Q1 2025 PRMC Automotive Index Review & Prospect

Q1 2025 PRMC Automotive Index Review & Prospect

Analyzing index performance and EV adoption trends, gaining insight into the realization pace of the sector's technology thesis and its evolving valuation framework.

Order Stability Sustains Performance, Rapid Growth in New Energy Production and Sales

In the first quarter of 2025, China's automotive industry operated steadily, with production and sales reaching 7.561 million and 7.470 million units, respectively, representing year-on-year growth of 14.50% and 11.20%. Notably, the new energy vehicle sector performed exceptionally well, with both pure electric and hybrid vehicles surpassing the 3 million mark in production and sales. In terms of exports, overall performance remained stable, although the growth rate in March was only 1%. In the second quarter, attention must be given to the potential negative impact of the tariff war on China's automotive exports.

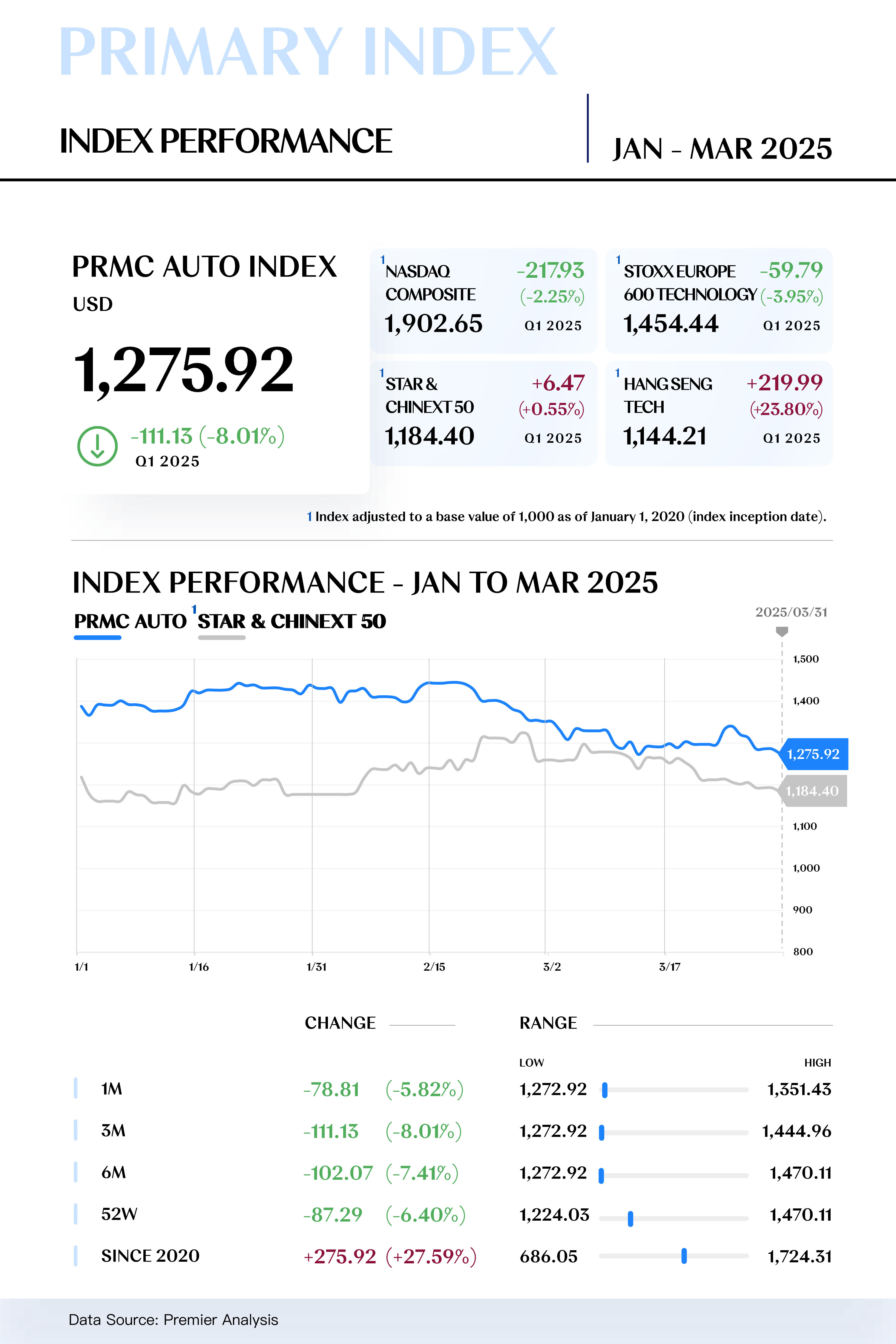

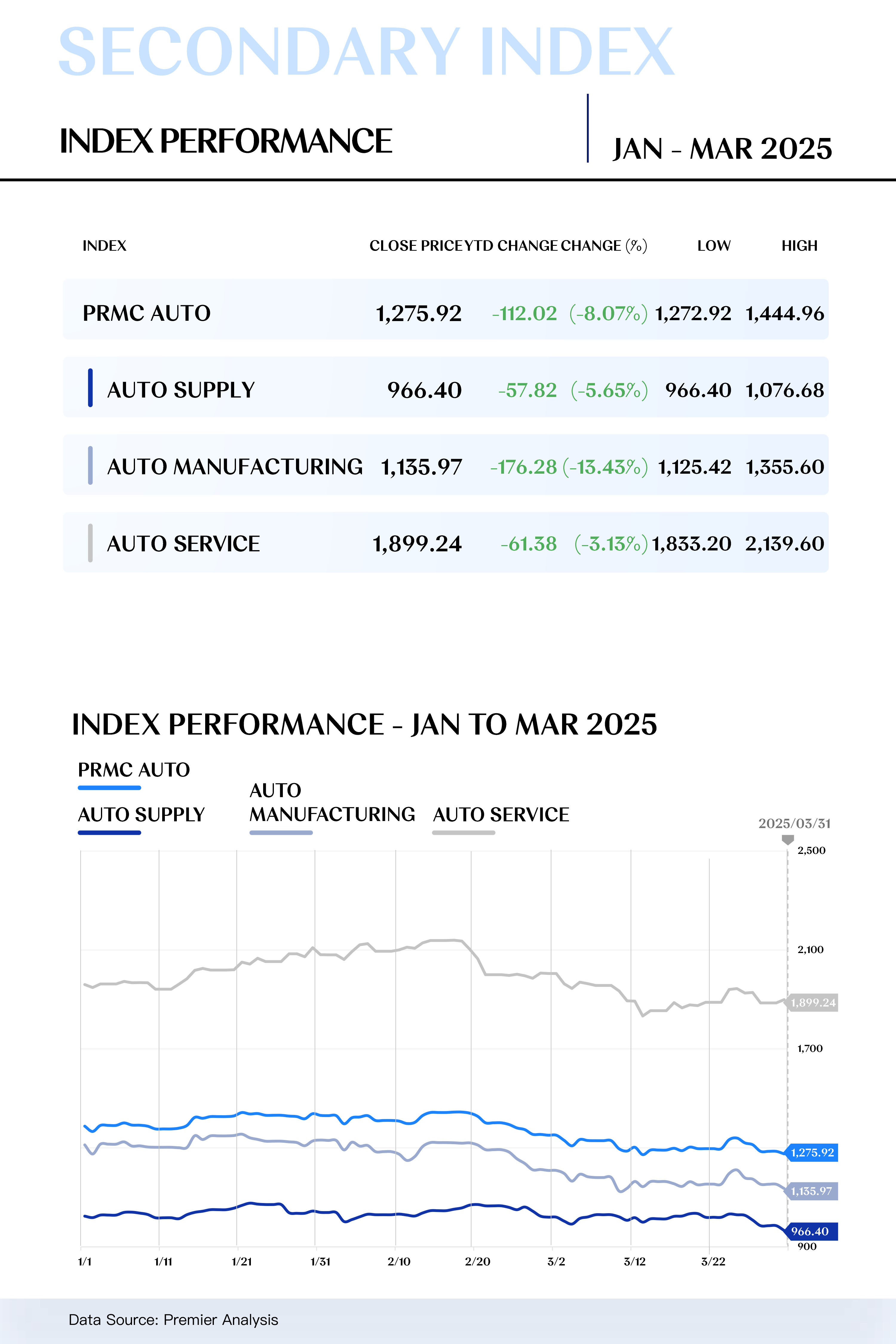

The PRMC Auto Index closed at 1,275.73 points in Q1, declining by 111.13 points (-8.01%), underperforming key global indices such as the NASDAQ Composite, STAR & CHINEXT 50, STOXX Europe 600 Technology, and Hang Seng Tech. Among the secondary indices, the Auto Manufacturing Index recorded the largest drop (-13.43%), followed by the Auto Supply Index (-5.65%), while the Auto Service Index proved more resilient (-3.13%).

In terms of individual stock performance, there was significant divergence in Q1. Companies such as Xpeng, Thyssenkrupp, and Zhejiang Leapmotor saw remarkable growth, with their stock prices rising substantially. On the other hand, Tesla, Aston Martin, and Zoomcar underperformed, with their stock prices lagging behind the early-year performance.

The wise adapt to change, the strong anticipate it. Looking ahead to Q2, China's automotive market is expected to maintain its steady recovery, supported by consistent policy direction and sustained technological leadership driving electrification. Furthermore, the implementation of the "Special Action Plan to Stimulate Consumption" and major industry events such as the Shanghai International Automobile Industry Exhibition will further energize the market. In contrast, the European market remains constrained by geopolitical risks and economic weakness, with retail demand unlikely to recover significantly in the short term. Capacity reductions and labor union protests continue to disrupt operations at some automakers. Meanwhile, the U.S. market faces mounting challenges, as rising protectionism and expectations of imported inflation exert dual pressure on consumer spending and corporate investment, casting a cloud over the near-term outlook for the automotive sector.

