BYD Holds Steady with Pragmatic Resolve for Its Century-Long Journey Amid Global Competition

BYD Holds Steady with Pragmatic Resolve for Its Century-Long Journey Amid Global Competition

Highlighting product and tech shifts at the Shanghai Auto Show, BYD’s ESOP practices, and a pragmatic organizational path—offering strategic direction for Chinese firms aiming for long-term success.

Under the spotlight of the 2025 Shanghai Auto Exhibition, the global automotive industry once again witnessed a clash between legacy giants and emerging players. This event is not only a battleground for new technological paradigms and product architectures, but also a mirror reflecting the profound shifts in industry power dynamics amid the ongoing reshaping of the global value chain.

Undeniably, within this cycle of transformation, Chinese automotive brands are progressing from “manufacturing participants” to “industry definers.”

Among them, BYD is undergoing a powerful evolution—from a cost and scale-driven growth model to one driven by high value-added growth—underpinned by its deep integration across the automotive value chain, exceptional financial resilience, and rapidly escalating brand equity. At the heart of this transformation lies a new value curve guided by pragmatic principles. More than just a growth strategy, it is a blueprint for building a century-lasting enterprise—one that contributes a defining chapter to the global rise of Chinese manufacturing.

Against the backdrop of profound global market segmentation and the reshaping of geopolitical structures, corporate leaders around the world are confronting an inescapable strategic challenge: how to achieve sustainable, high-quality growth at the convergence of industry turbulence and accelerated technological change—navigating cyclical fluctuations while maintaining a long-term outlook.

Simultaneously, driven by the national 15th “Five-Year Plan”, China’s economy is entering a new phase powered by “new quality productive forces.” The core mandate is clear: to drive the transformation and upgrading of traditional industries, foster emerging sectors, and strategically position future industries. This transformation is led by technological innovation and underpinned by the real economy. It is not merely an optimization of efficiency and cost, but a comprehensive enhancement of Total Factor Productivity (TFP)—encompassing technological progress, efficiency improvements, resource intensification, and systematic restructuring of factor allocation efficiency.

As a strategic industry characterized by high technological complexity, capital intensity, strong brand influence, and robust consumer momentum, the automotive sector naturally serves as a critical testing ground for enhancing Total Factor Productivity. This sector not only challenges companies to integrate technological innovation with efficiency optimization but also demands breakthrough advances in resource allocation, supply chain coordination, and organizational governance.

BYD, as the frontrunner of China’s automotive industry, has taken the lead in this new race. Guided by pragmatic principles, BYD has achieved multi-dimensional synergies in product architecture, technological stack deployment, organizational governance, and financial modeling—thereby establishing a comprehensive value creation ecosystem that spans from “manufacturing” to “value.” Its intrinsic dynamism is derived from a profound understanding of value creation, precise control over end-to-end efficiency, and a systematic approach to building organizational resilience and long-term competitiveness.

In an era where global enterprises are re-evaluating the logic of “enduring enterprises,” long-term value creation is emerging as an increasingly scarce competitive asset compared to short-term bursts of performance. For Chinese companies, building a century-long legacy is no longer an abstract vision. BYD is exemplifying the hallmark of a world-class giant through its systematic capabilities: establishing its foundation on pragmatism and pursuing enduring success through resilience.

Within this context, Premier seeks to deconstruct BYD’s trajectory of transformation from a multifaceted perspective, distilling its strategic steadfastness, financial performance momentum, and talent aggregation capabilities. Moreover, the analysis offers insights through an “organizational resilience framework characterized by pragmatism,” intended to guide and support the development of more enduring automotive enterprises:

1. From Participants to Definers: The New Landscape of Automotive Products and Technologies at the Shanghai Auto Exhibition

2. From Business Gains to Organizational Momentum: Insights into BYD’s ESOP Incentive Practices

3. From Pragmatism to Value Alignment: Forging a Century-Lasting Organizational Foundation

SECTION1

From Participants to Definers

The New Landscape of Automotive Products and Technologies at the Shanghai Auto Exhibition

In April 2025, the 21st Shanghai International Automobile Industry Exhibition opened to great anticipation. As a premier global auto exhibition, it not only drew the attention of top international automakers but also served as a key stage for Chinese automotive power to assert itself globally. While major OEMs showcased their latest innovations on the show floor, a deeper competition unfolded offstage—one concerning the global industry's narrative authority and future leadership.

East–West Showdown Intensifies:

Traditional Giants Strategize a Comeback, While Chinese Players Anchor the Market

In recent years, China’s NEV (New Energy Vehicle) industrial chain has matured rapidly, alongside consistent breakthroughs in complete vehicle development. As a result, "Made in China" is now firmly positioned at the center of the global automotive stage. From surging sales and technology exports to global brand expansion and overseas manufacturing, Chinese automakers are steadily expanding their international footprint. The 2025 Shanghai Auto Exhibition became a major battleground where Eastern and Western automakers unveiled their strategic arsenals.

