Q2 2025 PRMC Forward Mobility Index

Review & Prospect

Q2 2025 PRMC Forward Mobility Index

Review & Prospect

Anchored in index volatility and macroeconomy data, mapping the automotive industry’s risk unwind and opportunity reconfiguration under escalating trade frictions.

Trade Frictions Deepen the Downturn, Supply and Manufacturing Lead Gains

Global geopolitical uncertainties and fluctuating trade policies continued to cast a shadow in the second quarter of 2025, forcing the automotive industry to seek a new equilibrium amidst complex dynamics. The U.S. auto market showed an overall sluggish performance, as tariffs and policy uncertainties suppressed financing demand for vehicles. This, combined with weak consumer spending on durable goods, put pressure on sales for major automotive brands. Simultaneously, some multinational automakers adjusted their production plans and product rollouts in the U.S., increasing pressure on supply chain restructuring. The European auto market entered a period of structural adjustment, with tariff disputes further slowing the electric vehicle transition for European carmakers. A weak manufacturing sector and low consumer confidence hampered market recovery. In contrast, driven by economic recovery and supportive policies, the Chinese auto market continued its steady growth. Leading domestic brands further consolidated their market-leading positions, and the penetration rate of new energy vehicles (NEVs) continued to rise.

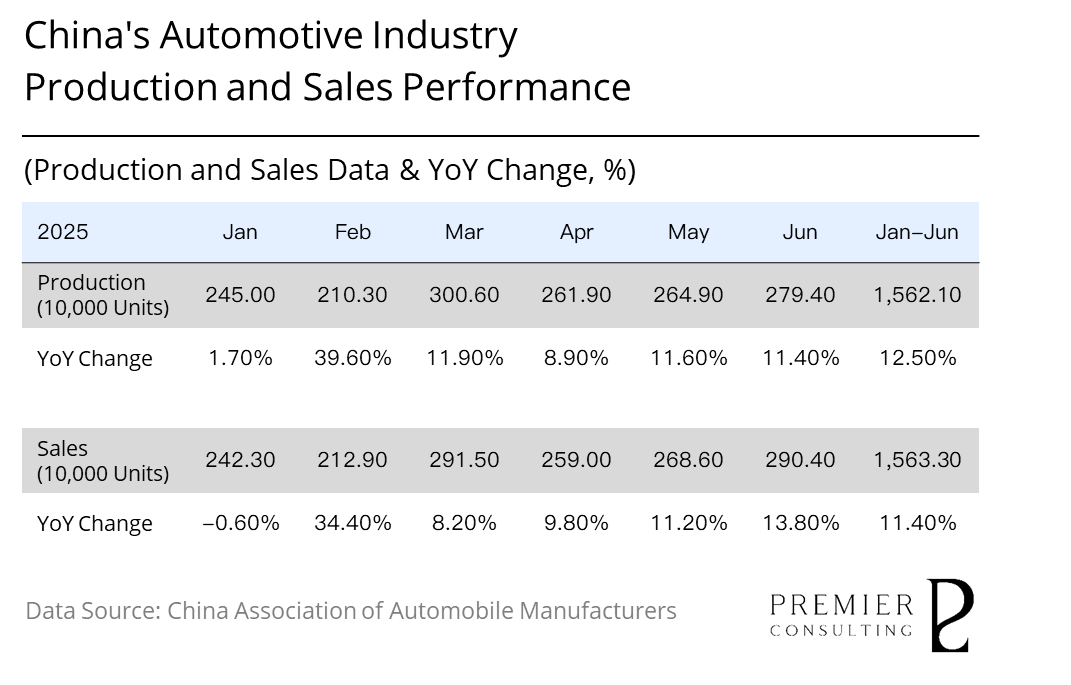

In the second quarter of 2025, China's auto industry maintained stable operation. 2025 H1, auto production and sales reached 15.621 million and 15.633 million units respectively, marking YOY increases of 12.50% and 11.40%. Notably, the sales growth rate accelerated by 0.2 percentage points compared to the first quarter. Auto exports continued their strong growth momentum, with a cumulative total of 3.083 million vehicles exported in the first half of 2025, a year-over-year increase of 10.40%, further expanding the industry's presence in overseas markets.

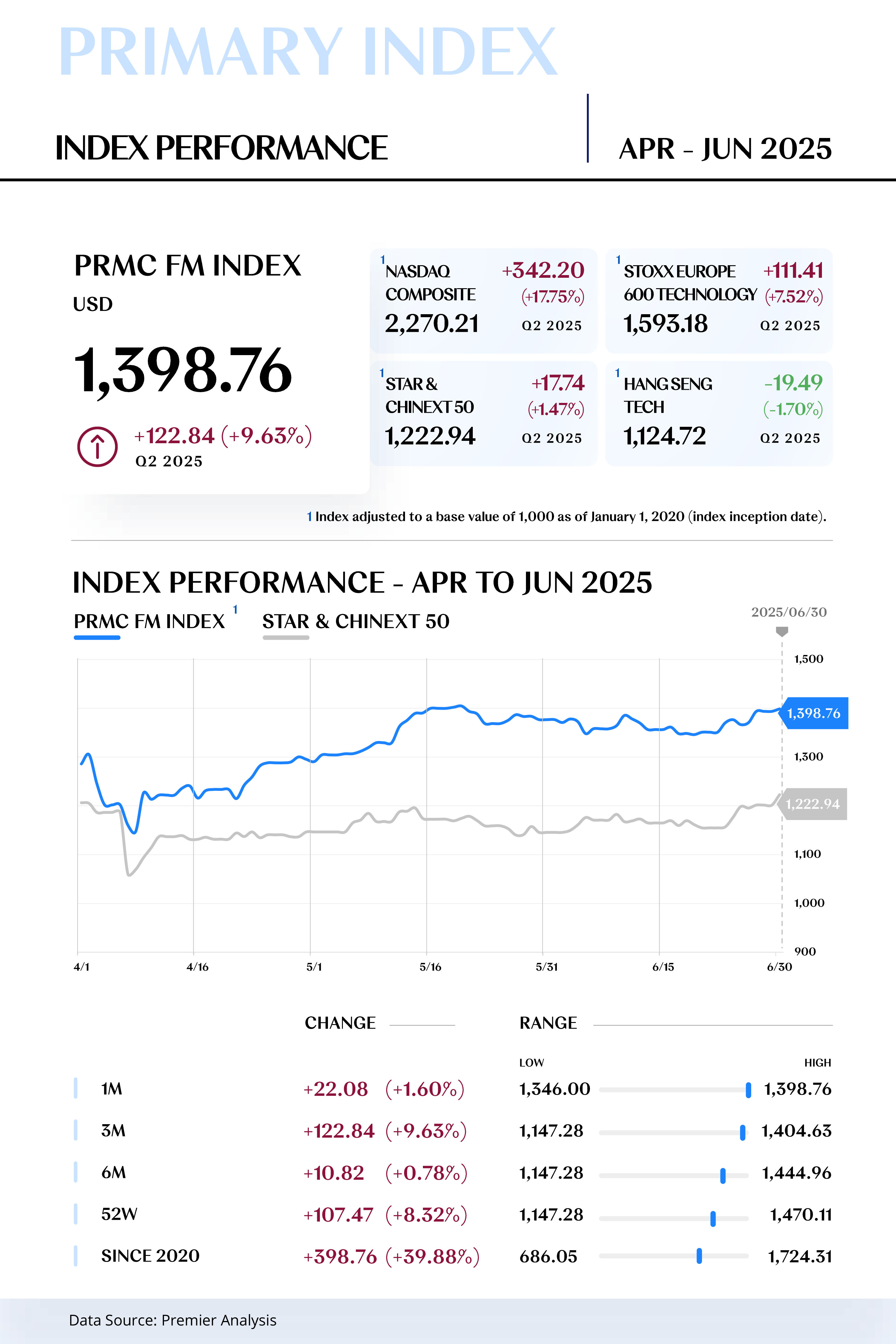

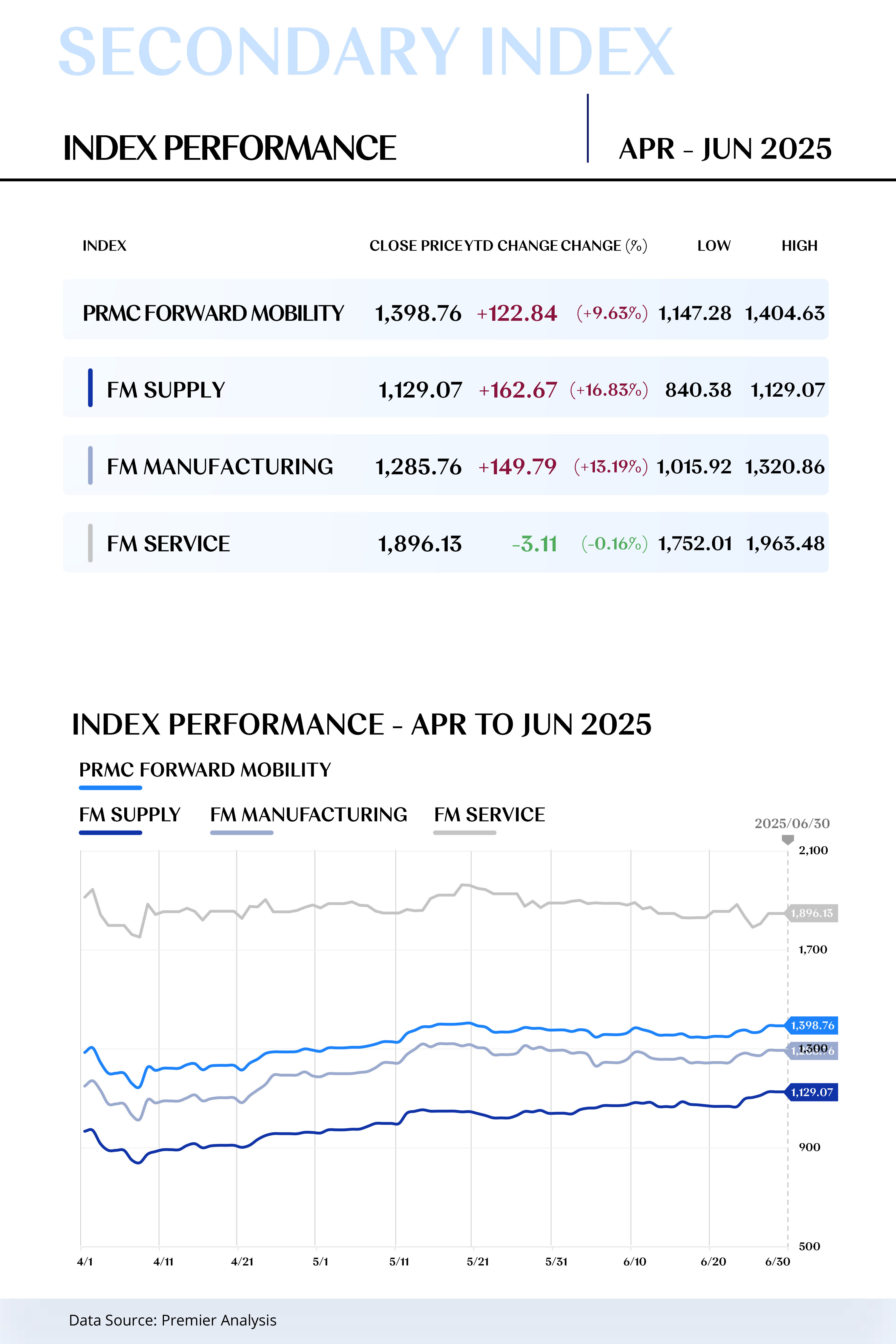

The PRMC Forward Mobility Index closed at 1,398.76 points in Q2, rebounding by 122.84 points (+9.63%) within the quarter. Its performance trailed the NASDAQ Composite but outperformed other major global indices such as the STOXX Europe 600 Technology, STAR & CHINEXT 50, and Hang Seng Tech. Among the sub-indices, the Forward Mobility Supply Index led the gain (+16.83%), followed by the Forward Mobility Manufacturing Index (+13.19%), while the Forward Mobility Service Index saw a slight retreat (-0.16%).

