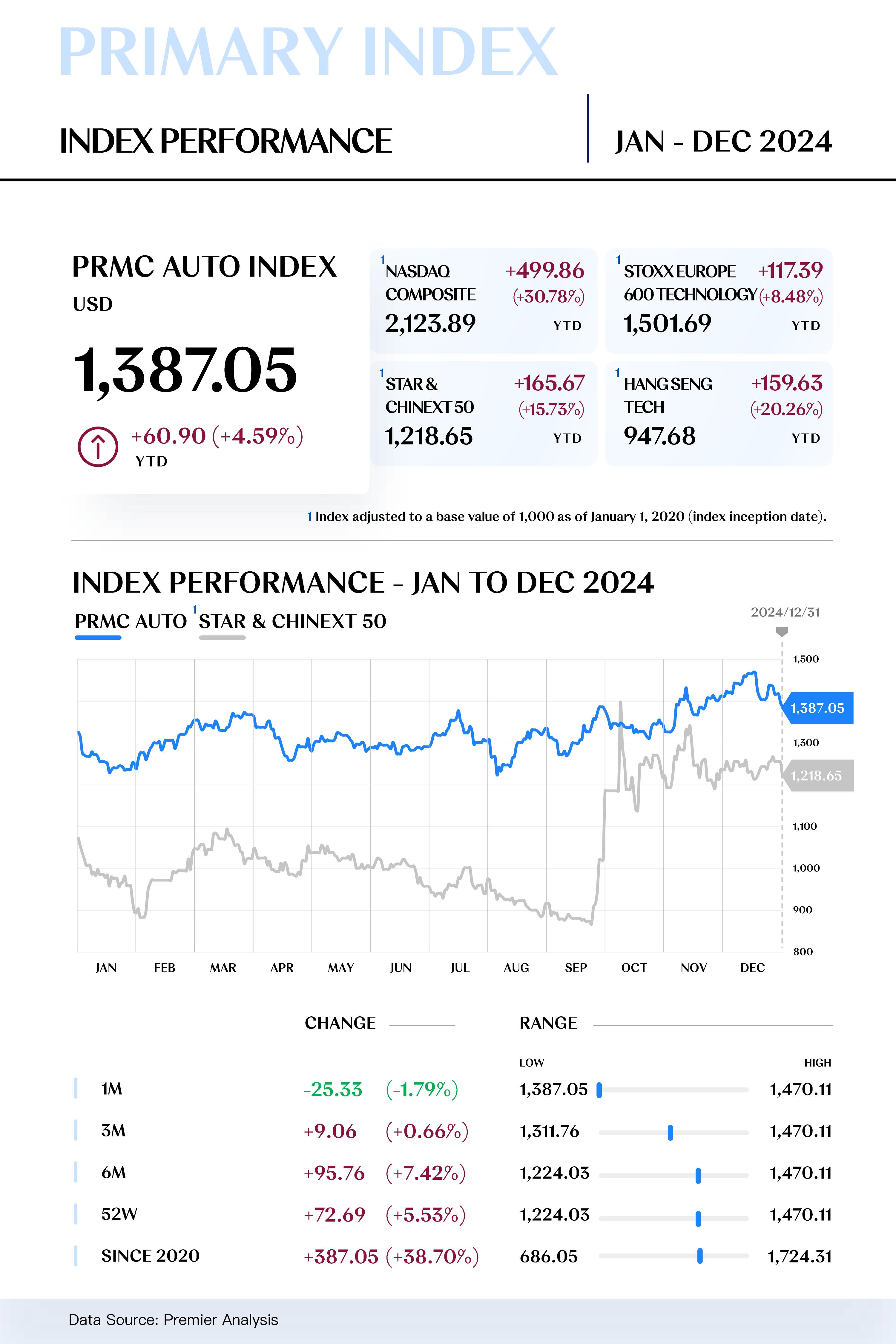

PRIMARY INDEX REVIEW & PROSPECT

Early Dip Followed by Recovery,

Mid-year Fluctuations,

And A Policy-driven Surge toward Year-end

In 2024, PRMC Auto Index closed at 1,387.05, up 60.90 from the beginning of the year, representing a year-on-year increase of 4.59%. The index’s performance throughout the year can be divided into three distinct phases:

Phase 1: Jan – Mar 2024

At the start of the year, weak U.S. manufacturing and employment data raised concerns about an economic downturn, fueling risk-averse sentiment and pressuring global equities. Meanwhile, the Federal Reserve’s December 2023 meeting minutes signaled a cautious stance on rate cuts, dampening market expectations and triggering a January pullback. In China, structural economic issues and weak investor confidence led to sharp stock market declines, further weighing on the index.

From February to March, strong U.S. non-farm payroll data and a PMI rebound into expansion territory signaled an economic recovery, boosting market sentiment. The European Central Bank (ECB) slowed rate hikes and adopted a more optimistic inflation outlook, while the People’s Bank of China (PBoC) implemented a 0.25 percentage point reserve requirement ratio (RRR) cut, injecting long-term liquidity and lowering corporate financing costs. These factors collectively stabilized the index and drove a gradual recovery.

