Beyond the LV x Takashi Murakami Collaboration:

A New Chapter in Experiential Luxury Business

Beyond the LV x Takashi Murakami Collaboration:

A New Chapter in Experiential Luxury Business

Experience is no longer an add-on, but the sculptor of time itself—etching a new chapter for the brand in the vast domain of luxury.

“We want to see the newest things. That is because we want to see the future, even if only momentarily.” —— Takashi Murakami

In the heart of Shanghai’s plane tree-lined district, the winter chill weaves through bustling crowds. Amid the cold, commercial vitality blooms—radiating a quiet warmth.

Outside a three-story building on Julu Road, a steady stream of diverse visitors pause and gather. A winding queue forms along the street, adding to the hum of life in the historic French Concession. On the building’s facade, LV’s initials and the brand’s iconic Monogram flowers have been transformed into three-dimensional installations. Scattered across the exterior and gently spinning in the breeze, they extend a warm invitation—welcoming passersby to witness the grand opening of a new year’s brand collaboration.

Limited-time retail activations have become a standard tactic in brand marketing. With substantial budgets, top-tier brands now routinely execute “City Takeovers”—a marketing strategy that saturates urban spaces with immersive brand presence. Yet the Louis Vuitton × Takashi Murakami collaboration raises the bar once again. Beyond the immersive retail environment, the brand has introduced a Mini Cinema and a curated Café Garden, evolving the pop-up model into a multifunctional experience hub—and setting a new benchmark for the industry.

In the context of the experience economy, consumer perceptions of luxury have shifted beyond the product itself toward deeper emotional resonance and cultural alignment. Sensory-driven experiential spaces, combined with brand storytelling that fosters cultural connection, are fast becoming essential tactics in capturing a finite and fiercely competitive market.

Simultaneously, the global tourism boom continues to gain momentum, unleashing renewed demand for high-end experiences. Under the trend of hyper-localization, brand retail spaces are evolving into cultural landmarks. These not only help rebalance outbound spending, but also present fresh consumer touchpoints—energizing both revenue growth and long-term brand equity.

Drawing on industry research, expert interviews, market visits, and consumer insights, Premier examines three strategic themes through a multidimensional lens to help luxury brands navigate the new landscape:

1. A Commercial Breakdown of the Louis Vuitton × Takashi Murakami Pop-Up

2. Experience-Driven Luxury Tourism Consumption Insights

3. Guidelines for Upgrading Customer Strategy Through Experience-Led Transformation

SECTION 1

Reimagining the Classic:

Unlocking New Travel Codes in the Experiential Luxury Business

A Commercial Breakdown of the Louis Vuitton × Takashi Murakami Pop-Up

As the chimes of 2025 welcomed the New Year, they also marked the global launch of the Louis Vuitton × Takashi Murakami collaboration’s latest chapter. This renewed partnership between the luxury powerhouse and the renowned artist takes shape as a limited re-edition capsule, reviving and reinterpreting their iconic collaboration that has spanned over two decades. Murakami’s signature elements are reintroduced across more than 200 creations, showcasing Louis Vuitton’s ongoing innovation in craftsmanship and contemporary art dialogue, breathing new life into timeless designs.

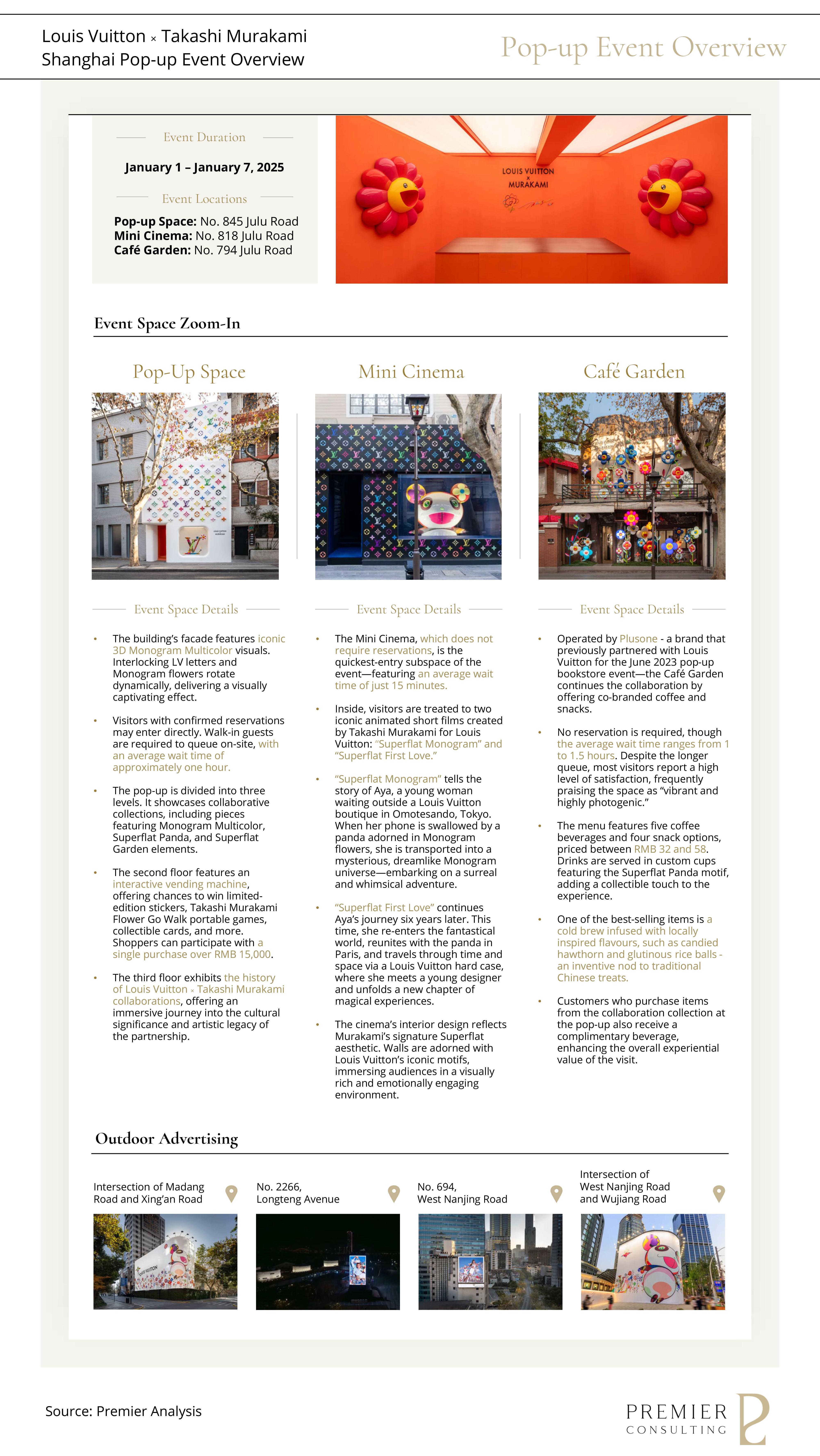

Marking over two decades of collaboration, Louis Vuitton × Takashi Murakami unveiled a dedicated pop-up experience in Shanghai’s vibrant Julu Road—one of the city’s trendiest cultural hubs. Three fashion-forward storefronts were transformed into branded immersive spaces, each designed around three core areas: a Pop-up Space, a Café Garden, and a Mini Cinema. Together, they created a dynamic brand district celebrating the convergence of people and space, brand and culture, art and commerce.

The retail space’s facade resembled a moving art installation, adorned with 3D Monogram Multicolor patterns. Vibrant LV letters and Monogram flowers rotated in kaleidoscopic hues, mesmerizing passersby with its dynamic interplay of light and colour.