Individual stock performance showed significant divergence in the second quarter. Companies such as Daimler, Tesla, and Xiaomi Group delivered standout performances, with their stock prices rising by over 20% during the quarter. In contrast, Dongfeng Motor, XPeng Motors, and BAIC BluePark performed poorly, with their stock prices falling by more than 10%.

Those who adapt to change will advance; those who control it will triumph.

Looking ahead to the third quarter, the Chinese auto market is expected to achieve "dual-driver growth" from both domestic and international fronts, powered by its advantages in new energy and supportive government policies. Exports are anticipated to maintain medium-to-high-speed growth, while domestic demand is set to recover, stimulated by multiple policies including "trade-in" programs and "NEVs to the Countryside." However, overseas trade barriers and domestic price wars will remain major challenges.

The European and U.S. markets both face systemic challenges at the macroeconomic level. The European auto market is constrained by sluggish demand due to economic slowdown and a weak manufacturing sector. The ongoing negotiations between China and the EU regarding NEV import tariffs, and regulatory compliance will be a key variable affecting the market landscape.

The direction of tariff policy of the United States remains highly uncertain. The resulting policy expectations are disrupting corporate decision-making and supply chain stability. Compounded by the fact that previous vehicle demand has been largely met, the overall market is expected to continue operating at a low level.

DOWNLOADS

Lite Report (71 pages)

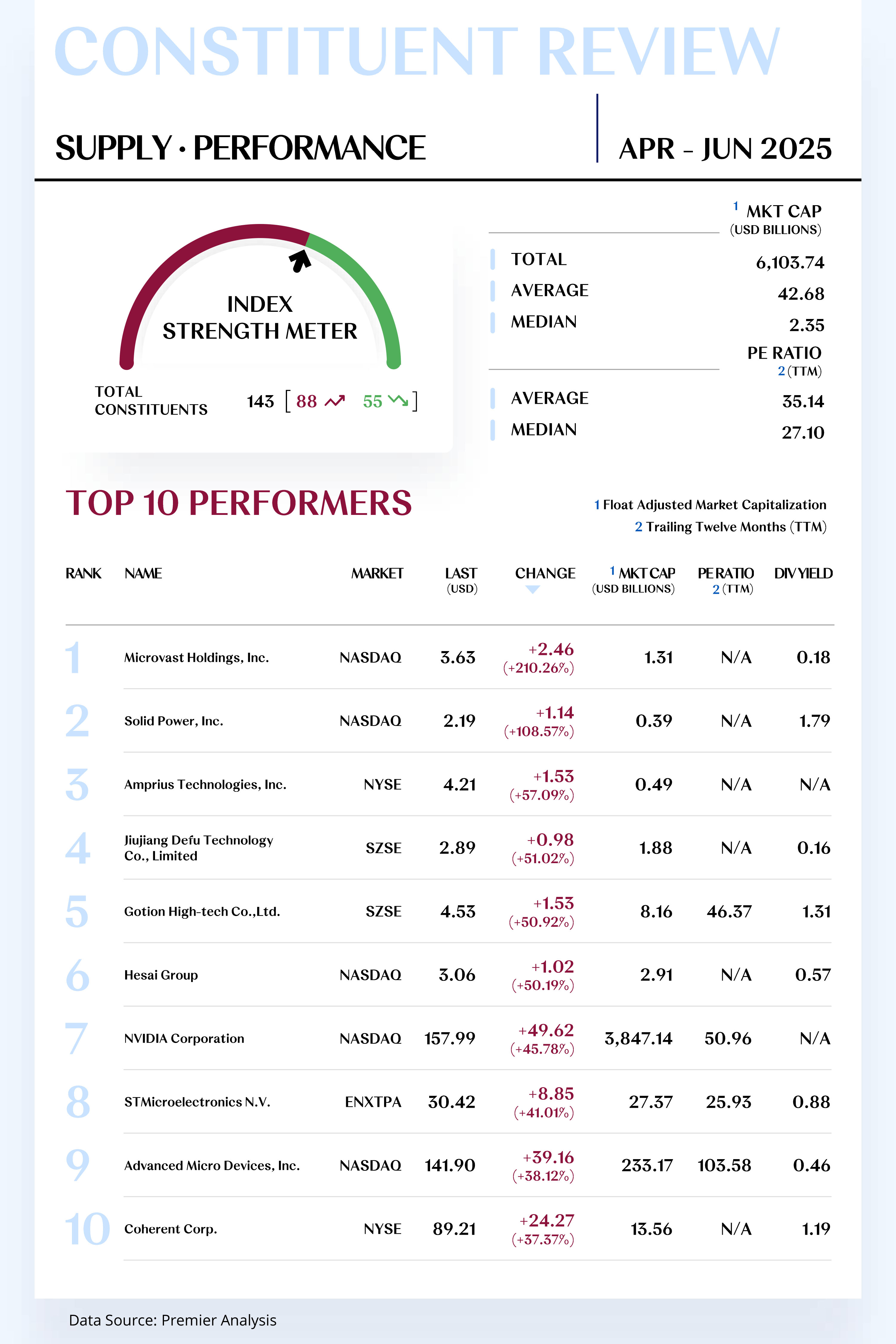

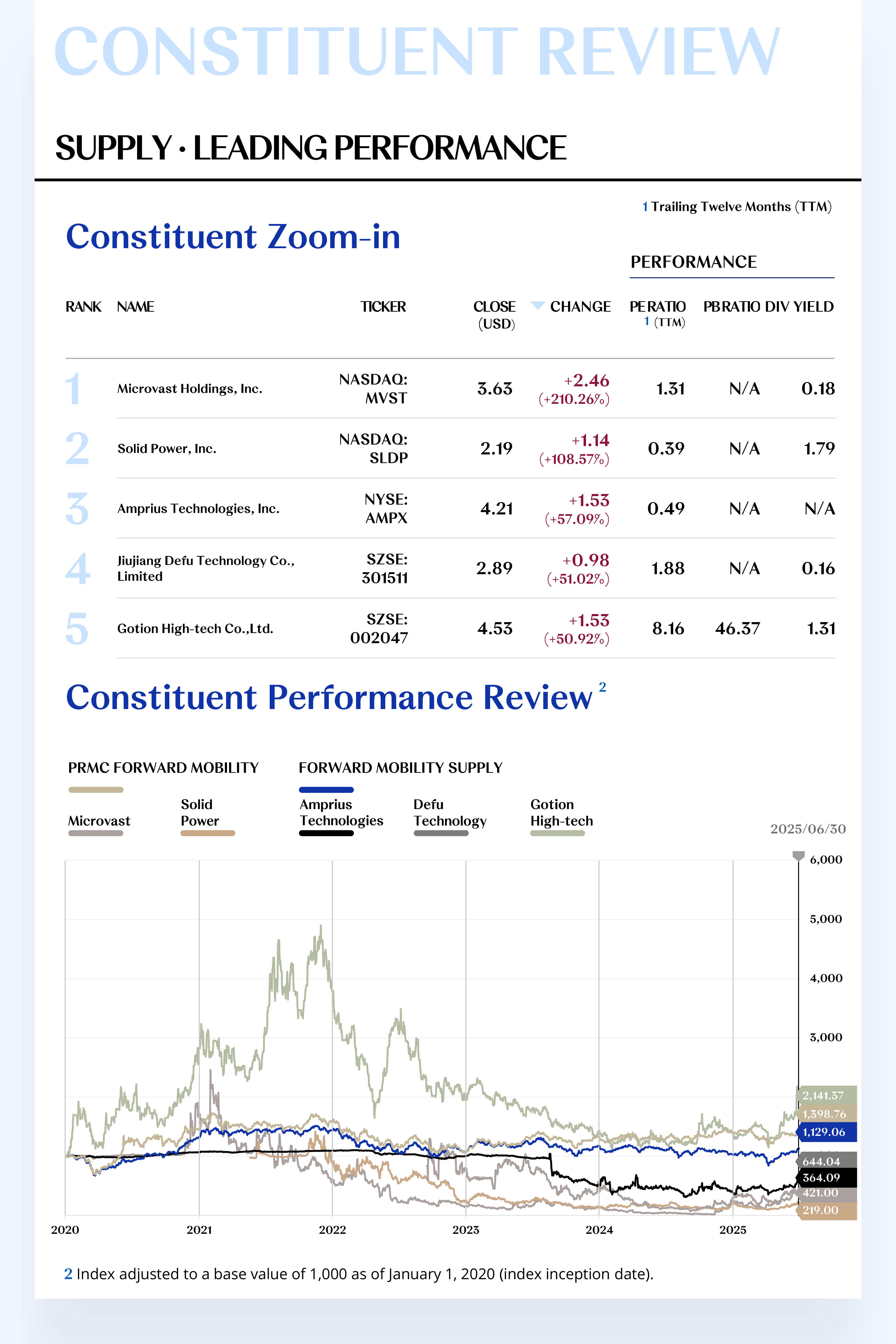

FORWARD MOBILITY SUPPLY CONSTITUENT ZOOM-IN

Capacity Expansion Fuels Long-Term Confidence,

Technology Breakthroughs Cement Competitive Edge

The Forward Mobility Supply Index comprises 143 stocks, with 88 rising and 55 declining.

Leading Performers

1. Microvast Holdings, Inc. (NASDAQ: MVST)

Microvast Holdings specializes in the design, development, and manufacturing of batteries for commercial electric vehicles, with products including cells, modules, and battery packs. Its fast-charging battery technology is one of the company's core competencies, primarily applied in commercial EVs such as electric buses, trucks, port equipment, and mining vehicles. In 2025 Q2, the company's stock price rose by $2.46 to close at $3.63, a quarterly gain of 210.26%.

The surge in the company's stock price was mainly driven by significant progress in production capacity expansion and new order acquisitions. In April 2025, the company announced a major milestone as its battery module and pack production lines at its Clarksville, Tennessee factory became fully operational. The facility is part of a project funded by the U.S. Department of Energy (DOE). This development boosted market confidence in the company's localized production and ability to maintain a stable supply chain and was seen as a key driver of the stock price increase. Additionally, Morgan Stanley analysts believe that despite short-term pressure on profitability, the company's vertical integration capabilities and technological advantages in the commercial vehicle sector constitute a solid long-term moat.

Looking ahead, Microvast's revenue is projected to grow significantly as production at its new Colorado factory gradually ramps up and new customer orders are fulfilled. The company is engaged in deep collaborations with multiple global commercial vehicle manufacturers and is poised for further breakthroughs in the energy storage systems (ESS) and specialty electric vehicle sectors.

2. Solid Power, Inc. (NASDAQ: SLDP)

Solid Power is a leading developer of solid-state battery technology, dedicated to providing high-performance batteries for electric vehicles and the aerospace industry. In 2025 Q2, the company's stock price increased by $1.14 to close at $2.19, a quarterly gain of 108.57%.

April 29, 2025, the company announced it had successfully delivered its A-1 sample cells to its key automotive partner, BMW, for testing. It also reported a critical breakthrough with its SP2 electrolyte material in terms of energy density and cycle life, marking a key step from the R&D phase toward commercial validation. Subsequently, in its first-quarter earnings report on May 8, the company reiterated its full-year development goals and highlighted ongoing collaborations with industry giants like SK On and Ford, which bolstered investor confidence.