DOWNLOADS

Lite Report (70 pages)

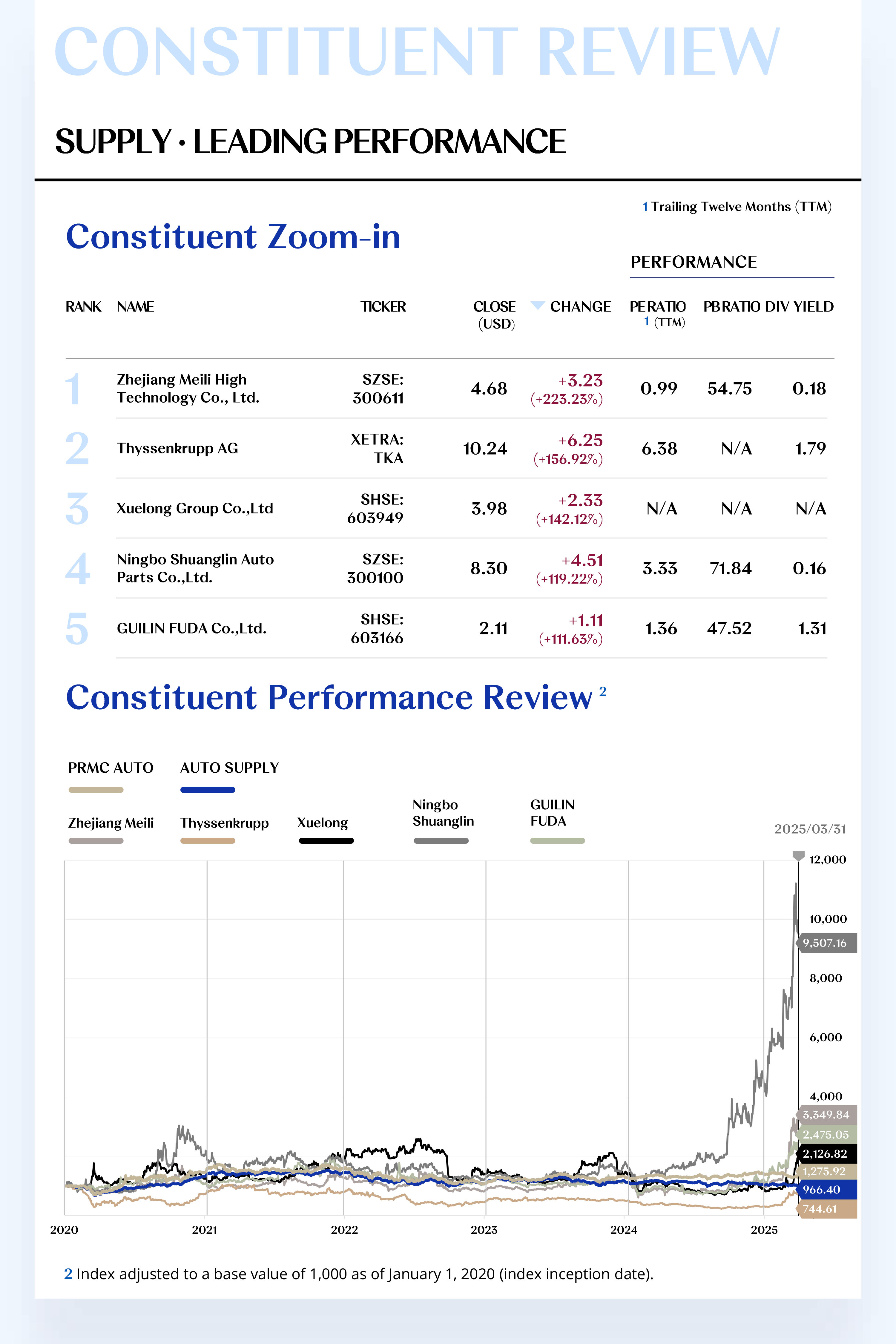

AUTO SUPPLY CONSTITUENT ZOOM-IN

Solid Orders Support

Business Performance,

Capacity Expansion Reinforces Market Confidence

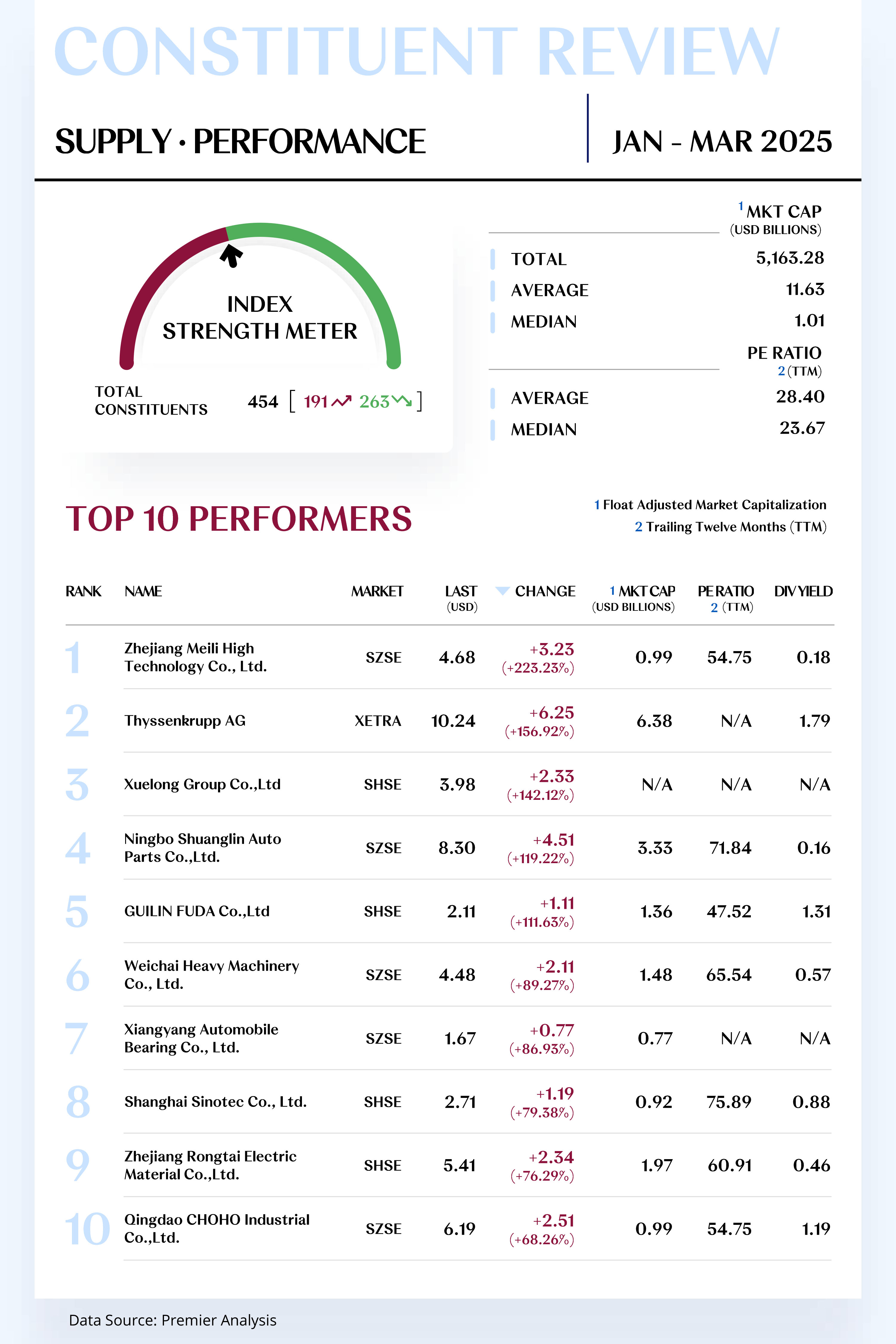

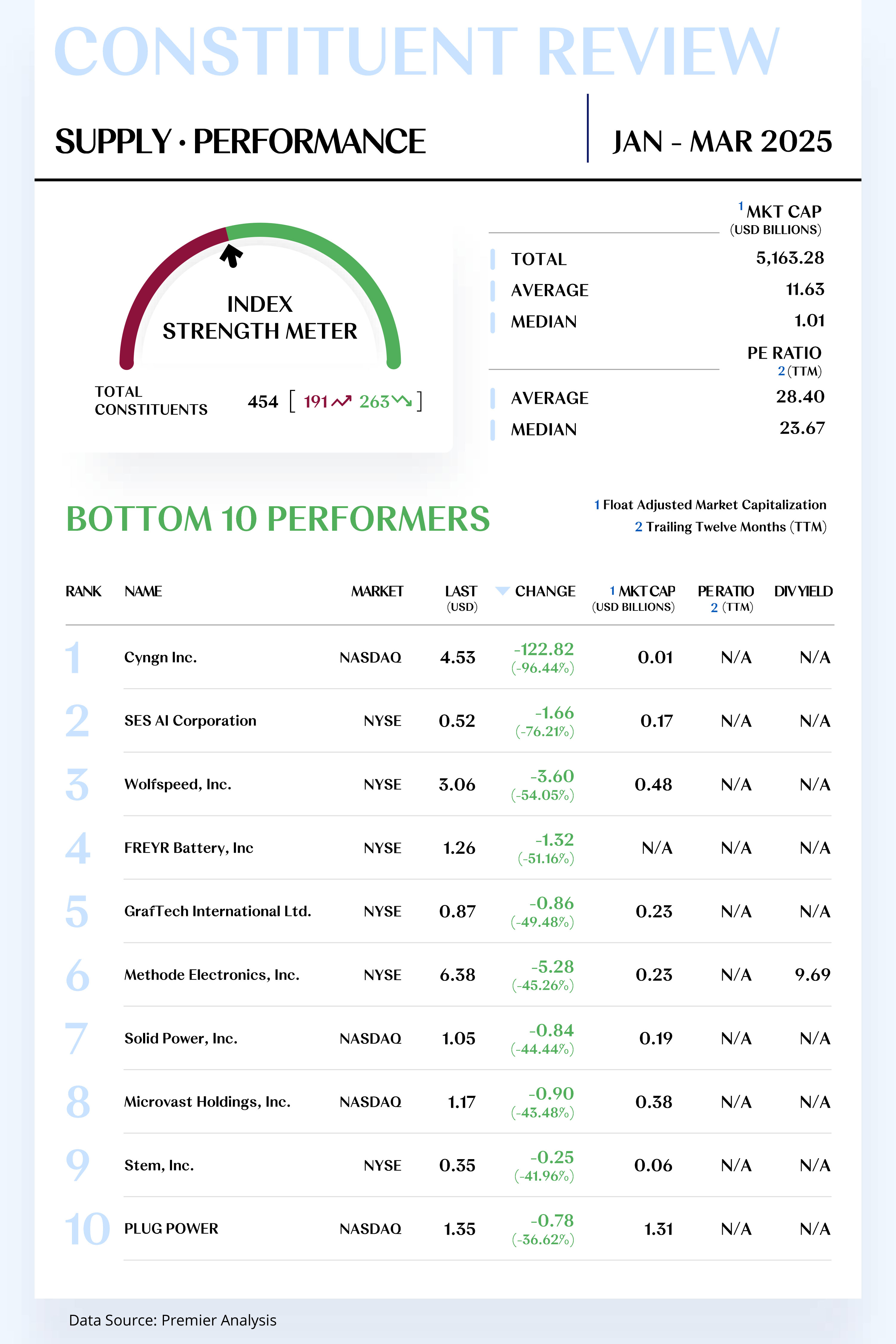

The Auto Supply Index comprises 454 stocks, with 191 rising and 263 declining.

Leading Performers

1. Zhejiang Meili High Technology Co.,Ltd.

Zhejiang Meili High Technology Co.,Ltd. specializes in the research, development, production, and sales of spring products, including suspension system springs, powertrain springs, and body and interior springs. The company also manufactures precision injection-molded products, such as safety system components and steering wheel system components, through its subsidiaries. In Q1 2025, its stock price rose by $3.23 to $4.68, reflecting a 223.23% increase.

The company continues to expand in the new energy vehicle sector, recently trial-manufacturing its first air spring assembly for passenger vehicles, enhancing product competitiveness. In January, the company completed the acquisition of core assets from the German company AHLE and established a subsidiary in Mexico, expanding its overseas market presence. On February 15, Meili Technology announced an investment in a project with an annual capacity of 2 million intelligent suspension systems and 10 million electric and hydraulic-driven elastic components, totaling 65 million RMB. This initiative will optimize its product structure, expand business scale, and solidify long-term development.

Looking to Q2, despite risks such as shareholder share reductions, the company’s continued investments in new energy vehicles, humanoid robots, and its leading position in the high-end spring market are expected to support performance growth. With global business expansion and rapid industry development, the company is positioned to maintain strong growth momentum.

2. Thyssenkrupp AG

Thyssenkrupp AG is primarily engaged in the steel, automotive technology, materials services, and maritime sectors, offering a wide range of technological and engineering solutions. In the first quarter of 2025, the company’s stock price increased by $6.25, closing at $10.24, reflecting a quarterly growth of 156.92%.