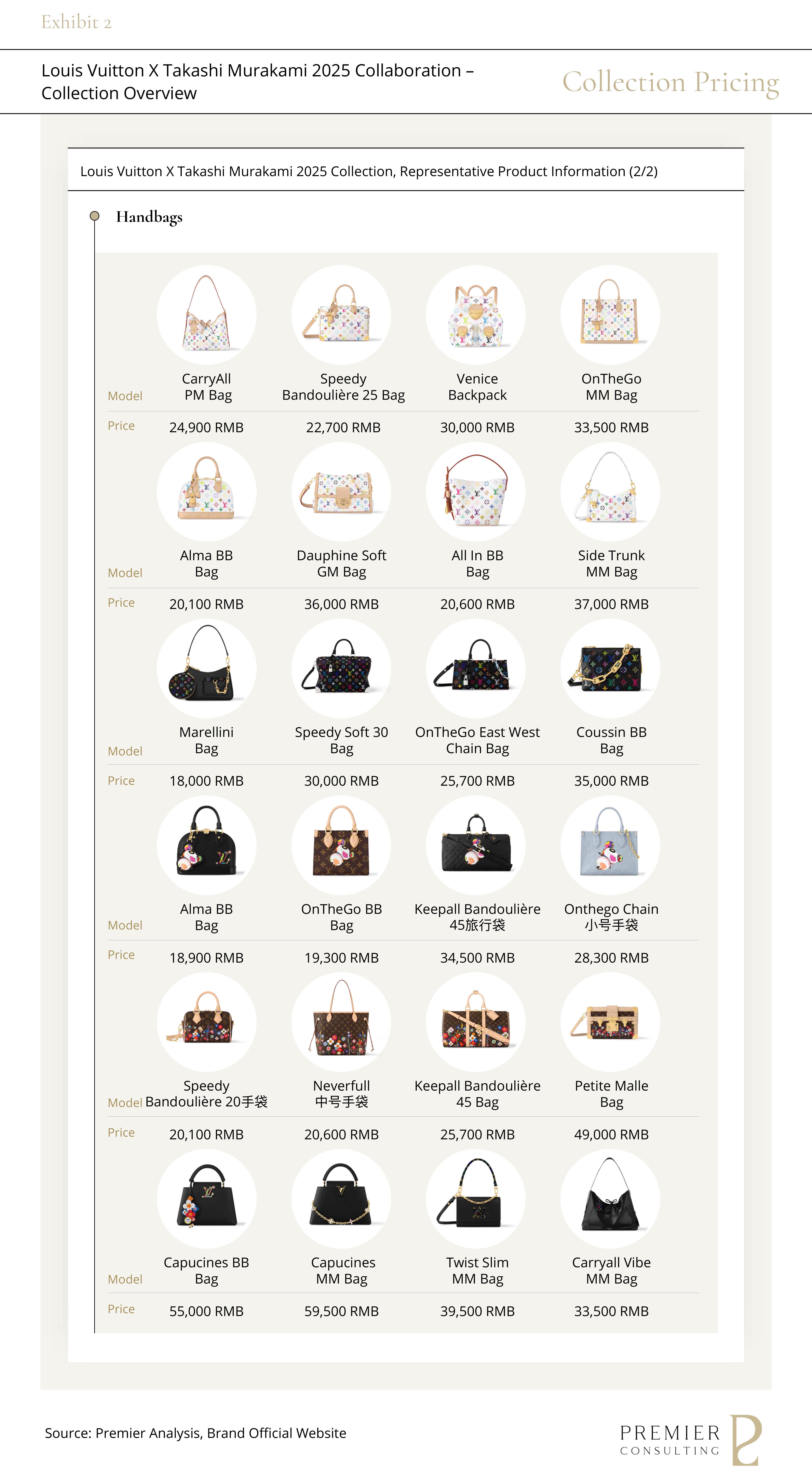

Inside, the three-story space features the latest pieces from the re-edition capsule. Murakami’s signature vibrant patterns enlivening everything from product details to wall decor—infusing the entire environment with his playful aesthetic.

On the second floor, a “vending machine” has become the center of attention. Visitors queue to try their luck at exclusive collectibles such as limited-edition stickers, Takashi Murakami Flower Go Walk portable games, and collectible cards. To qualify for the draw, many shoppers eagerly purchased small leather goods, accessories, and pet items to meet the RMB 15,000 spending threshold. Consumers gather around the machine to take photos and capture the moment, making it a social highlight of the event. This interactive energy not only deepens engagement but also drives strong cross-selling performance.

Upstairs on the third floor, the exhibition space tells the story of the two-decade collaboration. Archival displays of past collections trace the evolution of this iconic partnership, offering a cultural and artistic perspective that enriches the consumer’s understanding of its legacy.

Just a few steps away, the Café Garden is equally popular. With no reservations required, long lines form around the block, with average wait times ranging from 1 to 1.5 hours. Operated by Plusone—the same partner from LV’s 2023 Shanghai bookstore pop-up—the Café offers a limited-edition menu of five specialty coffees and four snacks, priced between RMB 32 and 58. Among the top sellers: a cold brew infused with traditional local flavors like candied hawthorn and glutinous rice balls. The Superflat Panda coffee cups have also become a coveted item among fans and collectors.

As an added gesture, customers who purchase from the collaboration series receive a complimentary specialty drink— extending brand engagement beyond the product and strengthening emotional affinity.

Only the retail space supports advance reservations, which must be made via the “My LV | Louis Vuitton” WeChat mini program. While users can choose a preferred date, specific time slots are not assigned, and each reservation allows entry for one additional guest. Visitors with confirmed bookings enjoy direct access, while walk-in guests must queue on-site.

For VICs (Very Important Clients), a priority reservation pathway is offered through their sales advisors. However, given the overwhelming demand, all available slots were booked within seconds of release—some VICs even had to queue in person due to full digital capacity. The mini program further provides exclusive brand digital assets, including four wallpapers and eight stickers, available for download.

This multi-dimensional experiential model is being simultaneously deployed across seven global fashion capitals: Shanghai, Singapore, Tokyo, Seoul, London, Milan, and New York. While the limited-edition capsule serves as a gateway to a broader consumer base, the initiative also signals the brand’s ambition to expand its presence across the full spectrum of lifestyle domains.

Notably, the Care Station — present in the Tokyo and Singapore editions — is absent from the Shanghai pop-up. This space offers exclusive services for Louis Vuitton × Takashi Murakami product owners, including archival restoration, leather cleaning, paint touch-ups, and hardware replacement, allowing visitors to observe LV artisans' meticulous craftsmanship up close. This immersive luxury care service not only enhances product collectability but also reinforces the brand’s commitment to sustainability.

The absence of this exclusive service in Shanghai may reflect region-specific strategies or localized operational considerations. However, for Chinese consumers—who have significantly contributed to the capsule’s sales volume—its omission risks creating a perception of unequal customer treatment across markets, potentially triggering discussions around regional disparities in brand experience.

Another example of regional differentiation lies in the lottery-based incentive mechanism. In China, customers who spend over RMB 15,000 in a single transaction receive a token that grants access to a prize draw. In contrast, pop-up events in other cities allow direct lottery participation through the purchase of select product lines—such as Monogram Multicolor—effectively lowering the threshold for acquiring limited-edition memorabilia.