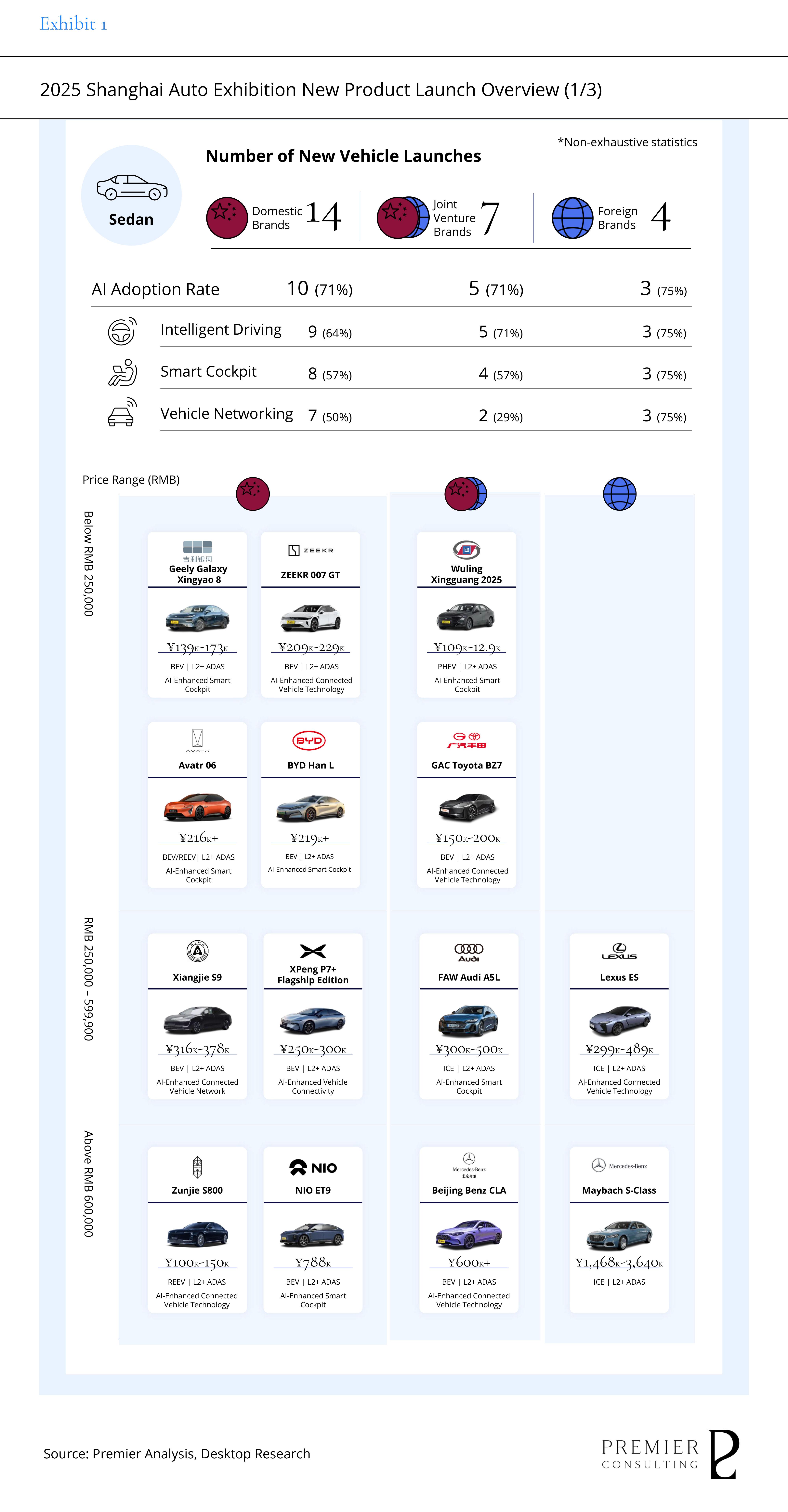

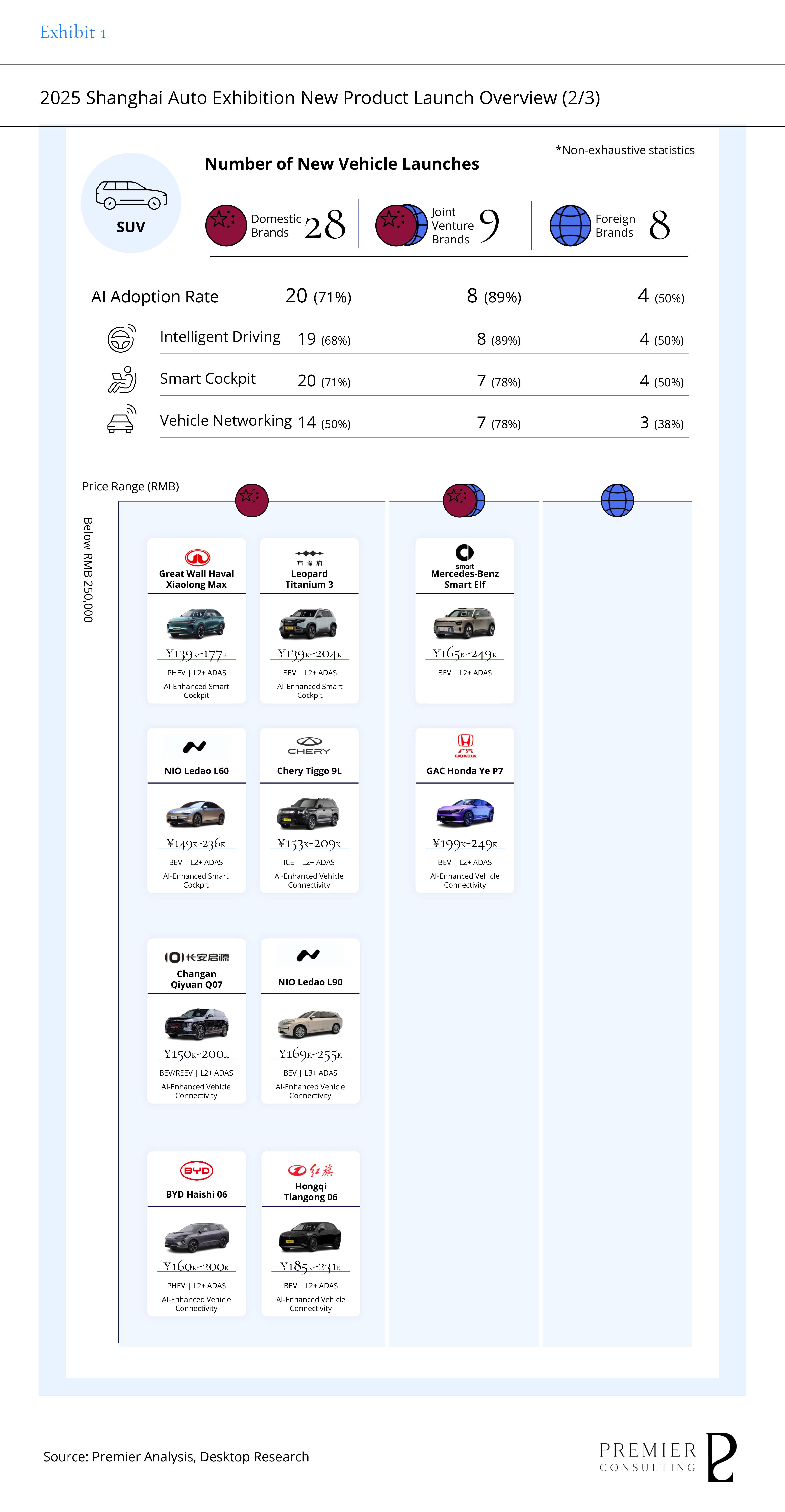

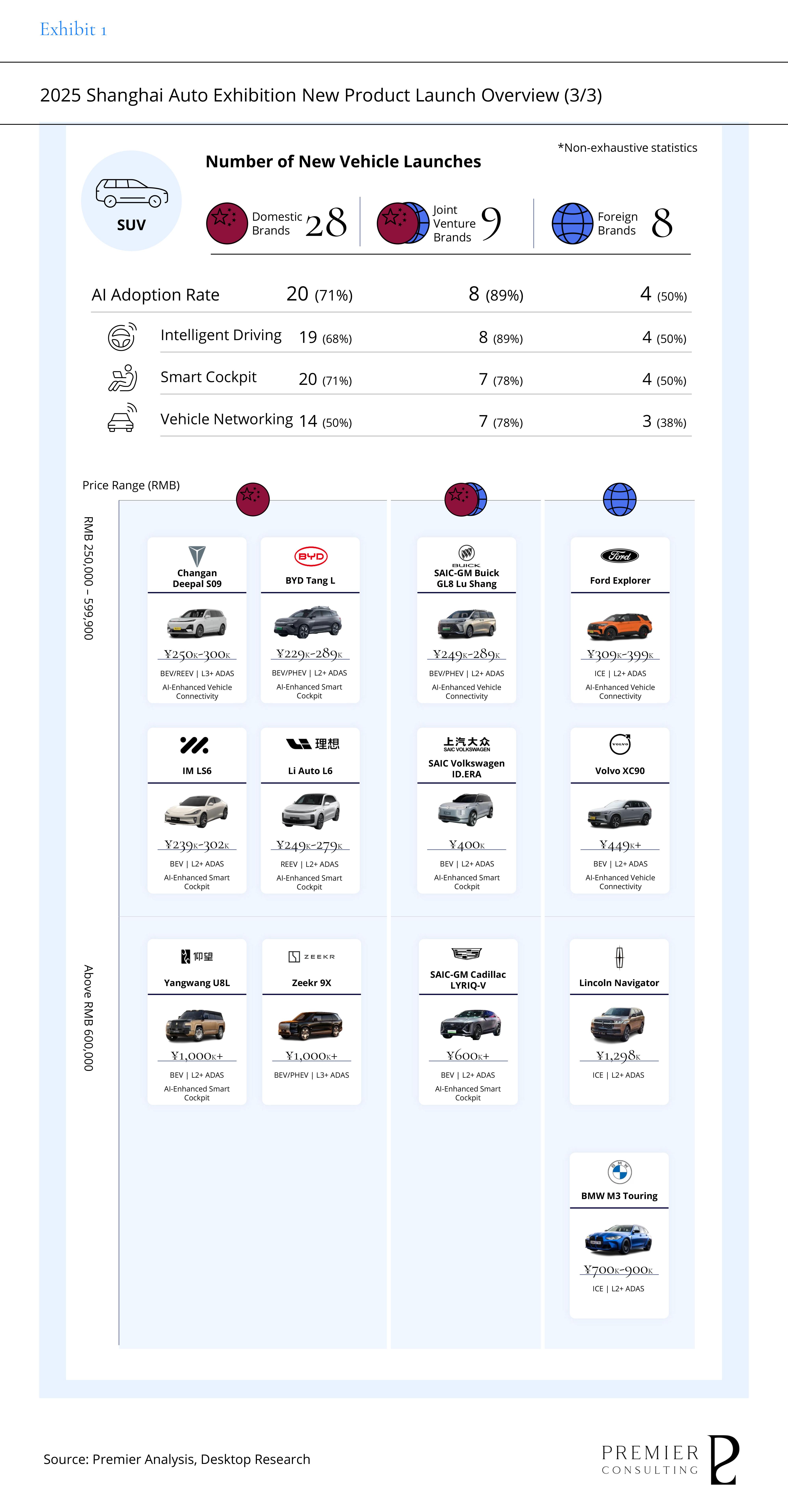

According to Premier’s analysis, over 80 new models were launched during the exhibition, with vehicles priced below RMB 250,000 and those in the RMB 250,000–600,000 mid-to-high-end segment forming the primary arenas of competition. Chinese brands accounted for more than half of the launches.