On February 13, 2025, the company released its financial results for the first quarter of the fiscal year 2024/25, reporting a reduction in net loss from €314 million in the same period last year to €51 million. Furthermore, through the implementation of the APEX 2.0 performance improvement program, the company achieved a 107% year-on-year increase in adjusted EBIT, reaching €191 million. Despite a 4% year-on-year decrease in sales to €7.83 billion, the maritime business sector secured an expansion order for the German-Norwegian joint submarine project, contributing to a substantial 57% increase in overall order intake, which reached €12.48 billion.

Looking ahead to the second quarter, the company expects its strong orders in the maritime sector and ongoing strategic restructuring plans to continue driving performance growth. The company anticipates full-year adjusted EBIT to be between €600 million and €1 billion, with free cash flow expected to turn positive, potentially reaching €300 million.

[For more insights, please download the full report]

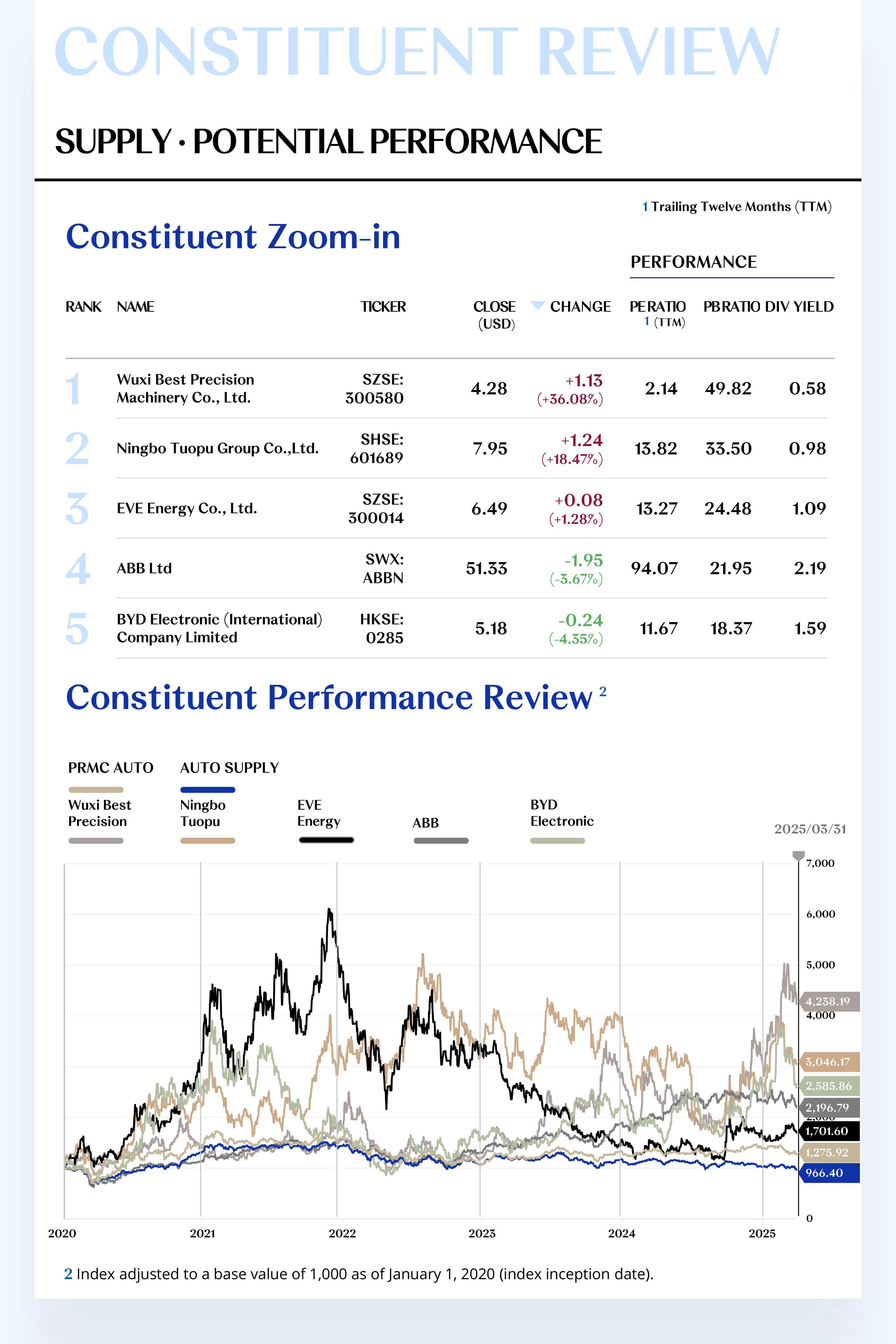

Potential Players

1. Wuxi Best Precision Machinery Co., Ltd.

Wuxi Best Precision Machinery Co., Ltd. specializes in the R&D, production, and sales of automotive chassis and engine system components, widely applied in the new energy vehicle sector. In Q1 2025, the company’s stock price rose by $1.13, closing at $4.28, a 36.08% quarterly increase.

In January 2025, its subsidiary, Anhui Best New Energy Vehicle Components Co., Ltd., successfully launched a project with an annual production of 10 million electric and hydraulic drive elastic components. Spanning 110 acres with 70,000 square meters of building area, the project represents a significant capacity expansion for key components in the new energy and intelligent driving sectors, expected to boost the company’s market competitiveness and technological capabilities.

Looking ahead to Q2, the company is poised to benefit from the ongoing expansion of the new energy vehicle industry and downstream demand, maintaining solid growth. Additionally, the company plans a production base in Thailand to strengthen its global operations. Best Precision is also enhancing its smart manufacturing system, improving automation and IT capabilities to solidify its competitive edge in high-end precision manufacturing, supporting long-term sustainable growth.

2. Ningbo Tuopu Group Co., Ltd.

Ningbo Tuopu Group Co., Ltd. specializes in automotive component R&D, production, and sales, covering chassis systems, thermal management, and intelligent driving systems. In Q1 2025, its stock price rose by $1.24, closing at $7.95, reflecting an 18.47% quarterly increase.

On March 10, the company acquired 100% of Wuhu Changpeng Automotive Components Co., Ltd. for 330 million RMB, strengthening its position in the key components of intelligent driving systems and enhancing technological integration and market competitiveness. Regarding R&D, it increased investment in its intelligent driving center from 300 million RMB to 440 million RMB, emphasizing its commitment to innovation.

Looking ahead to Q2, analysts forecast Q2 earnings per share of 0.59 RMB, up 26.88% year-on-year. HSBC has given the company a "Buy" rating, setting a target price of 79 RMB, citing its strategic investments in autonomous driving and humanoid robotics as drivers of long-term growth.

[For more insights, please download the full report]