In the coming months, Solid Power will continue to focus on the development of its A-2 sample cells and will iterate on its technology based on feedback from partners like BMW. The company's first electrolyte production line is now operational, laying a solid foundation for future large-scale production. As interest in next-generation battery technology grows within the automotive industry, Solid Power, as a pioneer in the solid-state battery field, is well-positioned to make further progress in technology validation and customer collaborations.

[For more insights, please download the full report]

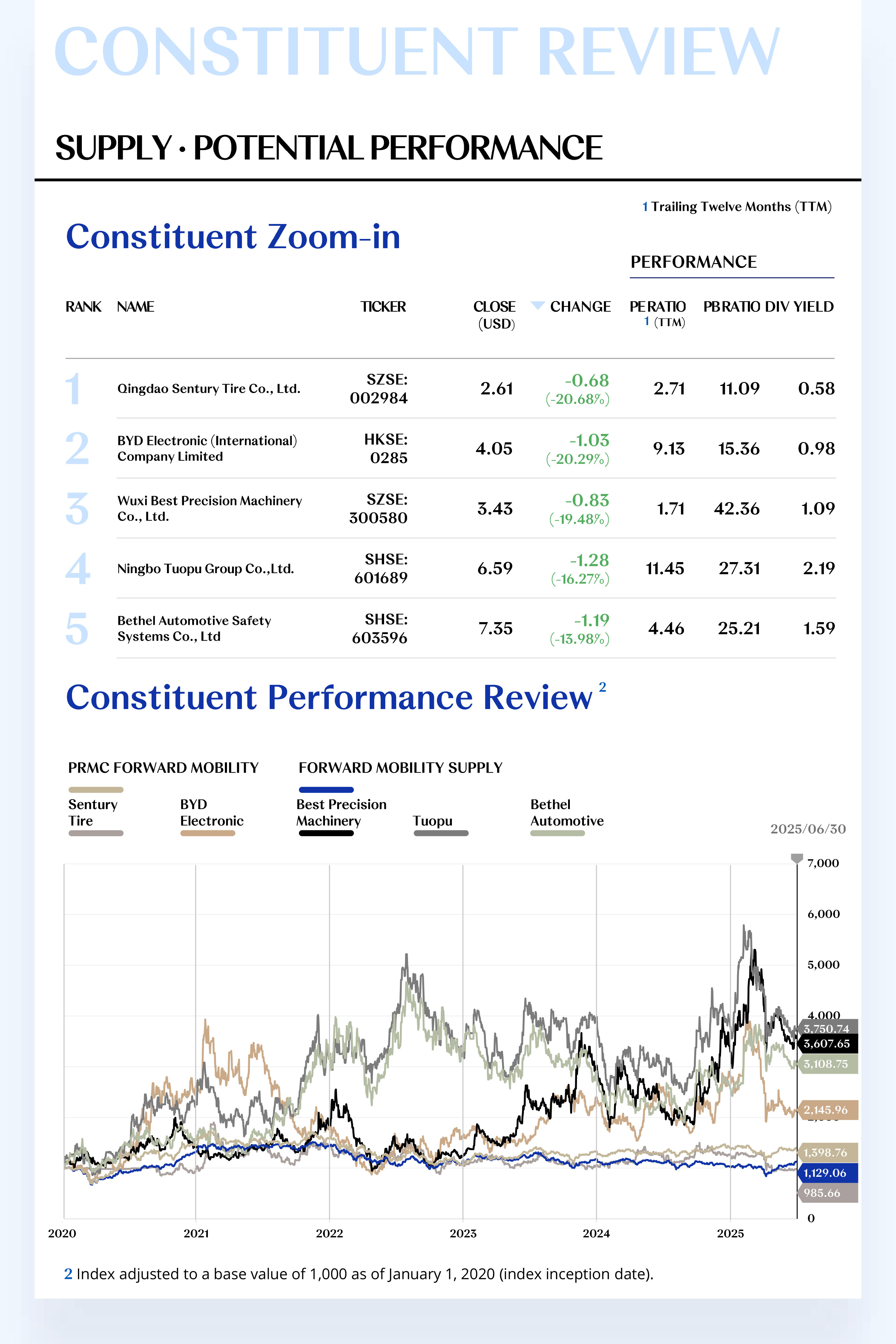

Potential Players

1. Qingdao Sentury Tire Co., Ltd. (SZSE: 002984)

Sentury Tire specializes in the research, development, production, and sales of automotive and aviation tires. Its main products include passenger car tires, light truck tires, and specialty tires. In 2025 Q2, the company's stock price fell by $0.68 to close at $2.61, a quarterly decline of 20.68%.

The full production capacity release of its Phase II factory in Thailand drove steady growth in the company's revenue and net profit in the first quarter. The company continues to advance its "833Plus" globalization strategy, with construction of its factory in Spain progressing smoothly and expected to enter the trial production phase by the end of 2025.

Although the company's stock price experienced a pullback in the second quarter due to sector-wide adjustments, fluctuations in raw material prices (such as natural rubber), and uncertainties in European and American trade policies, the overall institutional outlook remains positive.

Looking ahead to the third quarter, the start of mass production at the Morocco factory is expected to become a new source of revenue growth, while low sea freight costs will continue to optimize the company's profit structure. The company is poised for further business growth, driven by deeper expansion into the high-end European market and the advancement of high-value-added product lines like aviation tires.

2. BYD Electronic (International) Company Limited (HKSE: 0285)

BYD Electronic is a leading global platform-based high-end manufacturing enterprise. Its business is primarily divided into three major segments: consumer electronics, new intelligent products, and new energy vehicle systems. In the second quarter of 2025, the company's stock price dropped by $1.03 to close at $4.05, a quarterly decline of 20.29%.

In Q2, the company's consumer electronics business faced pressure due to a slower-than-expected recovery in the global smartphone market. However, the company's share within Apple's supply chain continued to increase, with its structural components and assembly services for high-end models providing stable revenue. On the other hand, the automotive electronics business delivered a strong performance. Benefiting from the accelerating trend of vehicle intelligence, the company's smart cockpit systems, domain controllers, and other products have gained recognition from major domestic and international automakers, leading to robust order growth.

Looking ahead, the consumer electronics business is expected to see marginal improvement as stocking demand for the peak season gradually picks up and major clients launch new products. While institutions such as Morgan Stanley and Goldman Sachs have made short-term adjustments to their target prices, they remain optimistic about the company's long-term development, particularly its business layout in emerging fields like automotive electronics and AI servers.

[For more insights, please download the full report]