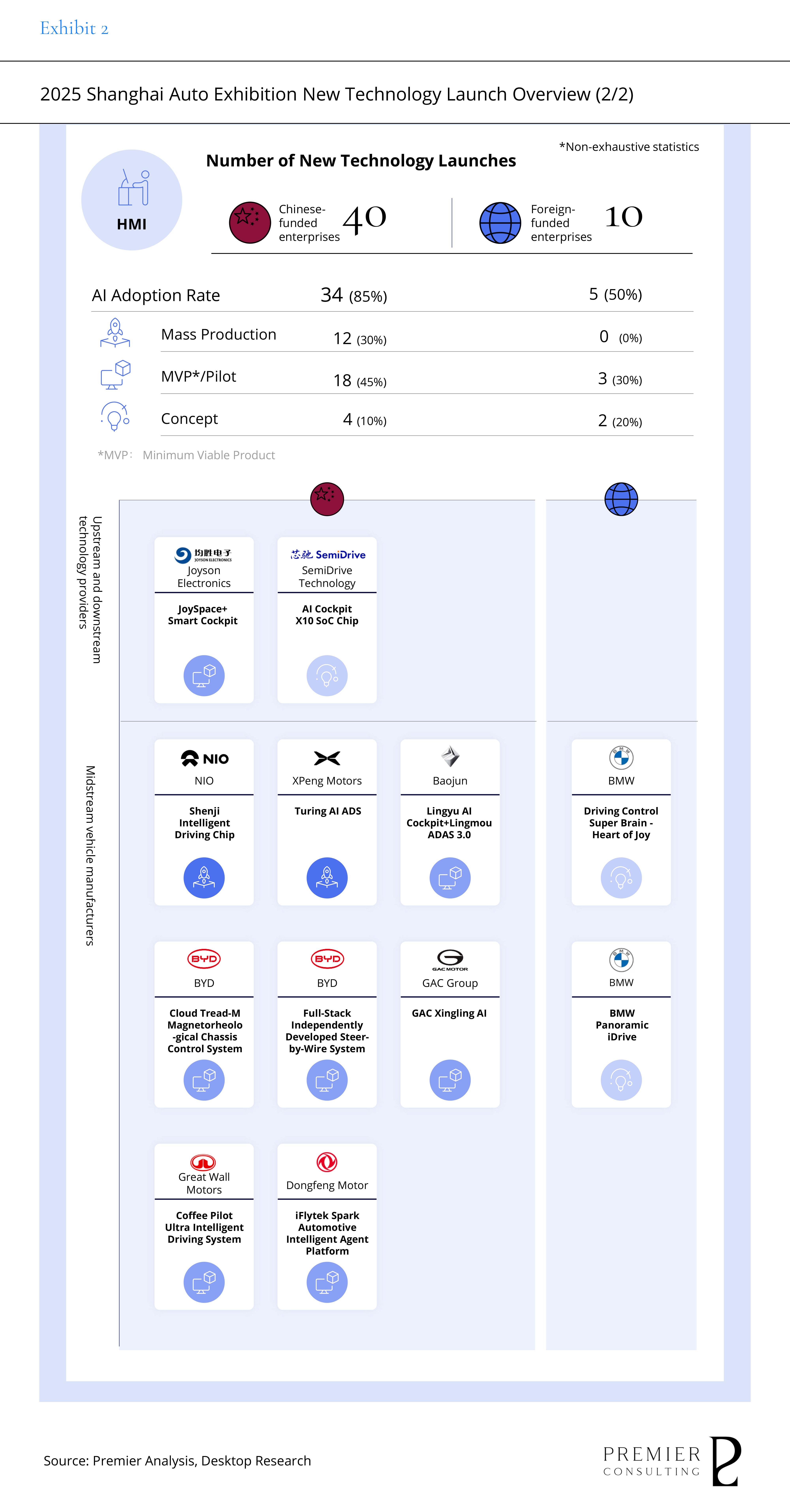

AI applications were integrated into over 70% of the newly released models, with smart driving and intelligent cockpit technologies remaining key areas of focus. The adoption of vehicle-to-everything (V2X) connectivity also saw notable growth. With the systematic rollout of full-stack technologies, automotive intelligence is evolving beyond isolated features, moving rapidly toward deep integration and system-wide coordination at the vehicle architecture level.

It is evident that Western OEMs leveraged the auto show as a pivotal opportunity to regain ground in the NEV segment, seeking to reassert influence in China through narratives of “safe return” and “local commitment.”

· Toyota: Leading with Trust, Rebuilding Its Local Technology Ecosystem

As the world’s largest automaker, Toyota made a high-profile appearance at this year’s Shanghai Auto Exhibition under the theme “Global Leadership, Rooted in China,” alongside its joint ventures—FAW Toyota, GAC Toyota, and Lexus—signaling unprecedented strategic emphasis on the Chinese market. A centerpiece of its presentation was the global debut of the bZ7, a mid-to-high-end all-electric SUV priced between RMB 250,000 and 599,900. Positioned around the themes of “safety, trust, and advanced technology,” the model exemplifies the new-generation offerings from joint venture brands (see Exhibit on JV-brand SUV launches).

Of greater strategic significance, however, is Toyota’s shift from product-level focus to a broader reconfiguration of its local R&D system. Through its “One R&D” initiative, the company is consolidating its research capabilities in China and, for the first time, introducing a regional chief engineer (RCE) model. This move aligns closely with the upward trend in the “local technology contribution ratio” shown in the exhibit—indicating a pivot from a global-import model toward a locally driven innovation pathway. The goal is to shorten product development cycles and better align with China’s rapid transition to intelligent vehicles.

Chinese Automakers Ascend:

From Full-Stack AI to Global Strategies

By contrast, Chinese carmakers showcased a pragmatic, results-driven approach—broad product coverage, robust technology, and clearly articulated narratives. Moving beyond earlier tendencies of flashy feature stacking, today’s Chinese brands are prioritizing scenario-based practicality, system integration, and mature deployment. Leading players such as BYD, Geely, Chery, and NIO presented a cohesive showcase of “Tech Made in China.”

· BYD: Strategic Discipline and Technical Depth Cement Its Central Role

As a centerpiece of the show, BYD launched five new models under its Ocean series, spanning both pure electric and plug-in hybrid platforms. These vehicles showcased aesthetic and technological evolution through “Marine Aesthetics” and the fifth-generation DM technology, contributing significantly to the SUV and sedan categories of Chinese-branded red/blue-label vehicles featured in the infographics. High-end sub-brand Denza debuted the Denza Z concept sports car, signaling its move toward premium positioning, while luxury brand Yangwang unveiled the U8L—a six-seat SUV with a 3250mm ultra-long wheelbase and gold detailing—highlighting a fusion of high performance and technological luxury.

Rather than chasing the trend of full-autonomous driving, BYD focused on practical AI systems such as its DiPilot driver-assistance platform and Cloud Chassis active suspension system. These grounded innovations form part of the “moderate deployment” section of the smart features matrix, positioning BYD as a brand building “trustable intelligence” through practical functionality.

Looking back on Auto Shanghai 2025, Western automotive giants sought new footholds in trust and localization, while Chinese automakers took confident strides onto the global stage through technological and organizational capabilities. This show was not just about new cars and technologies—it served as a bellwether for the industry’s future.

BYD’s standout performance exemplifies the broader leap of Chinese automotive strength. Innovation is no longer a fragmented collection of components but a system guided by strategy. Brand image is no longer a single label but a comprehensive cognitive reconstruction spanning products and organization.

It is now evident that the next global leader in the auto industry will not be a “brand,” but a “journey.”

Chinese automakers, with solid products and technology, are not just contenders—they are leading the journey into the future.