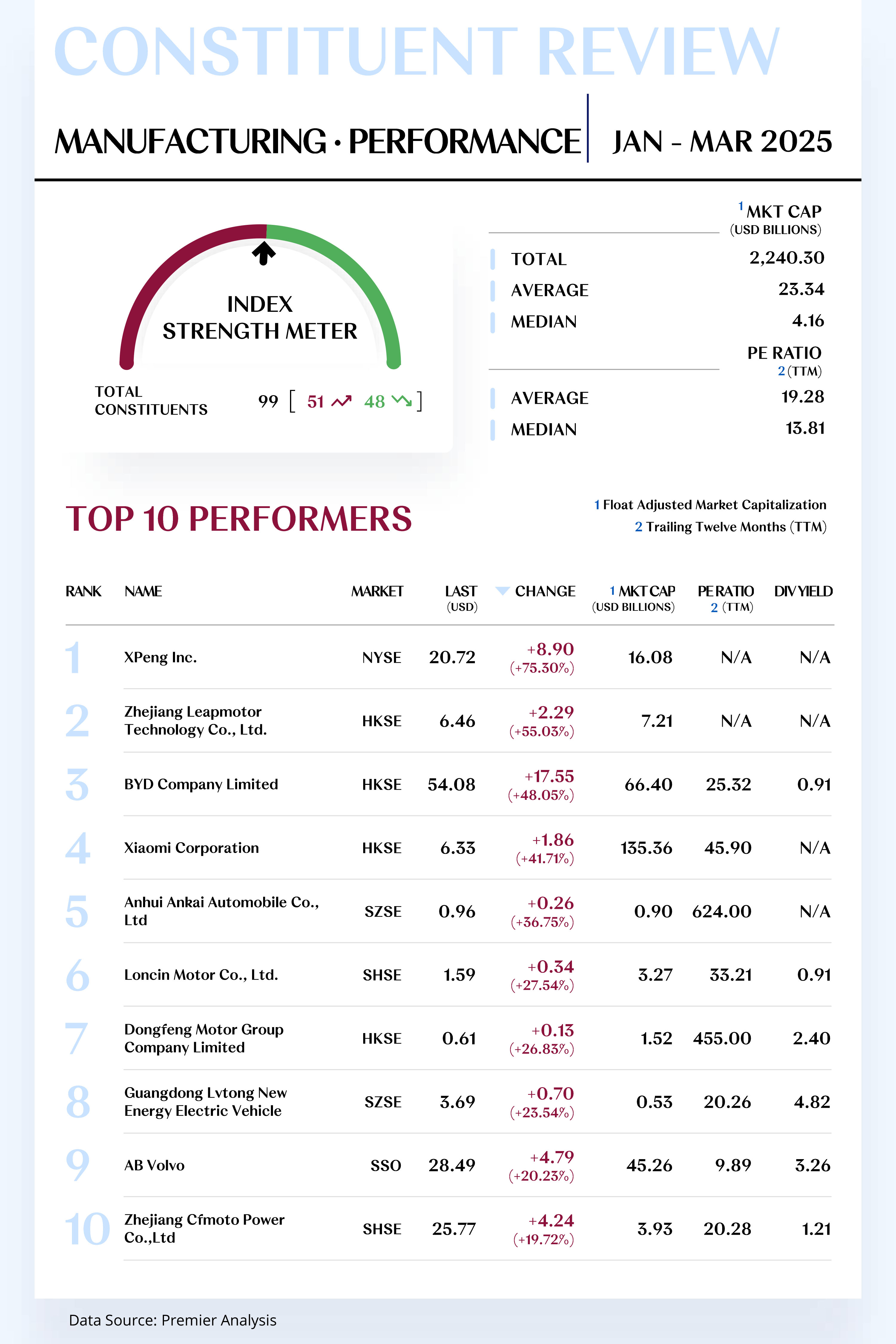

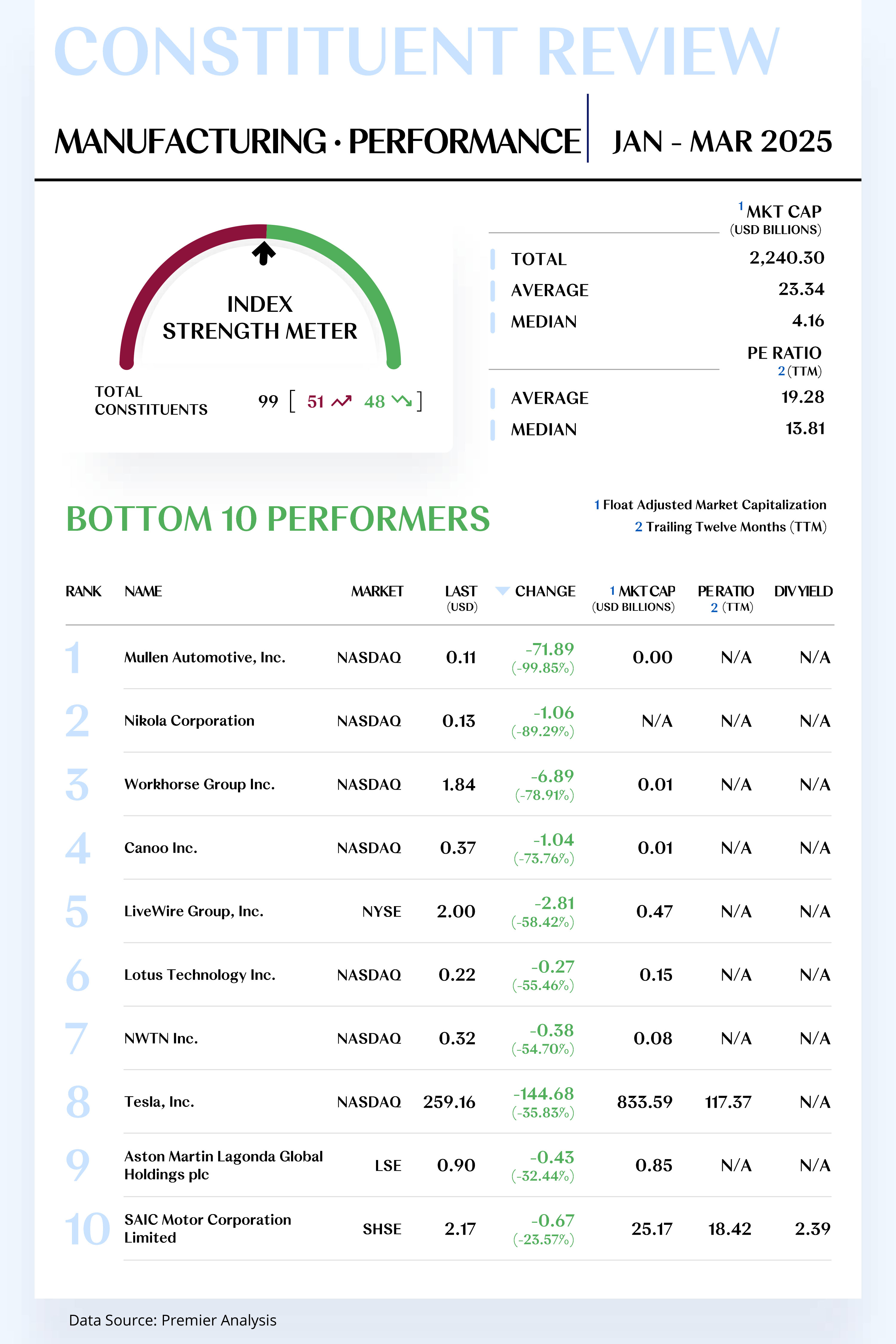

AUTO MANUFACTURING CONSTITUENT ZOOM-IN

Strong Sales Growth Momentum,

Strategic Product Portfolio Optimization

The Auto Manufacturing Index comprises 99 stocks, with 42 rising and 57 declining.

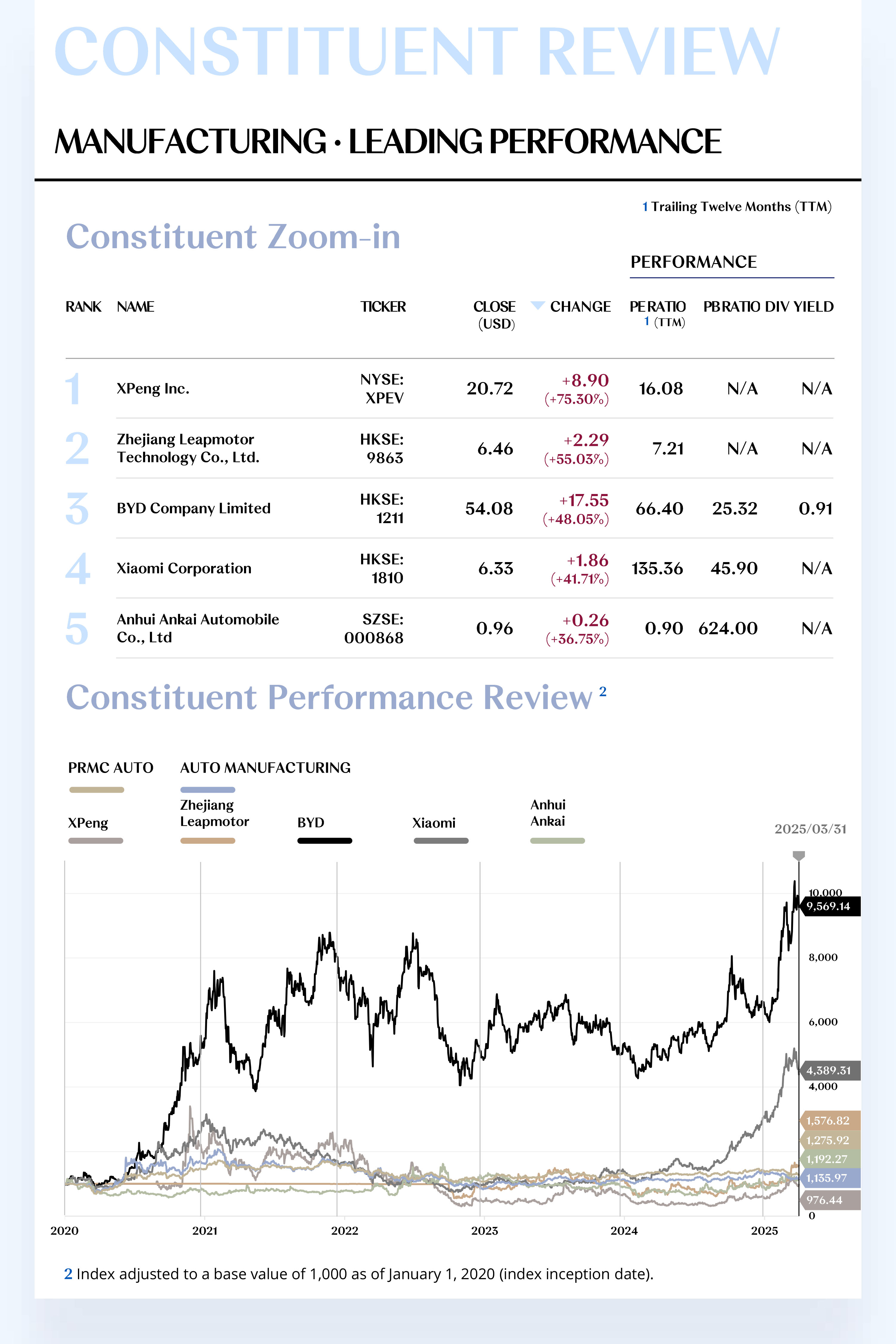

Leading Performers

1. XPeng Inc.

XPeng Inc. specializes in the development and manufacturing of smart electric vehicles, focusing on driving the transformation toward vehicle electrification and intelligence. In Q1 2025, its stock price increased by $8.90, closing at $20.72, marking a 75.30% quarterly gain.

In Q1 2025, XPeng continued its strong growth, delivering 94,008 vehicles, a 331% year-on-year increase and a 2.7% quarter-on-quarter rise, exceeding the prior delivery guidance. The flagship models performed exceptionally well: the MONA M03 delivered over 15,000 units for four consecutive months, setting a new record for deliveries of pure electric models by new energy vehicle makers. The P7+ also achieved a breakthrough, with more than 40,000 units delivered in four months, demonstrating consistent market success.

Looking ahead, the company plans to release several new pure electric and Kunpeng super electric platform models in the second half of 2025. By the end of 2026, it aims to build a diverse product matrix covering the mainstream price range of 100,000 to 500,000 RMB, from compact to large cars. As its technology and product lineup continue to evolve, XPeng is poised to strengthen its competitive edge in intelligent driving and new energy sectors, reinforcing its leadership in the industry.

2. Zhejiang Leapmotor Technology Co., Ltd.

Zhejiang Leapmotor Technology Co., Ltd. specializes in the development and manufacturing of smart electric vehicles, with a focus on advancing intelligent driving technologies. In Q1 2025, the company’s stock price rose by $2.29, closing at $6.46, a 55.03% increase for the quarter.

In Q1 2025, Leap Motor delivered approximately 88,000 vehicles, a 162% year-on-year increase. March deliveries reached 37,100 units, propelling it to the top of the new energy vehicle makers' monthly sales chart. Following the release of the sales figures, the stock surged by 13% on April 2, reflecting positive market expectations.

On the product front, the company is accelerating the rollout of its B-series models, aiming to launch the compact SUV B10, the mid-sized sedan B01, and the sporty hatchback B05 in 2025. The B10 made its debut at the 2024 Paris Motor Show and began pre-sales on March 10, 2025. This series is expected to be a key driver for achieving the company’s 500,000-unit sales target in 2025. In terms of international expansion, Leap Motor has established over 400 sales and service points globally, with over 350 locations in Europe and coverage in nearly 50 countries and regions across Asia-Pacific, the Middle East, Africa, and South America.

Looking ahead, the company plans to expand its channel network to more than 550 locations in 2025, further deepening its presence in emerging markets like Southeast Asia and the Middle East, with a target of doubling its overseas sales year-over-year.

[For more insights, please download the full report]