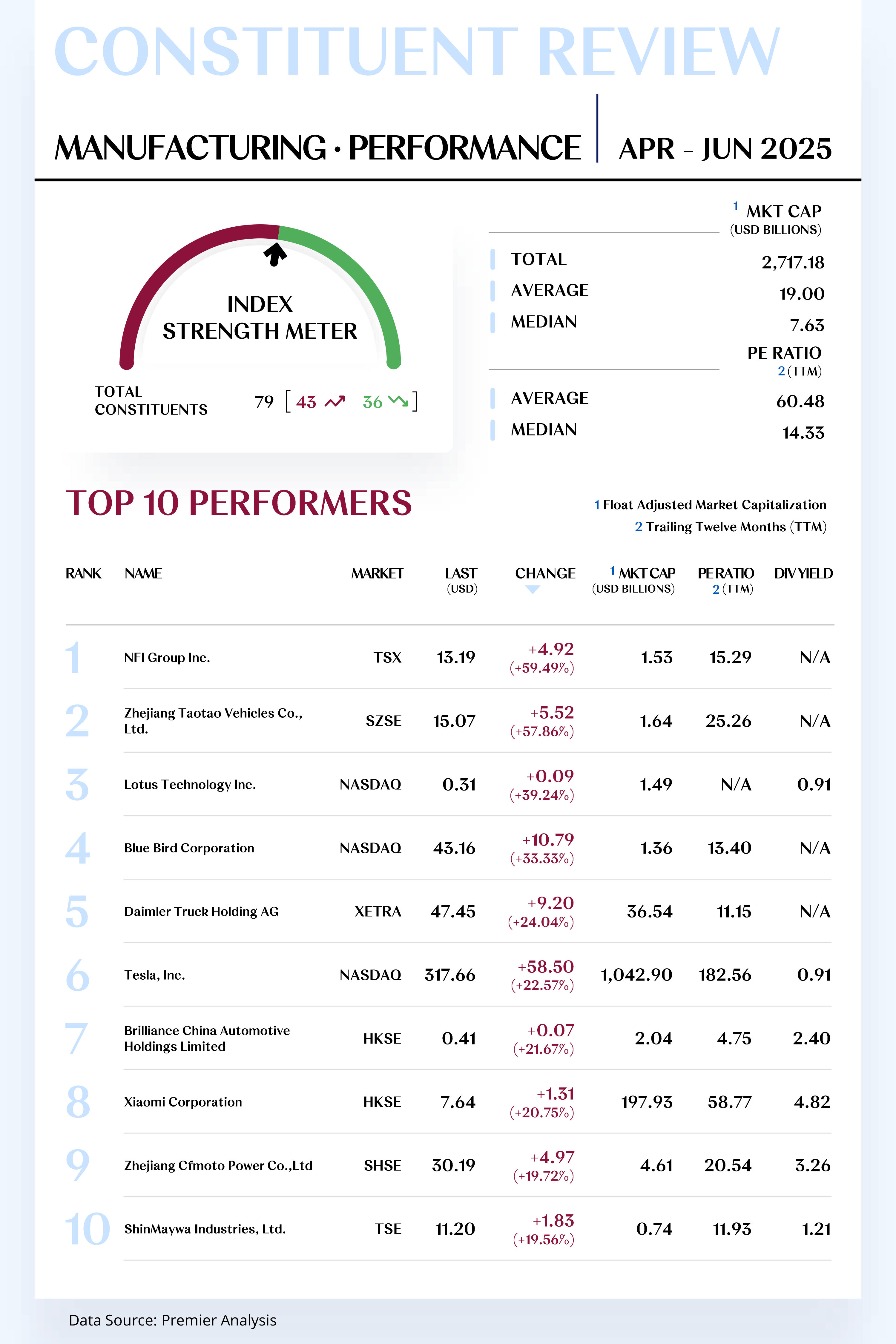

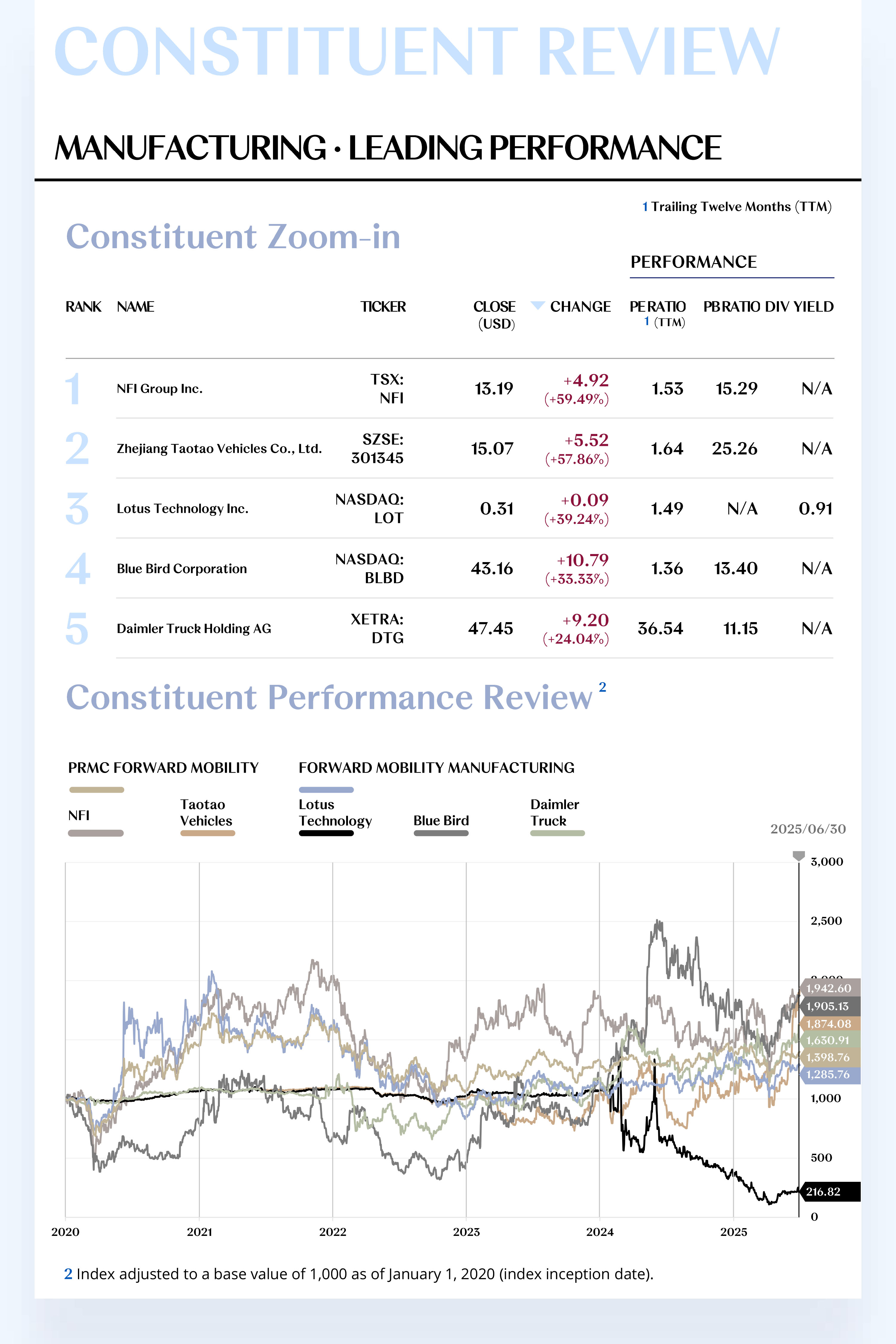

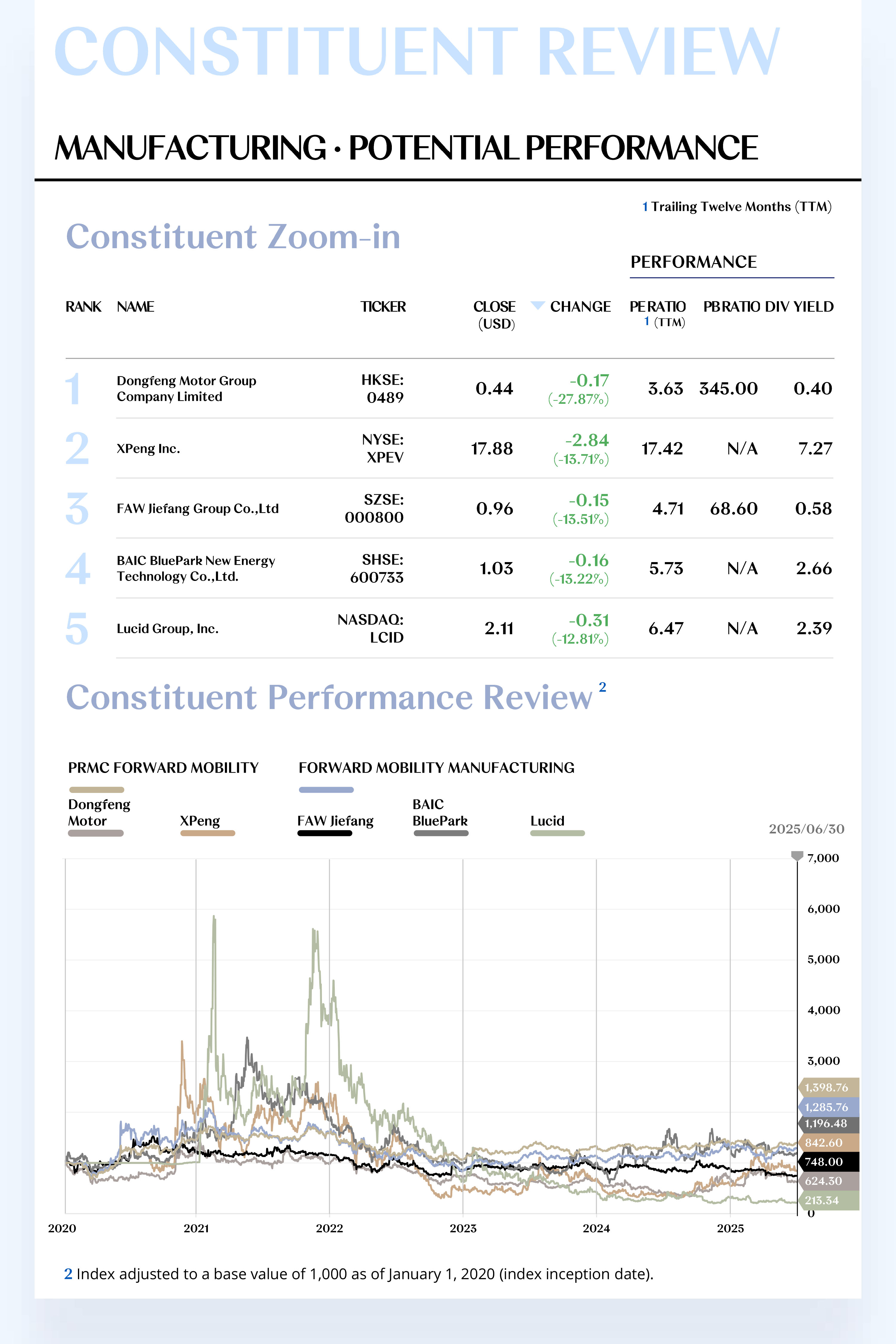

FORWARD MOBILITY MANUFACTURING CONSTITUENT ZOOM-IN

Accelerated Deliveries Fulfill Performance Expectations,

Full-Year Profit Guidance Reaffirms Market Confidence

The Forward Mobility Manufacturing Index comprises 79 stocks, with 43 rising and 36 declining.

Leading Performers

1. NFI Group Inc. (TSX: NFI)

NFI is one of the world's leading independent bus and coach manufacturers. The company owns multiple brands, including New Flyer® (heavy-duty transit buses) and Alexander Dennis Limited (single and double-deck buses). In the second quarter of 2025, the company's stock price rose by $4.92 to close at $13.19, a quarterly gain of 59.49%.

The company's strong stock performance in the second quarter was primarily driven by its continuously growing order backlog. In April 2025, the company announced it had received 1,575 equivalent units (EUs) in new orders during the first quarter of 2025, with 58% of these being for zero-emission vehicles. Furthermore, in its first-quarter earnings report released on May 8, 2025, the company reiterated its full-year financial guidance, projecting a positive free cash flow of $40 million to $70 million, which further boosted investor confidence.

Looking ahead, as cities worldwide continue to push for the electrification of their public transportation systems, NFI Group is expected to continue securing new orders. The company's five-year order backlog, valued at over $12 billion, provides a solid guarantee for future revenue. Leveraging its leading position in the North American market and its innovative zero-emission technology, NFI Group is anticipated to continue its growth trajectory in the third quarter, further solidifying its leadership position in the global bus market.

2. Zhejiang Taotao Vehicles Co., Ltd. (SZSE: 301345)

Zhejiang Taotao Vehicles specializes in the research, development, production, and sales of outdoor recreational vehicles such as all-terrain vehicles (ATVs), motorcycles, and electric scooters. Its main products include electric scooters, electric bicycles, electric golf carts, and ATVs. In the second quarter of 2025, the company's stock price increased by $5.52 to close at $15.07, a quarterly gain of 57.86%.

On April 28, 2025, the company released its first-quarter report for 2025, which showed a year-over-year operating revenue increase of 20.08% and a net profit increase of 51.13%, marking a strong start to the year. To meet continuously growing order demand, the company announced on June 12, 2025, a plan to invest up to 610 million RMB to build a new production base in Mexico. This move aims to better serve the North American market and enhance long-term competitiveness

Looking forward, as demand for outdoor powersports products continues to heat up in overseas markets, particularly in North America, Taotao Vehicles is well-positioned to benefit. The planned construction of the new factory in Mexico will not only effectively reduce certain tariff costs but also significantly shorten delivery times to major markets. With its cost-effective products and continuously expanding global footprint, the company is expected to further increase its global market share.

[For more insights, please download the full report]

Potential Players

1. Dongfeng Motor Group Company Limited (HKSE: 0489)

Dongfeng Motor is engaged in the vehicle manufacturing industry, with business covering the research, development, and production of passenger vehicles, commercial vehicles, new energy vehicles, and key components. It owns domestic brands such as Voyah, M-Hero, and Dongfeng Aeolus, as well as joint venture brands like Dongfeng Nissan and Dongfeng Honda. In the second quarter of 2025, the company's stock price fell by $0.17 to close at $0.44, a quarterly decline of 27.87%.

In the second quarter of 2025, Dongfeng Motor Group faced severe transformation challenges. Its joint venture segment (including Nissan and Honda) remained under continuous pressure from the impact of new energy vehicles, leading to a significant decline in sales and profit contributions. In its domestic brand segment, Voyah Motors saw month-over-month sales improvements, and its new model, the "Voyah Dreamer," achieved a breakthrough in the high-end MPV market. M-Hero Technology's "M-Hero 917" established a high-end electric off-road brand image, but its sales contribution remains limited.

In the mid- to long-term, the expansion of the product lineups for the Voyah and M-Hero brands and the expansion of their sales channels will be critical to the company's transformation. If their combined monthly sales can break the 10,000-unit threshold, the company's profit structure could see gradual improvement. The results of technology collaborations in the intelligent driving sphere are expected to be implemented in new 2026 models, which could become a key competitive differentiator.

2. XPeng Inc. (NYSE: XPEV)

XPeng is one of China's leading smart electric vehicle companies, dedicated to driving a profound transformation in future mobility through its full-stack, in-house developed autonomous driving system, intelligent cockpit, and electric platform. In the second quarter of 2025, the company's stock price fell by $2.84 to close at $17.88, a quarterly decline of 13.71%.

XPeng's business performance was a highlight in the second quarter, with vehicle deliveries surpassing 20,000 units for two consecutive months. Its primary models, the G6 and X9, along with the revamped P7i, jointly drove the sales rebound. In the technology realm, the XNGP urban intelligent driving feature continued to expand its coverage, with the rollout of its "mapless" solution advancing at an industry-leading pace. Substantial progress was made in its partnership with Volkswagen, achieving cost reductions and efficiency gains through joint procurement, while the joint development of two B-class SUV projects proceeded steadily. Despite numerous bright spots on the business side, the recovery progress of the company's gross profit margin remains a key point of market focus due to the ongoing industry-wide price war.

Looking forward, the deep collaboration with Volkswagen will continue to empower XPeng in platform R&D, supply chain synergy, and capabilities for overseas expansion. The new models jointly developed by both parties, expected to launch in 2026, are anticipated to become a critical pillar for new growth.