SECTION2

From Business Gains to Organizational Momentum

Insights into BYD’s ESOP Incentive Practices

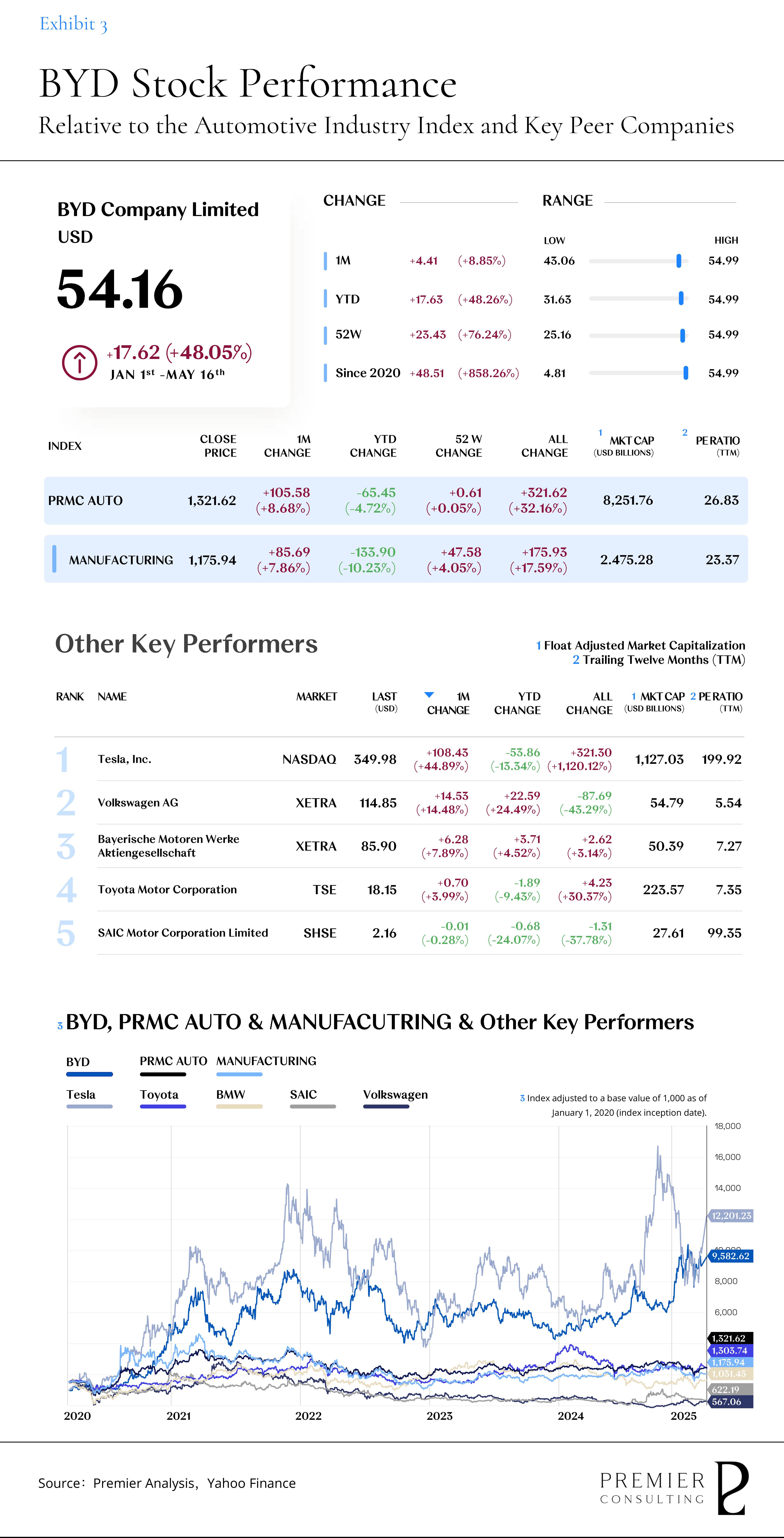

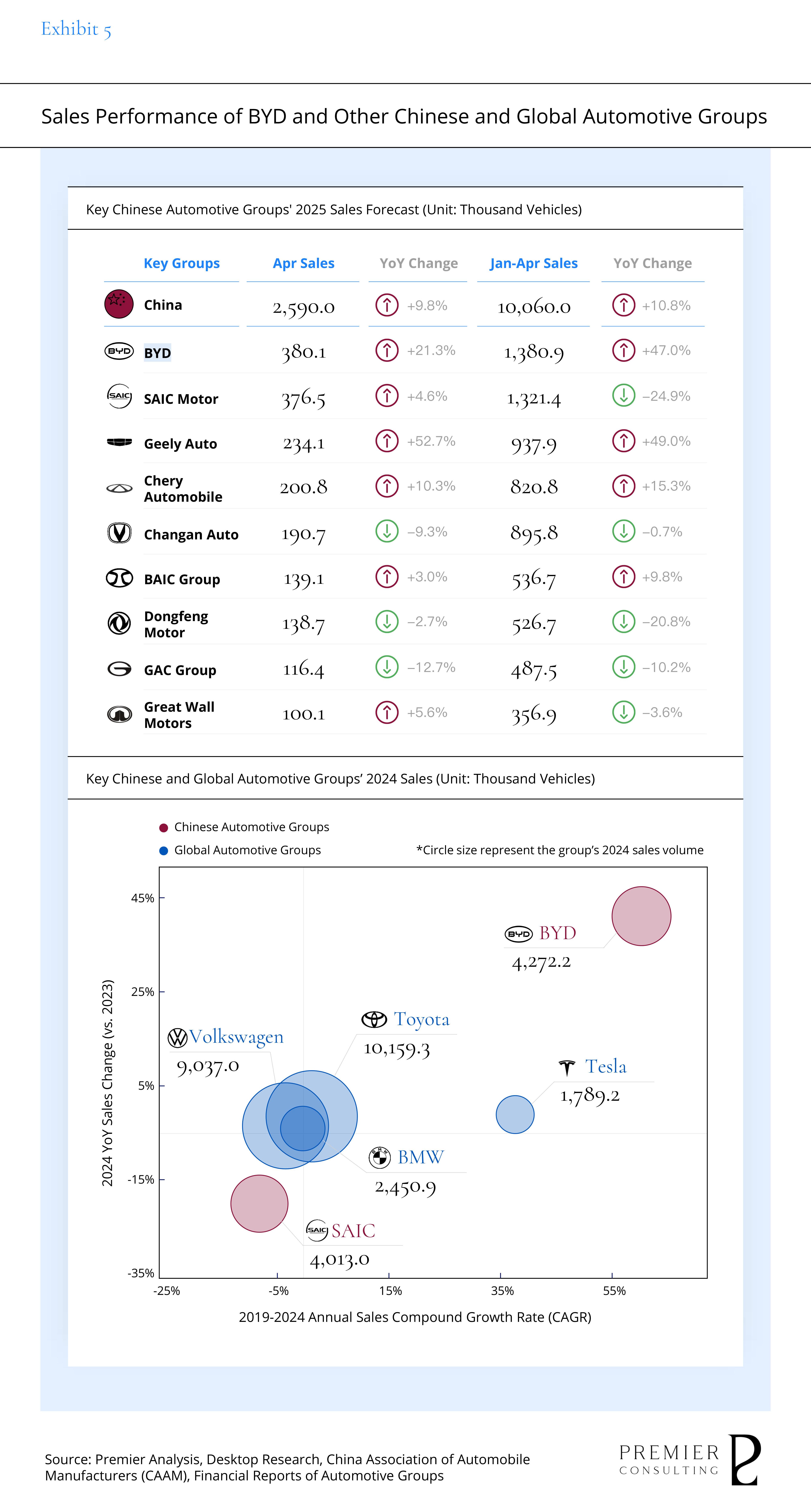

Since the beginning of 2025, BYD has continued its strong performance in the secondary market as a leading force in China’s automotive industry. Its stock price has steadily risen, significantly outperforming the PRMC Auto Index. Compared with the flat or declining stock trends of traditional automakers such as SAIC Motor, Toyota, and BMW, BYD’s cumulative increase has been particularly notable.

As of now, BYD ranks among the top global automakers in terms of market capitalization, second only to Tesla and Toyota, and far ahead of legacy players like Volkswagen, Mercedes-Benz, and BMW. It has emerged as a representative of the “China journey” that is reshaping global industry paradigms.

This performance reflects not only the structural tailwinds of the rising new energy cycle, but also BYD’s consistently better-than-expected sales and profitability. In the context of an accelerating industrial transition, the capital market is increasingly rewarding industry leaders with proprietary technology and system integration capabilities with higher valuation premiums.

· Leading Financial Performance with Clear Competitive Edge

In Q1 2025, BYD continued to deliver robust growth momentum, with nearly 1 million units sold—an approximate 60% year-on-year increase. Revenue rose 36% YoY to RMB 170.36 billion, while net profit doubled to RMB 9.16 billion. Key financial indicators improved steadily, with both gross margin and net margin significantly outperforming the domestic industry average, underscoring BYD’s systemic advantage in profitability optimization and cost control.

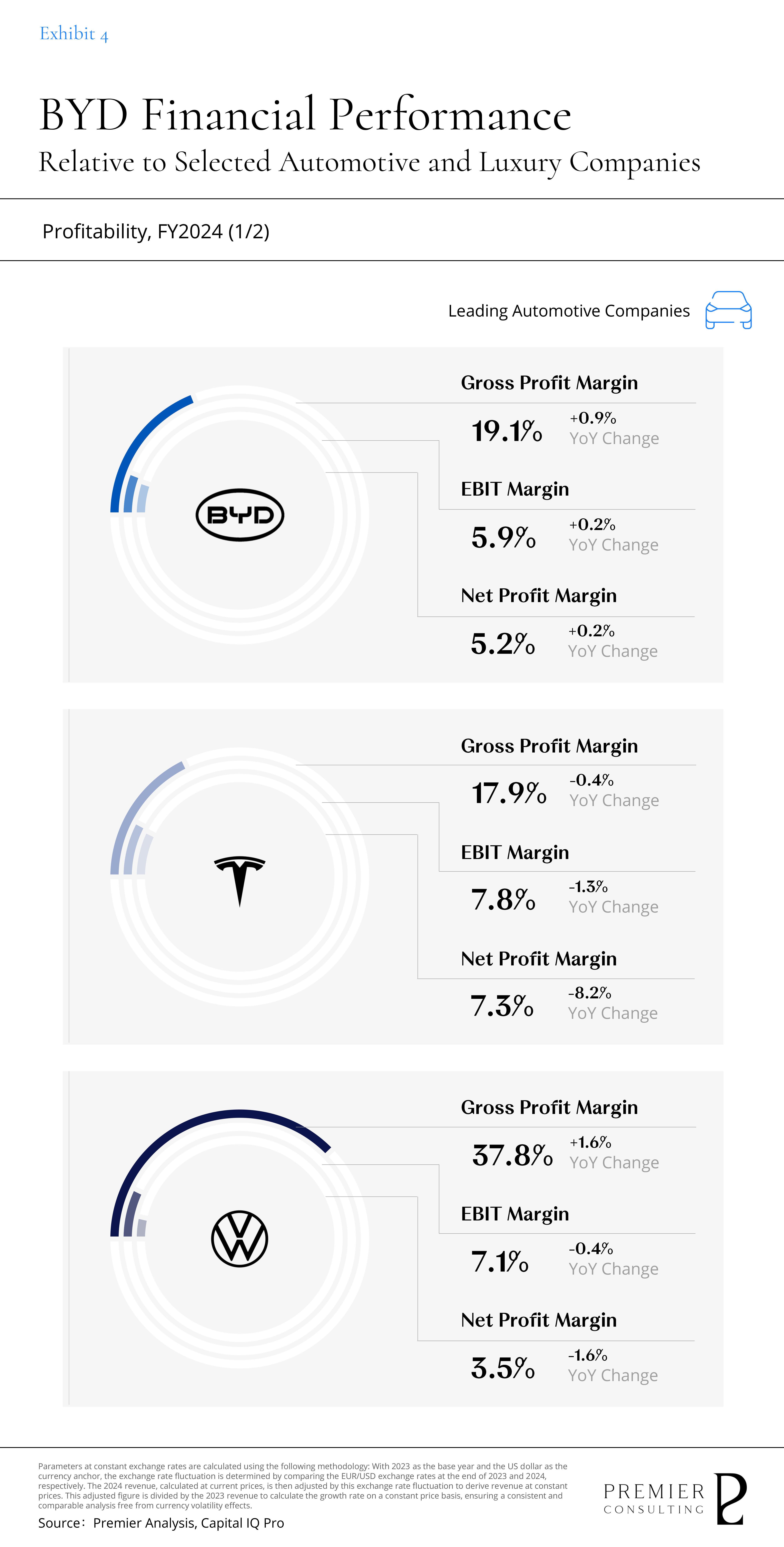

Although BYD's current net margin still trails a few high-performing peers such as Tesla, the gap is narrowing. BYD’s strategy of offering high cost-performance products across a full market spectrum—from mass to premium—combined with cost dilution through vertical integration, has helped establish a scalable and resilient profit model.

In contrast, Tesla’s high margins are supported by its direct sales model, premium pricing, and added-value services such as software subscriptions, highlighting the structural differences in their profit paths.