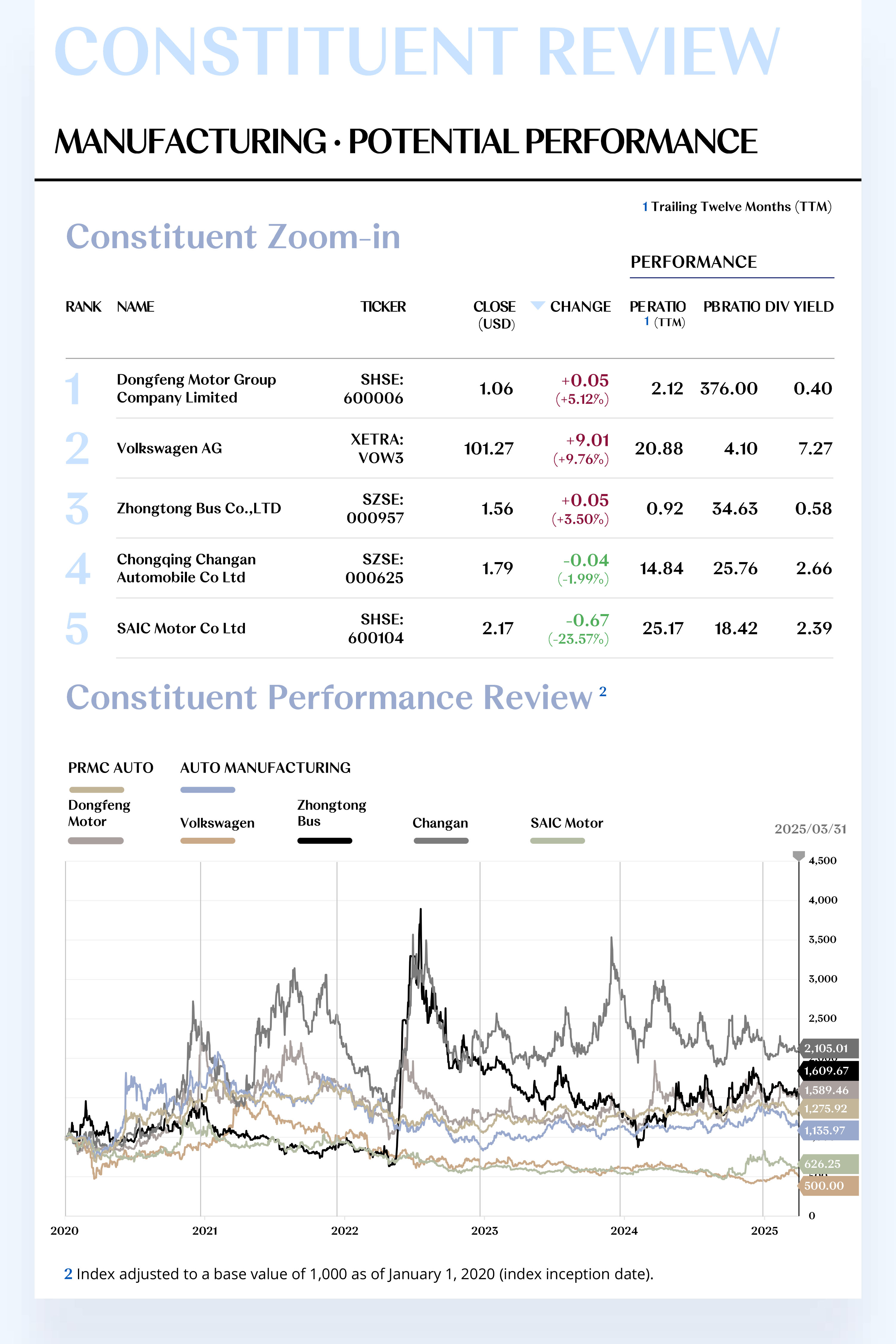

Potential Players

1. Dongfeng Motor Group Company Limited

Dongfeng Motor Group Company Limited is engaged in vehicle manufacturing, covering passenger cars, commercial vehicles, new energy vehicles, and key component development. It owns independent brands like Lantu, Mengshi, and Fengshen, as well as joint ventures like Dongfeng Nissan and Dongfeng Honda. In Q1 2025, the company’s stock price rose by $0.05, closing at $1.06, a 5.12% quarterly increase.

In Q1 2025, Dongfeng achieved a strong start, driven by policy support and technological innovation. On February 19, the company launched several key models and showcased advanced technologies such as "End-to-End Large Model Intelligent Driving," enhancing its competitiveness in the smart electrification field. Lantu’s sales from January to March reached 26,034 units, a 59% year-on-year increase, boosting brand awareness and market acceptance.

Looking ahead, Dongfeng is progressing with its strategic reorganization with Changan Automobile. According to an April 11 announcement, the integration plan is nearly complete, aiming to create a group with annual sales exceeding 5 million vehicles, potentially ranking among the global top five. This restructuring is expected to enhance industry concentration and enable efficient collaboration in R&D, manufacturing, and distribution, strengthening both companies' leadership in key technologies like intelligent connectivity and new energy. The strategic integration is set to optimize China’s automotive industry and boost global competitiveness.

2. Volkswagen AG

Volkswagen AG is engaged in vehicle manufacturing, covering passenger cars, commercial vehicles, luxury cars, and automotive parts R&D and production. It owns several well-known brands, including Volkswagen, Audi, Porsche, Skoda, and SEAT. In Q1 2025, the company’s stock price increased by $9.01, closing at $101.27, with a quarterly growth of 9.76%.

In Q1 2025, Volkswagen Group continued its steady growth in the global market, maintaining positive overall performance. Despite temporary impacts from CO₂ emission-related reserve provisions and restructuring costs, the group’s sales revenue increased by 3% year-on-year, reaching 78 billion euros (approximately $85.32 billion). Notably, Volkswagen performed strongly in the European market, particularly in the UK, where it became the highest-selling brand for new car registrations, surpassing BMW.

Looking ahead, the group maintains a positive outlook for the full year. The company expects a 5% year-on-year increase in sales revenue for the 2025 fiscal year, with an operating profit margin range of 5.5% to 6.5%. As its global strategy continues to progress and new models are accelerated, the group is expected to further strengthen its competitiveness in key global markets, supporting steady growth in sales and profits for the year.

[For more insights, please download the full report]