[For more insights, please download the full report]

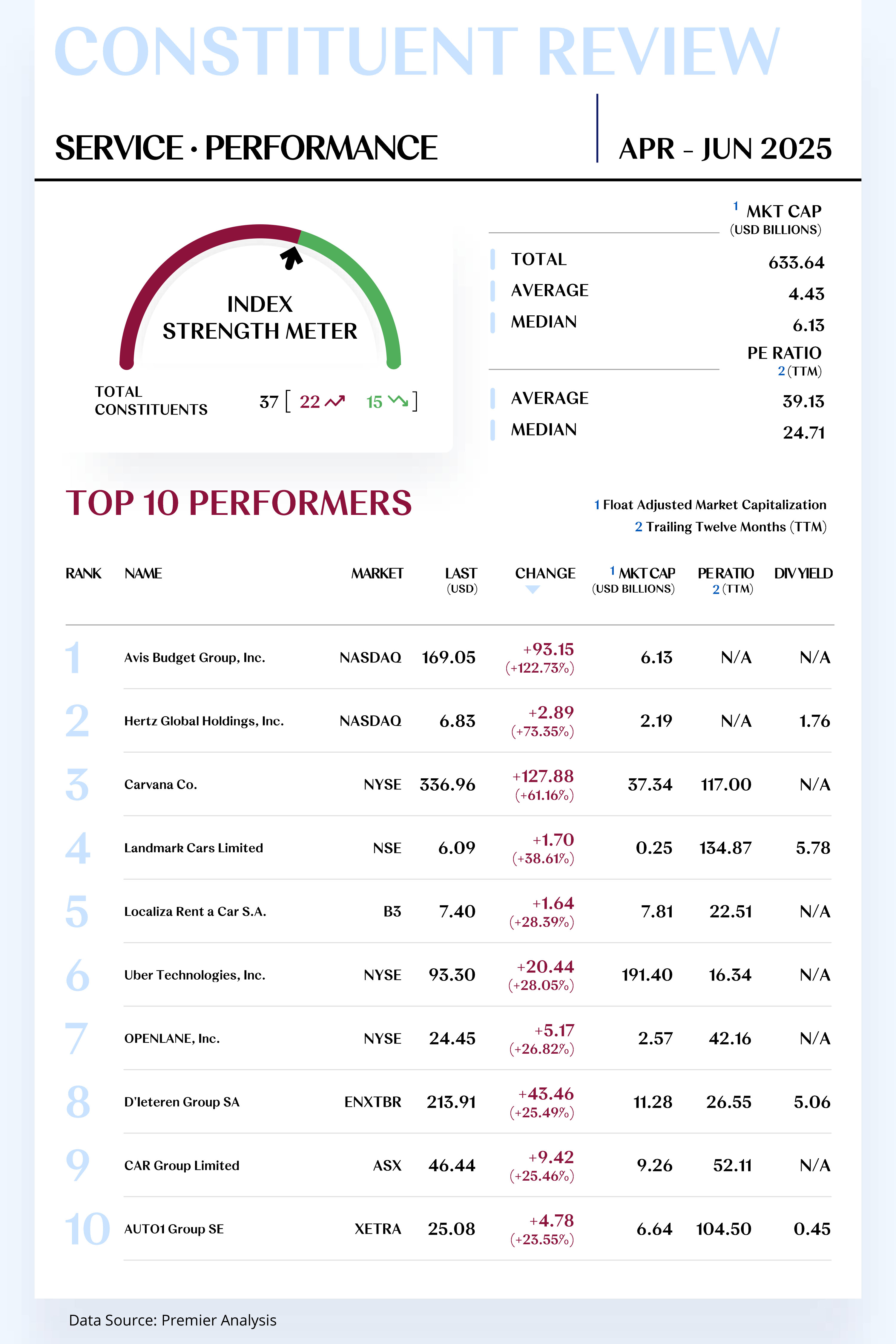

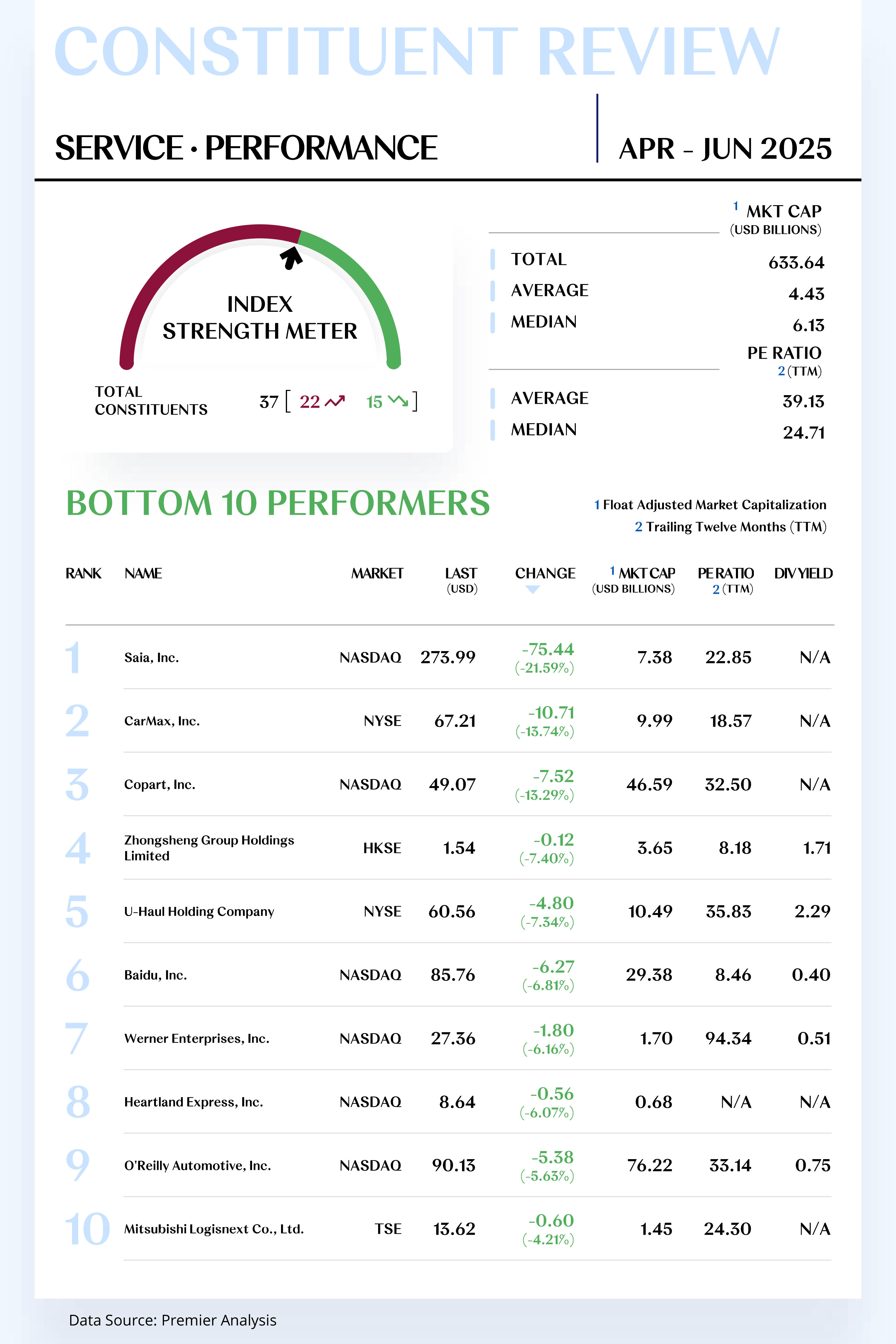

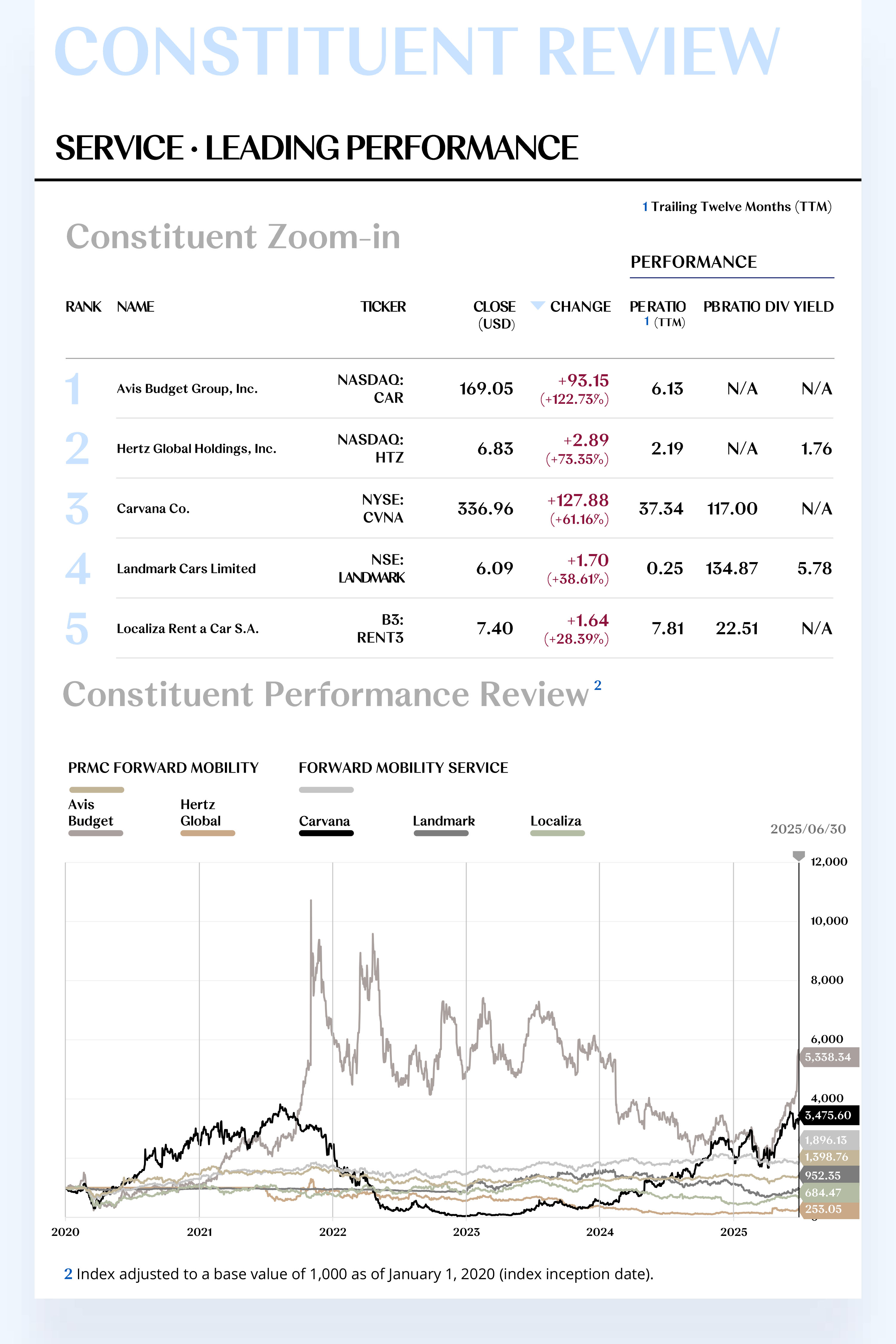

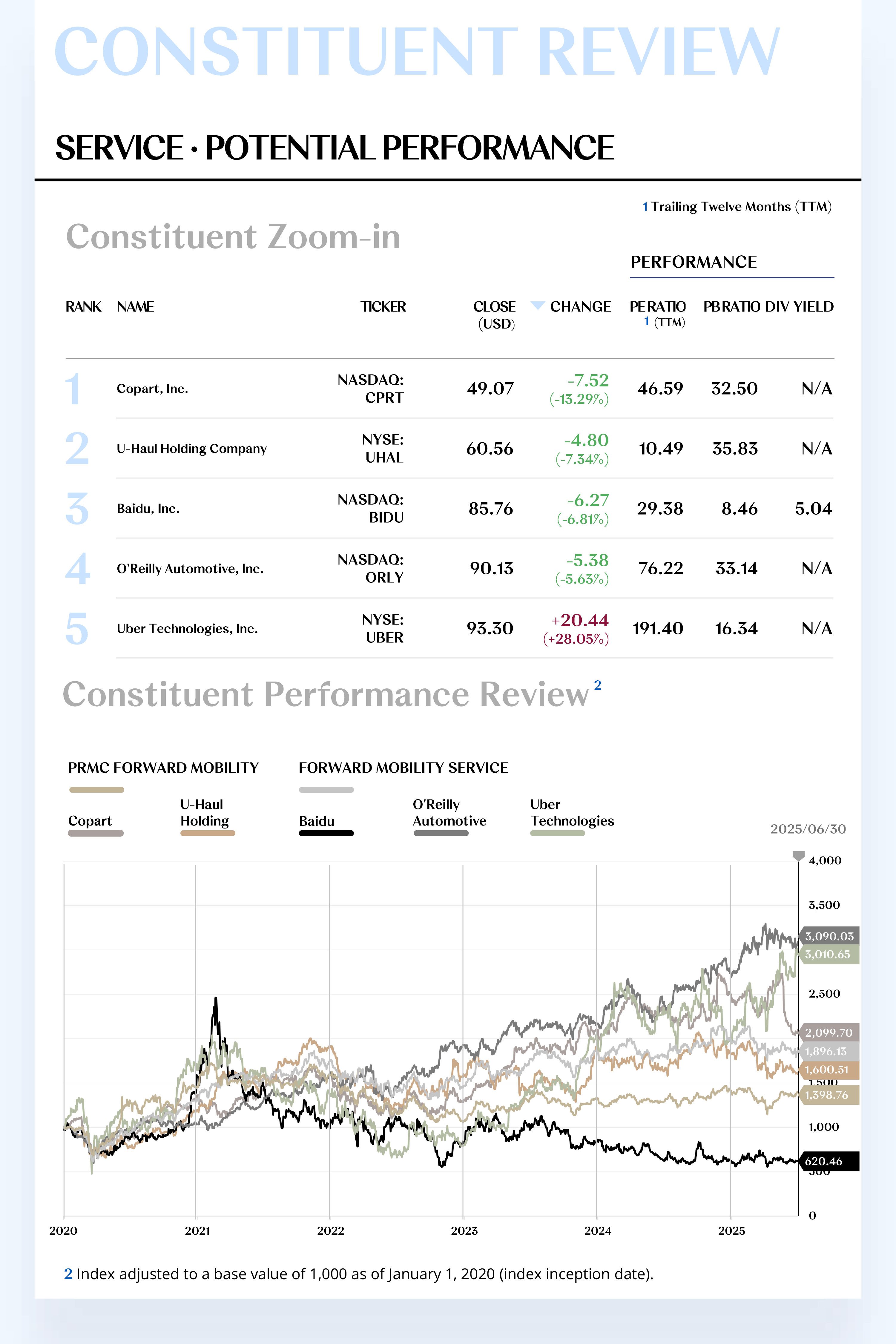

FORWARD MOBILITY SERVICE CONSTITUENT ZOOM-IN

Industry Collaboration Drives Synergistic Gains,

Cost Optimization Accelerates Financial Recovery

The Forward Mobility Service Index comprises 37 stocks, with 22 rising and 15 declining.

Leading Performers

1. Avis Budget Group, Inc (NASDAQ: CAR)

Avis Budget Group, a leading global provider of car rental and mobility solutions, owns brands like Avis, Budget, and Zipcar. In the second quarter of 2025, the company's stock price increased by $93.15, closing at $169.05, a quarterly gain of 122.73%.

During the quarter, the group announced an expanded partnership with The Floow, a smart driving behavior analysis company. This collaboration aims to use The Floow's technology to monitor driving behavior, with the goal of reducing accident rates and lowering insurance costs.

In terms of fleet electrification, the group continued to increase infrastructure investment, partnering with EverCharge to deploy 44 EVgo AC charging stations at Houston's George Bush Intercontinental Airport. This move responds to the rapid growth in demand for electric vehicle rentals and strengthens the company's position in new energy vehicle mobility solutions.

The company also announced a key management change in June 2025, appointing Daniel Cunha as the new CFO, effective July 1, 2025. He will succeed Izzy Martins, who served for over two decades. This change aims to introduce new financial strategic leadership to support the company's medium-to-long-term development goals in digitalization, sustainable mobility, and capital efficiency.

Looking ahead, the group projects its adjusted EBITDA to exceed $200 million in Q2. Management remains optimistic about the continued recovery in leisure travel demand and anticipates a marginal improvement in fleet procurement and maintenance costs.

2. Hertz Global Holdings, Inc (NASDAQ: HTZ)

Hertz Global Holdings is one of the world's largest airport car rental brands, with operations globally. In the second quarter of 2025, the company's stock price rose by $2.89, closing at $6.83, a quarterly gain of 73.35%.

According to the company's first-quarter earnings report, released in May 2025, direct operating expenses decreased by $92 million year-over-year, and vehicle depreciation dropped by 45% year-over-year. These improvements were achieved by strengthening cost controls and implementing strategic fleet rotation, indicating a continued improvement in fundamental performance. In the same period, the company successfully extended its $1.7 billion revolving credit facility to 2028, further enhancing its financial flexibility and debt repayment capabilities.

Hertz anticipates achieving its goal of a positive EBITDA within the year. The company is advancing foundational reforms to its revenue management system, aiming to significantly boost overall profit margins. With the peak travel season approaching and continued improvements in operational efficiency, the company is well-positioned to capitalize on the market recovery in the third quarter, driving simultaneous growth in revenue and profitability and continuing its positive recovery trend.

[For more insights, please download the full report]

Potential Players

1. Copart, Inc (NASDAQ: CPRT)

Copart, a leading global provider of online vehicle auction services, primarily serves vehicle dismantlers and used car dealers. In the second quarter of 2025, the company's stock price fell by $7.52, closing at $49.07, a quarterly decline of 13.29%.

For the third quarter of fiscal year 2025, the company's revenue was $1.02 billion, a year-over-year increase of 7.1%, which was slightly below market expectations. Net income was $326 million, up 6.5% year-over-year, but the growth rate slowed compared to previous quarters. During the quarter, the number of vehicles auctioned increased by 4.8% year-over-year, but the average selling price was pressured by fluctuations in used car values. The company also continued its global expansion, adding new operating centers in Germany and Spain to strengthen its European market coverage.