Phase 2: Apr – Jul 2024

In April, escalating geopolitical tensions rattled markets. Israel’s airstrike on Iran’s embassy in Syria heightened Middle East tensions, while Ukraine’s new conscription law intensified military confrontation with Russia, escalating the Russia-Ukraine conflict. These events fueled market volatility, leading to a three-week decline in the PRMC Automotive Index, which only began to recover by late April as tensions eased.

From May to June, tariff hikes on NEV imports by the U.S. and Europe, coupled with a slowdown in EV sales growth, triggered short-term fluctuations in the index, though overall stability remained intact. In July, the ECB’s rate cuts began to take effect, fueling optimism in European equities. Additionally, key automakers reported better-than-expected earnings, lifting investor sentiment and propelling the index to a year-to-date high. However, in late July, the Bank of Japan unexpectedly ended its long-standing ultra-loose monetary policy, sparking concerns over global liquidity tightening and causing the index to retreat in the following weeks.

Phase 3: Aug – Dec 2024

From August to September, major central banks shifted toward monetary easing. In September, the Federal Reserve implemented its first rate cut in years, lowering the federal funds rate to 4.75%-5.00%. The European Central Bank (ECB) followed suit, cutting the deposit facility rate by 25 basis points to 3.5%, after an initial rate reduction in June. Meanwhile, China introduced a series of stimulus measures, including a broad-based reserve requirement ratio (RRR) cut, adjustments to mortgage rates, and lower down payment requirements. These policies eased market concerns over economic downturns, fueling a steady recovery in the PRMC Automotive Index.

From October to December, the Fed and ECB continued their rate-cutting cycles. The Fed lowered rates by 25 basis points in both November and December, while the ECB also cut rates in October and December. Additionally, China ramped up its "trade-in" incentives for automobiles, boosting consumer demand for new energy vehicles (NEVs). Driven by monetary easing and supportive policies, the PRMC Automotive Index surged to its highest level of the year by year-end. Although December saw a slight pullback, the index remained above its starting level for the year.

