Management Innovation Reinforces Market Confidence,

Brand Synergy Drives Sustainable Growth

Management Innovation Reinforces Market Confidence,

Brand Synergy Drives Sustainable Growth

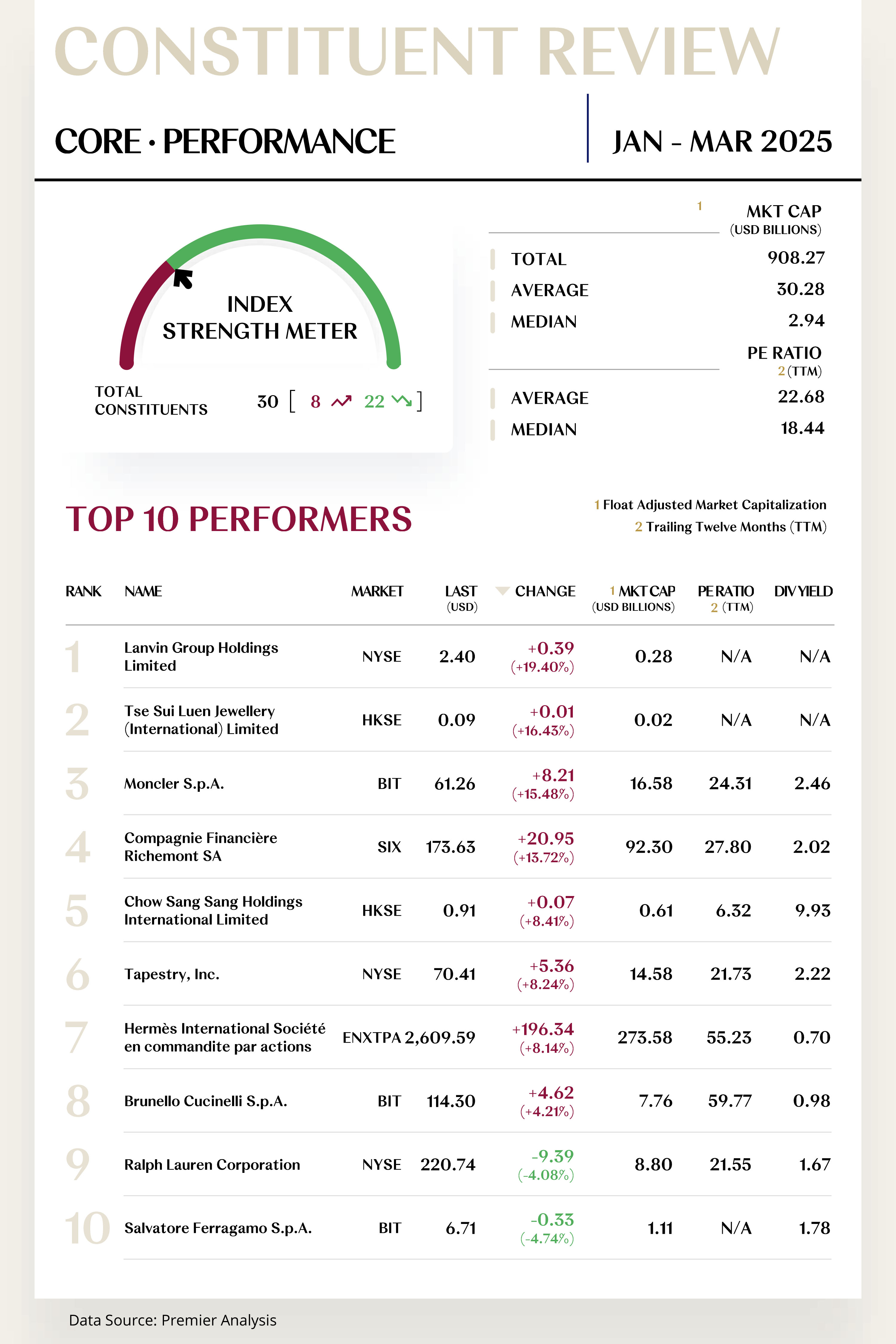

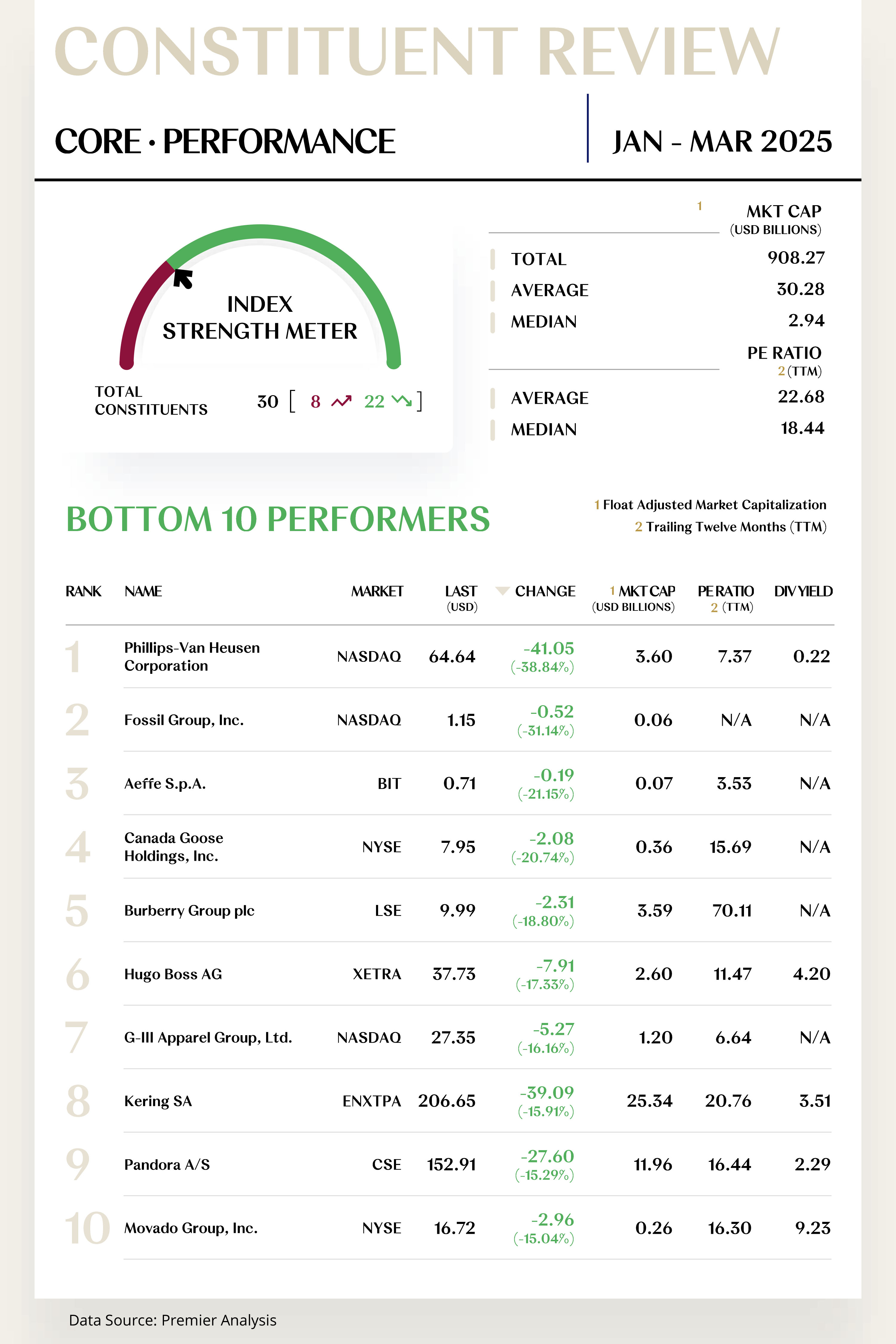