Looking ahead, the trend of used car price adjustments may continue to suppress the average selling price. However, the company is expected to offset some of this downward pressure through an expansion of auction volumes, particularly in international markets. In the medium to long term, the continuous expansion of its global operating network will solidify its scale advantage. It is essential to monitor the effectiveness of cost controls and the impact of the high-interest-rate environment on used car demand.

2. U-Haul Holding Company (NYSE: UHAL)

U-Haul, a leading provider of do-it-yourself moving and truck rental services in the United States, offers a variety of trucks, trailers, and vans for personal moving, commercial transport, and logistics needs. In the second quarter of 2025, the company's stock price fell by $4.80, closing at $60.56, a quarterly decline of 7.34%.

According to its latest report for the fourth quarter of fiscal year 2025, U-Haul's core moving equipment rental revenue declined year-over-year, pulling down overall revenue. This was attributed to a sluggish U.S. housing market and reduced population mobility. However, the self-storage segment showed strong resilience, with occupancy rates and rental income maintaining steady growth, becoming a key pillar of the company's performance. During the period, the company announced an exclusive moving service partnership with a major apartment management firm and continued to expand its self-storage network, strengthening its diversified business portfolio.

From a medium-to-long-term perspective, the self-storage business, with its counter-cyclical nature and stable cash flow, combined with the continuous expansion of its national network, is expected to become the core driver of the company's profitability. Strategic partnerships with real estate companies are also likely to improve customer conversion and loyalty. Moving forward, it will be crucial to monitor the effectiveness of cost structure optimization and the pace of economic recovery. If improvements in operational efficiency and a rebound in demand occur simultaneously, the company's earnings potential could become more apparent.

[For more insights, please download the full report]

MACROECONOMY UPDATES

Trade Frictions Heighten Uncertainty,

Global Economic Downturn Intensifies

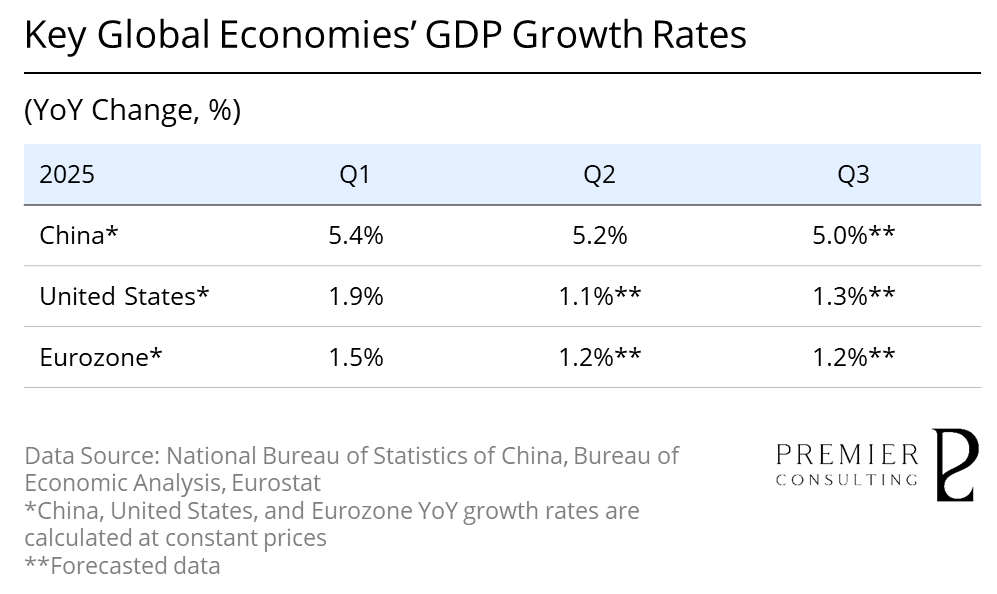

Global Economy Growth

Global: Rising Trade Tensions Heighten Uncertainty, Amplifying Global Economic Downturn Risks.

In the second quarter of 2025, the global economy continued its weak trajectory amidst multiple challenges. The persistent escalation of trade tensions, coupled with periodic adjustments in financial markets, has made the economic outlook more cautious. Although global inflation levels have generally receded and commodity prices have stabilized, providing some buffer for developing nations, weakening consumption momentum in major developed economies and a decline in corporate capital expenditure have dampened overall global growth.

At the same time, frequent geopolitical conflicts, stricter technology export controls, and the expansion of new trade barriers have further disrupted the stability of global industrial and supply chains, creating greater uncertainty for corporate operations and cross-border investment. On the policy front, major central banks worldwide have largely maintained a wait-and-see approach, and limited fiscal space has hindered their ability to implement counter-cyclical macroeconomic measures.

Looking ahead to Q3, the downward risks facing the global economy are expected to increase. The uncertainty surrounding tariff policies and their impact on the medium-to-long-term trade landscape will be a core focus. Tariff negotiations between countries and the competition and progress of regional economic cooperation mechanisms could be crucial variables for stabilizing international trade, with a tangible impact on the pace of global economic recovery.