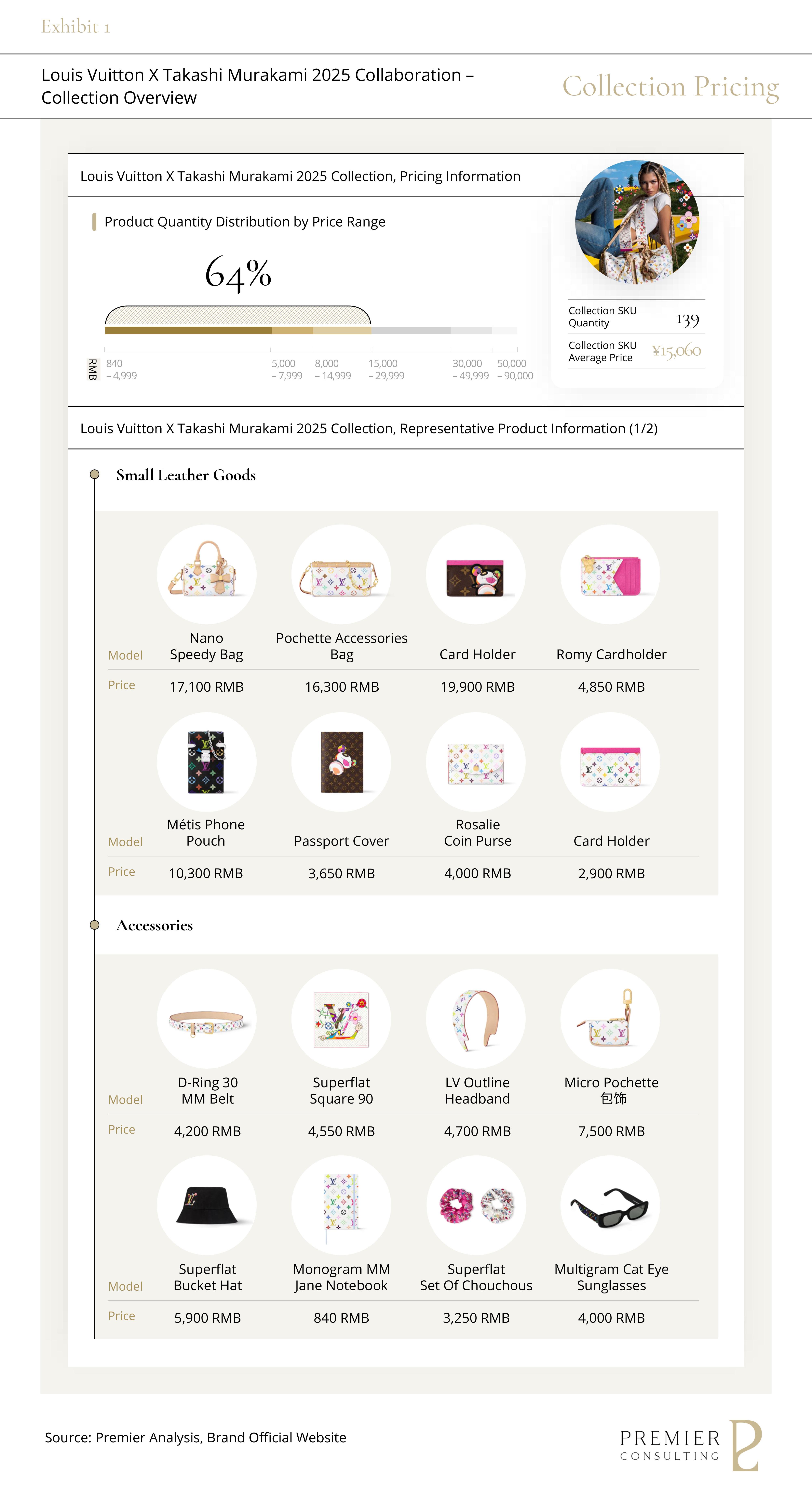

According to Premier’s analysis, 64% of items listed in the Louis Vuitton × Takashi Murakami collaboration on the brand’s official China website are priced below RMB 15,000 [Exhibit 1]. Notably, more than 50 items are priced under RMB 5,000. The lottery mechanism significantly boosts the purchase rate of entry-level products, encouraging consumers to increase their spending beyond the initial budgets.

Louis Vuitton has cleverly adapted the “Little Indulgence” consumer trend into an interactive mechanism that drives participation. By turning minor rewards into aspirational moments, the brand has successfully captured a younger, broader demographic—igniting desire, boosting conversion, and increasing cart size through cross-sell opportunities.

At the same time, the lottery rewards enhance the perceived rarity and collectible value of the capsule. During the campaign, the tokens themselves began circulating on secondary markets as tradable assets. Highly sought-after items such as the White Multicolor design sold out across all channels, with luxury resale platforms reporting market premiums of up to 20%.

The overwhelming demand and resale momentum underline the fervent enthusiasm of Chinese consumers for this collaboration. What began as a luxury product drop has transformed into a high-stakes pursuit, where fashion enthusiasts and collectors alike compete in a frenzy fueled by cultural cachet and exclusivity, driving both emotional and financial value.

The Louis Vuitton × Takashi Murakami collaboration has not only ignited a buying surge across China, but also demonstrated powerful international appeal. According to sales staff in China, consumers from South Korea, Japan, and Thailand have been among the key customer segments at offline boutiques. With the dual benefits of visa-free entry and tax refund policies, international tourists have become a major driver of incremental sales.

In Winter 2024, Shanghai surpassed Tokyo as the top destination for South Korean travellers. According to data from Trip.com, Korean bookings for Chinese New Year travel to China increased by 452% year-on-year—a clear sign of China’s robust tourism rebound and its rising prominence on the global travel map.

On social media, an influx of South Korean tourists sharing photos from Shanghai’s luxury shopping districts and cultural landmarks points to a growing trend: the city is rapidly becoming a must-visit destination for international high-end experiences. Against this backdrop, the Louis Vuitton × Murakami pop-up has emerged as a hotspot for global tourists, driven by attractive tax-free pricing, competitive product offerings, and broader availability—fuelling a renewed wave of luxury spending among overseas visitors in China.