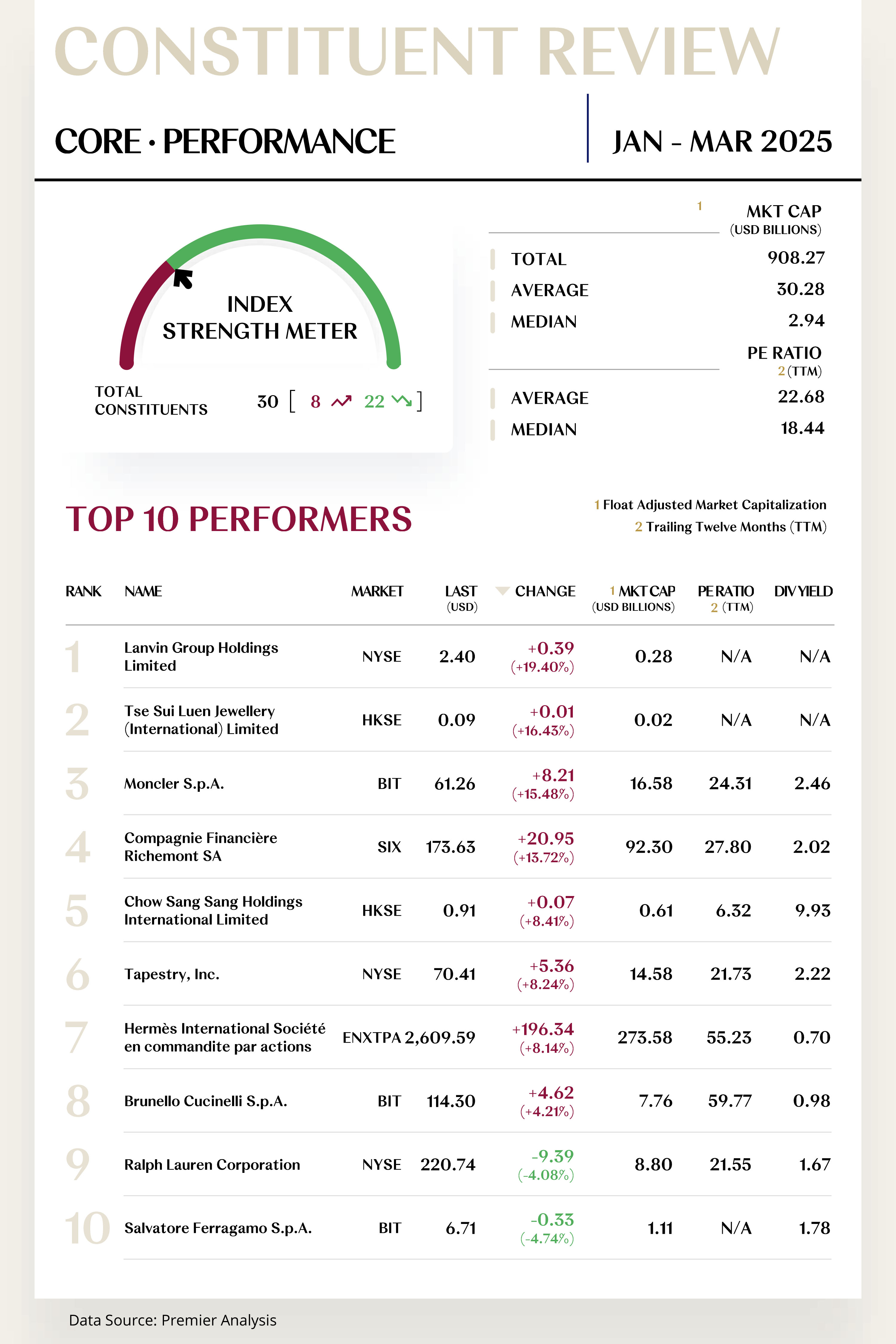

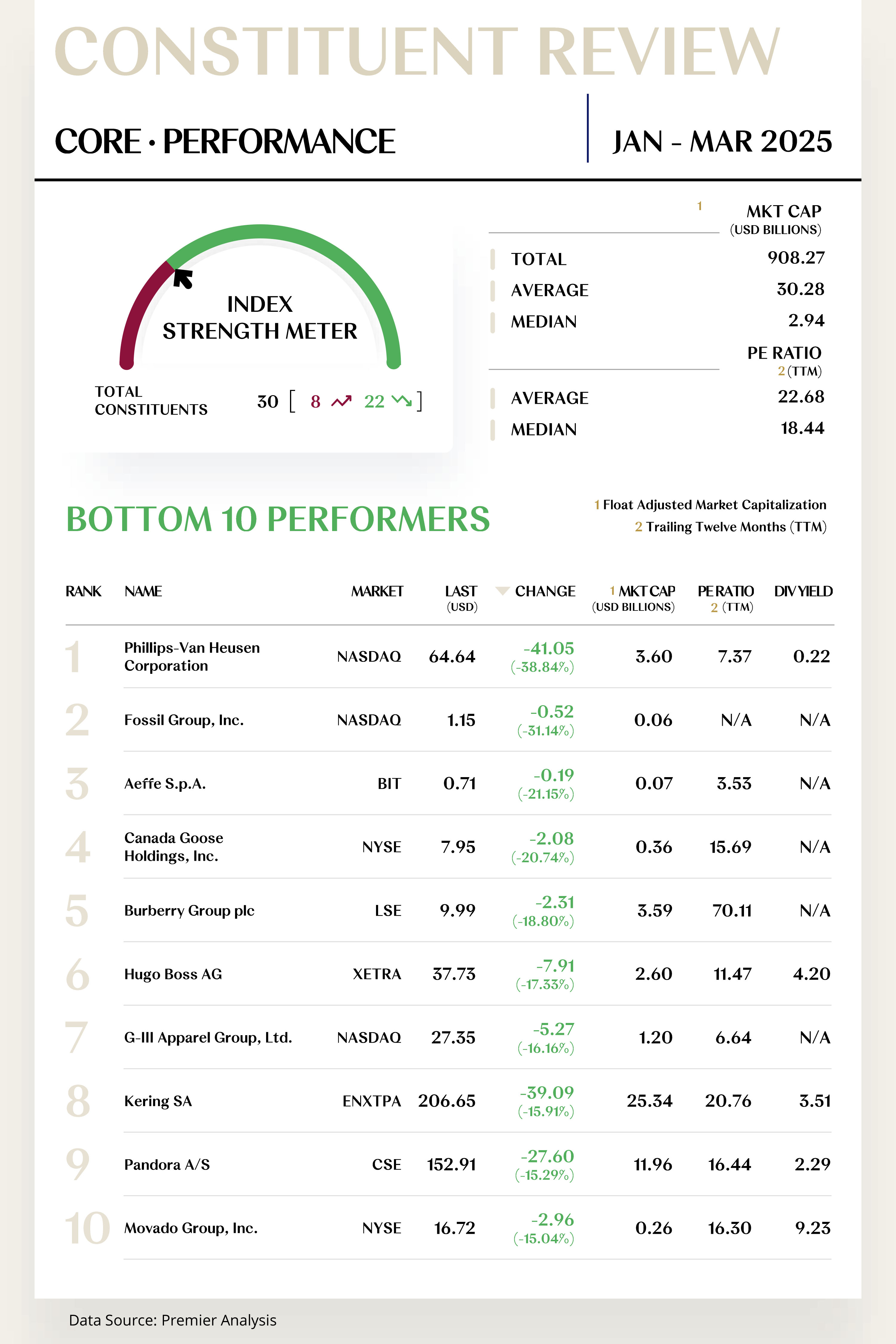

The Core Luxe Index comprises 30 stocks, with 8 rising and 22 falling.