As Chinese manufacturing climbs up the global value chain, improving profitability quality has become a strategic imperative for enterprises to weather cycles and ensure sustainable growth. For the automotive industry, the transition from cost-driven to value-driven models is now a central challenge.

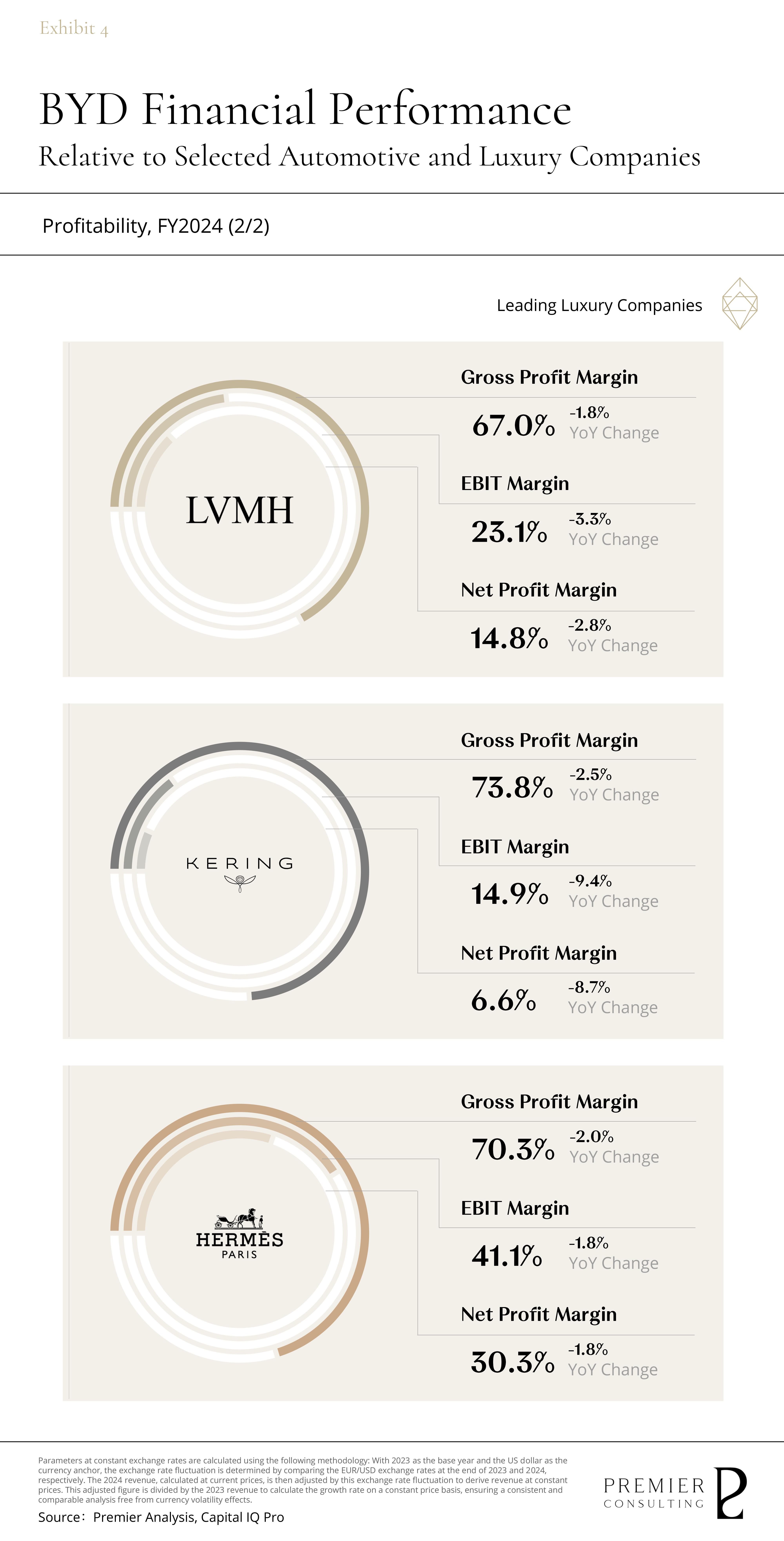

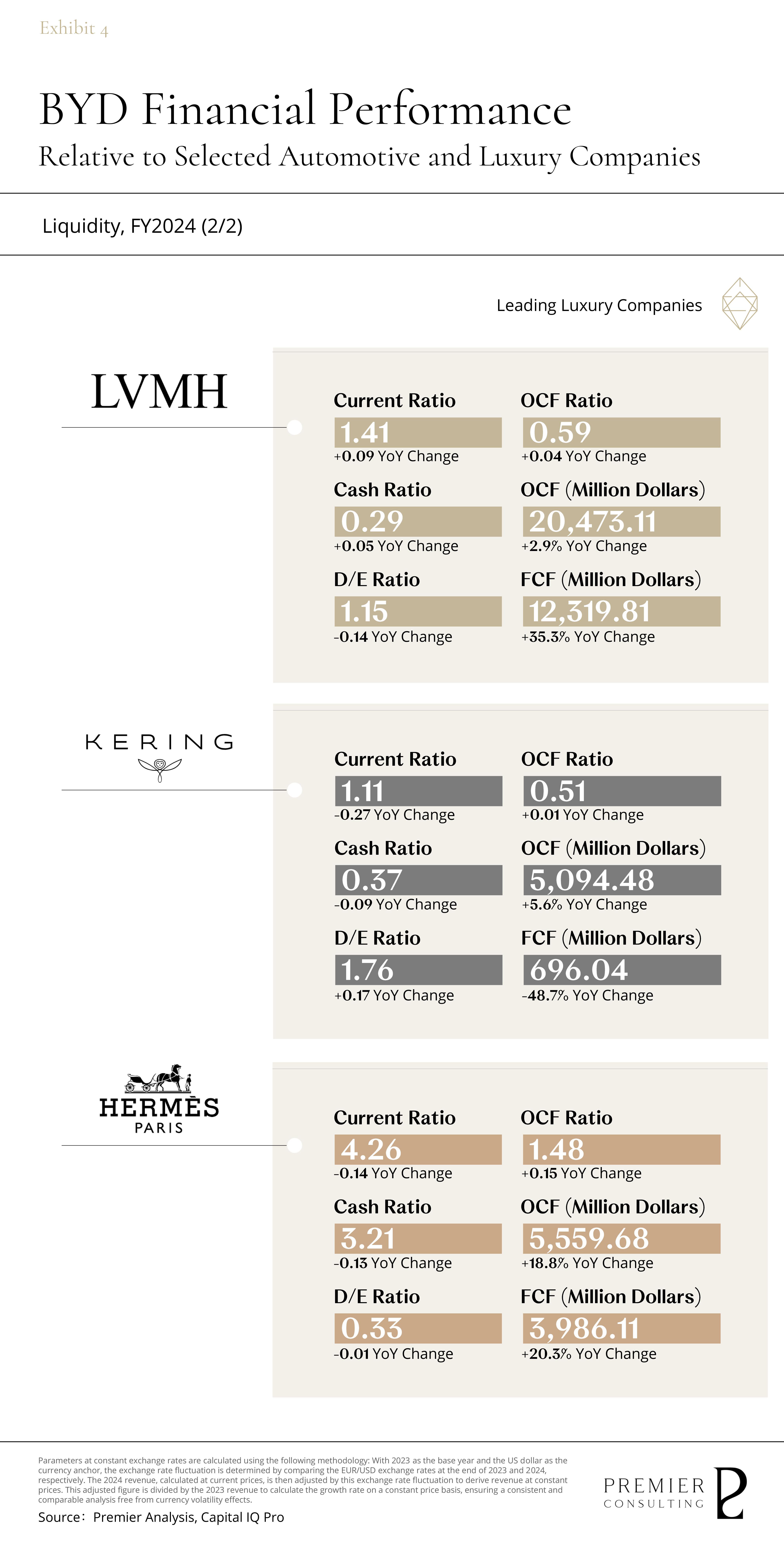

The luxury sector offers a compelling benchmark in this regard. Leveraging strong brand equity and highly concentrated value systems, luxury brands have long maintained gross margins of 60–70% and net margins far above the manufacturing industry average.

Though automotive and luxury differ significantly in capital intensity, R&D cycles, and operating models, this comparison signals a clear direction for Chinese manufacturers like BYD: to shift from “scale-driven” to “value-creation” profitability by consistently enhancing brand equity and product capabilities—thus building a resilient and globally competitive high-quality profit structure.