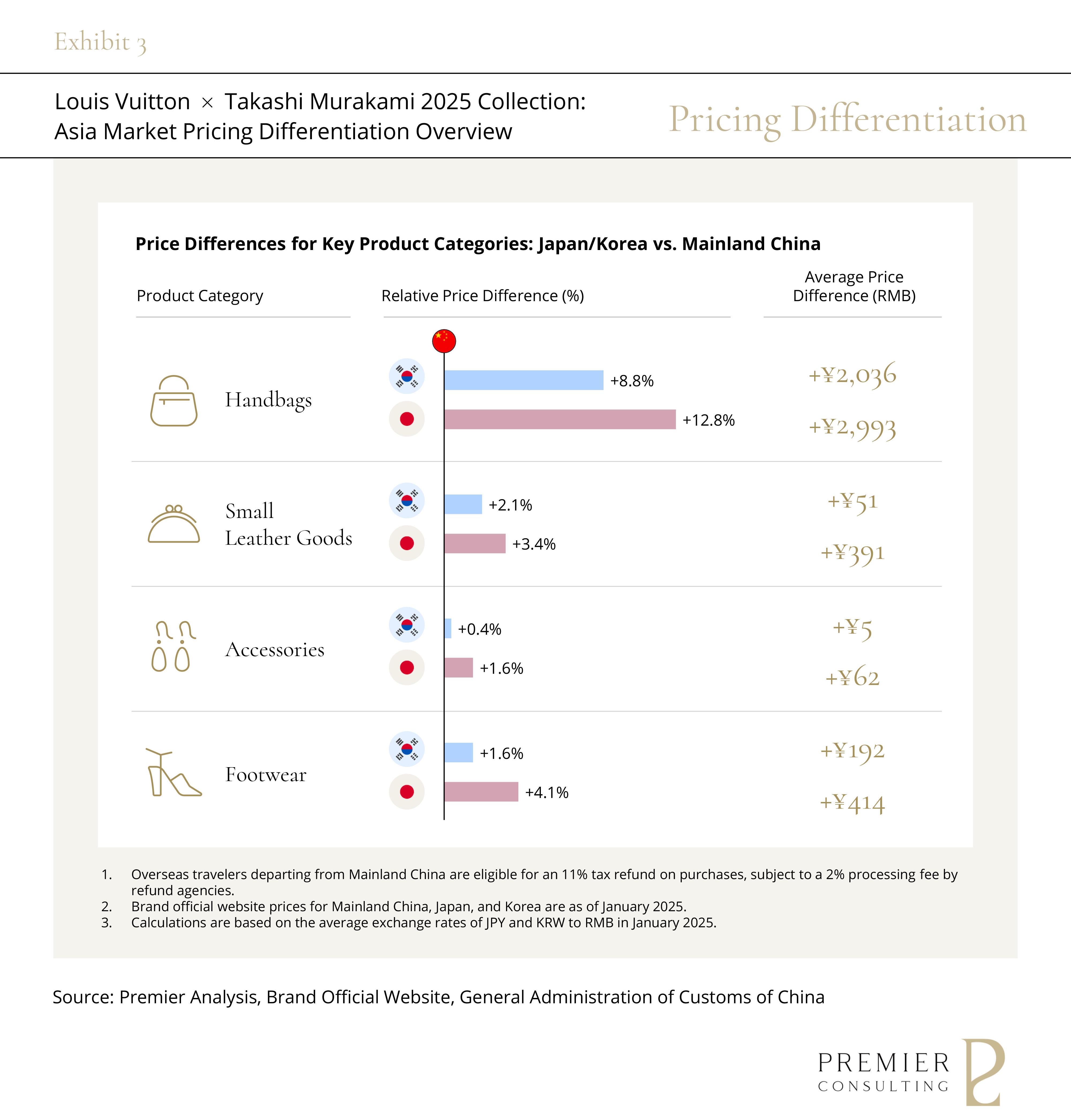

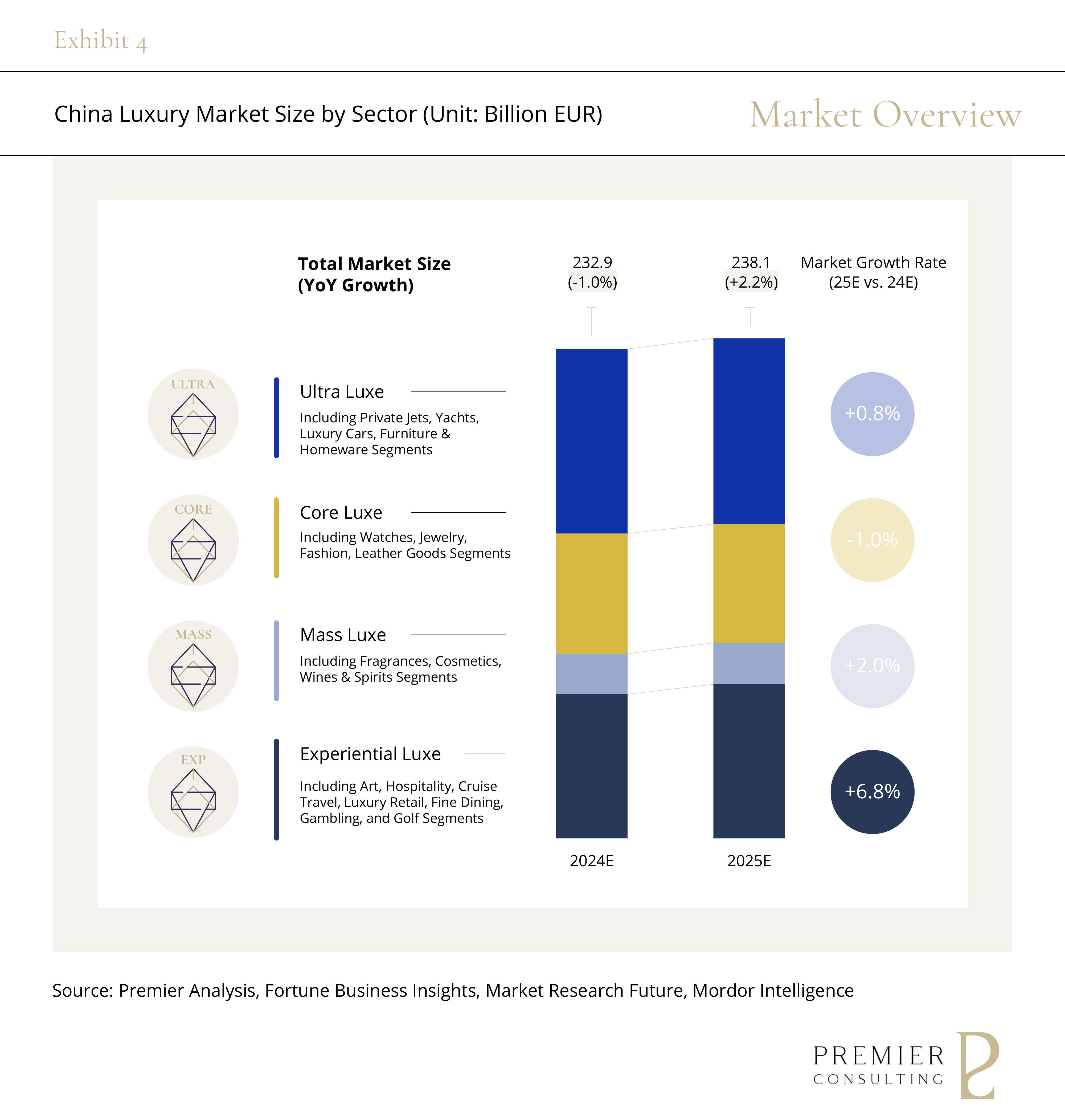

In the context of the Asian luxury landscape, pricing for the Murakami collaboration is noticeably more favourable in China. For example, within the handbag category, Korean consumers enjoy an average tax-free price advantage of 8.8% when purchasing in China compared to their home market. Japanese customers benefit even more, with a 12.8% average price difference [Exhibit 4]. Additionally, limited product availability on Louis Vuitton’s official Korean website has further pushed consumers toward cross-border shopping in more product-rich and price-competitive markets.

China holds a clear competitive edge in pricing and product availability—offering both higher value and broader assortment. This has positioned the Chinese market not only as a dominant driver of domestic luxury consumption, but also as an increasingly important destination for international luxury shoppers.

China's strategic significance to LVMH is undeniable. In its latest FY2024 earnings report, the Group revealed that the Asia-Pacific region (excluding Japan)—which includes China—accounted for 28% of global revenue, nearly a third of the total. However, despite LVMH achieving 1% organic growth globally, the region experienced an 11% decline in organic sales, underscoring the urgency of revitalizing this key market.

The transition from a “luxury business” to a “travel-driven luxury business” is underway. In 2025 and beyond, the ability to harness duty-free channels, pricing advantages, and the spending power of global high-net-worth travellers will define new frontiers of growth.

The next five years of luxury will not be anchored solely in regional affluence, but rather in the strategic orchestration of global consumption flows—connecting mobile wealth with multi-market, multi-touchpoint experiences to build sustainable brand loyalty.