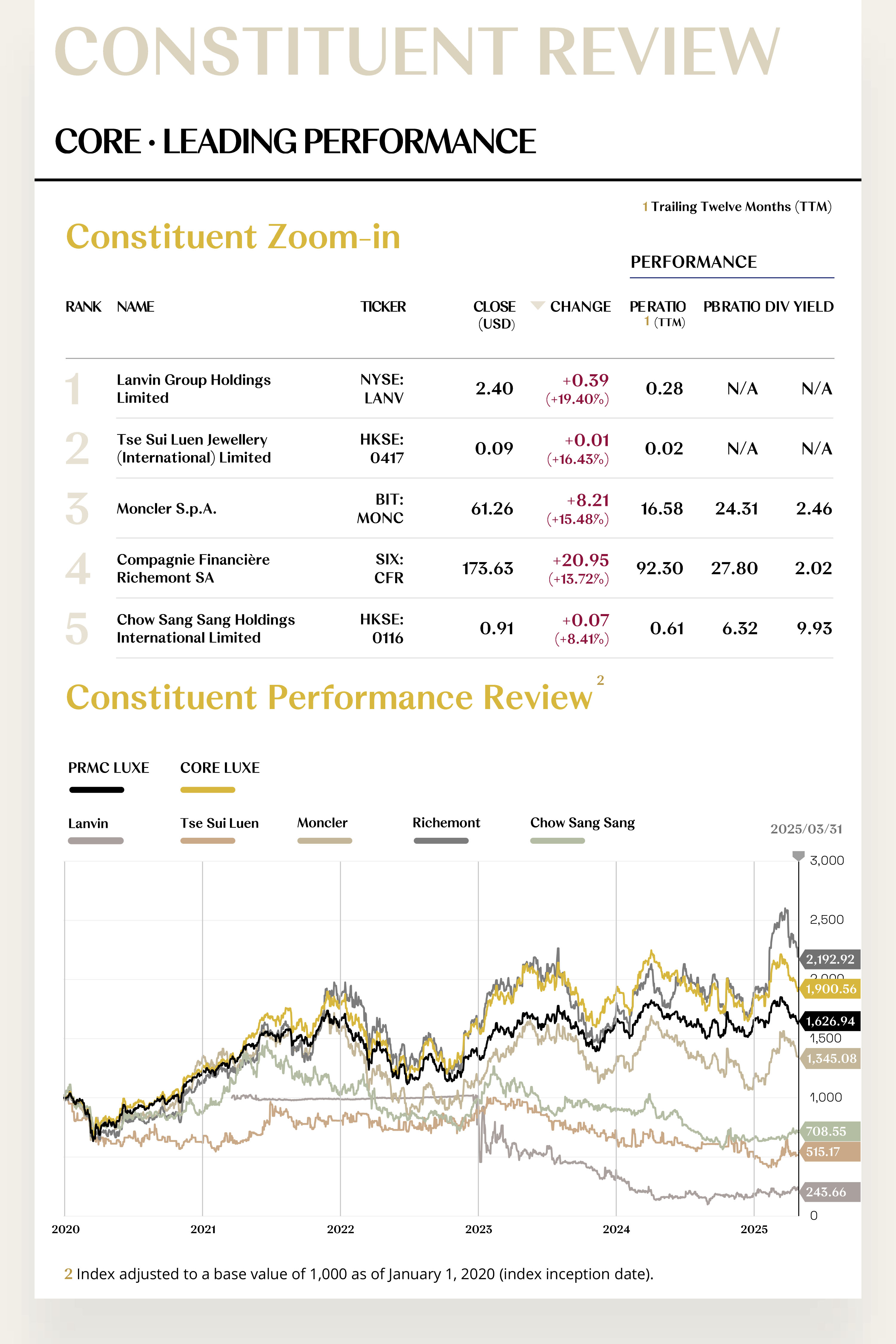

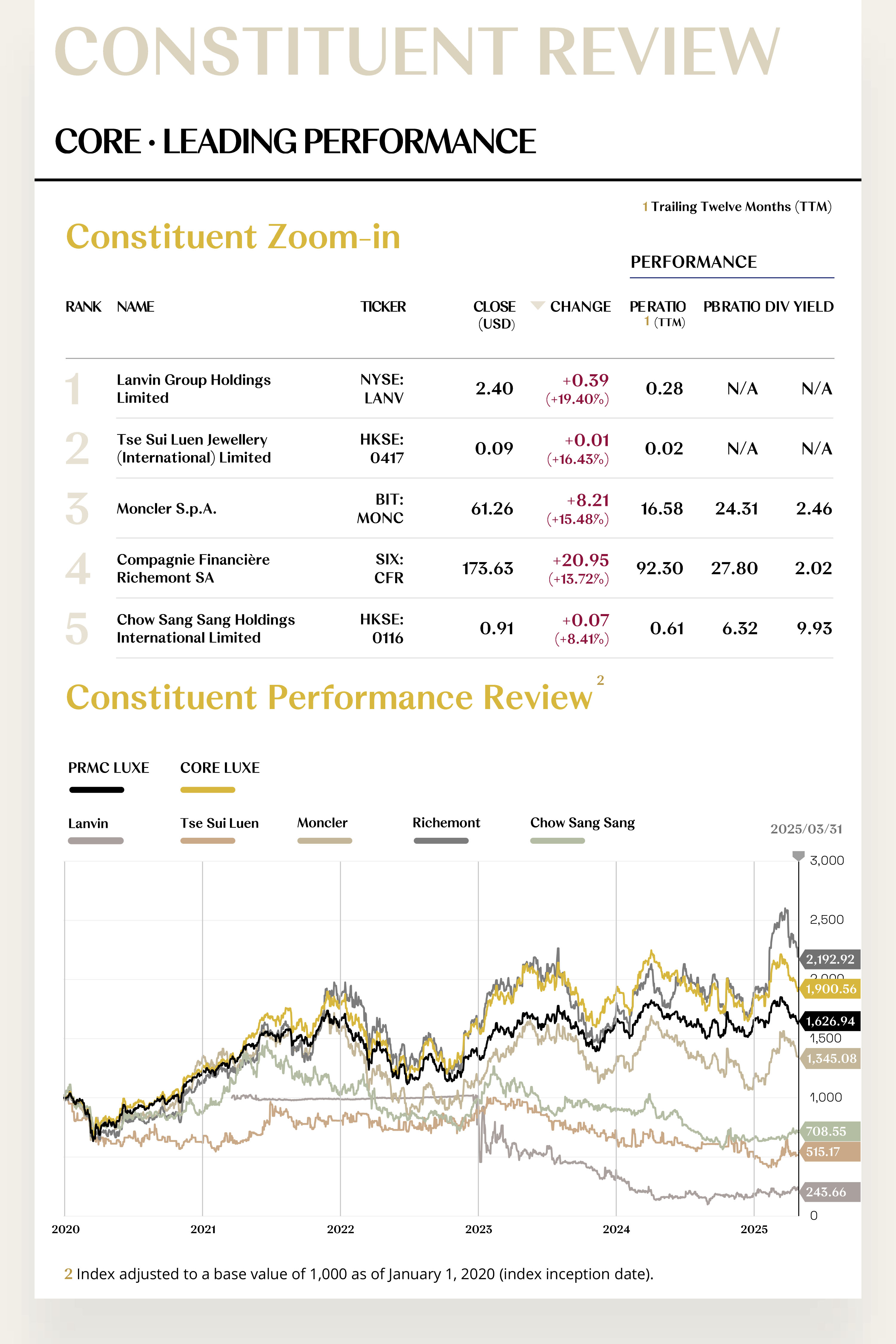

Leading Performers

1. Lanvin Group Holdings Limited

Lanvin Group Holdings Limited is a global luxury fashion conglomerate headquartered in China, with a portfolio of renowned brands including Lanvin, Wolford, Sergio Rossi, St. John Knits, and Caruso. The Group focuses on the high-end fashion and luxury sectors. In the first quarter of 2025, its share price rose by USD 0.39 to close at USD 2.40, representing a quarterly gain of 19.40%.

On January 16, the Group announced significant leadership and Board-level changes aimed at accelerating growth and driving the execution of its strategic plans. Although full-year 2024 revenue declined by 23% year-on-year to EUR 328 million, the Group remains optimistic about its outlook and plans to release audited financial statements detailing its 2024 performance on April 30, 2025. Furthermore, the Group anticipates achieving sales growth in 2025 through strategic partnerships and the launch of innovative products.

Looking ahead, the Group expects that recovering market demand, brand innovation, and agile market responses will continue to fuel its growth momentum. In the second half of the year, as the strategic plan is further implemented, the Group aims to drive a turnaround in performance and sustain its growth trajectory through further optimization of its product portfolio and enhanced brand equity.

2. Tse Sui Luen Jewellery (International) Limited

Tse Sui Luen Jewellery (International) Limited specializes in high-end jewelry, with operations spanning jewelry design, manufacturing, and retail across Mainland China, Hong Kong, Macau, and Malaysia. In the first quarter of 2025, the company's share price increased by USD 0.01 to close at USD 0.09, representing a quarterly gain of 16.43%.

Despite facing pressure from subdued consumer demand in Mainland China and Hong Kong, the company demonstrated resilience. According to its financial results for the first half of fiscal year 2025, sales revenue declined by 5.8% year-on-year to HKD 864 million. However, continued efforts in digital transformation and cost control reduced its net loss from HKD 57 million in the prior-year period to HKD 43.8 million, partially restoring investor confidence.

Looking to the second quarter, Tse Sui Luen Jewellery plans to further advance its digital transformation and refine its cost control strategies. The company is scheduled to announce its full-year fiscal 2025 results on June 18, with market attention focused on the effectiveness of its strategic execution and future growth potential. While short-term market conditions remain challenging, the gradual recovery of consumer markets and the continued implementation of strategic initiatives are expected to support a return to positive sales growth.