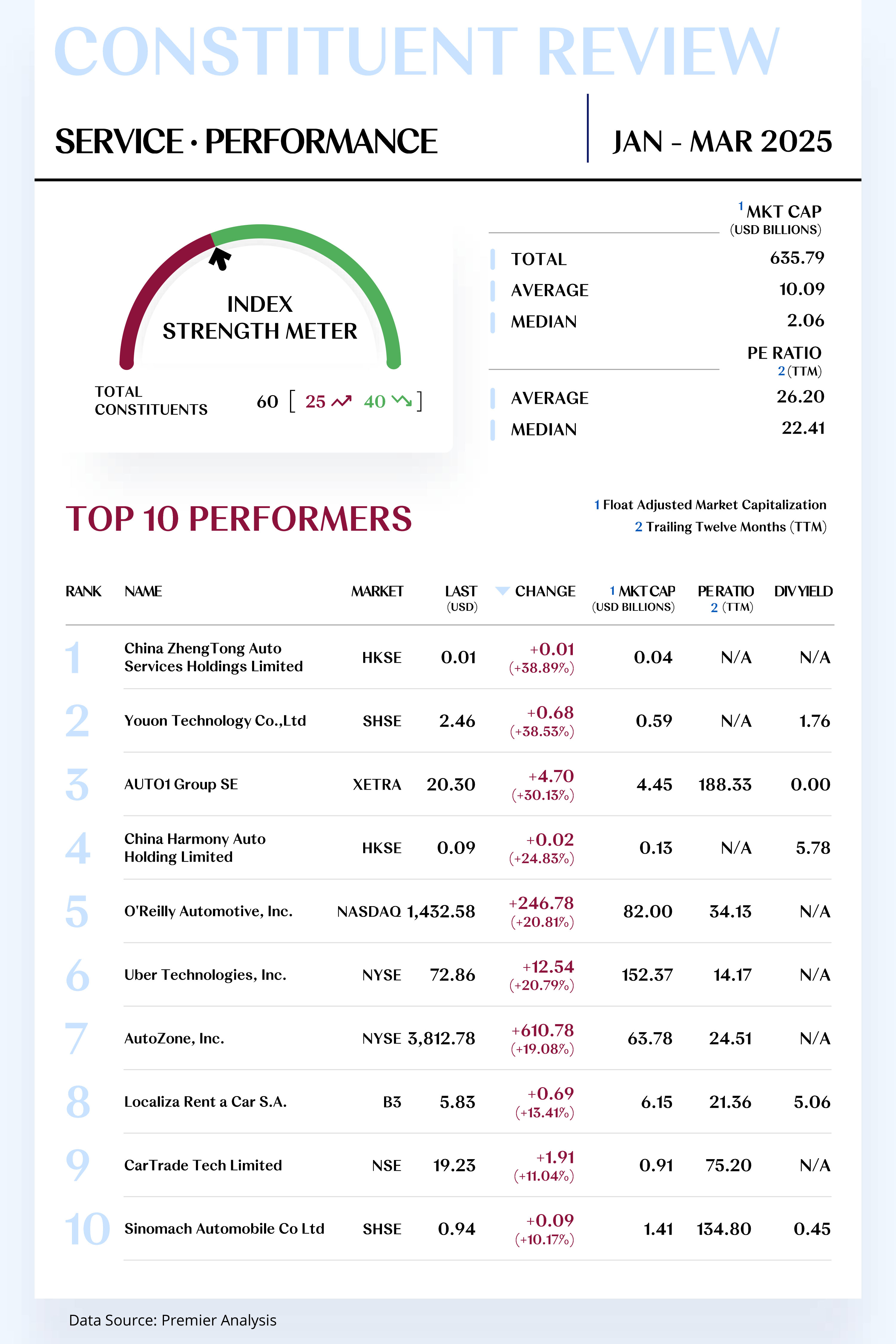

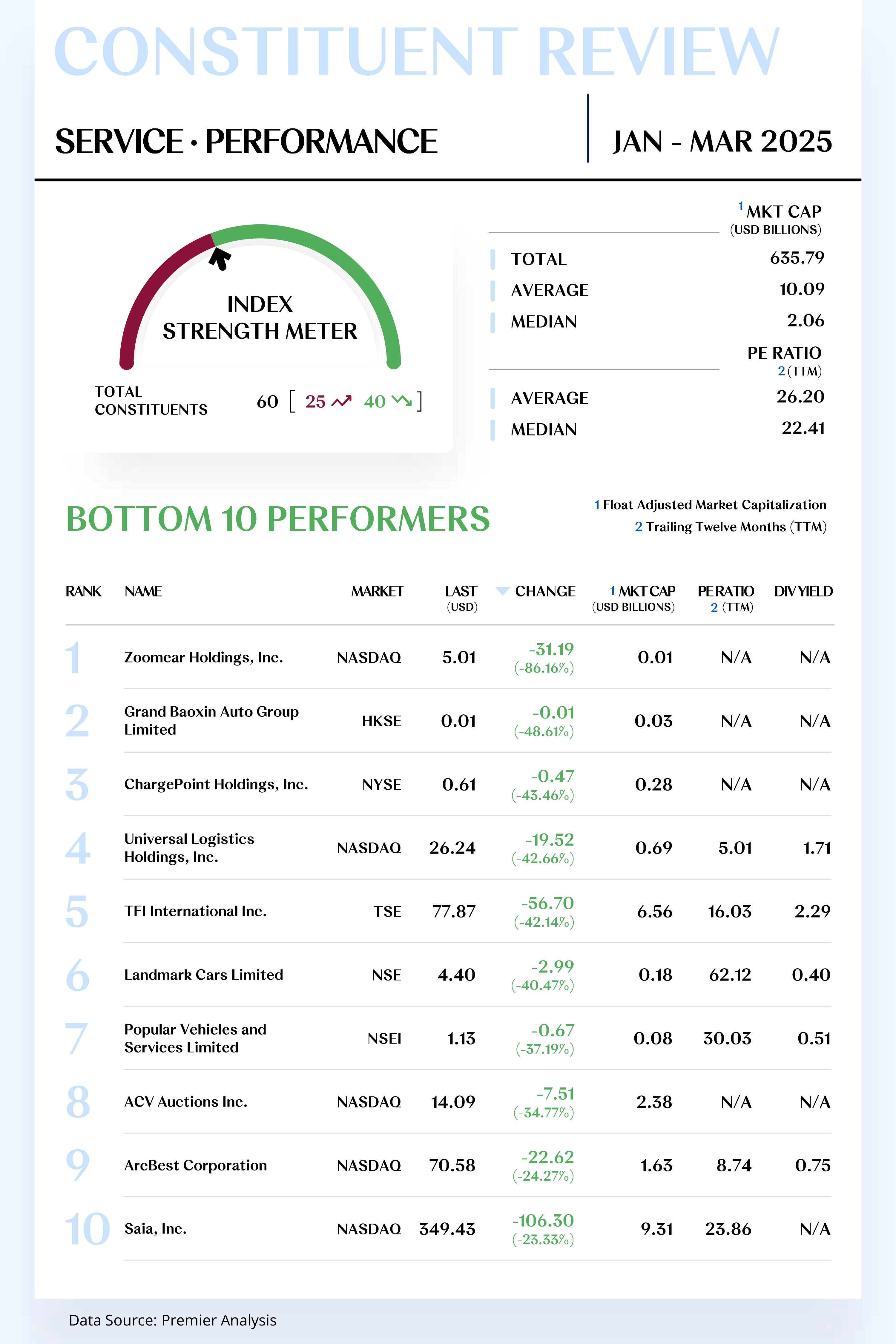

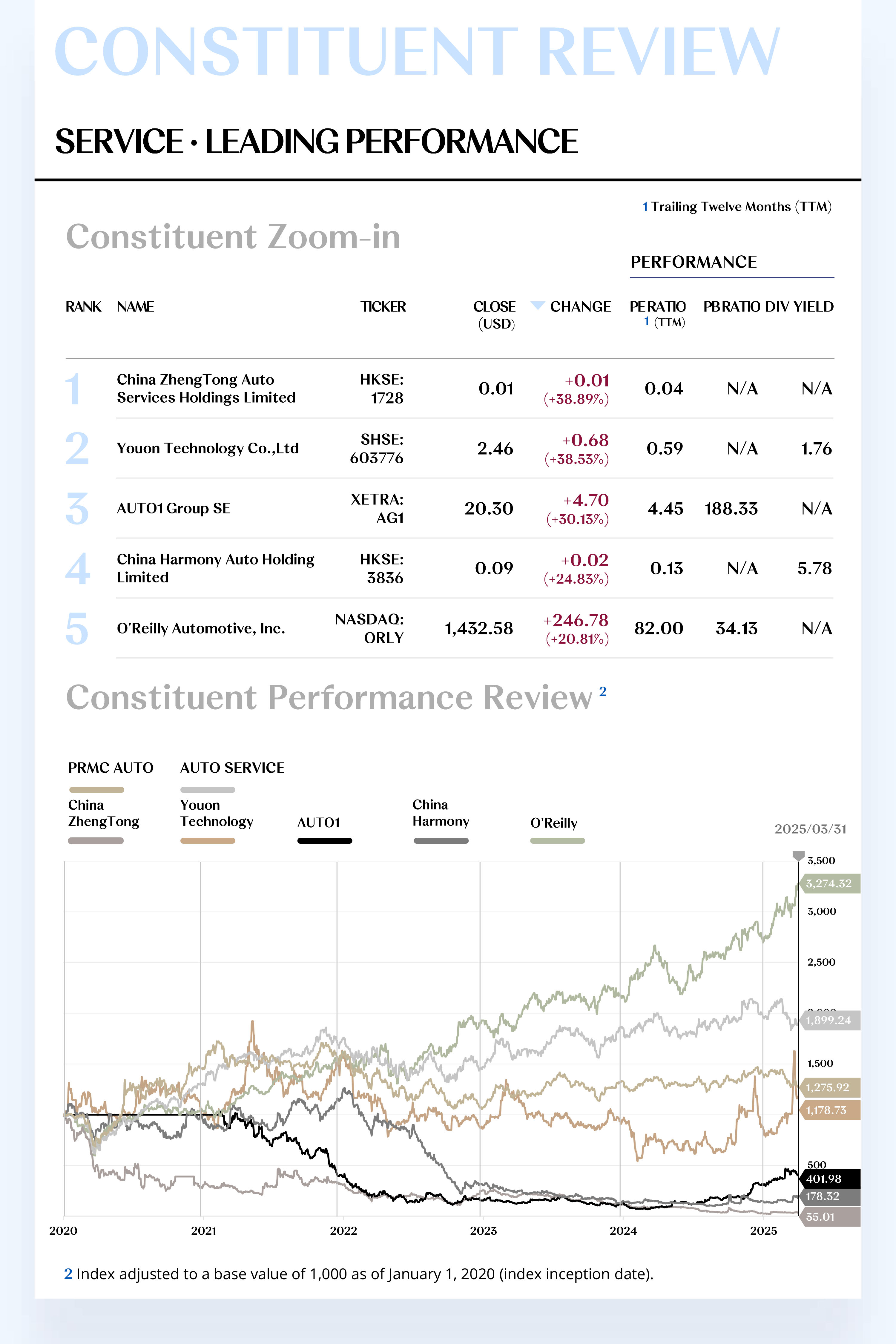

AUTO SERVICE CONSTITUENT ZOOM-IN

Capital Operations

Reinforce Investor Confidence,

Business Growth Bolsters Market Recognition

The Auto Service Index comprises 65 stocks, with 25 rising and 40 declining.

Leading Performers

1. China ZhengTong Auto Services Holdings Limited

China ZhengTong Auto Services Holdings Limited, a subsidiary of Xiamen C&D Inc., focuses on luxury and ultra-luxury car dealerships, covering brands like BMW, Audi, Porsche, and Jaguar Land Rover, as well as mid-to-high-end brands like Nissan and Honda. In Q1 2025, the stock price rose by $0.01, marking a 38.89% quarterly increase.

In Q1 2025, Zhengtong Automobile faced significant financial pressure. The company’s 2024 revenue was 20.7 billion yuan, a 14% year-on-year decrease. The net loss widened to 1.7 billion yuan, higher than the previous year’s 891 million yuan. Gross profit fell by 22.76%, and pre-tax losses reached 1.48 billion yuan, with the gross margin dropping to 3.8%, continuing to pressure profitability.

To improve capital structure, the company announced a private placement of 6.669 billion shares at 0.15 HKD each to introduce strategic investors, aiming to ease liquidity pressure and optimize its balance sheet. In Q2, while refinancing measures could stabilize finances long-term, the stock price faces short-term risks due to profit decline, shrinking market share, and high debt. Restoring market confidence will take time.

2. Youon Technology Co., Ltd.

Youon Technology Co., Ltd. focuses on green mobility solutions. In Q1 2025, its stock price increased by $0.68, closing at $2.46, a 38.53% rise.

On March 14, 2025, the company changed control. Former majority shareholder Sun Jisheng relinquished voting rights for 13.77% of shares, and Shanghai Hamo Commercial Consulting Co., Ltd. became the new controlling shareholder, with Yang Lei as the actual controller. To secure control, the company plans to issue up to 71,819,411 shares to the new shareholder, viewed as a positive signal for strategic investment. This led to three consecutive limit-up days from March 19 to 21, with a 20% increase.

Despite these changes, the company’s fundamentals remain under pressure. In Q1 2025, net losses attributed to shareholders widened to 24.62 million yuan, with a 26.2% decline in revenue.

Looking ahead to Q2, the control change and placement are expected to bring strategic adjustments and resource integration opportunities in shared mobility. If the new leadership can capitalize on industry synergies, the company may see medium-to-long-term growth through governance improvement, strategic focus, and market expansion.

[For more insights, please download the full report]

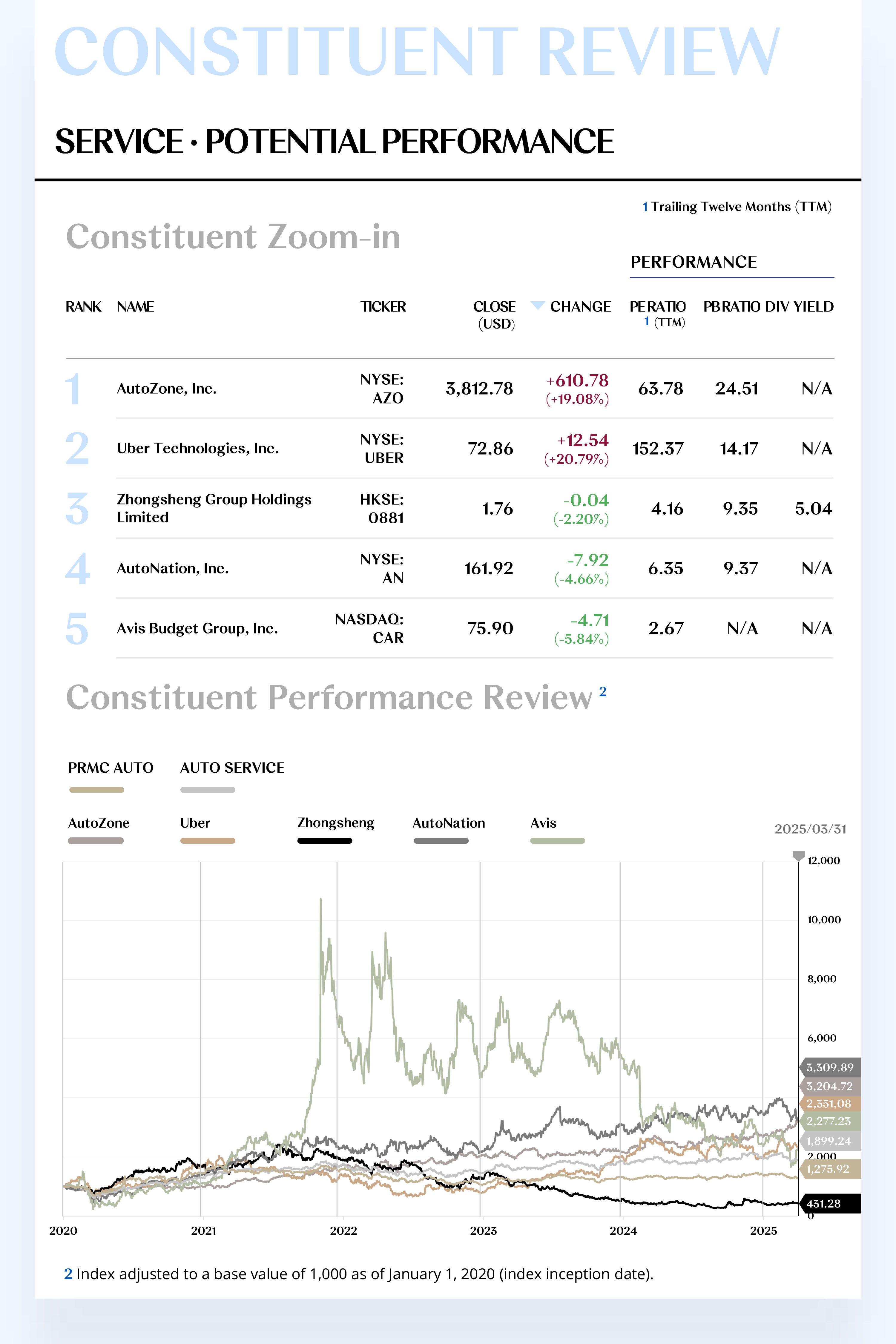

Potential Players

1. AutoZone, Inc.

AutoZone, Inc. is one of North America's largest automotive parts and accessories retailers, specializing in providing auto maintenance, repair parts, tools, and related services to individual car owners and professional customers. In Q1 2025, the stock price rose by $610.78, closing at $3,812.78, a 19.08% quarterly increase.

In Q1 2025, AutoZone achieved net sales of $4.3 billion, a 2.1% year-on-year increase. Same-store sales grew by 1.8% at constant exchange rates, with international markets showing particularly strong growth of 13.7%, while the U.S. market only saw a slight increase of 0.3%, reflecting a clear regional performance divergence. Net profit decreased by 4.8% to $565 million, with earnings per share (EPS) at $32.52, slightly below market expectations. Operating expenses rose to 33.3%, leading to a small decline of 0.9% in operating profit, which totaled $841 million.

The company invested $505 million in Q1, repurchasing 160,000 shares, signaling strong management confidence in the company’s long-term value. Looking ahead, AutoZone plans to continue accelerating store network expansion, focusing on emerging growth areas such as the electric vehicle aftermarket and online retail platforms, actively responding to the profound changes in the automotive industry‘s electrification and digitalization trends. Through structural optimization and market expansion, the company is poised to further solidify its leadership in the global automotive parts retail industry.