[For more insights, please download the full report]

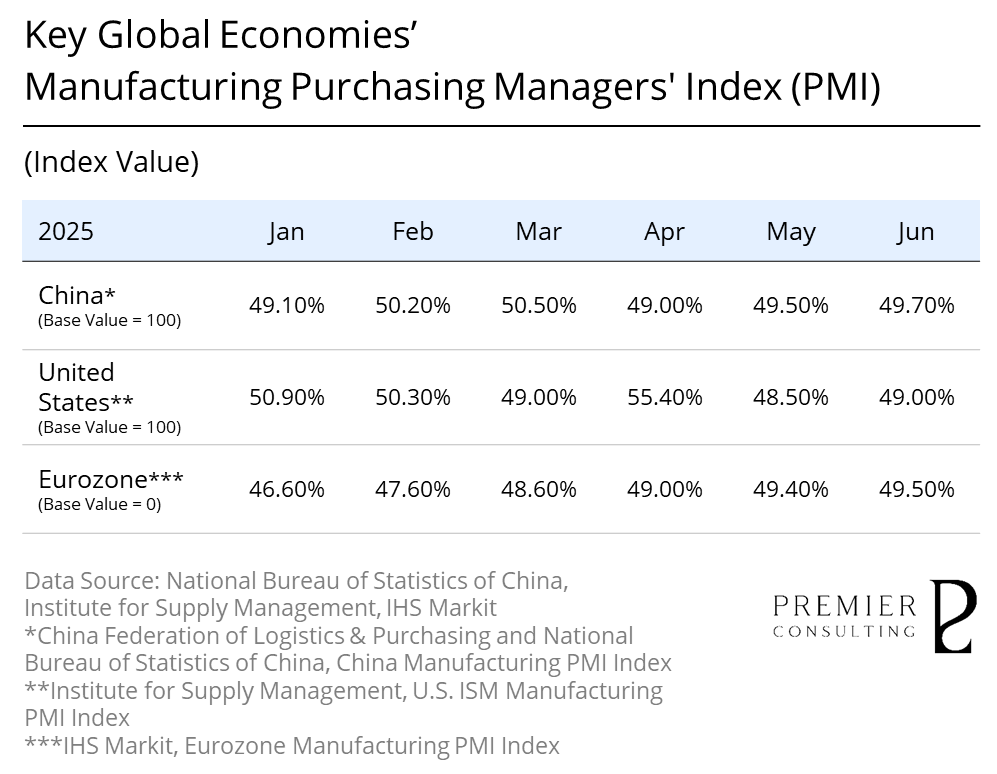

Manufacturing Purchasing Managers' Index Review

China: Manufacturing PMI Rises Monthly, Business Climate Strengthens

In the second quarter of 2025, China's Manufacturing PMI showed a month-over-month increase, with the June reading reaching 49.70%, nearing the expansion/contraction threshold. This indicates a significant strengthening of the manufacturing sector's recovery momentum.

Analyzing the sub-indices, both the Production and New Orders indices rose slightly month-over-month. The former increased from 49.80% to 51.00%, and the latter from 49.20% to 50.20%. Both have recently entered expansion territory, suggesting that both production and demand are providing more solid support for economic growth. However, the Employment Index remains in contraction, indicating that companies are cautious about hiring, and the conflict between labor costs and profitability has yet to be resolved.

Furthermore, a breakdown by enterprise size shows that the PMI for large enterprises was 51.20% in June, a 0.5 percentage point increase month-over-month and above the critical threshold. The PMIs for medium and small enterprises were 48.60% and 47.30%, respectively, representing a 1.1 percentage point increase and a 2.0 percentage point decrease month-over-month.

[For more insights, please download the full report]

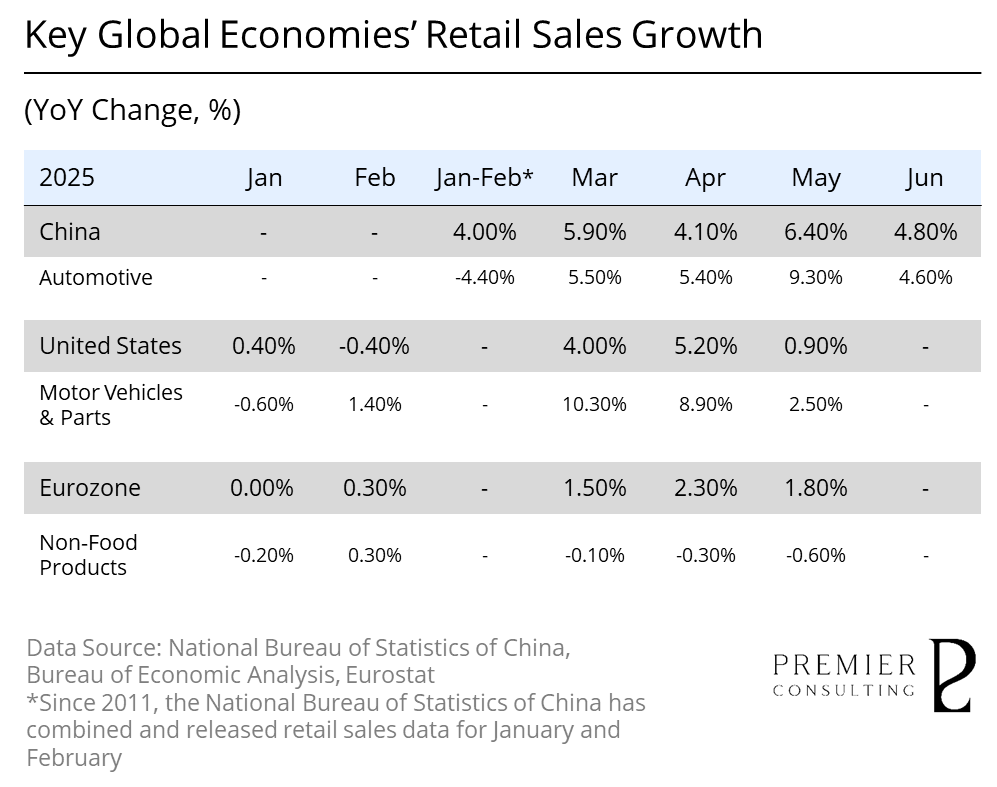

Retail Sales Growth Review & Outlook

China: Consumption Stimulus Policies Remain Effective, Market Vigor Accelerates

In the first half of 2025, China’s total retail sales of consumer goods reached 24.55 trillion yuan, up 5.0% year-on-year. Automotive goods contributed 2.35 trillion yuan, growing by 0.8%—below the overall average. However, a 4.6% rebound in June signaled a steady recovery in auto-related consumption.

Driven by structural upgrades and the holiday economy, services remained a key engine of domestic demand. From January to May, service retail sales rose 5.2% year-on-year, outpacing goods retail growth. Cultural tourism, leisure, and dining consumption surged, with catering revenue in May rising 5.9%—the highest since April 2024.

Meanwhile, under the consumer goods trade-in policy, retail sales of home appliances, electronics, office supplies, and furniture grew 25.6%–53.0% year-on-year in May, contributing 1.9 percentage points to total retail growth. This policy also fueled double-digit production growth in new energy vehicles, tablets, and e-bikes.

[For more insights, please download the full report]

INDUSTRY KEY FIGURES

Sector Maintains Stability in Q2,

BEV and Hybrid Models Drive Growth

Automotive Industry Maintains Solid Growth in Q2, with Double-Digit Increases in Production & Sales

In the first half of 2025, China's automobile production and sales reached 15.621 million and 15.633 million units, respectively, representing year-on-year growth of 12.50% and 11.40%. The sales growth rate for January to June expanded by 0.2 percentage points compared to the first quarter. In June alone, auto production and sales were 2.794 million and 2.904 million units, up 5.50% and 8.10% month-over-month, and 11.40% and 13.80% year-on-year.

[For more insights, please download the full report]

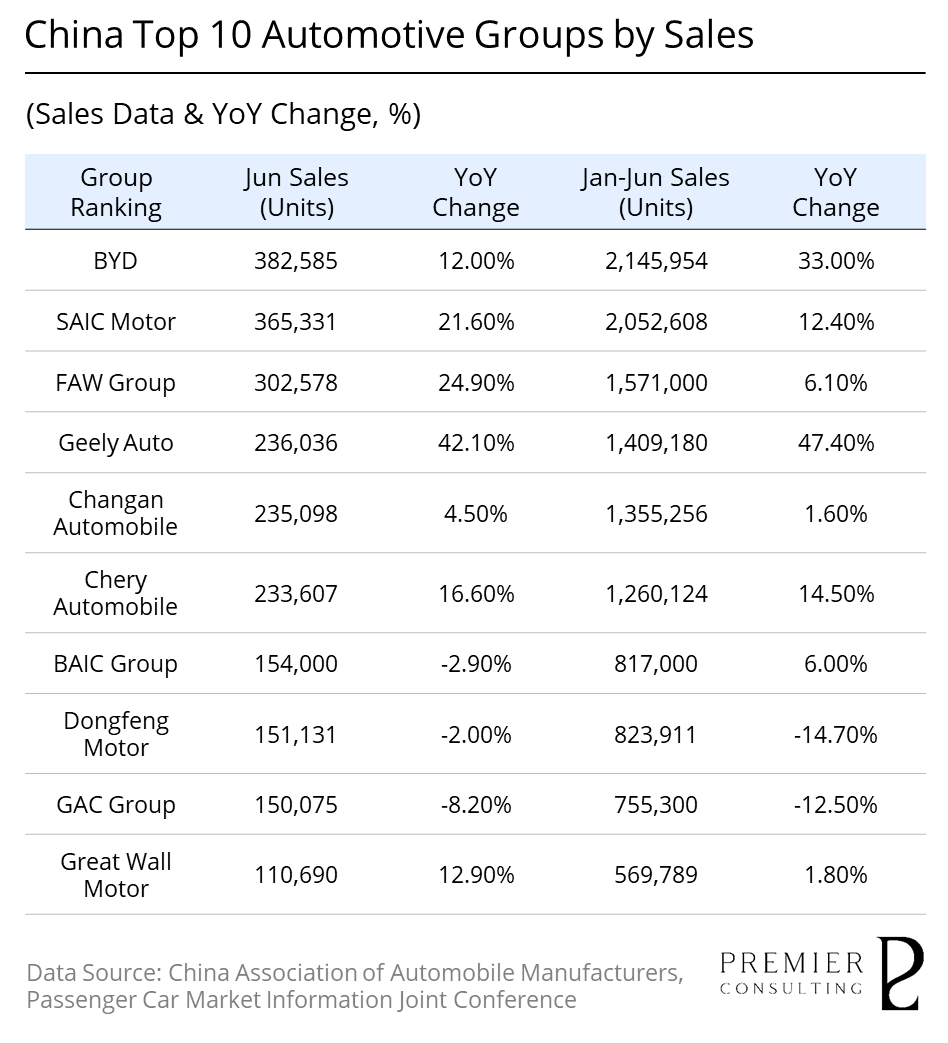

BYD Continues to Lead, SAIC Group Recovers, While Dongfeng and Others Face Challenges

Looking at the Chinese auto market in June, leading automakers performed steadily overall. BYD maintained its market-leading position with monthly sales of 382,585 units, a 12.00% year-on-year increase. Its cumulative sales for the first half of the year reached 2.146 million units, up 33.00% year-on-year. SAIC Group showed a clear recovery, with June sales reaching 365,331 units, a 21.60% year-on-year increase.

Meanwhile, Geely Auto's monthly sales surged by 42.10%, and its cumulative sales for the first half of the year hit 1.409 million units, a 47.40% year-on-year increase. This allowed it to surpass Changan Automobile, further solidifying its market position. In contrast, Dongfeng Group and GAC Group recorded negative year-on-year sales growth in June, affected by pressure on key models and a slower pace of electrification. They continue to face challenges in structural adjustments and rebuilding product competitiveness in the short term.