[For more insights, please download the full report]

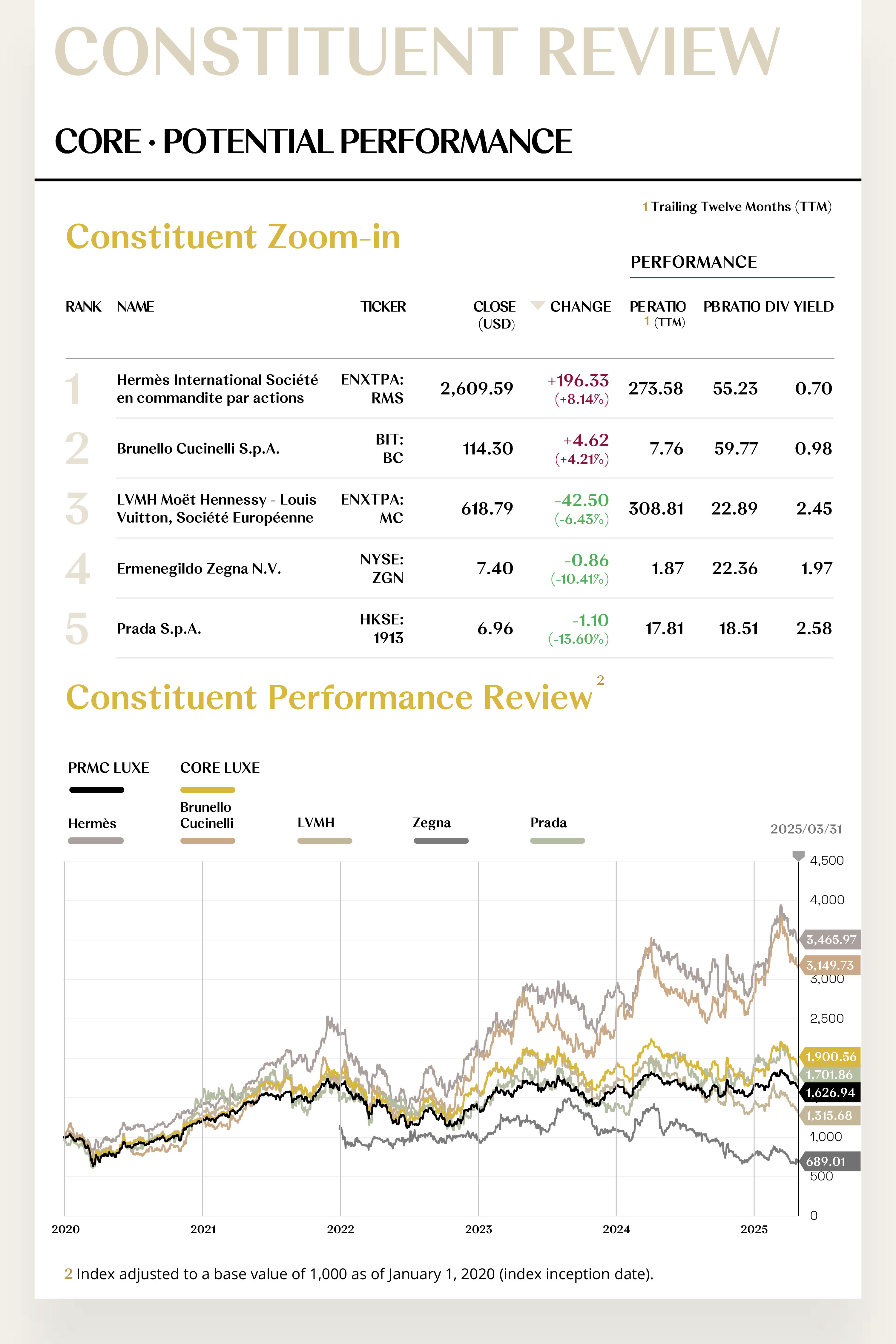

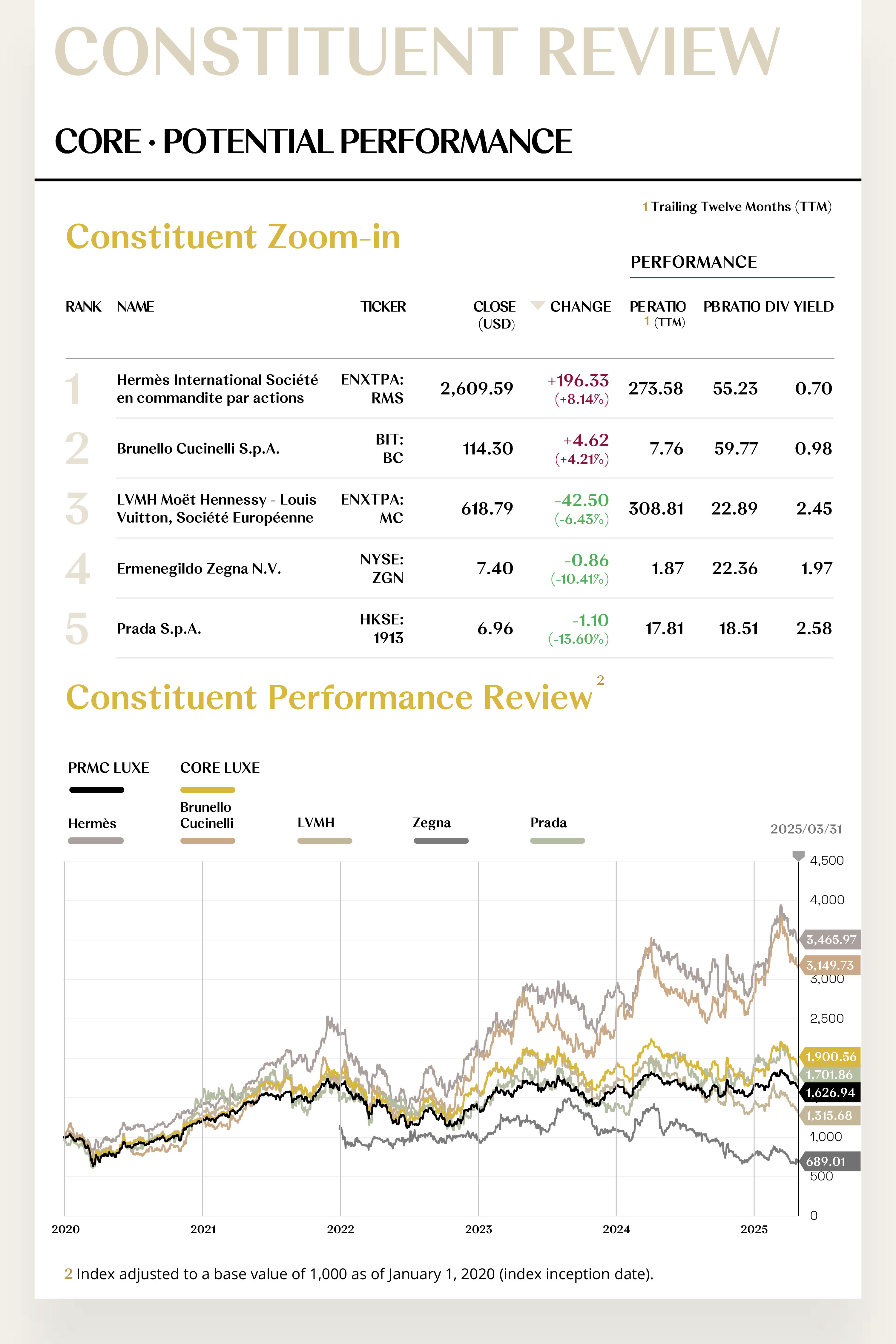

Potential Players

1. Hermès International Société en commandite par actions

Hermès International Société en commandite par actions is engaged in the production of high-end luxury goods, primarily focusing on leather goods, ready-to-wear, and accessories. Known for its exceptional craftsmanship and premium positioning, the brand is highly favored by consumers worldwide. Its renowned products include the famous Birkin and Kelly bags. In the first quarter of 2025, the company’s stock price rose by USD 196.33, closing at USD 2,609.59, representing a quarterly increase of 8.14%.

During the first quarter of 2025, Hermès achieved growth across multiple global markets, with consolidated revenue reaching EUR 4.13 billion, an 8.5% year-on-year increase. The company saw a 17% growth in Japan, 13% in Europe (excluding France), 14% in France, and 11% in the Americas, underscoring the brand’s strong appeal in various regional markets. Although the Greater China region faced short-term challenges, the Asian market (excluding Japan) still achieved a 1% growth, supported by brand loyalty and effective pricing strategies.

Looking ahead, Hermès plans to hold its Annual General Meeting on April 30, 2025, and release its first-half financial report on July 30, 2025. The company will continue to optimize and expand its global retail network to consolidate its market position. In response to the new U.S. tariff policies, Hermès