2. Uber Technologies, Inc.

Uber Technologies, Inc. provides transportation and delivery services, covering ride-hailing, food delivery, freight, and other business sectors. In Q1 2025, the stock price rose by $12.54, closing at $72.86, a 20.79% quarterly increase.

In Q1 2025, Uber achieved strong growth in its core businesses and improved profitability. According to management, total bookings are expected to grow by 17% to 21% year-on-year, with adjusted EBITDA expected to range between $1.79 billion and $1.89 billion, marking a 30% to 37% increase. Uber is also accelerating its autonomous driving initiatives and expanding rapidly in key markets such as the UK and Austin. The company is reinforcing its market share through technological innovation and regional penetration.

Looking to Q2, with continued momentum in core businesses, technological empowerment, and ongoing profitability improvements, Uber's stock price is likely to maintain its upward trajectory, driven by strong fundamentals and increased market confidence.

[For more insights, please download the full report]

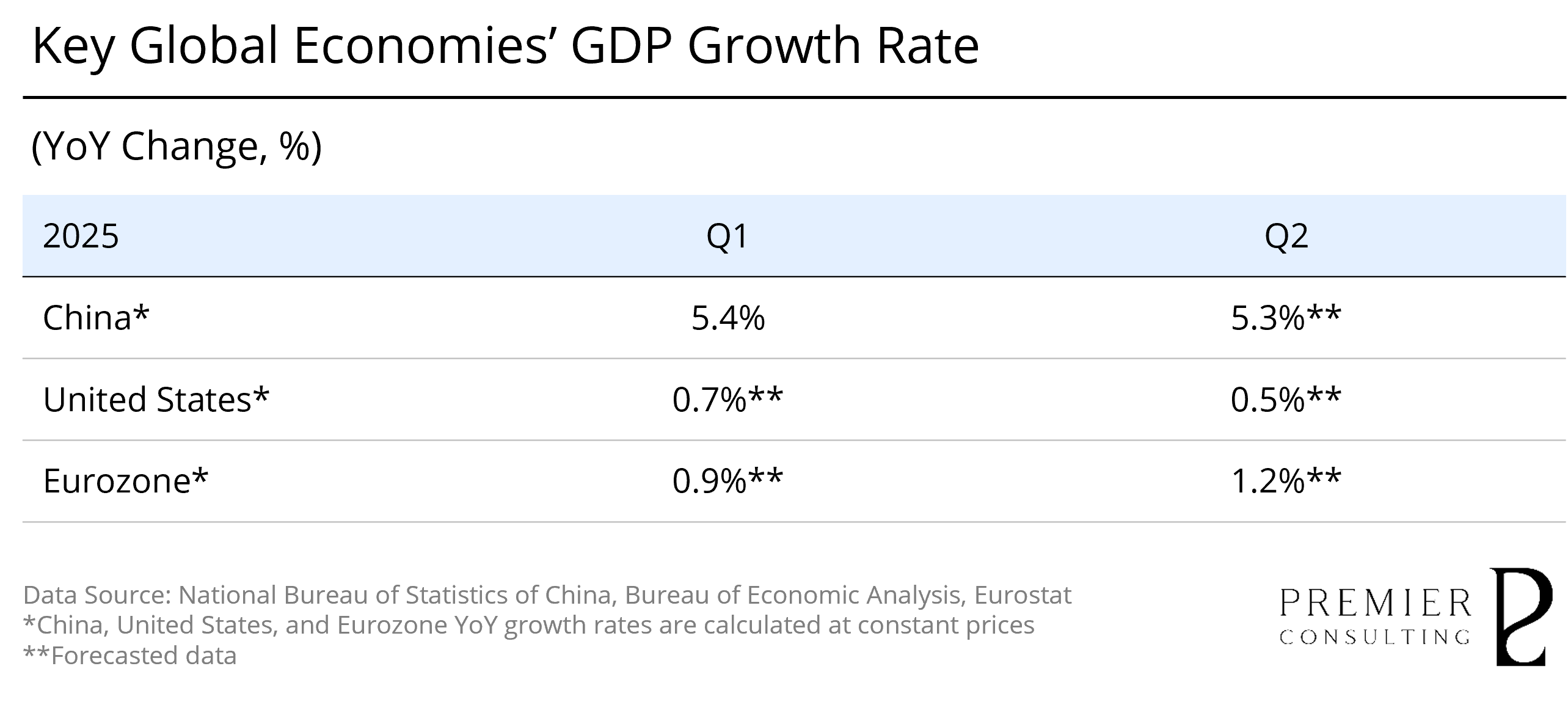

MACROECONOMY UPDATES

Rising Global Economic Turbulence, Recession Risks Demand Attention

Global: A Modest Economic Start, Caution Advised Due to Macroeconomic Fluctuations and Potential Recession Risks

In Q1 2025, the global economy continued its moderate growth trend. Inflation levels have eased, and the labor market has remained steady, supporting consumer momentum in major economies. However, under the pressure of high interest rates, global consumer and capital expenditure growth showed signs of fatigue. At the same time, central banks across countries have largely exited the interest rate cutting cycle, adopting a wait-and-see approach with monetary policy, while fiscal policies have become more cautious. Geopolitical risks and rising trade protectionism have also intensified tensions in international trade and supply chains, further weighing on the global economic outlook. In its latest World Economic Outlook, the International Monetary Fund (IMF) revised the global growth forecast for 2025 down from the initial 3.3% to 2.3%, signaling the potential for a global recession and warning nations to respond prudently.

[For more insights, please download the full report]

China: Manufacturing Expansion Remains Firm, SME Confidence Rebounds to Support Recovery

In March 2025, China’s Manufacturing Purchasing Managers’ Index (PMI) rose to 50.5%, up 0.3 percentage points from the previous month, signaling a continued improvement in manufacturing activity. By enterprise size, the PMI for large enterprises stood at 51.2%, down 1.3 percentage points but still above the expansion threshold, while PMIs for medium and small enterprises rose by 0.7 and 3.3 percentage points respectively, to 49.9% and 49.6%, though both remained below the threshold. Among the five sub-indices that make up the manufacturing PMI, production, new orders, and supplier delivery times were above the threshold, while raw material inventories and employment remained below. Notably, the new orders index rose by 0.7 percentage points to 51.8%, indicating further improvement in market demand.

[For more insights, please download the full report]

China: Policy Support Fuels Market Recovery, Automotive Sector Sees Structural Rebound

In March 2025, China’s total retail sales of consumer goods reached RMB 4.094 trillion, up 5.9% year-on-year. Within this, automotive retail sales totaled RMB 433 billion, rising 5.5% year-on-year. For the first quarter, total retail sales amounted to RMB 12.467 trillion, marking a 4.6% year-on-year increase, while automotive retail sales edged down by 0.8% to RMB 1.1237 trillion. Throughout the first quarter, the government prioritized expanding domestic demand and boosting consumption, allocating RMB 300 billion in ultra-long-term special treasury bonds to support initiatives such as upgrading consumer goods. Concurrently, local governments accelerated the rollout of consumption-stimulus measures, while auto shows and manufacturer-led subsidy campaigns provided additional momentum. These efforts collectively drove a strong start for the auto market in March. As the peak in fuel vehicle purchases ahead of the Spring Festival gave way to post-holiday demand for new energy vehicles, NEV penetration continued to rise, becoming the main force behind the spring recovery in the passenger vehicle market.

[For more insights, please download the full report]

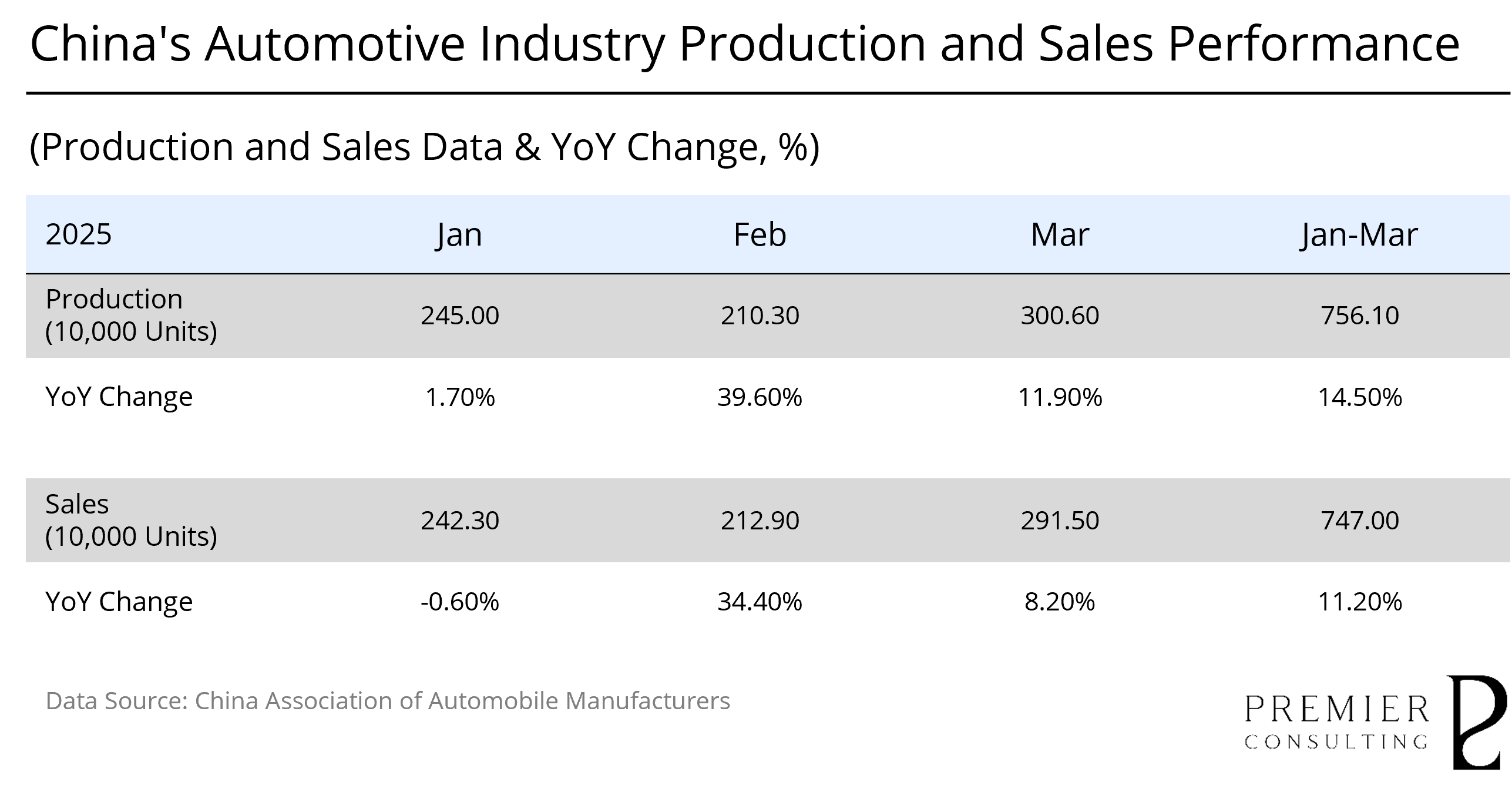

INDUSTRY KEY FIGURES

Strong Industry Performance in This Quarter, Rapid Growth in New Energy Vehicle Production and Sales

Automotive Industry Maintains Solid Growth in Q1,

with Double-Digit Increases in Production and Sales

From January to March 2025, China’s automotive production and sales reached 7.561 million and 7.470 million units respectively, representing year-on-year growth of 14.5% and 11.2%. Compared to the January–February period, the growth rates for production and sales narrowed by 1.7 and 1.9 percentage points, respectively. In March alone, automotive production and sales totaled 3.006 million and 2.915 million units, achieving month-on-month increases of 42.9% and 37.0%, and year-on-year growth of 11.9% and 8.2%, respectively.