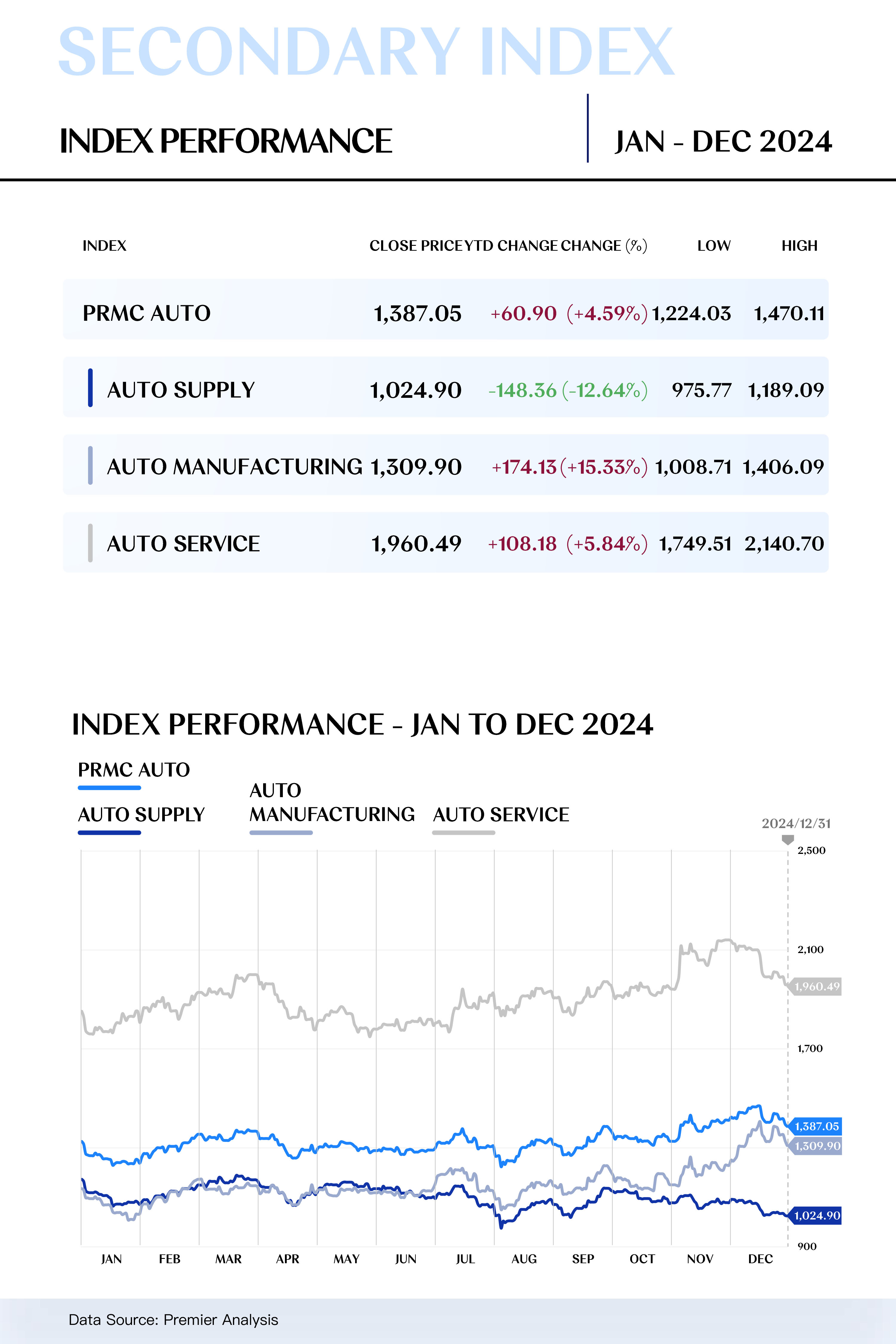

SECONDARY INDEX REVIEW & PROSPECT

upply Index Declines amid Volatility,

While Manufacturing & Service Index Show Steady Gains

The Auto Supply Index closed at 1,024.90, marking a 148.36 decline from the beginning of the year, down 12.64% year-over-year, making it the worst-performing sub-index of the year. Industry-wide price competition and cost pressures from automakers significantly squeezed upstream companies' profit margins, leading to persistent declines and volatility throughout the year. In December, raw material price fluctuations and weakening market demand further dragged the index lower, cementing its underperformance for the year.

The Auto Manufacturing Index delivered a strong performance, closing at 1,309.90, up 174.13, or 15.33% year-over-year, making it the best-performing sub-index of 2024. The Chinese central and local governments’ enhanced "trade-in" and purchase subsidies provided substantial support to midstream companies. Additionally, emerging trends in low-altitude economy and humanoid robotics created new market opportunities. The index entered an upward trajectory in July, driven by both policy incentives and rising market demand, reaching its highest point in December.

The Auto Service Index closed at 1,960.49, rising 108.18, or 5.84% year-over-year, demonstrating steady growth. The commercialization of Robotaxi and expansion of shared mobility fueled strong market demand, keeping the index on a gradual upward trend. Notably, in late November, corporate advancements in smart mobility and service innovation propelled the index to its annual peak, highlighting the resilience and potential of the downstream consumer market.

Looking ahead to the performance of secondary indices in Q1 2025, upstream enterprises are expected to remain under pressure due to ongoing cost constraints faced by automakers and fluctuations in raw material prices, leaving little room for short-term profit expansion. As a result, the upstream automotive index is likely to hover at a low level.

In the midstream sector, policies promoting vehicle trade-ins, alongside emerging trends such as the low-altitude economy and intelligent manufacturing, may sustain strong market sentiment at the start of the quarter. However, as policy effects gradually diminish and corporate earnings expectations adjust, a certain degree of correction in the index may follow.

For the downstream index, the accelerating commercialization of Robotaxi services and the continued growth of the shared economy will support market resilience. Nevertheless, uncertainties in consumer spending behavior and the pace of intelligent technology adoption could introduce short-term market volatility.

.jpg)

24/25 PRMC Automotive Index

Review & Prospect

Feb 02, 2026

Offering investors fresh perspective, seizing short-term volatility, and positioning for long-term growth in the automotive sector.

Intelligence Powers New Momentum,

Value Anchors the Future

In 2024, the automotive industry index reflected a complex landscape shaped by policy shifts, technological evolution, and capital dynamics. From the rising global penetration of new energy vehicles to the brink of large-scale adoption of intelligent driving technologies, market fluctuations underscored the sector’s deep transformation. The convergence of technological and product cycles drove valuation gains for select automakers, while industry leaders—especially in smart components and foundational hardware for electrification and robotics—demonstrated clear competitive advantages in niche segments.

Looking ahead to 2025, the industry stands at the intersection of globalization and regionalization, with electrification and intelligence remaining the primary drivers of index growth. However, market divergence will become more pronounced. Investment strategies will shift from short-term domestic market share expansion to long-term category diversification (e.g., low-altitude economy, humanoid robotics) and sustained growth in overseas markets. Companies benefiting from synchronized technology and product cycles are expected to outperform, driving index momentum.

For investors, 2025 will be a pivotal year to balance value and growth with strategic precision. From upstream resource consolidation to midstream intelligent manufacturing and downstream consumption upgrades, opportunities arising from supply chain localization and smart manufacturing will span the entire industry. Leading players in electrification and intelligence, leveraging both domestic expansion and global value chain integration, will emerge as key capital market favorites.

During this critical window, Premier focuses on key component stocks within the PRMC Automotive Index’s three sub-indices—Auto Supply (upstream), Auto Manufacturing (midstream), and Auto Service (downstream)—complemented by index trend analysis. This approach aims to provide investors with fresh perspectives, capturing short-term opportunities while strategically positioning for long-term growth.