This transformation in luxury’s growth model has only just begun.

SECTION 2

Expand Perspectives,

Embrace New Opportunities in Luxury Travel

Experience-Driven Luxury Tourism Consumption Insights

The slowdown in China’s luxury market growth has become a widely acknowledged reality across the global industry. A shift toward more rational high-end consumption, economic uncertainties, and fluctuating consumer confidence have led to a temporary adjustment period in this critical market. However, beneath this seemingly subdued landscape, a new engine of growth is emerging. The rise of “experiential luxury” is now reshaping the industry—moving beyond traditional product-based consumption to become a powerful force driving recovery.

Luxury is increasingly permeating the full lifestyle ecosystem. High-end hotels, fine dining, luxury cruises, wellness retreats, sports events, and exclusive cultural experiences—once the domain of premium lifestyle categories—are now strategic priorities for global luxury groups. Premier forecasts that by 2025, China’s experiential luxury market will grow at a compound annual rate of 6.8% [Exhibit 4], far outpacing the growth of traditional luxury segments and contributing significantly to the broader market rebound.

The rise of experiential luxury is not coincidental—it is reinforced by the global "China Travel" phenomenon. Since early 2024, global search interest in traveling to China has steadily risen—peaking in Q4, driven by a series of policy incentives. In November 2024, the Chinese government introduced visa-free entry policies for travellers from six countries, including France, Germany, Italy, and Japan, and extended the visa-free transit period to 30 days for certain foreign nationals. These measures have triggered a rapid revival of international travel interest in China, accelerating the return of global tourists and directly stimulating inbound luxury consumption.

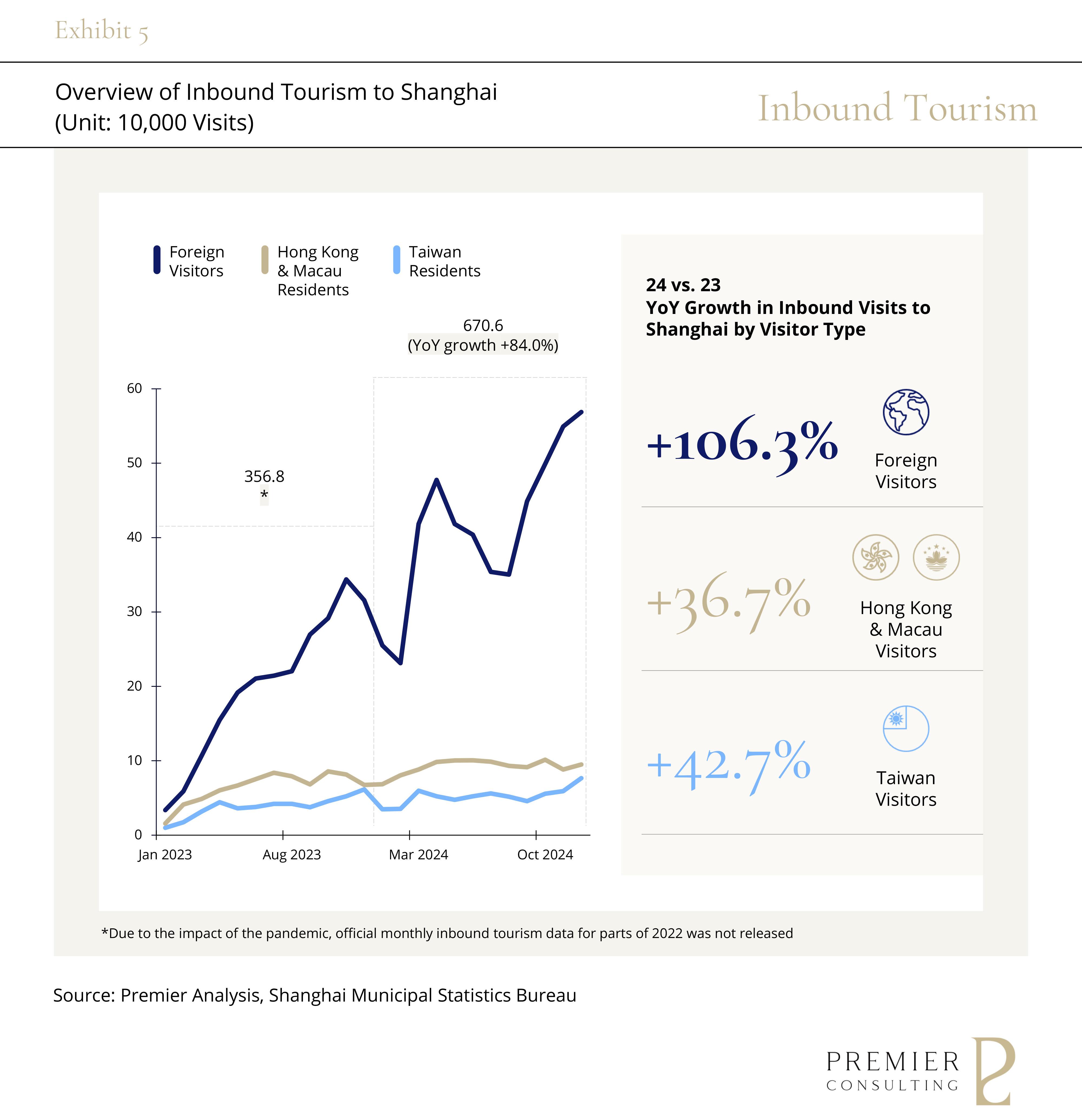

The impact of relaxed travel policies has been quickly reflected in data. In 2024, international arrivals into Shanghai reached 6.706 million, representing an 84% year-on-year increase [Exhibit 5]. Among them, the growth in foreign tourists was particularly striking—surging by 106.3%. This upward trend extended beyond visitors from Europe, North America, and Southeast Asia—travellers from Hong Kong, Macau, and Taiwan also showed a strong rebound.

The influx of international tourists signals a reverse flow of luxury spending that had previously been lost to overseas markets. Cities like Shanghai are no longer just travel destinations; they are rapidly emerging as strategic hubs for luxury brands—ideal for delivering high-end experiences and deploying immersive marketing strategies. Flagship stores along West Nanjing Road, the Bund, and Lujiazui are experiencing a resurgence of international foot traffic, while top-tier hotels and private salons are seeing a significant uptick in affluent clientele. In response, brands are swiftly rolling out multidimensional activation strategies to capture the renewed appetite for premium experiences among high-net-worth travellers.