has clearly stated its intention to offset the impact by raising product prices in the U.S. market. With its strong brand power, refined regional operations, and flexible risk management strategies, Hermès is poised to further solidify its leadership in the luxury industry.

2. Brunello Cucinelli S.p.A.

Brunello Cucinelli S.p.A. operates in the high-end luxury fashion sector, renowned for its exquisite cashmere apparel and "quiet luxury" style. The company is committed to offering top-tier fashion products to global consumers. In the first quarter of 2025, its stock price increased by USD 4.62, closing at USD 114.30, marking a quarterly rise of 4.21%.

In the first quarter of 2025, Brunello Cucinelli achieved significant growth, due to its premium positioning and global expansion. Sales in Asia, the Americas, and Europe grew by 11.3%, 10.3%, and 10.1%, respectively, while retail and wholesale channels saw sales growth of 11.9% and 8.2%. Fueled by strong performance in key markets, the company’s quarterly sales reached EUR 341.5 million, an increase of 10.5% year-on-year.

Looking ahead, the company plans to hold its Annual General Meeting on April 28, 2025, and continue the expansion of its Solomeo factory in Italy, with the goal of doubling production capacity by 2033, laying the foundation for long-term growth. Despite global economic uncertainties, the management maintains a strong expectation of around 10% sales growth for 2025 and 2026, reflecting their firm confidence in the brand's value and market expansion strategies.