[For more insights, please download the full report]

PRIMARY INDEX REVIEW & PROSPECT

Early-Quarter Pressures Ease,

Subsequent Months Show Mild Recovery

In the second quarter of 2025, the PRMC Forward Mobility Index closed at 1,398.76 points, declining by 122.84 points, a decrease of 9.63%.

This quarter, the marginal improvement in the geopolitical and trade environment provided a strong boost for the auto sector's valuation recovery. In the Middle East, a ceasefire agreement was reached between Israel and Iran after a period of sustained conflict, significantly easing global market risk aversion. Crude oil prices stabilized without systemic upward pressure, providing crucial assurance for cost stability in the energy and logistics segments of the automotive supply chain.

At the same time, international trade frictions also saw a positive turn. While the U.S. government's "reciprocal tariffs" policy earlier in the year caused significant market volatility, high-level consultations between the U.S. and China were restarted, leading to a preliminary new trade framework agreement. This significantly reduced global investors' concerns about supply chain disruptions and cost spillovers.

Looking ahead to the third quarter of 2025, the index is expected to continue its moderate upward trend, but regional divergence will become more pronounced.

In the United States, despite the FOMC's decision to maintain interest rates in June, the Fed's economic forecasts showed growing concerns about a slowdown in growth. If the trend of falling inflation continues, the possibility of a rate-cutting cycle beginning in the second half of the year increases, which could provide marginal support for automotive consumption and manufacturing investment.

However, the short-term direction of policies like "reciprocal tariffs" remains uncertain. Persistent trade frictions intensify cost pressures and operational uncertainties for companies, disrupting vehicle manufacturing and supply chain deployment and forcing automakers to be more cautious in their Q3 planning.

Furthermore, U.S. household car consumption already shows signs of being overextended, and a demand rebound is limited until financing conditions ease significantly. Overall, the pace of recovery in the U.S. market may be weak in the third quarter and is unlikely to provide strong support.

The Eurozone saw some inflation pressure ease in the second quarter, and the European Central Bank lowered its inflation expectations, creating policy room for future easing. This marginal improvement in the monetary environment should help boost regional auto demand, especially given persistently low consumer confidence.

However, the Eurozone's economic fundamentals remain weak. The industrial momentum of core manufacturing nations like Germany has not fully recovered, and the uneven pace of recovery among member states means the overall trend will likely continue to be "low-level volatile."

Focusing on the Chinese market, the first half of the year was marked by insufficient domestic demand recovery and persistent weakness in industrial goods prices, which exacerbated macroeconomic deflationary pressure. The government has now explicitly made "boosting consumption" its key policy focus for the next phase.

Looking ahead to the third quarter, both central and local governments are expected to roll out a new round of structural stimulus measures, including fiscal subsidies, consumer vouchers, and car purchase tax incentives. The focus will be on promoting new energy vehicles, implementing "trade-in" policies, and unlocking consumption potential in lower-tier markets. These initiatives are expected to boost automotive consumption momentum, drive a steady recovery in sales, and activate activity throughout the industry chain, serving as a key force driving the industry index upward.

[For more insights, please download the full report]

SECONDARY INDEX REVIEW & PROSPECT

Supply and Manufacturing Lead Gains,

Service Holds Elevated Stability

The Forward Mobility Supply Index closed at 1,129.07 points in the first quarter, rising 162.67 points, or 16.83%. The upstream index's rebound was driven by a confluence of multiple positive factors, prompting a quick recovery from its previous lows.

First, global automakers adjusted their full-year production and sales forecasts during the quarter, leading to a recovery in demand for raw materials and key components. This improved overall earnings expectations. As delays in new vehicle deliveries eased and inventory cycles bottomed out, orders for Tier 1 and Tier 2 suppliers increased, boosting the valuation of parts companies.

Second, international commodity prices stabilized. Core raw materials for new energy vehicles like lithium, nickel, and copper stopped their decline and rebounded. This, combined with falling inflation expectations, marginally eased market concerns about costs. Furthermore, positive signals from trade negotiations between the U.S. and China, as well as between China and Europe, showed signs of easing in automotive supply chain tariff disputes.

Looking ahead to 2025 Q3, The Forward Mobility Supply Index is expected to continue a gentle upward trend, but its performance may become more fragmented. Structurally, the raw materials segment might see increased volatility due to a weakening short-term inventory replenishment momentum and price fluctuations in some commodities. In contrast, the parts segment is likely to maintain steady growth, supported by sustained high production schedules from OEMs and continuous improvement in European light-duty vehicle sales.

Meanwhile, with rising demand in Middle Eastern and Southeast Asian markets, relevant suppliers' shipments are expected to continue increasing. Upstream companies with comprehensive global footprints will have greater resilience and growth flexibility. Overall, The Forward Mobility Supply Index has the foundation for a continued recovery in the third quarter, but potential impacts from currency fluctuations, commodity market disruptions, and geopolitical factors on cross-border supply chains should be monitored.

The Forward Mobility Manufacturing Index closed at 1,285.76 points in Q2, rising 149.79 points, or 13.19%. Index's strong rebound was primarily driven by a valuation recovery after previous declines and a synchronized rebound in production and sales in key markets.

First, with rising consumer confidence in North America and Europe and the continued easing of supply chain bottlenecks, automakers maintained high production schedules. Global light-duty vehicle and premium model sales showed a recovery, leading to upward revisions in automakers' earnings expectations. In the electric vehicle sector, the accelerated implementation of overseas production plans by major automakers like Tesla, Ford, and Hyundai drove a significant increase in global vehicle production capacity utilization.

Second, the valuation pressure caused by previous cost disruptions and policy uncertainties gradually eased. The marginal de-escalation of trade frictions between the U.S. and Europe, as well as between China and Europe, showed signs of tariff disputes being resolved. This enhanced the stability of cross-border production and export chains, leading to a rebound in investor risk appetite.

Looking ahead to the third quarter of 2025, Forward Mobility Manufacturing Index is expected to continue its upward trend, supported by three key factors.

First, the start of the traditional "delivery peak season" will see major automakers in the U.S., Europe, and Japan launch new models. This, combined with various promotional activities, is expected to keep sales high.

Second, automakers are continuing to advance their electrification and smart technology strategies, which increases the proportion of high-value-added models and helps improve profit structures.

Third, rising vehicle penetration in emerging overseas markets will strengthen the growth momentum of export-oriented automakers. However, given the tighter credit environment for consumers in the U.S. and Europe, and global geopolitical risks challenging the stability of the parts supply chain, automakers' sustained stock performance will depend on their brand power, product portfolio upgrades, and ability to diversify markets.

The Forward Mobility Service Index closed at 1,896.13 points in Q2, declining 3.11 points or 0.16%. The overall stability of the index reflects a balanced state between the recovery of end-consumer demand and service systems.

On one hand, despite the moderate performance of consumer markets in North America and Europe due to inflation and high interest rates, a stable automotive financing penetration rate and stabilized used car prices have maintained the fundamental resilience of car sales and financial services.

On the other hand, the gradual recovery of global travel has driven steady growth in fleet management, car rental, and mobility services. At the same time, while the construction of charging networks continues in the U.S. and Europe, a reduction in subsidies and cautious capital spending mean the profitability of charging and battery swapping operators still needs to be proven. Overall, downstream sub-sectors are moving in divergent directions, balancing each other out and keeping the index in a state of mild volatility with cautious stability.

Looking ahead to the third quarter of 2025, the Forward Mobility Service Index is expected to continue its slight upward trend. The summer travel peak will lead to increased vehicle usage, and a recovery in demand for rental and fleet services will help related companies see a seasonal improvement in revenue.

Furthermore, the pace of investment in EV charging infrastructure is expected to accelerate in the U.S. and Europe. This, combined with some operators optimizing their business models, could lead to a marginal improvement in charging operational efficiency and a boost in industry sentiment. Finally, with the start of a new used car circulation cycle and optimized inventory structures, used car trading platforms and the aftermarket maintenance sector in North America are likely to see an increase in transaction volume.

[For more insights, please download the full report]

.jpg)

Review & Prospect

Charting Future Mobility

Through Regulatory Foresight

Q2 2025 PRMC Forward Mobility Index

Review & Prospect

Feb 02, 2026

Anchored in index volatility and macroeconomy data, mapping the automotive industry’s risk unwind and opportunity reconfiguration under escalating trade frictions.

Trade Frictions Deepen the Downturn, Supply and Manufacturing Lead Gains

Global geopolitical uncertainties and fluctuating trade policies continued to cast a shadow in the second quarter of 2025, forcing the automotive industry to seek a new equilibrium amidst complex dynamics. The U.S. auto market showed an overall sluggish performance, as tariffs and policy uncertainties suppressed financing demand for vehicles. This, combined with weak consumer spending on durable goods, put pressure on sales for major automotive brands. Simultaneously, some multinational automakers adjusted their production plans and product rollouts in the U.S., increasing pressure on supply chain restructuring. The European auto market entered a period of structural adjustment, with tariff disputes further slowing the electric vehicle transition for European carmakers. A weak manufacturing sector and low consumer confidence hampered market recovery. In contrast, driven by economic recovery and supportive policies, the Chinese auto market continued its steady growth. Leading domestic brands further consolidated their market-leading positions, and the penetration rate of new energy vehicles (NEVs) continued to rise.

In the second quarter of 2025, China's auto industry maintained stable operation. 2025 H1, auto production and sales reached 15.621 million and 15.633 million units respectively, marking YOY increases of 12.50% and 11.40%. Notably, the sales growth rate accelerated by 0.2 percentage points compared to the first quarter. Auto exports continued their strong growth momentum, with a cumulative total of 3.083 million vehicles exported in the first half of 2025, a year-over-year increase of 10.40%, further expanding the industry's presence in overseas markets.

The PRMC Forward Mobility Index closed at 1,398.76 points in Q2, rebounding by 122.84 points (+9.63%) within the quarter. Its performance trailed the NASDAQ Composite but outperformed other major global indices such as the STOXX Europe 600 Technology, STAR & CHINEXT 50, and Hang Seng Tech. Among the sub-indices, the Forward Mobility Supply Index led the gain (+16.83%), followed by the Forward Mobility Manufacturing Index (+13.19%), while the Forward Mobility Service Index saw a slight retreat (-0.16%).

Individual stock performance showed significant divergence in the second quarter. Companies such as Daimler, Tesla, and Xiaomi Group delivered standout performances, with their stock prices rising by over 20% during the quarter. In contrast, Dongfeng Motor, XPeng Motors, and BAIC BluePark performed poorly, with their stock prices falling by more than 10%.

Those who adapt to change will advance; those who control it will triumph.

Looking ahead to the third quarter, the Chinese auto market is expected to achieve "dual-driver growth" from both domestic and international fronts, powered by its advantages in new energy and supportive government policies. Exports are anticipated to maintain medium-to-high-speed growth, while domestic demand is set to recover, stimulated by multiple policies including "trade-in" programs and "NEVs to the Countryside." However, overseas trade barriers and domestic price wars will remain major challenges.

The European and U.S. markets both face systemic challenges at the macroeconomic level. The European auto market is constrained by sluggish demand due to economic slowdown and a weak manufacturing sector. The ongoing negotiations between China and the EU regarding NEV import tariffs, and regulatory compliance will be a key variable affecting the market landscape.

The direction of tariff policy of the United States remains highly uncertain. The resulting policy expectations are disrupting corporate decision-making and supply chain stability. Compounded by the fact that previous vehicle demand has been largely met, the overall market is expected to continue operating at a low level.