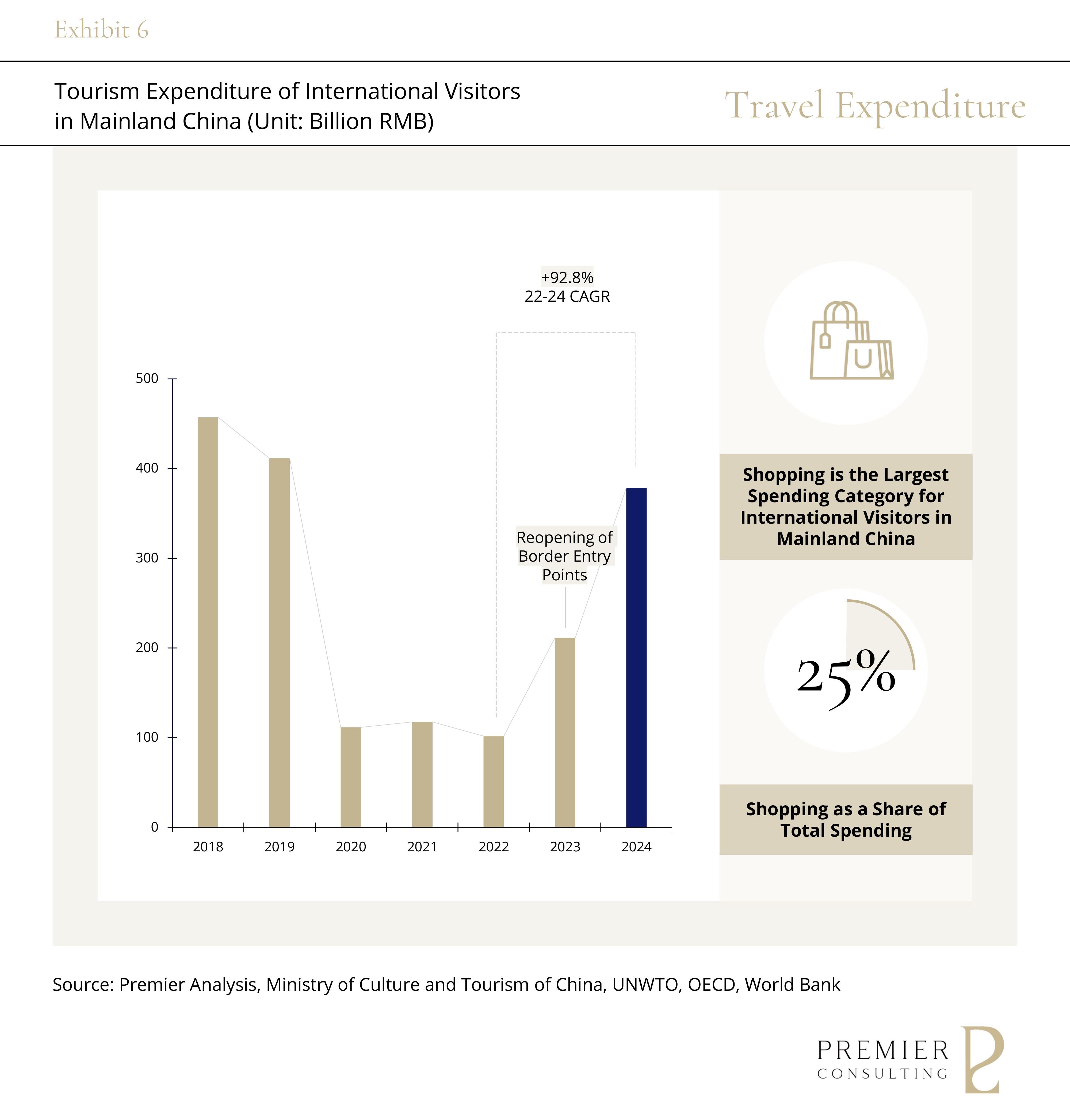

The spending power of international tourists in China is also remarkable. In 2024, international tourist expenditure in Mainland China grew at a compound annual rate of 92.8%, with shopping accounting for 25% [Exhibit 6] —the largest share of visitor spending. In other words, travel to China is no longer only about sightseeing and cultural exploration—it has also become a critical opportunity for global luxury brands to recapture outbound spending within Chinese borders.

From flagship boutiques and duty-free airport retail to exclusive in-hotel luxury retail, China’s high-end consumption landscape offers significant untapped potential. As brands recalibrate their growth strategies, these premium consumption touchpoints are set to become pivotal battlegrounds for future market share.

Despite its strong global appeal, China’s tourism economy remains underutilized compared to other advanced Asian markets.

According to the World Economic Forum (WEF) 2024 Travel & Tourism Development Index, China ranks second in Asia in tourism competitiveness, trailing only Japan. However, its tourism sector’s contribution to GDP remains significantly lower than that of more mature markets like Japan and South Korea.

Data from BofA Global Research shows that in the first three quarters of 2024, China’s tourism exports totalled RMB 74.5 billion, representing just 0.2% of nominal GDP. In comparison, South Korea’s tourism exports account for 0.9% of GDP, Japan’s for 1.3%, and Singapore’s for over 4.5%.

If China were to match South Korea or Japan in tourism’s GDP contribution, the sector could generate an additional RMB 200–350 billion in revenue. For luxury brands, this translates into a major under-realized opportunity—not only in retail, but across an ecosystem of high-end travel, personalized services, and luxury lifestyle experiences that are poised to become critical battlegrounds in the next phase of industry competition.

The center of gravity in the luxury market is shifting from transactional product purchases to emotional, immersive experiences. For global luxury players, the convergence of China’s travel recovery and the broader resurgence of global tourism marks a moment of exceptional opportunity. Brands that move early are already staking claim to new growth territories, gaining a competitive edge in this rapidly evolving landscape.

As the luxury market undergoes structural transformation, brands find themselves at a critical inflection point. Luxury is no longer defined solely by ownership, but by its deep integration into consumers’ lifestyles, identities, and emotional experiences. The shift from “material possession” to “experiential luxury” is not only expanding the commercial boundaries of the industry—it is reshaping the consumption logic of high-net-worth individuals. Luxury brands are evolving from symbolic markers into immersive lifestyle ecosystems that accompany consumers across every aspect of their daily lives.

Drawing on insights from the “2024 Global Luxury Traveler Study”, Premier has identified three core behavioural shifts shaping the future of luxury travel—offering critical guidance for forward-looking brand strategies:

1. Changing Demographics in Luxury Travel:

Younger Core Segments and the Rise of Multi-Generational Journeys

The demographic landscape of luxury travel is shifting. Luxury is no longer the exclusive domain of a select elite—it is increasingly becoming a holistic lifestyle for affluent families.