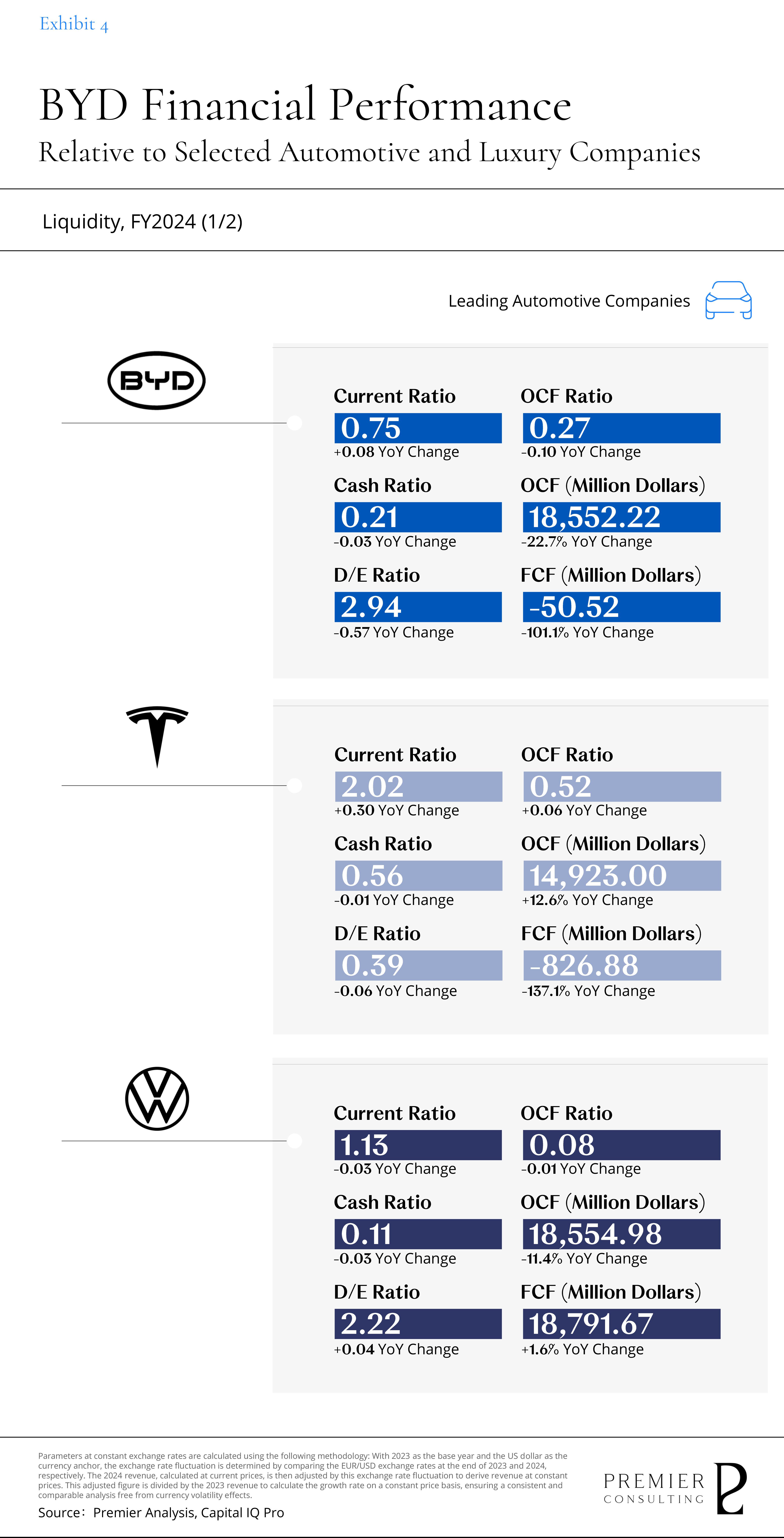

· Optimized Cash Flow Structure Matches Investment Intensity with Growth Expectations

Driven by ongoing capacity expansion and forward-looking technological deployment, BYD has maintained a high level of capital expenditure in recent years. As a result, its free cash flow (FCF) has temporarily turned negative, reflecting a deliberate effort to scale up strategic investment. However, operating cash flow (OCF) remains robustly positive, indicating strong underlying business fundamentals.

This “strong investment, steady return” cash flow structure reflects a healthy expansion model during an upward industry cycle. Compared to Tesla’s previous capital-intensive growth phase or the dual pressures faced by some traditional OEMs amid transformation, BYD’s cash flow performance appears relatively stable.

While the automotive manufacturing sector naturally entails capital intensity and longer cycles—unlike the asset-light, high-margin, high-cash-conversion luxury sector—BYD’s current cash flow model demonstrates its sound financial resilience and resource management capabilities. These qualities are key to supporting sustained investment in global expansion and technological iteration.

· Controlled Leverage Structure Strengthens Financial Resilience

Although BYD previously had a relatively high book leverage ratio, it has effectively mitigated financial risks through systematic debt structure optimization. On one hand, it has reduced high-cost liabilities such as bank loans; on the other, it has leveraged interest-free financing tools like accounts payable and customer advances. Currently, over 90% of its liabilities are interest-free.

This financing model, built on supply chain trust, allows BYD to maintain a high leverage ratio at minimal funding cost, keeping financial pressure within manageable limits.

Underpinned by rising sales and steadily improving profitability, BYD has established a financial closed loop characterized by “high investment – strong returns – low-cost leverage,” providing a solid foundation for its next phase of global expansion and organizational upgrades.

It is important to note that BYD’s impressive market and financial performance is not incidental, but the result of sustained efforts across three critical dimensions—strategy, business, and organization—driven by pragmatic execution. These measures have together created a competitive advantage that is increasingly difficult to replicate:

Strategic Leadership:

Proactive Planning to Secure Long-Term Advantage

BYD’s strategic foresight has continued to bear fruit in recent years. From its early pivot to new energy, to its global capacity layout, self-owned logistics system, and accelerated overseas plant deployment, BYD has demonstrated a level of forward-looking vision and execution far exceeding the industry average.

By expanding capacity and strengthening supply chains even amid the disruptions of COVID and global logistics bottlenecks, BYD laid the groundwork for future sales growth and overseas expansion.

These pragmatically oriented strategic moves reveal BYD’s keen grasp of industry evolution and its adept resource orchestration, reinforcing its strategic autonomy within the global value chain.

Business Gains:

Structural Upgrade Drives Growth, Cost Advantage Builds Moat

In the first four months of 2025, BYD’s vehicle sales rose 57.9% YoY, making it the top-selling Chinese automaker and further expanding its global share. This growth did not rely on aggressive price cuts but stemmed from product mix optimization and overseas capacity localization—driving both high-margin models and key markets in tandem.

Meanwhile, BYD’s long-standing strategy of vertical integration and in-house development of core components has yielded significant cost control advantages. This has allowed the company to remain resiliently profitable amid multiple rounds of industry price wars.

In a hyper-competitive environment, industry differentiation is intensifying. BYD’s optimized cost structure and economies of scale have enabled counter-cyclical expansion, positioning it as both a beneficiary of pricing shifts and a stabilizer of the industry equilibrium.

Organizational Management:

Talent Retention and Evolving Incentive Systems

In response to sector-wide talent mobility pressure since 2024, BYD has continued to strengthen its long-term retention mechanisms alongside foundational incentives.

In addition to issuing multi-billion-yuan annual profit-sharing bonuses, BYD launched an employee stock ownership plan (ESOP) at the end of the year, using equity-based incentives to align core personnel with long-term corporate value.

This initiative has enhanced organizational cohesion and employee loyalty, while demonstrating high responsiveness and financial discipline in the face of intense talent competition. BYD is gradually developing a dual-track incentive system that combines short-term rewards with long-term value-sharing—delivering sustained organizational momentum for global expansion.