[For more insights, please download the full report]

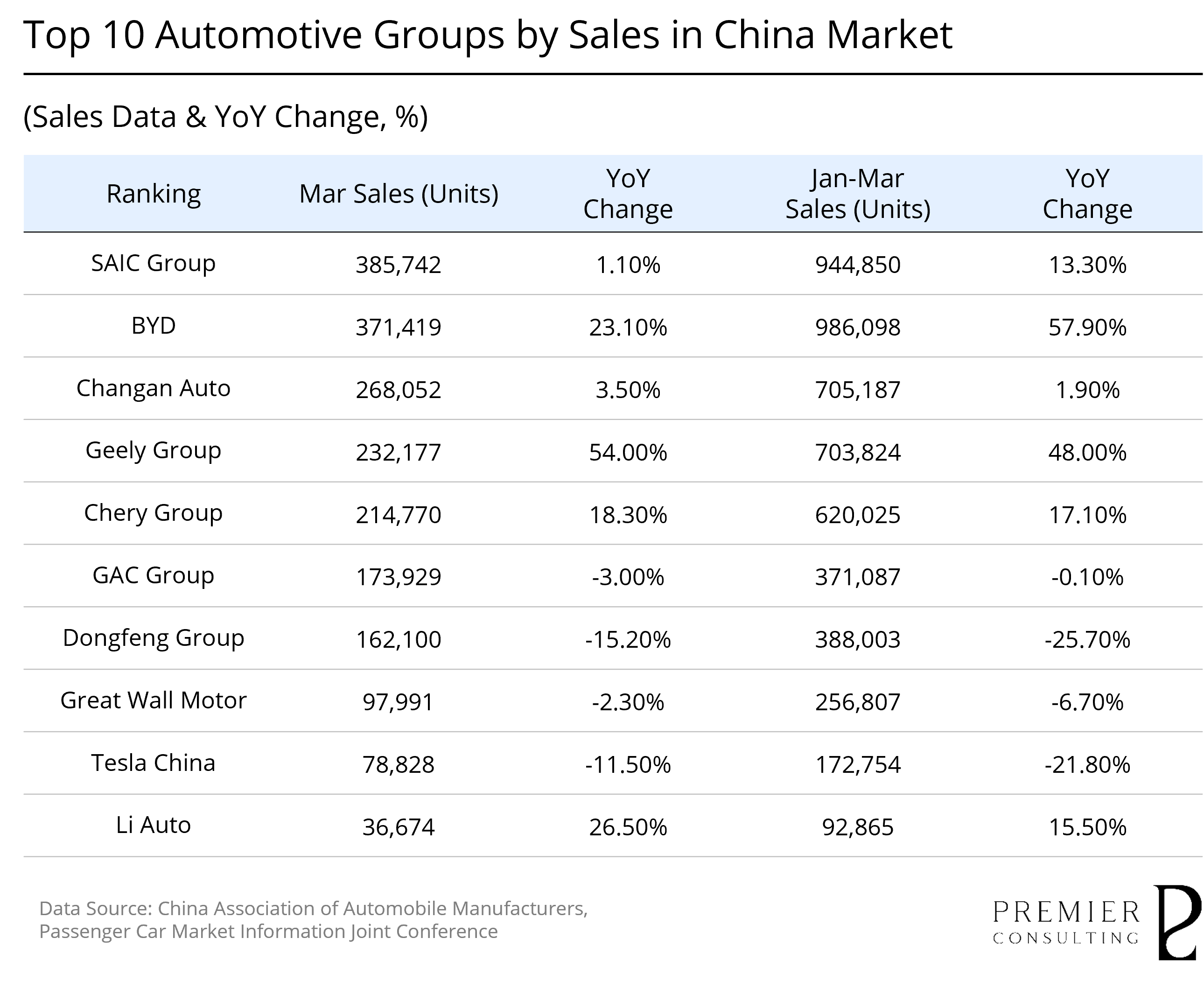

BYD Continues to Expand Its Lead, While Traditional Automakers Such as SAIC and GAC Face Mounting Challenges

In the first quarter of 2025, BYD maintained its leading position in China's automotive market, achieving monthly sales of 371,419 units with a year-on-year growth rate of 23.1%. Its cumulative sales for January to March reached 986,098 units, representing a substantial year-on-year increase of 57.8% and further widening its lead over the second-place SAIC Group. Geely Group also delivered an outstanding performance, recording March sales of 232,177 units—a 54% year-on-year surge, making it the fastest-growing major automaker for the month.

In contrast, many traditional car manufacturers faced significant challenges. Although SAIC Group retained the highest monthly sales volume at 385,742 units, its year-on-year growth in March was a modest 1.1%. Both Dongfeng Group and GAC Group continued to experience sales declines, with March volumes down 15.2% and 3.0% year-on-year, respectively. Great Wall Motor also failed to reverse its downward trend, with a 2.3% year-on-year decrease in March sales.

Among foreign players, Tesla’s China operations reported March sales of 78,828 units, marking an 11.5% year-on-year decline. Cumulative sales for the first quarter fell by 21.8%, resulting in a contraction of its market share. In contrast, Li Auto, representing the new generation of EV manufacturers, sustained steady growth, delivering 36,674 units in March—an increase of 26.5% year-on-year.

[For more insights, please download the full report]

PRIMARY INDEX REVIEW & PROSPECT

Quarterly Trends Show Volatility,

Index Surge Before Retreating

In the first quarter of 2025, the PRMC Auto Index closed at 1,275.92 points, declining by 111.13 points, a decrease of 8.01%. Frequent shifts in global macroeconomic policies and geopolitical tensions significantly impacted investment sentiment and valuations across the automotive sector. In late March, U.S. President Trump signed an executive order imposing a uniform 25% tariff on all imported vehicles, exceeding market expectations and placing substantial cost pressures on foreign automakers, while further intensifying global trade frictions. Simultaneously, the U.S. tightened export controls on China’s high-tech sectors, affecting the cross-border flow of smart vehicle chips and autonomous driving technologies, thereby undermining confidence in the industry’s innovation chain. Under these combined headwinds, the sector remained under pressure, with valuation premiums continuing to compress.

Looking ahead to Q2 2025, the PRMC Auto Index is expected to maintain a volatile trend amid evolving capital market sentiment shaped by tariff adjustments and geopolitical risks. In the U.S., persistent protectionism is amplifying imported inflation risks, while shrinking household wealth and policy uncertainty weigh on consumption and corporate investment expectations, adding pressure to financial markets. In Europe, recovery remains sluggish, constrained by high interest rates and weak external demand, with manufacturing and retail sectors continuing to lag. By contrast, China’s automotive market is expected to sustain its consumption momentum, supported by macroeconomic stimulus measures such as ultra-long-term special government bonds and programs promoting the replacement of older consumer goods. The NEV sector, driven by electrification and intelligentization, is set to continue leading structural growth and serve as a key pillar supporting the index’s stabilization.

SECONDARY INDEX REVIEW & PROSPECT

ll Three Secondary Indexes Fell,

Led by Significant Losses in the Manufacturing Index

The Auto Supply Index closed at 966.40 points in the first quarter, down 57.82 points or 5.65%. Throughout the quarter, global commodity demand remained weak, leading to low prices for automotive raw materials. The spot price of battery-grade lithium carbonate fell to RMB 74,000/ton, hitting a multi-year low and weighing on upstream material stocks. Meanwhile, terminal demand stayed soft, with automakers slowing procurement and squeezing upstream margins. Although companies continued investments in electrification and intelligentization, rising production costs amid supply chain instability added pressure. Looking ahead to Q2, with valuations already low, upstream market expectations have stabilized, and the index is likely to trend steadily, though a full recovery depends on broader macro improvements.

The Auto Manufacturing Index closed at 1,135.78 points in Q1, down 176.28 points or 13.43%. As a highly cyclical sector, vehicle manufacturing was hit hard by external shocks, including the Trump administration's tariff policies. Several brands, such as Audi and Tesla, suspended deliveries to the U.S. and China markets respectively, amplifying concerns over global trade tensions. This triggered a sharp correction in the midstream index from late February. Looking ahead, sustained tariff pressures and rising costs from electrification and intelligentization will likely intensify industry competition, keeping the midstream segment under continued downward pressure in the near term.

The Auto Service Index closed at 1,899.24 points in Q1, declining 61.38 points or 3.13%. Compared with upstream and midstream, the downstream sector showed greater resilience, supported by stable demand for maintenance and aftersales services. While new vehicle price cuts pressured dealer margins, diversification into high-margin businesses like aftersales and auto finance helped offset impacts. Additionally, battery swapping and charging operators continued expanding their user base despite being in the investment phase. Looking ahead, downstream momentum could benefit from the commercialization of Robotaxi services and new mobility models, though global trade tensions could weigh on logistics and supply chain services, limiting further recovery.

.jpg)

Review & Prospect

Q1 2025 PRMC Automotive Index Review & Prospect

Feb 02, 2026

Analyzing index performance and EV adoption trends, gaining insight into the realization pace of the sector's technology thesis and its evolving valuation framework.

Order Stability Sustains Performance, Rapid Growth in New Energy Production and Sales

In the first quarter of 2025, China's automotive industry operated steadily, with production and sales reaching 7.561 million and 7.470 million units, respectively, representing year-on-year growth of 14.50% and 11.20%. Notably, the new energy vehicle sector performed exceptionally well, with both pure electric and hybrid vehicles surpassing the 3 million mark in production and sales. In terms of exports, overall performance remained stable, although the growth rate in March was only 1%. In the second quarter, attention must be given to the potential negative impact of the tariff war on China's automotive exports.

The PRMC Auto Index closed at 1,275.73 points in Q1, declining by 111.13 points (-8.01%), underperforming key global indices such as the NASDAQ Composite, STAR & CHINEXT 50, STOXX Europe 600 Technology, and Hang Seng Tech. Among the secondary indices, the Auto Manufacturing Index recorded the largest drop (-13.43%), followed by the Auto Supply Index (-5.65%), while the Auto Service Index proved more resilient (-3.13%).

In terms of individual stock performance, there was significant divergence in Q1. Companies such as Xpeng, Thyssenkrupp, and Zhejiang Leapmotor saw remarkable growth, with their stock prices rising substantially. On the other hand, Tesla, Aston Martin, and Zoomcar underperformed, with their stock prices lagging behind the early-year performance.

The wise adapt to change, the strong anticipate it. Looking ahead to Q2, China's automotive market is expected to maintain its steady recovery, supported by consistent policy direction and sustained technological leadership driving electrification. Furthermore, the implementation of the "Special Action Plan to Stimulate Consumption" and major industry events such as the Shanghai International Automobile Industry Exhibition will further energize the market. In contrast, the European market remains constrained by geopolitical risks and economic weakness, with retail demand unlikely to recover significantly in the short term. Capacity reductions and labor union protests continue to disrupt operations at some automakers. Meanwhile, the U.S. market faces mounting challenges, as rising protectionism and expectations of imported inflation exert dual pressure on consumer spending and corporate investment, casting a cloud over the near-term outlook for the automotive sector.