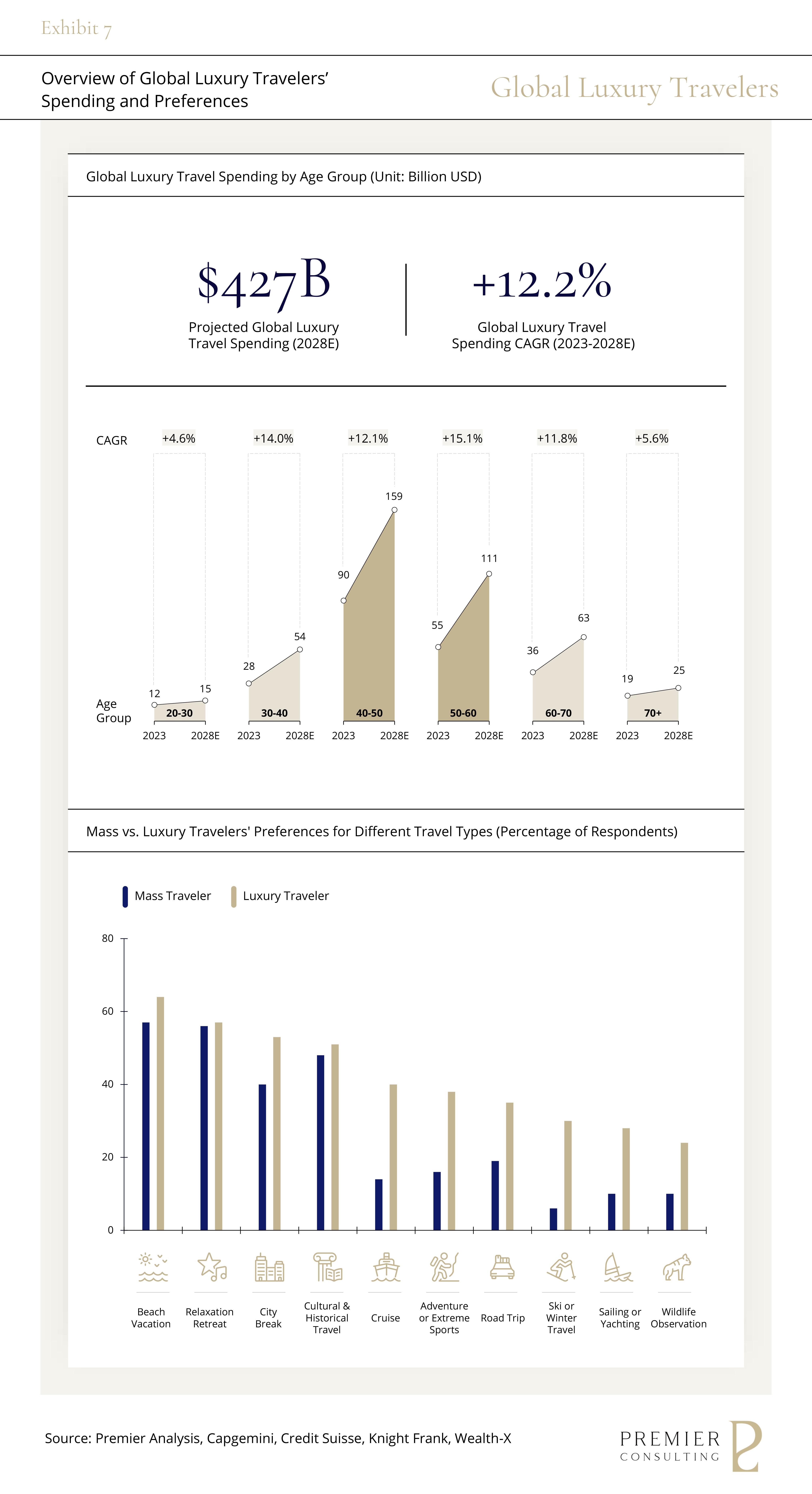

- A Younger Spending Core: While Baby Boomers (born 1946–1964) still wield purchasing power, 60% of the luxury leisure travel market is now driven by consumers under 60 [Exhibit 7]. In particular, the 40–60 age segment is showing high levels of travel activity. The younger generation’s growing demand for high-end travel is driving luxury brands to rethink and innovate their product and service offerings, with a strong emphasis on meaningful, experience-driven design.

- Multi-Generational Travel Is On the Rise: Luxury travel is evolving from individual indulgence to shared family experiences. Increasingly, high-net-worth families are choosing to travel across three generations—grandparents, parents, and children together. These travellers prefer villa-style accommodations, private estates, or luxury cruise suites, which offer privacy and intimacy while preserving a sense of togetherness.

- Family Travel as a Growth Engine: Brands must recognize the specific needs of affluent families. Designing immersive, age-appropriate experiences for younger travellers will be key—not only making luxury vacations inclusive for all ages, but also positioning them as rituals of generational bonding and legacy.

- Young HNWIs as Future Growth Drivers: While luxury travellers aged 20–30 currently represent a smaller portion of the market; their long-term spending power is immense. This segment values social connectivity, authenticity, sustainability, and digital integration. Brands that can effectively engage with this audience now, will secure a decisive competitive advantage in the years ahead.

2. Travel Preferences:

The Ideal Journey Is Comfortably Familiar, Yet Refreshingly New

Luxury travellers are not solely driven by novelty. Instead, they often seek fresh, elevated experiences in familiar destinations—redefining traditional vacations through the lens of sophistication and depth.

- Classic Vacations Remain Dominant: 65% of luxury travellers prefer sun-and-beach getaways, while 55% prioritize relaxation-focused holidays [Exhibit 7]. This pursuit of ultimate comfort keeps destinations like the Maldives, Bali, and the French Riviera among the most coveted in the luxury travel market.

- Supply Gap in Luxury Leisure Hotels: Despite demand, there remains a shortage of high-end resorts in these popular areas. Many luxury hotels remain concentrated in business travel hubs, leaving a supply-demand mismatch in leisure-focused settings. For brands, investing in seaside, mountain, or lakeside destinations presents a clear opportunity to fill this market gap.

- Exotic Adventures Retain Niche Appeal: Yacht expeditions, polar explorations, and wildlife safaris continue to attract a loyal segment of ultra-luxury travellers. Despite high costs, the uniqueness and exclusivity of these trips make them potent symbols of status for high-net-worth individuals.

- Novelty Drives Destination Re-visits: 72% of luxury travellers express a desire to explore new destinations—a figure significantly higher than that of mass travellers (44%). However, their higher travel frequency means that even new places can quickly become familiar. As a result, reimagining classic destinations presents a high-impact opportunity for luxury brands to sustain engagement.

- Experience Innovation Is Essential: To encourage repeat visits, brands must reinvent luxury vacations with new layers of experience. Offerings such as standalone villas, private diving excursions, sailing adventures, or immersive cultural programming can breathe new life into well-known destinations—enticing affluent travellers to return and rediscover.

3. Decision Drivers:

Status Symbol as a Loyalty Token, with Premium Experiences Far Exceeding Points-Based Programs

Luxury travellers approach loyalty programs with a distinct mindset—one that differs fundamentally from that of mass travellers. Rather than chasing points and discounts, they value identity recognition, personalized privileges, and emotional connection.

- Loyalty Programs are a Decision Factor, but Not Equivalent to Price Sensitivity: 68% of luxury travelers stated that loyalty programs are an important factor when choosing accommodation, a percentage significantly higher than that of ordinary travelers (41%) [Exhibit 11]. However, this does not equate to price sensitivity—it reflects a desire for elevated recognition.

- Privileges Matter More Than Discounts: For luxury consumers, loyalty is built through exclusive experiences: private butlers, customized room setups, personalized welcome amenities, and direct access to hotel management. These intangible status benefits far outweigh conventional perks like discount rates or point redemptions.

- Brand Affinity Is Critical: 77% of luxury travellers prioritize brand reputation over price, and 84% rely on official star ratings to guide choices [Exhibit 11]. What they seek is consistent excellence—refined aesthetics, elevated service standards, and globally aligned luxury experiences that reinforce their identity.

- Loyalty Programs Resonate Strongly in China and the UAE: Unlike Western markets, high-end travellers in China and the UAE show a strong preference for branded luxury hotel chains, with independent hotels holding a much smaller market share. This underscores the rising strategic importance of loyalty infrastructure in China’s luxury travel market.

Luxury is no longer just about the product—it’s about building a seamless, immersive experience. As the industry pivots from "selling luxury goods" to "delivering luxury travel experiences," brands must undergo a deep transformation in how they invest along the value chain. Experience is no longer a marketing add-on—it’s the core growth driver.

This calls for a new business model and a reshaped customer journey—where luxury brands embed themselves into travelers’ lives through elevated environments, cultural moments, and exclusive services. By reimagining experiences as extensions of brand value, companies can unlock deeper engagement, stronger loyalty, and sustainable long-term growth.

SECTION 3

New Value, New Journey:

Turning Crisis into Strategic Opportunity

Guidelines for Upgrading Customer Strategy Through Experience-Led Transformation

Driven by the rise of the experience economy and the “experiential luxury” trend, the luxury industry is undergoing a profound shift—from product-centric to experience-centric growth. This transformation entails:

- A shift from transactional, one-off purchases to lifecycle experience management

- An evolution from static store operations to dynamic scenario-based brand engagement

- A redefinition of loyalty, moving from points-based mechanisms to identity-driven, high-touch relationships

At the root of this transformation is a deep reconfiguration of how consumers perceive luxury value. Historically, luxury was anchored in brand premium, product scarcity, and symbolic status. But as the market environment evolves and consumer values mature, the traditional value framework is being rewritten. Scarcity is no longer just about the product—it is now about the ability to create exclusive, emotionally resonant experiences that forge long-term, meaningful relationships with customers.