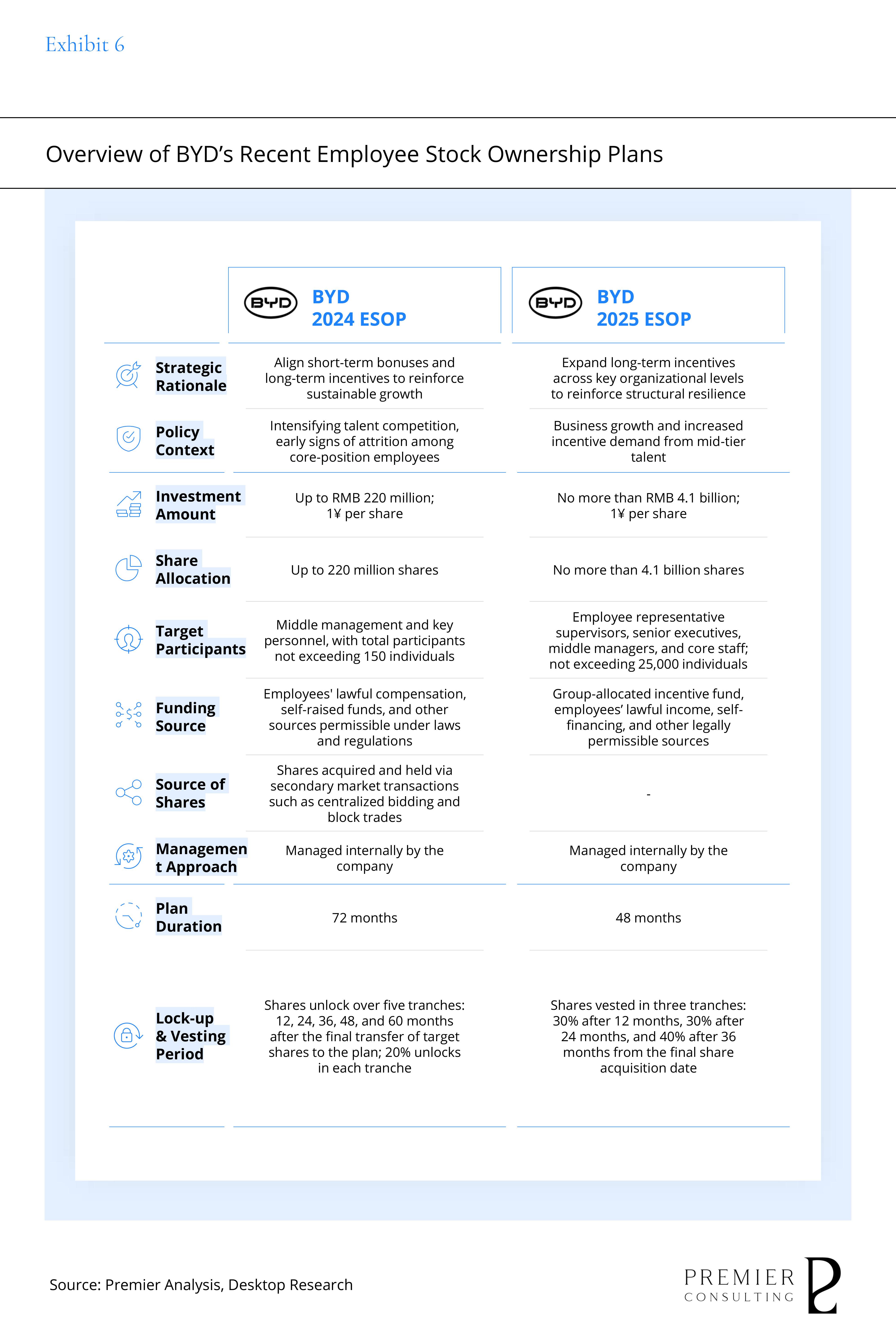

· Deepening Equity Incentives to Power Long-Term Organizational Vitality

BYD’s organizational evolution is most clearly reflected in the deepening of its employee stock ownership program (ESOP). At the end of 2024, the company piloted a small-scale ESOP targeting approximately 150 key personnel. This initiative aimed to stabilize the core talent pool, trial equity incentive mechanisms, and build stickiness by aligning medium- to long-term interests.

In 2025, amid intensified market competition and accelerated globalization, BYD rapidly upgraded its equity incentive system, officially launching a new ESOP that expanded coverage to approximately 25,000 people—including management, key functions, and frontline staff—signaling a strong commitment to “growing with the organization.”

BYD also improved policy design around funding structure, plan design, and vesting mechanisms, expanding the breadth of incentives while ensuring financial viability. This move has generated positive responses internally and externally, further enhancing BYD’s appeal in the talent market and providing a robust organizational foundation for steady expansion and technological advancement.

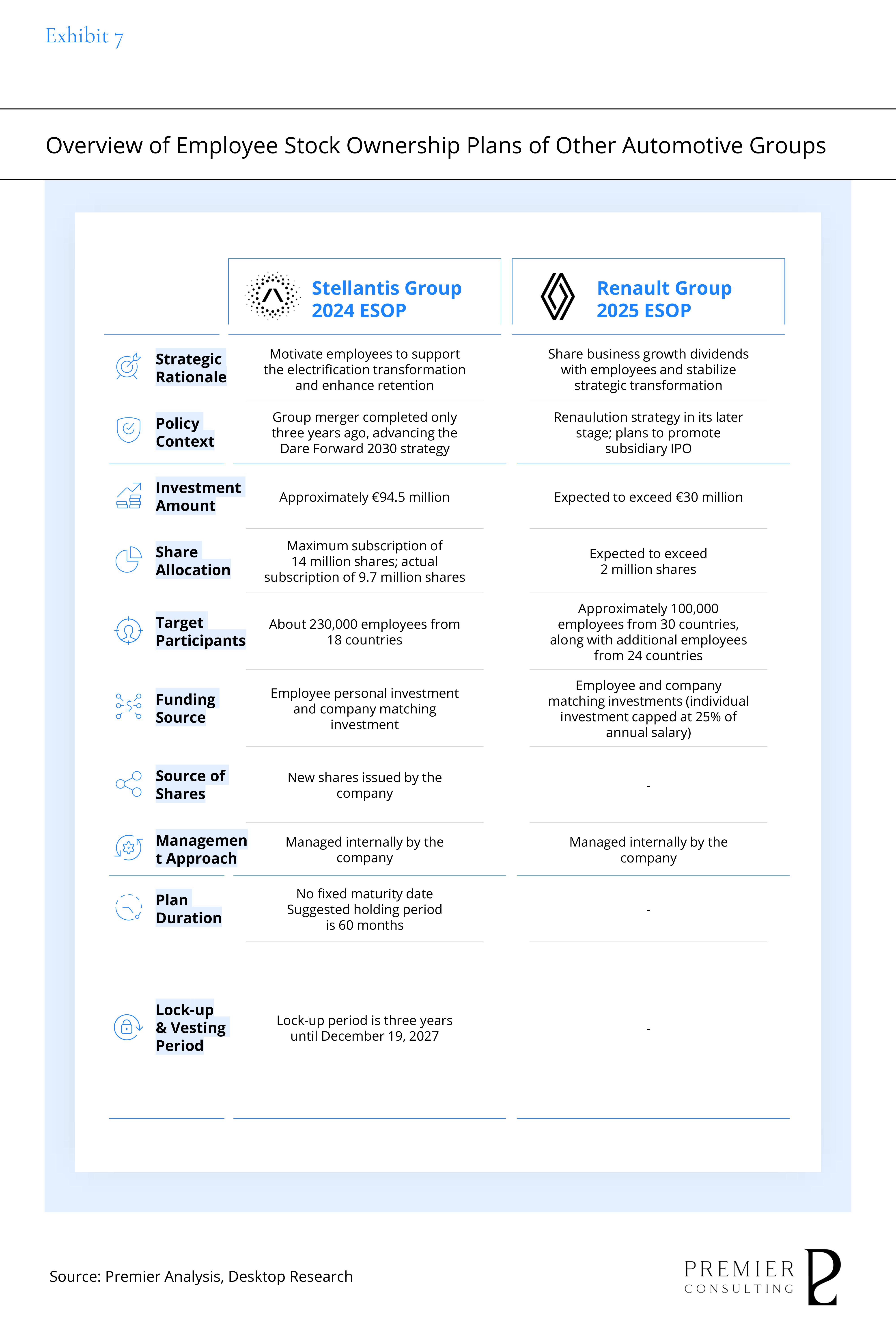

· Global Enterprises Embrace Equity Incentives: ESOPs as a Shared Strategy for Organizational Resilience

BYD’s exploration of equity incentive mechanisms is far from an isolated case. Globally, an increasing number of industry-leading companies are adopting ESOPs as a critical lever to enhance organizational resilience. In the automotive sector, for instance, both Stellantis Group and Renault Group have launched global employee shareholding plans in 2024 and 2025 respectively. These initiatives aim to address the dual pressures of transformation and long-term development by strengthening employees’ sense of belonging and enhancing strategic execution capabilities.

Amid the accelerating shift toward electrification and intelligent mobility, such companies are turning to equity incentives to foster internal cohesion and support the transition from traditional manufacturing enterprises to high-tech organizations.

In the luxury industry—long distinguished by high value-added creation, strong brand identity, and organizational resilience—equity incentives are also gaining traction in response to emerging challenges. Since 2023, the sector has faced headwinds including reduced spending by high-net-worth individuals and rising global economic uncertainty.

Against this backdrop, LVMH introduced a new round of global employee shareholding in 2024, leveraging the concept of “shared growth” to strengthen internal brand alignment. Hermès, on the other hand, opted for a more direct approach by granting shares to all employees, signaling recognition of long-term employee contributions. These actions not only deepen resonance with the brand’s ethos but also mark a strategic shift toward value co-creation as a new paradigm in talent management.

In the high-tech manufacturing sector, where companies are characterized by high technological intensity, talent dependency, and capital sensitivity, organizational governance is evolving rapidly. Amid ongoing competition for top talent and mounting innovation pressure, technology firms are particularly motivated to stabilize organizational expectations and boost employee retention to reinforce investor confidence. In 2024, Alibaba expanded its employee stock ownership coverage, underscoring a strategy centered on “retaining, stabilizing, and empowering talent.” Similarly, TCL Zhonghuan leveraged ESOPs to align the interests of its management and core technology teams amid global expansion and a strategic shift toward high-end manufacturing. These companies share a common logic: positioning equity incentives as both stabilizers and accelerators of organizational strategy—providing structural support through periods of high uncertainty.

From External Breakthrough to Internal Evolution:

Chinese Enterprises Advance in Organizational Management

Chinese enterprises have largely transitioned from catching up to taking the lead in terms of technology, product development, and market presence. Now, the next critical frontier for leapfrog growth lies in advancing organizational management capabilities.

With respect to employee ownership mechanisms, Chinese companies are actively benchmarking against global best practices, drawing on decades of institutional experience from Western firms in equity incentives, partnership models, and employee empowerment. While ESOPs have long been embedded in the governance structures of Western automakers and multinational corporations, they remain relatively novel within the Chinese corporate context. As such, implementation is still in the exploratory phase, often facing challenges of localization and limited precedent.

Yet it is precisely through such iterative experimentation and proactive adaptation that Chinese firms are opening a new chapter in internal governance. BYD offers a compelling illustration of this evolution: transitioning from small-scale pilots to broad-based participation, from mid-level incentives to comprehensive coverage, and from financially sustainable frameworks to improvements in both organizational stability and employee retention. This demonstrates that Chinese companies are indeed capable of establishing effective modern incentive systems—so long as they align them with their unique business rhythms and developmental stages to create a tailored governance logic.

More critically, as competitive advantages in product strength, supply chains, and distribution channels—traditional “hard power” factors—continue to converge, the resilience of organizational structure and culture is emerging as the true competitive moat. The core of future enterprise competitiveness will lie not only in technological edge or cost efficiency, but in the ability to build a team with shared purpose, seamless collaboration, and sustainable growth potential. This marks a fundamental shift—from “building products” to “building organizations”—and represents a crucial capability threshold that Chinese brands must cross to achieve enduring success over the next century.