[For more insights, please download the full report]

Management Innovation Reinforces Market Confidence,

Brand Synergy Drives Sustainable Growth

Oct 14, 2025

The Core Luxe Index comprises 30 stocks, with 8 rising and 22 falling.

Leading Performers

1. Lanvin Group Holdings Limited

Lanvin Group Holdings Limited is a global luxury fashion conglomerate headquartered in China, with a portfolio of renowned brands including Lanvin, Wolford, Sergio Rossi, St. John Knits, and Caruso. The Group focuses on the high-end fashion and luxury sectors. In the first quarter of 2025, its share price rose by USD 0.39 to close at USD 2.40, representing a quarterly gain of 19.40%.

On January 16, the Group announced significant leadership and Board-level changes aimed at accelerating growth and driving the execution of its strategic plans. Although full-year 2024 revenue declined by 23% year-on-year to EUR 328 million, the Group remains optimistic about its outlook and plans to release audited financial statements detailing its 2024 performance on April 30, 2025. Furthermore, the Group anticipates achieving sales growth in 2025 through strategic partnerships and the launch of innovative products.

Looking ahead, the Group expects that recovering market demand, brand innovation, and agile market responses will continue to fuel its growth momentum. In the second half of the year, as the strategic plan is further implemented, the Group aims to drive a turnaround in performance and sustain its growth trajectory through further optimization of its product portfolio and enhanced brand equity.

2. Tse Sui Luen Jewellery (International) Limited

Tse Sui Luen Jewellery (International) Limited specializes in high-end jewelry, with operations spanning jewelry design, manufacturing, and retail across Mainland China, Hong Kong, Macau, and Malaysia. In the first quarter of 2025, the company's share price increased by USD 0.01 to close at USD 0.09, representing a quarterly gain of 16.43%.

Despite facing pressure from subdued consumer demand in Mainland China and Hong Kong, the company demonstrated resilience. According to its financial results for the first half of fiscal year 2025, sales revenue declined by 5.8% year-on-year to HKD 864 million. However, continued efforts in digital transformation and cost control reduced its net loss from HKD 57 million in the prior-year period to HKD 43.8 million, partially restoring investor confidence.

Looking to the second quarter, Tse Sui Luen Jewellery plans to further advance its digital transformation and refine its cost control strategies. The company is scheduled to announce its full-year fiscal 2025 results on June 18, with market attention focused on the effectiveness of its strategic execution and future growth potential. While short-term market conditions remain challenging, the gradual recovery of consumer markets and the continued implementation of strategic initiatives are expected to support a return to positive sales growth.

[For more insights, please download the full report]

Potential Players

1. Hermès International Société en commandite par actions

Hermès International Société en commandite par actions is engaged in the production of high-end luxury goods, primarily focusing on leather goods, ready-to-wear, and accessories. Known for its exceptional craftsmanship and premium positioning, the brand is highly favored by consumers worldwide. Its renowned products include the famous Birkin and Kelly bags. In the first quarter of 2025, the company’s stock price rose by USD 196.33, closing at USD 2,609.59, representing a quarterly increase of 8.14%.

During the first quarter of 2025, Hermès achieved growth across multiple global markets, with consolidated revenue reaching EUR 4.13 billion, an 8.5% year-on-year increase. The company saw a 17% growth in Japan, 13% in Europe (excluding France), 14% in France, and 11% in the Americas, underscoring the brand’s strong appeal in various regional markets. Although the Greater China region faced short-term challenges, the Asian market (excluding Japan) still achieved a 1% growth, supported by brand loyalty and effective pricing strategies.

Looking ahead, Hermès plans to hold its Annual General Meeting on April 30, 2025, and release its first-half financial report on July 30, 2025. The company will continue to optimize and expand its global retail network to consolidate its market position. In response to the new U.S. tariff policies, Hermès has clearly stated its intention to offset the impact by raising product prices in the U.S. market. With its strong brand power, refined regional operations, and flexible risk management strategies, Hermès is poised to further solidify its leadership in the luxury industry.

2. Brunello Cucinelli S.p.A.

Brunello Cucinelli S.p.A. operates in the high-end luxury fashion sector, renowned for its exquisite cashmere apparel and "quiet luxury" style. The company is committed to offering top-tier fashion products to global consumers. In the first quarter of 2025, its stock price increased by USD 4.62, closing at USD 114.30, marking a quarterly rise of 4.21%.

In the first quarter of 2025, Brunello Cucinelli achieved significant growth, due to its premium positioning and global expansion. Sales in Asia, the Americas, and Europe grew by 11.3%, 10.3%, and 10.1%, respectively, while retail and wholesale channels saw sales growth of 11.9% and 8.2%. Fueled by strong performance in key markets, the company’s quarterly sales reached EUR 341.5 million, an increase of 10.5% year-on-year.

Looking ahead, the company plans to hold its Annual General Meeting on April 28, 2025, and continue the expansion of its Solomeo factory in Italy, with the goal of doubling production capacity by 2033, laying the foundation for long-term growth. Despite global economic uncertainties, the management maintains a strong expectation of around 10% sales growth for 2025 and 2026, reflecting their firm confidence in the brand's value and market expansion strategies.

[For more insights, please download the full report]