To stay competitive in this new era, brands should confront rising consumer expectations and redefine how they deliver value. This begins by addressing three structural vulnerabilities that are eroding trust:

1.Price Inconsistency: Global price disparities are undermining consumer trust

The luxury industry’s long-standing regional pricing strategy is increasingly challenged. Differences in taxes, exchange rates, and local pricing policies have resulted in 10–30% price gaps for the same product across markets. As digital transparency improves, consumers are easily able to compare prices globally, fuelling cross-border shopping behaviour and diminishing trust in brand pricing integrity. Over time, this erodes pricing power and perceived value.

2.Value Recalibration: From product ownership to emotional, cultural, and experiential fulfilment

Luxury consumption is shifting from owning physical products to seeking personalized experiences, cultural connection, and emotional meaning. Today’s consumers care not only about materials and design, but also about how brands craft immersive experiences, offer tailored services, and create a sense of community and belonging. High-net-worth millennials and Gen Z in particular are willing to pay a premium for limited experiences, curated travel, and customization—areas where traditional luxury retail models still fall short, widening the gap between brand delivery and consumer expectation.

3. Loyalty Erosion: Weakened brand bonds in a world of mobile, choice-rich consumers

Loyalty among luxury consumers is weakening—especially among younger affluent segments. These consumers are increasingly brand-fluid, favouring individual expression and new discoveries over long-term allegiance to a single brand. Meanwhile, the rebound in international travel and the ease of global luxury shopping are making loyalty even more fragmented. The traditional notion of a “fixed customer base” is rapidly evolving into a highly mobile, opportunity-driven luxury audience.

In this new reality, product delivery and post-sale services are no longer the endgame. Consumers now expect brands to act as curators of their ideal lifestyle, offering a seamless blend of identity, community, and emotional resonance—today and in the future.

To maintain pricing power and long-term brand equity, luxury brands should shift from selling products to orchestrating meaning. The premium of the future will be built not only on what a brand offers, but on how deeply it understands, engages, and inspires its customers.

In response to shifting consumer expectations, Premier proposes a redefined luxury brand value framework built on experience, long-term relationships, and exclusivity. The future of brand equity will be shaped by four key dimensions:

1. Experiential Equity: Consumers today seek more than just products—they want memorable, immersive brand experiences. Luxury brands should build accessible, participatory, and sensorial environments that allow consumers to live the brand: from private events and curated travel to artistic and cultural crossovers. The brand becomes not just something consumers buy into, but a seamless part of their lifestyle.

2. Product Equity: The product remains central—but it is no longer sufficient on its own. Consumers expect more than material and craftsmanship. Products must now tell a story, reflect the brand’s heritage, and connect meaningfully with the broader brand experience ecosystem.

3. Consumer Lifetime Depth: Loyalty is no longer driven by point systems—it is cultivated through personalization, privilege, and sustained engagement. Evolving membership programs must emphasize identity, long-term service, and community participation. The goal is to build deeper, longer-lasting consumer relationships that increase lifetime value.

4. Exclusivity: Luxury scarcity is shifting from product limitation to access restriction. True differentiation lies in how a brand creates exclusive experiences and curated membership circles that reinforce status, identity, and emotional connection—not just limited-edition goods.

In short, “Experience × Engagement × Exclusivity” is the true competitive moat for luxury brands in the new era of experiential luxury.

Through the intelligent solution, CAPE AInspire, Premier empowers brands to realize their full brand value potential by advancing along four strategic levels:

Customer Journey Optimization, Globally Localized Experiential Operations, Precision Market Calibration, and Brand Scarcity Building.

SECTION 4

Closing Remarks

The century-old allure of luxury lies in the harmonious fusion of rare materials and exquisite craftsmanship, embodying humanity’s pursuit of ultimate beauty and aspiration. Today, this emotional resonance has transcended individual objects, evolving into a rich and multidimensional expression.

When ephemeral spaces amplify urban trends, when global membership privileges extend to secluded retreats, and when storefronts transform into immersive art theaters, an unparalleled experience emerges—becoming the most powerful brand currency in an era of value reinvention.

As cherry blossoms dance in the March breeze, the long-awaited second chapter of Louis Vuitton × Takashi Murakami: Cherry Blossom unfolds.

Imagine: floral motifs bloom not only across the collection but also through illuminated airport corridors, zen-inspired hotel gardens, and gold-embossed passport covers for brand members. The legacy of luxury is no longer captured by inventory sell-through metrics, but by the unveiling of a global, experience-first infrastructure. In this fertile ground—nurtured by trillions in consumer potential—the roots of brand value must extend beyond transactional utility, anchoring instead in the deep soil of cultural symbiosis. Here, they grow endlessly, branching across continents, enriched by the meaning they deliver.

As petals fall and the season turns, the experiential scroll of elegance continues to unfold—gently, confidently—across the flourishing new era of global luxury travel.

How Brunello Cucinelli Masters Technology to Preserve Craftsmanship?

Beyond the LV x Takashi Murakami Collaboration:

A New Chapter in Experiential Luxury Business

Feb 02, 2026

Experience is no longer an add-on, but the sculptor of time itself—etching a new chapter for the brand in the vast domain of luxury.

“We want to see the newest things. That is because we want to see the future, even if only momentarily.” —— Takashi Murakami

In the heart of Shanghai’s plane tree-lined district, the winter chill weaves through bustling crowds. Amid the cold, commercial vitality blooms—radiating a quiet warmth.

Outside a three-story building on Julu Road, a steady stream of diverse visitors pause and gather. A winding queue forms along the street, adding to the hum of life in the historic French Concession. On the building’s facade, LV’s initials and the brand’s iconic Monogram flowers have been transformed into three-dimensional installations. Scattered across the exterior and gently spinning in the breeze, they extend a warm invitation—welcoming passersby to witness the grand opening of a new year’s brand collaboration.

Limited-time retail activations have become a standard tactic in brand marketing. With substantial budgets, top-tier brands now routinely execute “City Takeovers”—a marketing strategy that saturates urban spaces with immersive brand presence. Yet the Louis Vuitton × Takashi Murakami collaboration raises the bar once again. Beyond the immersive retail environment, the brand has introduced a Mini Cinema and a curated Café Garden, evolving the pop-up model into a multifunctional experience hub—and setting a new benchmark for the industry.

In the context of the experience economy, consumer perceptions of luxury have shifted beyond the product itself toward deeper emotional resonance and cultural alignment. Sensory-driven experiential spaces, combined with brand storytelling that fosters cultural connection, are fast becoming essential tactics in capturing a finite and fiercely competitive market.

Simultaneously, the global tourism boom continues to gain momentum, unleashing renewed demand for high-end experiences. Under the trend of hyper-localization, brand retail spaces are evolving into cultural landmarks. These not only help rebalance outbound spending, but also present fresh consumer touchpoints—energizing both revenue growth and long-term brand equity.

Drawing on industry research, expert interviews, market visits, and consumer insights, Premier examines three strategic themes through a multidimensional lens to help luxury brands navigate the new landscape:

1. A Commercial Breakdown of the Louis Vuitton × Takashi Murakami Pop-Up

2. Experience-Driven Luxury Tourism Consumption Insights

3. Guidelines for Upgrading Customer Strategy Through Experience-Led Transformation