While BYD’s path may not be the only solution, its journey has opened a new dimension of strategic thinking for Chinese enterprises: “organizational soft power” should no longer be viewed as ancillary, but as a core undertaking for long-term value creation.

SECTION3

From Pragmatism to Value Alignment

Forging a Century-Lasting Organizational Foundation

Grounded in pragmatism, sustained by resilience. For decades, BYD has upheld a pragmatic philosophy centered around the user, building deep brand loyalty through stable product performance, exceptional value-for-money, and ongoing technological innovation. This down-to-earth, problem-solving brand approach permeates both product iteration and customer experience, while also shaping the company’s end-to-end governance model. It has become a vital key for navigating cycles and constructing long-term competitive strength.

Likewise, any organizational transformation must be rooted in practical effectiveness, gradually evolving into a shared value system that connects internal operations and external engagement—ultimately forming the resilient foundation for enduring corporate success.

To support enterprises in translating pragmatism from a strategic philosophy into a sustainable organizational capability system, Premier has introduced the CAPE Transformation framework for pragmatic organizational resilience. This model integrates eight critical capabilities across four resilience pillars to help organizations establish a robust foundation that is both adaptable in the present and strategically guiding for the long term—enabling them to navigate environmental complexity and systemic organizational challenges.

Specifically, the CAPE framework focuses on the following eight organizational capabilities:

- Future-Focused Transformation Capability

Build a strategy development mechanism that enables dynamic adjustment, factoring in market trends, policy shifts, and evolving competitive landscapes. The goal is to move from “current adaptation” to “future leadership.”

- Agile Product and Market Portfolio Orchestration Capability

Strengthen multi-product, multi-region, and multi-customer portfolio management capabilities to swiftly allocate resources and pivot strategies, ensuring responsiveness to external volatility and internal evolution.

- Intelligent Production and Supply Network

Develop a data-driven, flexible manufacturing system and a multi-source, collaborative supply chain to enhance responsiveness, efficiency, and end-to-end execution in a globalized environment.

- End-to-End Risk Prediction and Response Capability

Establish a closed-loop risk management system that covers perception, analysis, and response to a wide range of risks—from operational disruptions and compliance changes to geopolitical shocks—ensuring business continuity and asset security.

- Modular and Collaborative Innovation Mechanism

Promote modular development across products, processes, and capabilities. Break down silos and use platform-based mechanisms to enable cross-team collaboration and multipoint co-innovation.

- Consensus-Driven Cultural Empowerment

Build a culture centered on shared values, continuously reinforcing organizational goals, behavioral standards, and long-term vision to strengthen cohesion and alignment.

- Cross-Functional Talent Capabilities for Transformation

Focus on reshaping talent capabilities across functions and contexts, cultivating a workforce equipped to navigate cross-business, cross-technology, and cross-cultural environments in support of transformation initiatives.

- Key Skills Pipeline and Technology Succession

Create a tiered management system for critical positions and technical experts, ensuring effective transfer of know-how and preventing capability gaps—thus reinforcing long-term competitive strength.

In terms of practical implementation, the CAPE framework centers around four key focus areas:

Strategic Resilience:

Anchored in Reality, Steered by Agility

In a macro context marked by uncertainty and shifting cycles, strategy is no longer a static blueprint but a continuously evolving capability. From a pragmatic perspective, strategic resilience requires companies to maintain a clear long-term direction while enhancing real-time responsiveness to external variables and dynamically optimizing resource allocation—ensuring a sustained tension between “current constraints” and “future guidance.”

Operational Resilience:

Grounded in Cost, Led by Value

Amid resource tightening and rising risk exposure, enterprise operations are shifting from an efficiency-first model to one that prioritizes resilience. Pragmatic operational resilience does not rely on excessive redundancy but instead seeks cost-controlled, value-oriented systems. By embedding redundancy, monitoring, and stress-testing into core operations, companies can build systems capable of sensing disruptions, buffering locally, and recovering quickly—ensuring continuity and reliability even in volatile environments.

Talent Resilience:

Built on Reusability and Flexible Deployment

In an environment of rapid change, organizations need talent systems that go beyond static job-to-skill matching. Pragmatic talent resilience focuses on structural flexibility and situational adaptability. Through institutionalized talent planning and agile organizational governance, companies can ensure uninterrupted staffing for critical roles, timely execution of key tasks, and steady momentum during transformation—regardless of shifts in pace, priorities, or resources.

Organizational and Cultural Resilience:

Powered by Consensus, Guided by Order

In the context of rapid expansion and deep uncertainty, corporate culture is no longer a “soft asset” but a vital institutional force underpinning strategic execution, operational coordination, and talent stability. Pragmatic cultural resilience emphasizes actionable governance, sustainable mechanisms, and self-healing organizational states. A four-fold system—consensus leadership, procedural alignment, mechanism integration, and psychological support—ensures consistency, stability, and loyalty, even under pressure.

SECTION4

Closing Remarks

Built on pragmatism, driven by resilience.

BYD has forged its organizational core through a pragmatic ethos and systemic resilience—redefining the competitive logic for global automakers. By staying true to its mission of delivering real user value, and by strengthening its organizational capacity to weather change, the company stands poised for long-term leadership in the global arena.

As more Chinese enterprises embrace this approach, they will chart a new journey for sustainable growth with distinct national characteristics. The very notion of "high value-add" will be redefined along this path—etched with the hallmarks of national pride and long-term brand building:

True global leaders are not driftwood riding the waves,

but enterprises rooted in real value and forged through enduring resilience—

rising with the winds, unshaken by time.

.jpg)

Review & Prospect

BYD Holds Steady with Pragmatic Resolve for Its Century-Long Journey Amid Global Competition

Feb 02, 2026

Highlighting product and tech shifts at the Shanghai Auto Show, BYD’s ESOP practices, and a pragmatic organizational path—offering strategic direction for Chinese firms aiming for long-term success.

Under the spotlight of the 2025 Shanghai Auto Exhibition, the global automotive industry once again witnessed a clash between legacy giants and emerging players. This event is not only a battleground for new technological paradigms and product architectures, but also a mirror reflecting the profound shifts in industry power dynamics amid the ongoing reshaping of the global value chain.

Undeniably, within this cycle of transformation, Chinese automotive brands are progressing from “manufacturing participants” to “industry definers.”

Among them, BYD is undergoing a powerful evolution—from a cost and scale-driven growth model to one driven by high value-added growth—underpinned by its deep integration across the automotive value chain, exceptional financial resilience, and rapidly escalating brand equity. At the heart of this transformation lies a new value curve guided by pragmatic principles. More than just a growth strategy, it is a blueprint for building a century-lasting enterprise—one that contributes a defining chapter to the global rise of Chinese manufacturing.

Against the backdrop of profound global market segmentation and the reshaping of geopolitical structures, corporate leaders around the world are confronting an inescapable strategic challenge: how to achieve sustainable, high-quality growth at the convergence of industry turbulence and accelerated technological change—navigating cyclical fluctuations while maintaining a long-term outlook.

Simultaneously, driven by the national 15th “Five-Year Plan”, China’s economy is entering a new phase powered by “new quality productive forces.” The core mandate is clear: to drive the transformation and upgrading of traditional industries, foster emerging sectors, and strategically position future industries. This transformation is led by technological innovation and underpinned by the real economy. It is not merely an optimization of efficiency and cost, but a comprehensive enhancement of Total Factor Productivity (TFP)—encompassing technological progress, efficiency improvements, resource intensification, and systematic restructuring of factor allocation efficiency.

As a strategic industry characterized by high technological complexity, capital intensity, strong brand influence, and robust consumer momentum, the automotive sector naturally serves as a critical testing ground for enhancing Total Factor Productivity. This sector not only challenges companies to integrate technological innovation with efficiency optimization but also demands breakthrough advances in resource allocation, supply chain coordination, and organizational governance.

BYD, as the frontrunner of China’s automotive industry, has taken the lead in this new race. Guided by pragmatic principles, BYD has achieved multi-dimensional synergies in product architecture, technological stack deployment, organizational governance, and financial modeling—thereby establishing a comprehensive value creation ecosystem that spans from “manufacturing” to “value.” Its intrinsic dynamism is derived from a profound understanding of value creation, precise control over end-to-end efficiency, and a systematic approach to building organizational resilience and long-term competitiveness.

In an era where global enterprises are re-evaluating the logic of “enduring enterprises,” long-term value creation is emerging as an increasingly scarce competitive asset compared to short-term bursts of performance. For Chinese companies, building a century-long legacy is no longer an abstract vision. BYD is exemplifying the hallmark of a world-class giant through its systematic capabilities: establishing its foundation on pragmatism and pursuing enduring success through resilience.

Within this context, Premier seeks to deconstruct BYD’s trajectory of transformation from a multifaceted perspective, distilling its strategic steadfastness, financial performance momentum, and talent aggregation capabilities. Moreover, the analysis offers insights through an “organizational resilience framework characterized by pragmatism,” intended to guide and support the development of more enduring automotive enterprises:

1. From Participants to Definers: The New Landscape of Automotive Products and Technologies at the Shanghai Auto Exhibition

2. From Business Gains to Organizational Momentum: Insights into BYD’s ESOP Incentive Practices

3. From Pragmatism to Value Alignment: Forging a Century-Lasting Organizational Foundation